Market Highlights: Wall Street sentiment remains high, 9 most innovative firms, and 5 small caps to watch today

Which are the most innovative companies in the world? Picture Getty

- ASX to open higher on Monday after Wall Street’s third straight weekly gains

- ChargePoint tumbled -35pc, while GAP surged over 30pc

- And which are the most innovative companies in the world?

Aussie shares are poised to open higher on Monday as Wall Street eked out its third consecutive weekly gain on Friday. At 8am AEDT, the ASX 200 index futures was pointing up by +0.4%.

In New York, the S&P 500 rose by +0.13%, the blue chips Dow Jones index was up by +0.01%, and the tech-heavy Nasdaq climbed by +0.08%.

Hopes of a “soft landing” drove market sentiment last week as traders grew convinced the Fed Reserve could ease back on interest rate hikes without reigniting inflation.

Oil prices rebounded by 4% on Friday amid bets that OPEC will extend output cuts when the cartel meets next on November 26th.

To stocks, EV charging stock, ChargePoint plunged by -35% as Q3 revenue fell well below estimates.

Applied Materials, one of the largest chipmakers in the US, fell -4% after it reportedly came under US criminal probe for evading export restrictions on China’s top chipmaker, SMIC.

Fashion retailer GAP surged 30% after Q3 earnings blew away expectations.

Microsoft fell -1.7% and is expected to fall further when the market opens later tonight after OpenAI fired its founder and CEO Sam Altman over the weekend.

Microsoft is the startup’s biggest backer with a more than US$10 billion stake, and CEO Satya Nadella is reportedly furious after being blindsided by OpenAI’s decision.

Looking ahead, it will be a busy week for RBA governor Michele Bullock and her colleagues, with speeches due at the ASIC Annual Forum, ABE Annual Dinner, and Australian Securitisation Forum.

RBA’s minutes for the November meeting is also scheduled for Tuesday.

