MFS: Keep an eye on this indicator as investors approach ‘day of reckoning’

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

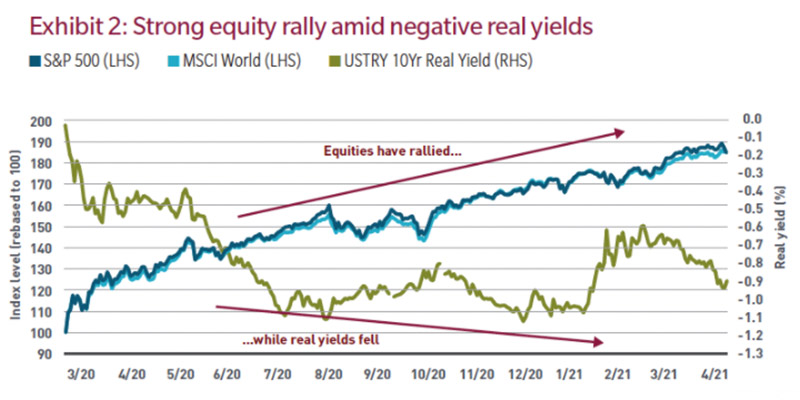

Equity markets have undergone a notable post-COVID shift since February.

Tech is out and commodities are in (some major biotech wins notwithstanding).

It makes for an interesting setup heading into the second half of the year, as economic growth picks up and inflation rises.

In that context Robert Almeida, global strategist at MFS Investment Management, says investors will have to grapple with a “day of reckoning” as real yields begin to rise.

What are real yields?

Real yields are calculated as nominal bond yields, adjusted for inflation.

Right now rates are at rock bottom. Inflation is low but picking up, which means real yields are negative.

Why do they matter?

Almeida noted at the height of the COVID-19 chaos, policy makers were determined to prevent it from morphing into a credit crisis on financial markets.

The liquidity flood continued through 2020 at the first sign of any disturbance.

Before the pandemic, real yields weren’t exactly high — fluctuating in a “meagre range” between 0-1%, Almeida noted.

But the fact they were positive gave markets “some sort of measuring stick” to base asset prices off, he said.

In light of the emergency COVID-19 policy response, risk assets have become “unmoored” from their fundamentals.

“Without an anchor, it’s apparent why risk assets have risen as they have,” Almeida said:

Looking ahead, MFS reckons negative real yields aren’t sustainable.

At some point they will go positive, although what “we’re less confident about is the timing or the rate at which real yields will rise”, Almeida said.

Inflation will play a role, to the extent that yields rise in response to higher inflationary pressures.

While the inflation outlook is the topic of endless debate, Almeida is in the camp that thinks rising prices will prove transitory.

He doesn’t think the “secular disinflationary forces of the past decade-plus — elevated debt levels, ageing demographics and continued digitalisation” will reverse course.

However, at some point yields will normalise.

“Regime shifts are always clear in hindsight but rarely at the point of inflection, yet markets have a way of sniffing them out,” Almeida says.

And as the lines in the chart above converge, investors should be prepared for higher yields to “undermine equity valuations”.

If liquidity does tighten, it may not mean a market calamity.

But investors will have to be nimble — as has been demonstrated already with the rotation out of tech since February.

“As we go from forecast to fact, we believe market performance and leadership will look materially different than they have in the past several quarters,” Almeida said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.