Market Highlights: Another tech rally in US, the most Googled finance words, and 5 small caps to watch

ASX to start week lower despite Wall Street rally on Friday. Picture Getty

i

- ASX to start week lower despite Wall Street rally on Friday.

- Amazon, Meta hit highs after beating forecasts

- Blowout jobs report in US pummelled crude prices

The ASX is poised to start the week lower despite a rally on Wall Street. At 8am AEDT, the ASX 200 index futures contract was pointing down by -0.7%.

On Friday, the S&P 500 rose by +1.07%. The blue chips Dow Jones index was up by +0.35%, and the tech-heavy Nasdaq surged by +1.74%.

Tech stocks continued their charge after behemoths Amazon and Meta Platforms hit highs on solid earnings.

Meta surged 15% to a record high after smashing earnings expectations. Amazon jumped by +8% to a two-year high as Q4 sales came in ahead of forecasts at US$170bn.

President Biden meanwhile declared that America’s economy “is the strongest in the world” after the latest non-farm payroll report released on Friday blew expectations away.

The US added 353,000 jobs in January, twice the forecast.

“The blowout January jobs report – payrolls surging, wages jumping, unemployment falling – means the Federal Reserve will be in no hurry to cut interest rates,” said a note out of ING Bank.

“However, we have to point out there are some less positive stories here. Nearly all the jobs the American economy is adding are part-time, and the average work week fell to 34.1 hours – that is recession territory!”

Back home, the RBA will hand down its interest rates decision on Tuesday.

“This week’s board meeting looks set to be a non-event, with pricing showing a certain hold. Instead, the focus shifts to the language from RBA Governor Michele Bullock and whether she takes a dovish tone,” said Josh Gilbert, market analyst at eToro.