The most innovative global firms

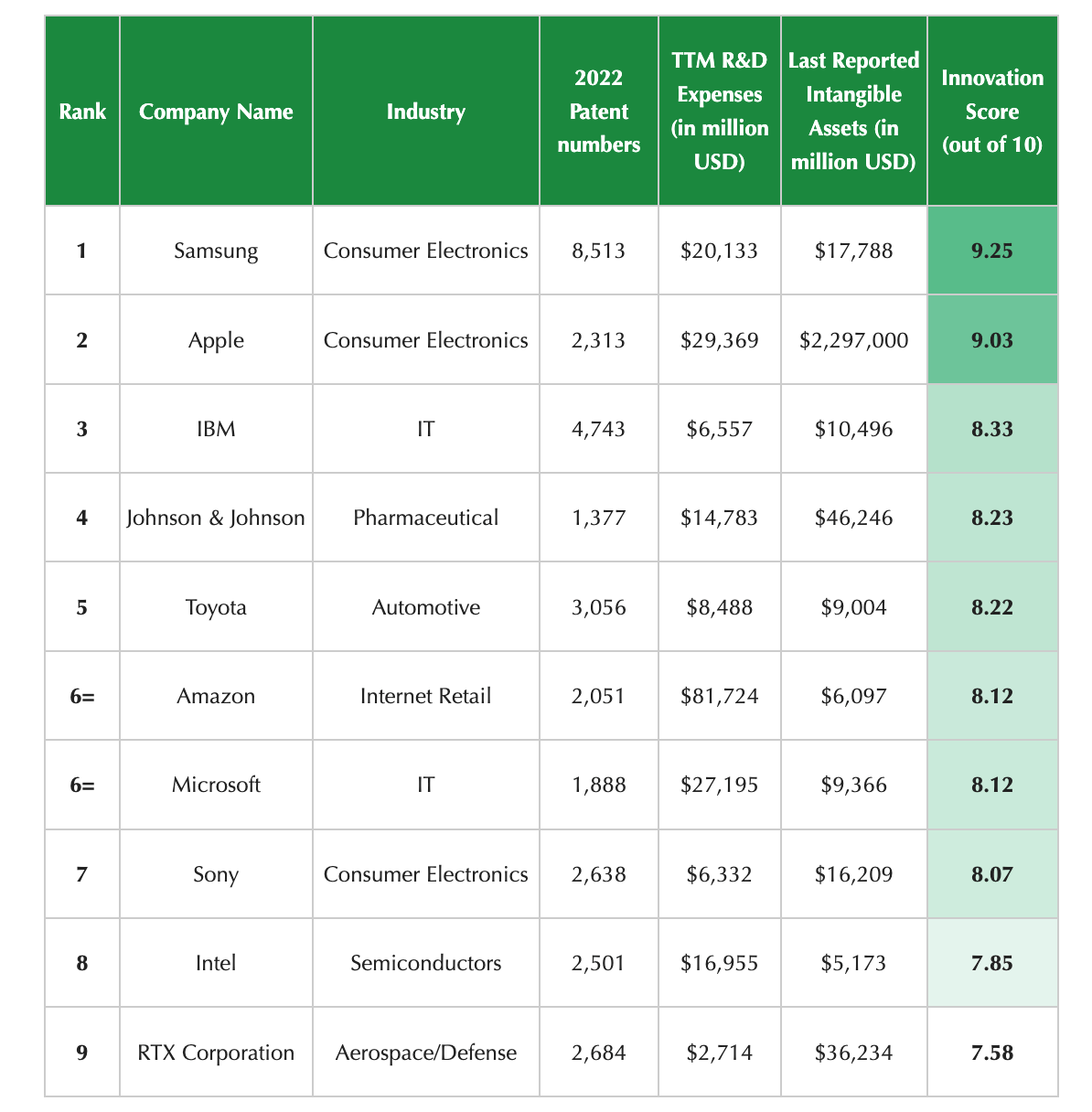

Experts at FOREX.com have commissioned Journalistic.org to conduct research to uncover which global companies are the most innovative.

The rankings are based on factors such as the number of US-registered patents in 2022, the number of R&D expenses over the last 12 consecutive months, and their last reported Intangible Assets.

Data revealed that Samsung is the most innovative company, with an innovation score of 9.25/10. The consumer electronics giant issued 8,513 new patents in 2022, which is the most out of all companies in the data.

Competitor Apple is the second-most innovative company, with an innovation score of 9.03/10. Apple invested over $29 billion on R&D in the past year, which is the third-highest out of companies in the top 10, and they reported over a whopping $2.29 trillion in intangible assets in 2022, also ranking first.

In third place with a score of 8.33/10 is IT giant IBM. Registering 4,743 patents last year, half that of Samsung in first place, they have surprisingly lost their 29-year reign as the patent leader in the US.

In other markets …

Gold price fell -0.04% to US$1,980.01 an ounce.

The benchmark US 10-year treasury yield was flat at 4.44%

Oil prices surged over 4%, with Brent trading at US$80.52 a barrel.

Iron ore futures fell -0.4% to US$128.95 a tonne.

The Aussie dollar claimed back the US65c handle, up 0.6% to US65.10c.

Meanwhile, Bitcoin was up 1.15% in the last 24 hours to US$37,053.

5 ASX small caps to watch today

Fenix Resource (ASX:FEX)

Fenix has signed a binding Ore Purchase Agreement with a local iron ore producer, 10M Pty Ltd, for the purchase of 500,000 tonnes of high-grade hematite iron ore from the Twin Peaks Direct Shipping Iron Ore Project in WA. 10M will supply 500,000 tonnes of +60% Fe Direct Shipping Ore from the Woolbung Peak deposit for a fixed mine gate payment, plus a profit share payment upon sale. Fenix will be responsible for haulage, storage, port services, ship loading, marketing and sales utilising the company’s expanded port capacity and logistics capabilities.

Dreadnought Resources (ASX:DRE)

A focused lithium-caesium-tantalum (LCT) pegmatite review has been completed, resulting in 16 camp scale LCT pegmatite targets at Central Yilgarn and Mangaroon. 10 camp scale (up to 15km x 2km) targets have been generated at Central Yilgarn, and six camp scale (up to 25km x 9km) targets have been defined at Mangaroon. Evaluation of all targets will continue into 2024.

Widgie Nickel (ASX:WIN)

Infill drilling has confirmed high grade mineralisation below Widgie’s 132N open pit, with high-grade assays of up to 25.95% nickel. Mineralisation remains open at depth, and the structure’s lower channel flank remains unconstrained. Highlights include: 9.14m @ 10.44% Ni from 330.00m, and 11.33m @ 2.77% Ni from 314.53m. Geological modelling is underway with updated Mineral Resource Estimate to be completed in early 2024.

Zenith Minerals (ASX:ZNC)

Ground-based electromagnetic (EM) geophysical surveys have confirmed nickel sulphide targets at the Hayes Hill Lithium – Nickel Project in WA. The EM surveys have defined two nickel sulphide drill targets adjacent to the well-defined surface geochemical targets at Green Bananas. One discrete, strong (up to 20,000 siemens) bedrock conductor was located immediately west of the geochemical target, and another conductor located immediately south. Both are robust sub-surface nickel sulphide drill targets, says ZNC.

ImpediMed (ASX:IPD)

ImpediMed has announced CEO and board changes. Rick Valencia will step down from his role as CEO effective immediately, to be replaced by Dr Parmjot Bains on 8 January 2024. Tim Cruickshank has stepped down as CFO, and chair McGregor Grant has assumed the responsibilities of CFO effective immediately in an interim capacity, and will be an executive chairman.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.