Market Highlights and 5 ASX Small Caps to watch on Tuesday

Gov P Lowe of the RBA shrounded in shadow and looking pretty slashy via Getty

Wall Street rebounded while you slept, rallying late like there was some kind of looming rate change.

Investors are in three minds ahead of a mega Federal Reserve interest rate call on Wednesday. A bit of Shakespearean equivocation in the air. Buy, sell and/or sit.

The Nasdaq got in some late licks, rising strongly at the close to be 1.6% higher – gamer stock Activision Blizzard climbed well over 3% after me mate Warren Buffett’s Berkshire Hathaway stole a near 10% bite out of it.

Euro-markets were maudlin on Monday with weak China factory data and absolutely crappy views of Shanghai-in-lockdown sparking a ‘flash crash’ in Stockholm and trimming 1.5% off the pan-European STOXX 600 index fell, which by 1.5% after earlier being down 3%.

Global oil prices rose on expectations that supply may be crimped by a European ban on Russian crude imports and the same take on China and its factory data. Brent crude oil futures rose 0.6% to $108, copper fell 3.2%, gold fell 1.8%, and iron ore rose 3.1% to $146. The London Metals exchange was closed overnight for a very British holiday.

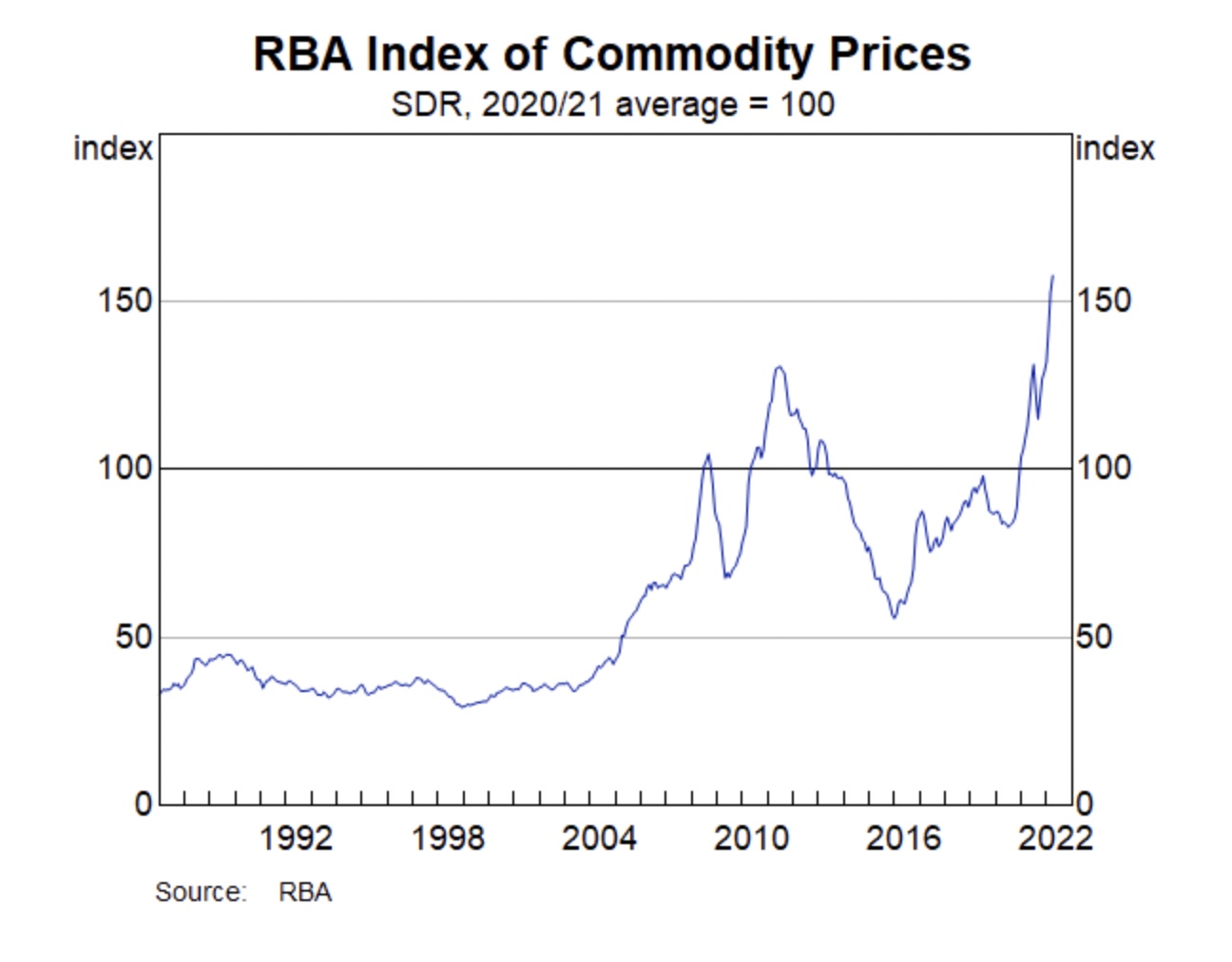

But the Reserve Bank has some good numbers on commodity prices which mean so much to us Down Here:

At home, the Reserve Bank Board meets and many people are still sifting through the weekly ANZ read on consumer confidence both happening this morning.

On the former Westpac says, given the strength of the labour market and inflation, the bank is expected to announce the start of the tightening cycle. Westpac anticipates an increase of 15bps to 0.25%. A decent call, hedge bets is sound, I reckon.

5 ASX small caps to watch today

Nice story: EQS offers stock market trading advice, research, investor education and fund management has an IPO set for: $5.5m at $0.20.

The IPO provides capital to scale Equity Story’s business by expanding the range of services offered and driving subscription based membership and education growth through targeted marketing activities. As well as working towards initiating new revenue verticals, and exploring complementary acquisitions and partnerships.

CEO Trent McGraw says: “Listing on the ASX is an important milestone for the Company’s future progress and development. Equity Story is now well positioned to execute our growth initiatives.”

