Market Highlights: Tech stocks in focus as Nasdaq jumps 1pc, and 5 ASX small caps to watch today

ASX to open higher, as tech heavy Nasdaq jumped over 1pc. Picture Getty

- ASX to open higher, as tech heavy Nasdaq jumped over 1pc

- Crude prices slumped by over 3pc

- Higher for longer rates scenario will lead to corporate defaults, says Janus Henderson

Aussie shares are poised to open higher, tracking gains on Wall Street. At 8am AEST, the ASX 200 index futures was pointing up by +0.4%.

In New York, the S&P 500 rose by +1.20%, the blue chips Dow Jones index was up by +1.58%, and the tech-heavy Nasdaq climbed by +1.16%.

Stocks sensitive to interest rates climbed the most and eyes now turn to Apple, which is set to report its earnings on Thursday (US time).

McDonald’s jumped +2% after beating estimates for Q3 as higher menu prices boosted sales growth.

Tesla shares fell -5% and led the decline in auto stocks following a disappointing forecast from ON Semiconductor, a company that makes microchips for automotives.

General Motors lifted +0.5% after reaching a tentative agreement with the United Auto Workers (UAW) union, joining its rivals Stellantis and Ford.

To commodities, crude prices slumped by 4% even as the World Bank warned that oil prices could soar to a record high of more than US$150 a barrel if the war in the Middle War escalates into a regional, full-scale conflict.

Meanwhile, the Fed Reserve will convene for the first of its two-day meeting later today (US time).

To recap, at its last meeting in September, the Fed elected to maintain the target range for the Fed Funds rate at 5.25%-5.50%, and retained its tightening bias.

In recent weeks however, several Fed Speakers, including Fed Chair Powell, have sounded more cautious and noted that the rise in longer-term bond yields have reduced the need for further monetary policy tightening.

“As such, the market is widely expecting the FOMC to keep the Fed Funds target rate unchanged at 5.25%-5.50% in November,” says Tony Sycamore of IG.

Janus Henderson warns of defaults if rates rise higher

With the Fed rates decision expected on Thursday AEDT, experts at Janus Henderson predict a higher for longer interest rate environment will have a domino effect on corporate defaults.

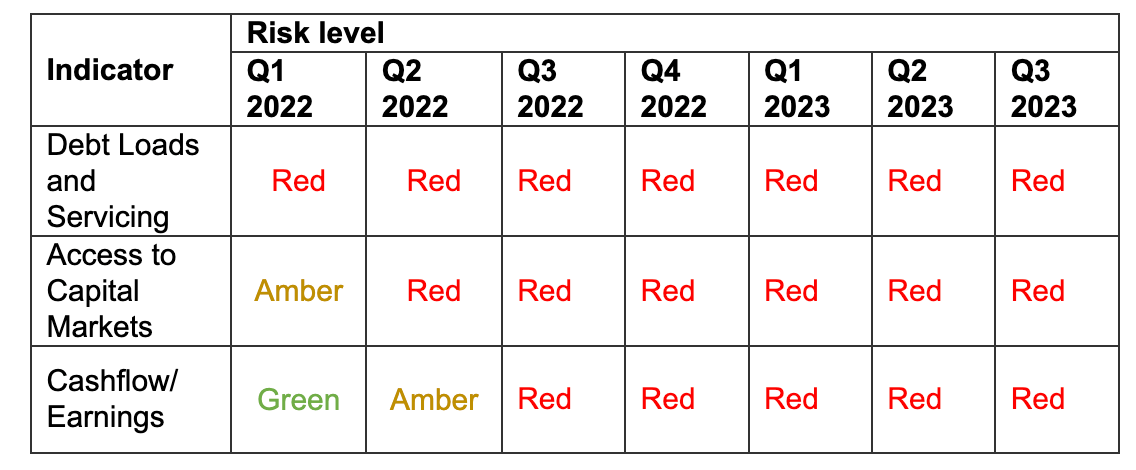

Janus Henderson’s latest Investors’ Credit Risk Monitor notes that although the impact will be lagged, the staggering rise in interest rates will lead to more defaults in the years ahead.

The report shows that the key indicators tracked (‘Cashflow and Earnings’, ‘Debt Loads and Servicing’, and ‘Access to Capital Markets’) all remain red for the fourth quarter in a row.

“The credit cycle tends to turn only if three conditions are present: high debt loads, lack of access to capital, and an exogenous shock to cash flow,” said Jim Cielinski, global head of Fixed Income at Janus Henderson Investors.

According to Cielinski, these conditions are all present today: the yield curve is inverted, lending standards are tightening, and central bank policy globally has been aggressively moving tighter.

“Each cycle is different, but a combination of high debt levels and a higher for longer interest rate environment is putting pressure on companies to service that debt, while cutting off access to capital at a reasonable price.

“In such an environment, active security selection is critical,” he added.

In other markets …

Gold price fell -0.5% to US$1,996.06 after earlier breaching the psychological US$2k level.

Oil prices tumbled more than -3%, with Brent now trading at US$87.84 a barrel.

10-year US bond yield jumped 5bp to 4.89%.

Iron ore futures was up 0.13% at US$118. 70 a tonne.

Base metals prices were higher, with 3-month nickel futures surging by +1.63%, and copper futures up by +1.42%.

The Aussie dollar keeps on climbing, up +0.6% to US63.71.

Meanwhile, Bitcoin was down -0.5% in the last 24 hours to US$34,508.

5 ASX small caps to watch today

Good Drinks Australia (ASX:GDA)

GDA’s total revenue was up 6% on pcp. GDA own brands and partner brands continued to outperform the retail beer market, up 9% in challenging market conditions. Net Sales Revenues per litre improved over the last quarter, however discounting is anticipated for the key Christmas trading period. Cost of goods per litre reduced over last year, stabilising at $1.08/L (own brands).

Lithium Energy (ASX:LEL)

A scoping study has highlighted Solaroz’ potential as a large scale, long life, and high margin lithium project. LEL says the project has exceptionally strong economics, including production capacity of up to 40,000 tpa battery grade Lithium Carbonate Equivalent (LCE), pre-tax Net Present Value of US$3.9bn, Internal Rate of Return (IRR) of 44%, payback period of two years, and average life of mine EBITDA of US$730 million.

Keypath Education (ASX:KED)

Keypath delivered strong revenue growth in Q1 FY24 of 13.1% to US$35.5 million, providing confidence in its strategic focus on Healthcare in the US and the APAC region. Q1 adjusted EBITDA was US$2.2 million, an increase of US$5.6 million from Q1 FY23. Total cash on hand as of September 30 was US$32.9 million, with no debt.

James Bay Minerals (ASX:JBY)

Spodumene was discovered at Aero Property at James Bay, Canada. Spodumene crystals were observed within Warhawk outcrop during maiden field prospecting campaign. This discovery is located along trend from Winsome Resources (ASX:WR1)’s Cancet lithium deposit, and Patriot Battery Metal’s (ASX:PMT) world-class CV5 Deposit (Corvette).

Encounter Resources (ASX:ENR)

RC drilling has intersected niobium-REE mineralised carbonatites at the Green and Emily targets in the south of the Aileron project (100% ENR), in the West Arunta region of WA. Two, 200m spaced, RC holes completed in the eastern part of the Green target have intersected carbonatites to end of hole that are variably anomalous in niobium and REE. Assays from Green and Emily are expected in December 2023-January 2024.

At Stockhead we tell it like it is. While Lithium Energy and Encounter Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.