Market Highlights: Debt ceiling climax weighs on markets, Albanese brings home the bacon from G7

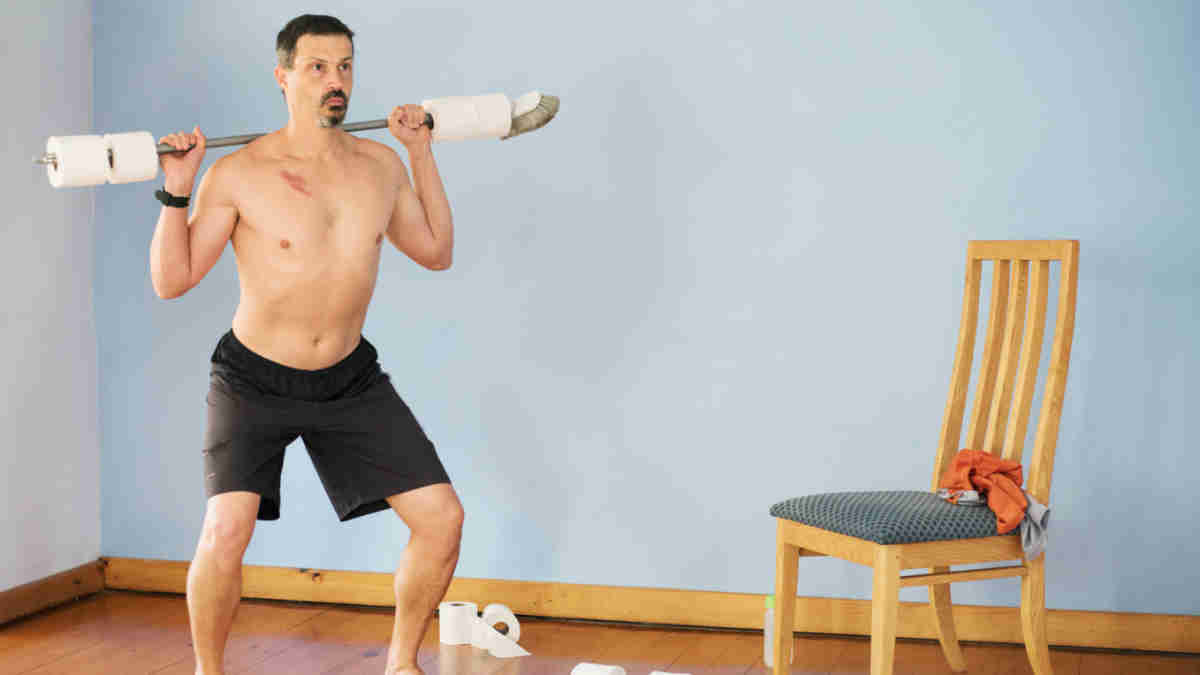

Debt ceiling crisis weighs on markets. Picture Getty

- The ASX is set to fall modestly lower on Monday on debt ceiling uncertainties

- Foot Locker plunged 27% after slow sales in Q1

- Climate and energy set to be established as the third pillar of the Australia-US alliance

Aussie shares are set to open lower on Monday morning after a modest selloff on Wall Street. At 8am AEST, the near-dated ASX200 contract was pointing down by -0.1%.

On Friday, US indexes finished lower by less than half a per cent on uncertainty over the US debt ceiling.

President Biden and House Speaker McCarthy will resume their talks today (US time), and without a deal, the US could default on its US$31.4tn debt.

“We have got 11 days to go,” McCarthy said on Sunday, as he urged Biden and Democrats to be “sensible about this.”

Another uncertainty this week is the Wednesday release of the US Fed minutes from its last meeting, which will reveal whether the board leans towards easing or tightening.

Fed Chair Jerome Powell, speaking alongside former Fed Chair Bernanke on Friday, noted the Fed may not have to raise rates as much if tighter credit conditions continue to weigh.

In stock news, Foot Locker plunged 27% after slow sales in Q1 led to a 11% sales drop, prompting the company to slash its outlook just two months after announcing it to the market.

