Market Highlights: Magnificent 7 all at sea in New York as iron ore trades higher

Actors Steve McQueen (left) and Yul Brynner in the western film 'The Magnificent Seven', 1960. (Photo by Archive Photos/Getty Images)

- ASX Futures point to a positive open for Day 4, 2024

- Wall St closes mixed

- Iron ore is up, oil is down

Alas, Eddie’s still somewhere in the remote terrain of southern France, rallying the Maquisards, so it’s more of the other Eddy until “All France has been liberated from the mad tyranny of moderate progressive Emmanuel Macron.”

For now, local markets are set to begin higher, with the SPI 200 futures index pointing up by 21 points, or 0.28%.

Wall Street’s been far from convincing, but the ASX can hardly lay claim to the mega-tech weighting which has led losses in New York.

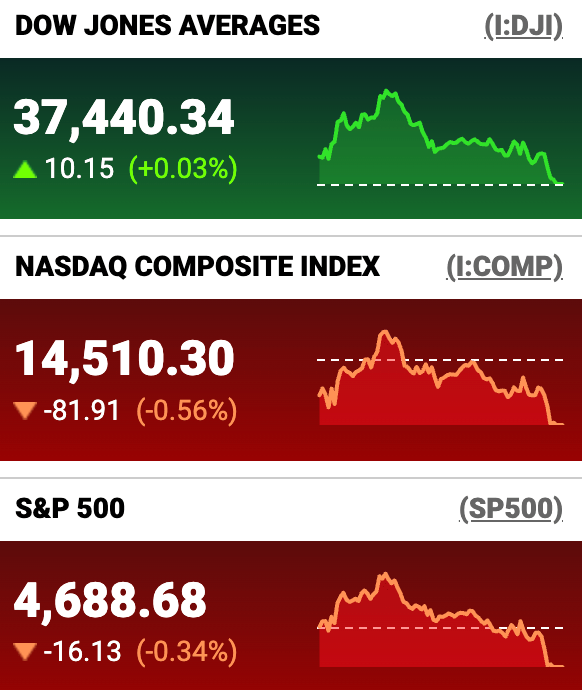

The Dow Jones Industrial Average has at least begun the arduous climb to retrace the 300 or so points it yielded during the Wednesday session. It’s ended 0.03% higher.

The S&P500 is down -0.34%, while the Nasdaq Composite isn’t in the mood and has slipped a further 0.56%, adding to the more than 1% it squandered on Day 2, 2024, losses this time led by Amazon.

Elsewhere, the Energy and Consumer Discretionary Sectors were worst-on-field, Financials the best led by JPMorgan which is now at a new all-time high of circa US$173, up almost 10% to make it a 28% gain, YTD.

Exxonmobil dropped -1%, tracking oil declines following a reported dive in gasoline demand via the latest EIA report.

The yield on the US 10-year Treasury note was 9 basis points higher to 3.99%, with New York following suggestions of strength in the labour market.

The US ADP reported 164,000 new jobs in December, well above the estimates of 115,000. The jobless rate is now where US traders are focusing for clues on the cash rate.

Meanwhile, the main problem for the tech-heavy is the return of reason vs euphoria when it comes to the mega-tech names as traders consider some of the wildly overstretched valuations when markets and the US Fed in fact remain cloaked in the same uncertainty to around cash rates

Apple, the Yul Brunner of the Magnificent 7, is trading about 5.5% lower already this week, subtracting a further 1% overnight following a downgrade by Piper Sandler, two days after Barclays also lowered its Apple rating.

That’s 5five days of losses led by various members of the Mag-7.

Finally, Bitcoin and Ether are rising again. BTC is leading the crypto stutter-charge with a 2.5% gain.

In other markets …

The gold price is up by 0.11% to US$2,042.98 an ounce.

Oil is lower. Both WTI and Brent Crude, down -0.8%.

The benchmark 10-year US Treasury yield is about 8 points higher at 3.99%.

Iron ore futures are up +0.35% to US$145.

The Aussie dollar slipped by -0.34% to US67.06c.

6 ASX small caps to watch today

Discovery Alaska (ASX:DAF) says it’s executed a transformational deal for control of the ~6,500 hectare Vinasale Gold Project in Alaska, securing a binding Mining Lease Agreement with Doyon, Ltd, an Alaska Native Regional Corporation.

Located ~310km northwest of Anchorage and ~26km south of McGrath, DAF says the ‘landmark transaction significantly advances the Company’s growth strategy, with the project hosting a reported historic NI 43-101 inferred resource of 22Mt @ 1.53g/t for 1.08Moz gold and indicated resource of 2.29Mt @ 1.84g/t for 135koz gold (using a 1g/t cut-off grade for both resource categories)1 at the Central Zone prospect.

Telix Pharmaceuticals (ASX:TLX) reports that it’s ‘considering’ an initial public offering (IPO) in the US, with American Depositary Shares representing its ordinary shares on the Nasdaq Global Market.

Telix’s ordinary shares will remain listed on the Australian Securities Exchange.

TLX say the number of ADSs that may be offered, the number of underlying ordinary shares that may be issued, the price for such instruments and the timing of the offering remain a mystery.

It’s toughest times for Core Lithium (ASX:CXO), which has called a halt to production at its Northern Territory mine due to the falling price of lithium. The cash-crimped company is in the midst of a strategic review.

Calima Energy’s (ASX:CE1) been in a trading halt all year sorting out the cash sale of its Blackspur Oil Corp which it says is a done deal for $83.3m.

Oceana Lithium (ASX:OCN) has reported final results from the phase one scout RC drilling campaign at its Solonópole Lithium Project in Ceará State, Brazil, which intercepted ‘multiple thick pegmatites containing some anomalous Lithium and Tantalum grades at shallow depth.’

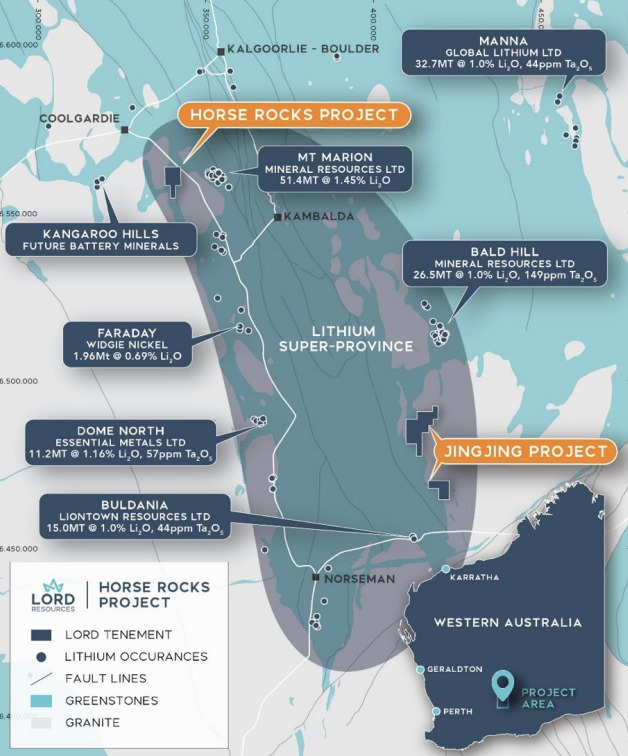

Lord Resources (ASX:LRD) says it’s identified ‘extensive fractionated pegmatites at its Horse Rocks Project within the Coolgardie-Norseman Lithium Super-Province in Western Australia, not too far from the Buldania Lithium Deposit (Liontown Resources) and the operational Bald Hill Lithium Mine (Mineral Resources)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.