Meet SNAS and BBUS, or, The Simple Way to Make Money out of People Losing Money

ETF this. Via Getty

Surprising no one, in a simply awful week for the global equities, the best performing ASX-traded funds were those betting heavily against the market.

In fact the two funds which’ve best performed year-to-date – and over the past 12 months – brought home the bacon.

Looking at reported daily flows from the 23rd September across the ASX, Evan Metcalf, CEO of Global X (previously ETF Securities), says the clear performers were again The Global X Ultra Short Nasdaq 100 Hedge Fund (ASX:SNAS), and the BetaShares US Equities Strong Bear Currency Hedged (Hedge Fund) ETF (ASX:BBUS).

In a barren week of blood-letting and gnashing of Wall Street teeth, these twin high-risk, short-tempered and rather contrary plays are cleaning up.

SNAS is an actively managed fund with a purported aim to:

Provide investors with negatively geared exposure to the Nasdaq-100 Index. Ideally, the geared returns are negatively related to the returns of the Nasdaq-100 Index by investing primarily in a portfolio of short E-mini Nasdaq-100 Futures contracts listed on the Chicago Mercantile Exchange.

Evil, yet effective in times of when the crazy is going on.

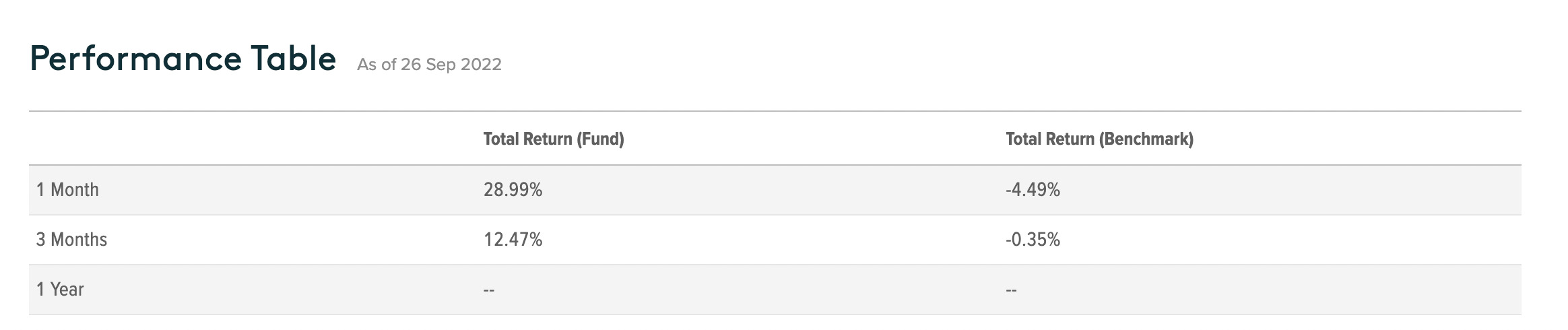

SNAS Performance

The BBUS play is hand-wrought to:

Provide protection from a declining US share market. The BetaShares BBUS Fund uses equity index futures contracts to generate magnified returns that are negatively correlated to the S&P 500 Total Return Index.

When the S&P 500 falls, BBUS should rise and vice versa.