And Glenn McGrath is on board.

Listing today – $12.5m at $0.50 – is this explorer with a pipeline of precious and base metal discoveries over in Nevada.

Its portfolio includes the Blackhawk polymetallic silver-gold epithermal discovery and the Blackhawk porphyry copper-gold discovery.

SNG also has the Warrior, New Pass and Colorback gold projects and around 12,000m of drilling is planned over the next 12 months.

The fintech has increased its customer base and expanded its app in the US.

There’s an official launch into Australia in the post, crypto trading services will also be launched as a key driver of growth and the company sees continued growth in the US market across all key metrics.

Douugh finished Q3 with its customer base growing to 97,389, or around 227% year-on-year (YoY), total accumulated card spend by existing customers since launch also grew to $16.8m, a rise of 1,674% YoY.

The oyster with the world at its feet has had a mad, bad, wonderful few days.

The share price went off like raw shellfish in the sun, yesterday – peaking at over 120% – before settling to a more cheerful 82% gain at the close.

The secret sauce? The company says the ‘inclement weather’ – that’s the insane rain that’s been falling since like, forever – just vindicated its geographic diversification strategy, meaning the lads got in a decent oyster harvest.

But when E33 shared the news last week the share price fell for two days straight. Sank, stone-like.

I believe I said last week, yesterday and now today: the people must have their oysters. Should be fun to watch.

While Revolver’s recent high-grade intersections at its Dianne project were certainly encouraging, a little time spent digesting the results has revealed its true scale.

Multiple drill results of more than 50m grading +0.9% copper from surface, including a 77m interval at 0.91% copper, have clearly indicated that the Green Hill Corridor is much larger than expected and has been shown to be at least 130m wide and 220m along strike.

This proves the presence of a high-grade multi-commodity massive sulphide orebody that remains open at depth and along strike, which is of a style and scale analogous with the Golden Grove deposit.

RRR says the growing Green Hill Corridor mineralisation system is adjacent to the high-grade massive sulphide zone with sampling and drill sampling showing that it remains open in at least three directions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.