Morgan Stanley boss James Gorman (who is Australian-American), said he plans to step down as CEO within the next year and assume the role of executive chairman. The bank’s share price fell almost 3% on the news.

Climate and energy exports

PM Albanese left the G7 meeting in Hiroshima content with the outcome that ensures climate and energy will be established as the third pillar of the Australia-US alliance, along with defence and economic co-operation.

Following the meeting, the US National Security Council and Australia’s federal Department of Industry, Science and Resources will now work together on the “Clean Energy Industrial Transformation”.

“If we think about industries like hydrogen, without that support, there would be a massive incentive for hydrogen-based industries to be based in the US,” Albanese said to the press in Hiroshima.

“So the big risk with the Inflation Reduction Act for the world – because we need to reduce the world’s emissions, not just that of one nation state – is that you’ll see capital leave Australia to go to the US. This is about addressing that.”

The federal government is also expected to announce an updated critical minerals strategy, which will explain how Australia’s abundant supply of “future facing” minerals will play a role in the US and globally.

In other markets …

Crude oil prices climbed slightly by 0.15%, with WTI now trading at US$71.65 a barrel.

“Oil looks like it might be stuck in a range around the low-$70s until we see further evidence that a debt deal will be reached and that supercore inflation doesn’t heat up,” said Oanda analyst, Edward Moya.

Gold lifted by +0.1% to US$1,979.66 an ounce.

“Gold’s record run to uncharted territory came to an abrupt end over the past couple of weeks on debt ceiling optimism, surging Treasury yields following hawkish Fed speak, and as recession fears ease,” said Moya.

Bitcoin was down -1% in the last 24 hours to US$26,777.

Legendary hedge fund manager, Paul Tudor Jones, said he will always keep a “small” exposure to BTC since it is “the only thing that humans can’t adjust the supply in.”

“From the beginning, I’ve always said I want to have a small allocation to it because it’s a great tail event,” Jones said.

“It’s the only thing that humans can’t adjust the supply in. So I’m sticking with it; I’m going to always stick with it. It’s just a small diversification in my portfolio.”

5 ASX small caps to watch today

AFT Pharma (ASX:AFT)

For the full year, AFT’s operating revenue was up 20% on the prior year to $156.6 million, lifted by strong product sales growth in all regions. Operating profit was $19.7 million, in line with the prior year’s $20.4 million. The company released a FY24 guidance for operating profit of $22 million to $24 million and declared a maiden dividend of 1.1 cents per share.

Gentrack Group (ASX:GTK)

The software solutions specialist for the energy industry reported a 48% increase (on pcp) in operating revenue to $84.3m for the half year. Gentrack’s bottom line net profit was $7.88m, a massive 235% increase on pcp. The company acknowledged the results include substantial one-off revenues, but both FY23 and FY24 revenue guidance have been upgraded to a range of $157m to $160m (from previous guidance of $147m to $150m respectively).

Amplia Therapeutics (ASX:ATX)

Amplia announced it has received grant funding to undertake a research collaboration with Australia’s national science agency CSIRO to develop novel topical formulations of the company’s FAK inhibitors. Amplia will work with CSIRO to help develop formulations of its small molecule FAK inhibitors that could be applied topically (i.e. directly) to wounds and burns to aid healing and reduce scarring.

Mandrake Resources (ASX:MAN)

Mandrake has executed a Well Access Agreement (WAA) with a local helium/oil and gas producer at the 100%-owned Utah Lithium Project. The company says the WAA allows Mandrake to re-enter multiple existing oil and gas wells to sample lithium brines, significantly accelerating the exploration program and pathway to a maiden Lithium Resource.

Australian Gold and Copper (ASX:AGC)

An eight square kilometre gradient array induced polarisation (IP) survey, along with a dipole-dipole survey line, has confirmed the presence of a strong chargeability anomaly at the Hilltop target. This is the second of three high impact IP surveys being undertaken at the South Cobar Project, targeting sulphide-hosted base metal and gold mineralisation. This new IP anomaly adds to the recently announced Achilles IP targets located 20km to the north which defined two compelling drill targets.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.