Market Highlights: Wall Street defies Powell’s hawkish comments; and 5 stocks to watch on the ASX today

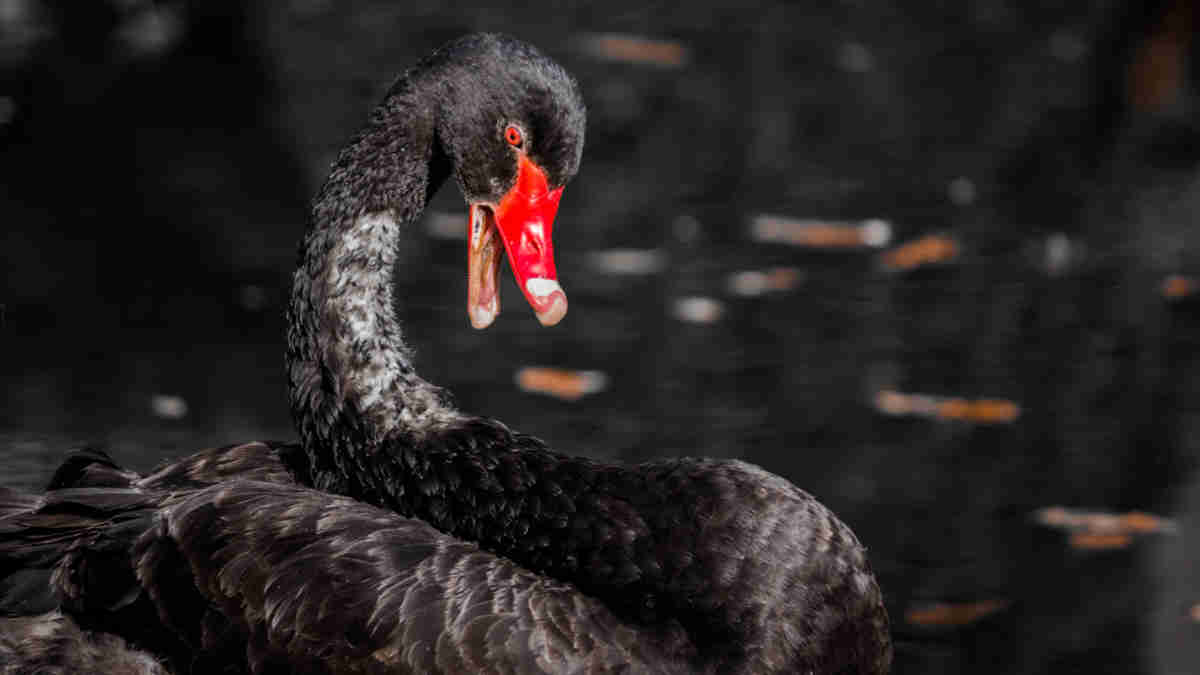

Author Nassim Taleb warns of a 2008-style crash. Picture Getty

- The ASX is set to open higher after a rally on Wall Street

- Fed Chair Jerome Powell delivered an expected hawkish tone at Jackson Hole

- Author Nassim Taleb warns of a 2008-style crash

The ASX will open higher on Monday after Fed chairman Powell’s hawkish comments failed to keep Wall Street from rallying. At 8am AEST, the ASX 200 index futures was pointing up by +0.3%.

On Friday, the S&P 500 and Dow Jones rose by +0.7%, while tech heavy Nasdaq climbed +0.9%.

Jerome Powell told a group of world’s central bankers in attendance at Jackson Hole, Wyoming, that the US’ fight against inflation isn’t over, and the Fed could return to hiking rates.

“Although inflation has moved down from its peak, a welcome development, it remains too high,” Powell said.

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

To stock news, payments company Affirm jumped 29% after Q4 revenue beat estimates.

Meta sank 3%, while chipmaker Marvell Technology lost 7% following its Q2 results.

Department store Nordstrom fell nearly -8% after issuing a cautious outlook, and also after the University of Michigan consumer sentiment index fell from 71.6 to 69.5 in August.

Back home, earnings season continues on the ASX, and today’s reporting schedule include:

Appen (ASX:APX), Fortescue Metals (ASX:FMG), Keypath Education (ASX:KED), and Liberty Financial (ASX:LFG).

Taleb reveals two sectors to avoid

Black Swan author Nassim Nicholas Taleb told a recent interview on NBC that a 2008 style crash could be coming.

After years of ultra low interest rates, people are saddled with debt they can’t pay as interest rates increase rapidly, Taleb explained.

“The risk is right in front of us. If you see a fragile bridge, you know it’s going to collapse at some point.”

According to Taleb, there are two sectors he would avoid right now – real estate and new technology.

“More than US$100 trillion in real estate valuation. But we’re not at 3% mortgages anymore. We’re at 7% and going north.”

As for new AI technology, “it’s going to be very unstable”, he said.

Taleb concluded by saying that we may have to go through a 2008-style crash first before these problems can be fixed.

“The whole structure needs to tumble,” he warned.

In other markets …

Gold price fell modestly by 0.12% overnight to US$1,915.15 an ounce.

Oil prices rose +0.6%, with Brent trading now at US$84.95 a barrel.

Iron Ore 62% fe gained +0.35% to US$108.21/tonne.

The Aussie dollar fell slightly to US64.10c.

Bitcoin meanwhile traded flat in the last 24 hours to US$26,054.

JPMorgan says the recent cryptocurrency market’s downtrend appears to be coming to an end, adding that liquidations on crypto startups are “largely behind us.”

However, the bank warned that a “new round of legal uncertainty” for crypto market awaits, making it sensitive to future developments.

5 ASX small caps to watch today

Bastion Minerals (ASX:BMO)

Bastion has signed a binding Letter of Intent (LOI) with ASX listed Hot Chili (ASX:HCH) for an option for HCH to acquire the Cometa Copper Project in Chile for up to US$3.3 million in cash. The divestment will enable Bastion to focus on the highly prospective Canadian Lithium Project and Swedish Rare Earth Element (REE) Project.

ikeGPS Group (ASX:IKE)

IKE has signed a new subscription contract with a large US-wide infrastructure customer, in this instance supporting a network assessment in California.The contract is expected to generate IKE approximately $1.5m or greater of subscription revenue in the coming 18 to 24 months. This is a contract extension following an initial proof of concept deployment.

Trajan Group (ASX:TRJ)

The scientific and medical equipments company continues to perform strongly with Net Revenue up more than 50%, and nEBITDA up more than 60% year-on-year. Trajan’s outlook guidance also remains positive. FY24 Net Revenue is expected to come in at $170.0m-$180.0m, and nEBITDA (Core business) is expected at $25.7m-$27.5m.

Quickstep Holdings (ASX:QHL)

Quickstep announced that it has signed an exclusive agreement with TB2 LLC of Breckenridge in Colorado for the TB2 Pod Interface system. The patented system provides an autonomous means of connecting a range of podded solutions to drones, and is designed to work on any UAS capable of accepting the TB2 system. Quickstep will provide an initial $500,000 for engineering and structural integration services.

LCL Resources (ASX:LCL)

A recently completed field program conducted by LCL geologists at its 100% owned Imou copper-gold porphyry in the PNG has returned exciting trench results including: 32m @ 0.49% Cu, 0.46g/t Au (FPR23TR001), and 120m @ 0.27% Cu, 0.23g/t Au, including 26m @ 0.49% Cu, 0.41g/t Au from 26m (FPR23TR002).

At Stockhead we tell it like it is. While Hot Chilli and Quickstep are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.