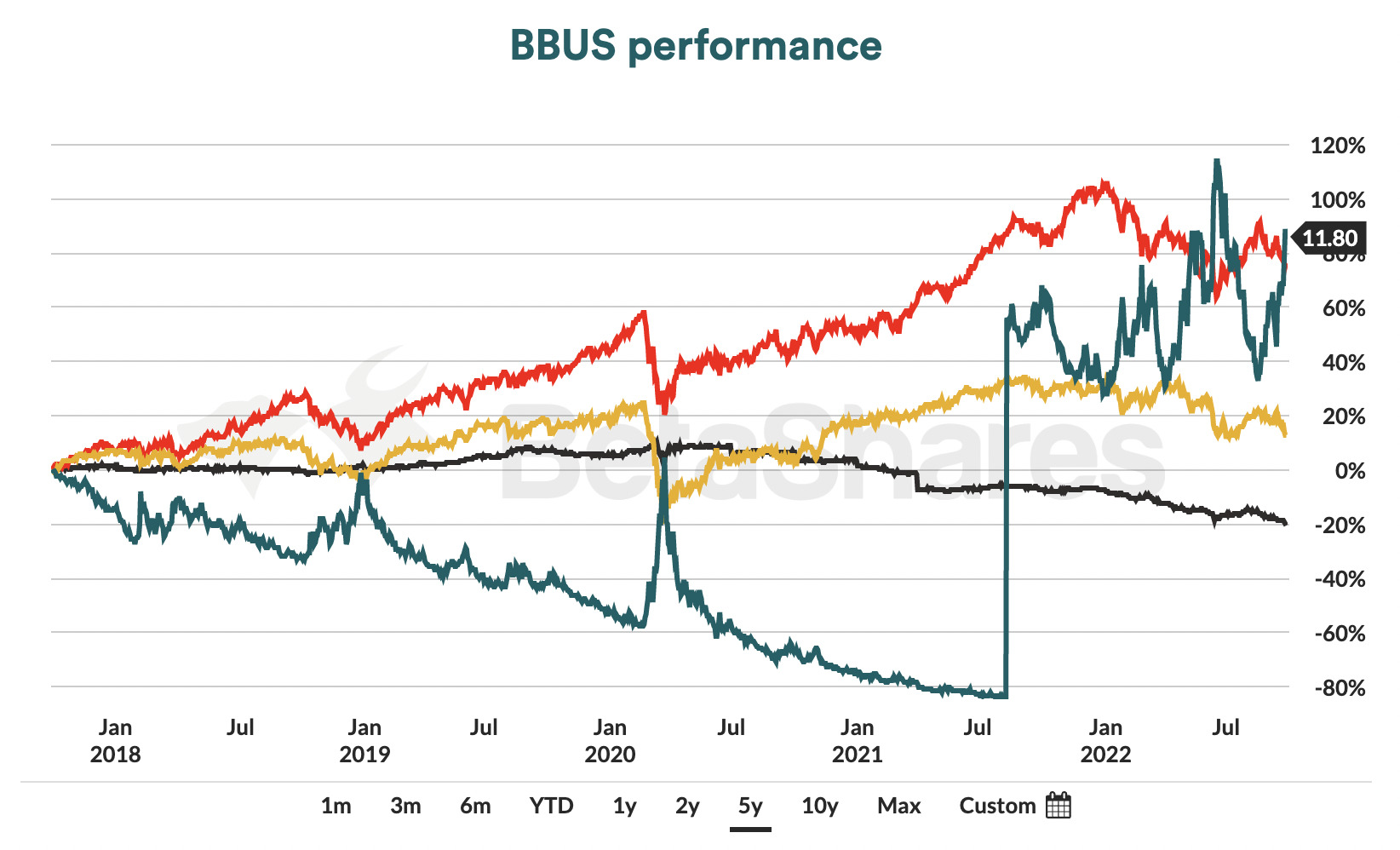

The chart below shows the 5-year performance of BBUS vs key asset classes of Aussie shares (VAS), US shares (IVV) and global bonds (VIF):

High-risk hedging

These are undoubtedly high-risk ETFs to have ticking away in a portfolio, and even the makers warn investors that they’re expected to perform poorly over long periods of time.

But that’s the contrary beauty. Both lean on equity index futures contracts to generate magnified returns that are negatively correlated to their host index.

I’m not one, but experienced investors jump on to hedge their portfolio against markets in times of trash, effectively betting against the US stock market.

All I know is that a high-risk strategy magnifies gains and losses, and will probs keep you up nights compared to a simple ETF tracking the S&P 500 Index.

“BBUS is a highly volatile Fund,” Betashares kindly says, “and there is no guarantee the ETF will provide effective or perfect protection in a falling market.”

Evan also says:

The poorest performing ETFs last week were the familiar faces of crypto, innovative technology, and geared funds.

“These funds have suffered this year as rising interest rates have caused investors to sell off riskier assets,” Metcalf says.

There were $137 million in reported inflows. Not huge and also not a surprise.

“A cash ETF – ISEC – got top gong for inflows,” Metcalf says.

“Cash ETFs, which invest in bank deposits, have seen surprisingly muted inflows this year – despite being one of the biggest winners from rising interest rates.

“There were $87 million in reported outflows. Precious metals ETFs – such as GOLD, ETPMAG, ETPMPM – and miners ETFs – such as MVR, MNRS – saw some of the biggest outflows. Commodities prices have fallen in recent weeks as investors price in a higher probability of a recession.”

The most traded funds for the week were in keeping with the yearly average. The one exception appears to be our new, old friend the SNAS, which has continued climbing up the ranks of most traded funds in 2022, Year of the Simple Way to Make Money out of People Losing Money.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.