Traders’ Diary: Everything you need to know before the ASX opens

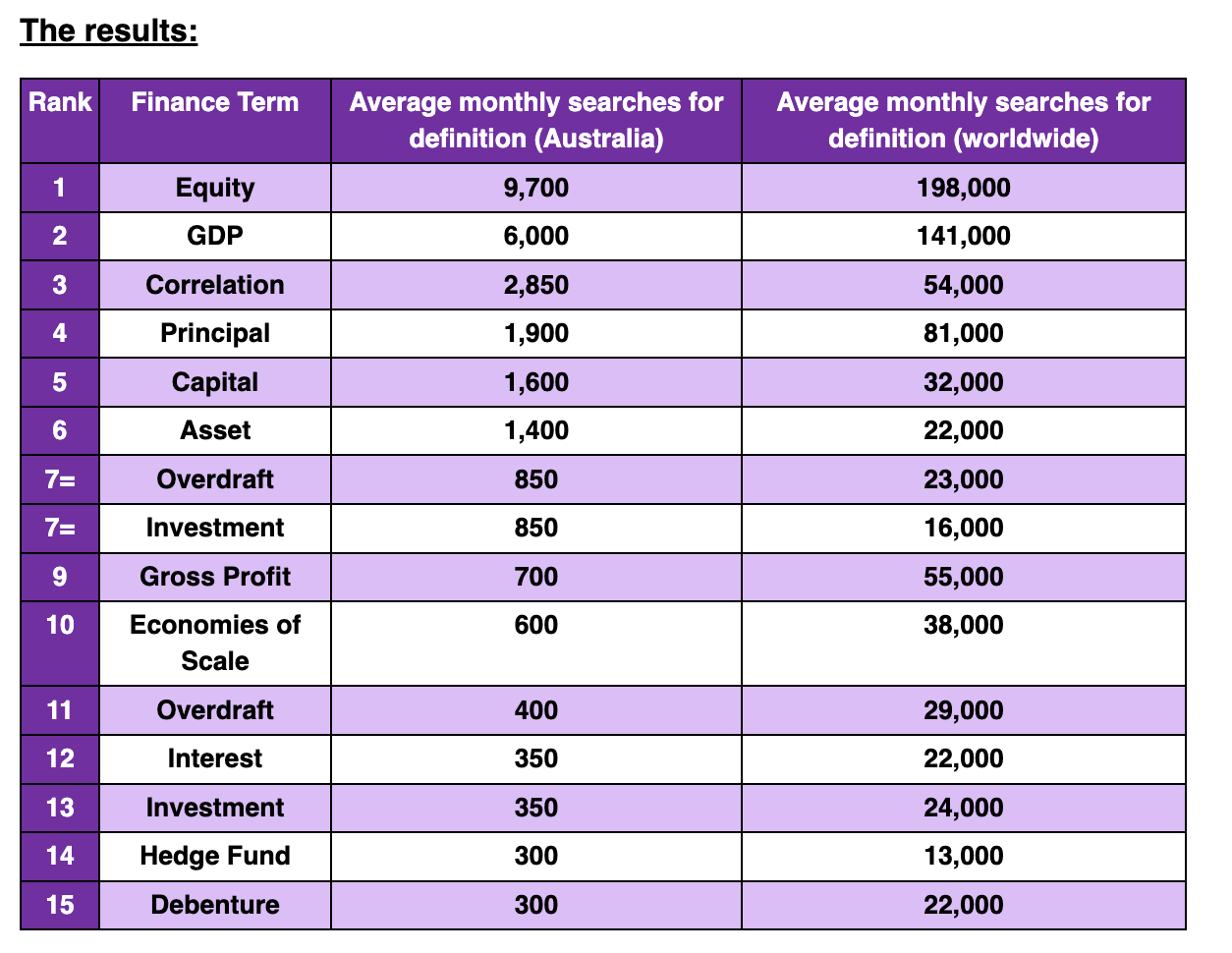

Most Googled financial terms

On a lighter note… finance can sometimes be confusing for those unfamiliar with the commonly used terms.

According to research from City Index, ‘Equity’ is the most confusing finance term for Australians, with an average of 9,700 monthly searches (198,000 globally for ‘Equity meaning’).

Equity can be a confusing term due to its different interpretations – which can be difficult for those unfamiliar with its different contexts.

For example, in the stock market, it represents the value that shareholders hold in a company. But in real estate, it refers to the value of a property when removing any outstanding mortgages.

City Index has thus given this definition to the term ‘equity’:

Definition: Equity, typically referred to as shareholders’ equity (or owners’ equity for privately held companies), represents the amount of money that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debt was paid off in the case of liquidation.

Here are the other financial terms that Aussies most often Googled for:

In other markets …

Gold price fell by -0.75% US$2,039.56 an ounce.

Oil prices tumbled by another -2%, with Brent now trading at US$77.30 a barrel.

Crude has been pummelled recently by a resurgent US dollar after Fed Powell said he won’t cut rates in March, and following the blowout jobs report on Friday.

The benchmark 10-year US Treasury yield skyrocketed by 16 basis points (bond prices lower) to 4.02%.

Iron ore futures crumbled by -4% to US$125.60 a tonne.

The Aussie dollar also gave away -0.85% to US65.17c.

Meanwhile, Bitcoin was down almost -0.5% % in the last 24 hours to US$42,834.

5 ASX small caps to watch today

LGI (ASX:LGI)

LGI has entered into a Landfill Gas Rights agreement with BINGO Industries, covering BINGO’s Eastern Creek landfill site in Western Sydney. The agreement entitles LGI to install landfill gas extraction infrastructure, and install, operate, and own a 4-megawatt (4MW) renewable power station on the site. The agreement provides for renewable electricity generated on site to be sold to BINGO. The initial term of the agreement is 15 years with two options for 5-year extensions. Phase one of the project is forecast to earn annual EBITDA of between $3.0m and $3.5m, depending on electricity prices.

Arafura Rare Earths (ASX:ARU)

Arufa announced the appointment of Darryl Cuzzubbo as managing director and CEO, following the departure of Gavin Lockyer. Cuzzubbo joined the board of Arafura as a non-executive director in November 2021. He has extensive operational and project development expertise. Cuzzubbo also has detailed knowledge of the company’s current financial and operational progress.

New World Resources (ASX:NWC)

An undrilled, strong coincident IP/magnetic anomaly has been delineated immediately southwest of the high-grade Antler Copper Deposit in Arizona. NWC believes it is a compelling lookalike target for potential resource expansion. The new “Bullhorn Target” lies 350m SW of the Antler Deposit and is characterised by a 400m-long strong magnetic anomaly; with a coincident 400m-long very strong IP chargeability anomaly.

Pantera Minerals (ASX:PFE)

Pantera reported continued growth in the Superbird leased acreage position, which firmly secures Pantera as one of the most significant players in the Southwest Arkansas Smackover Brine play. The Superbird Lithium Brine Project’s land position has grown an additional 11%, and now totals 13,457 acres, adjacent and on trend from Exxon Mobil’s Lithium Brine project. With a further 8,600 acres under negotiation, the Superbird Lithium Brine Project now has a clear path to 20,000 leased acres.

Artemis Resources (ASX:ARV)

Artemis said its recent ground reconnaissance program has resulted in a significant lithium pegmatite discovery at the Mt Marie Lithium Prospect. Ground reconnaissance sampling from tenement E47/1746 delivered positive assay results including: 23AR01-17 – 1.82% Li2O; 23AR01-16 – 1.62% Li2O; and 23AR01-15 – 0.78% Li2O.

At Stockhead we tell it like it is. While Arafura Rare Earths, New World Resources and Pantera Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.