Market Highlights and 5 ASX Small Caps to watch on Thursday

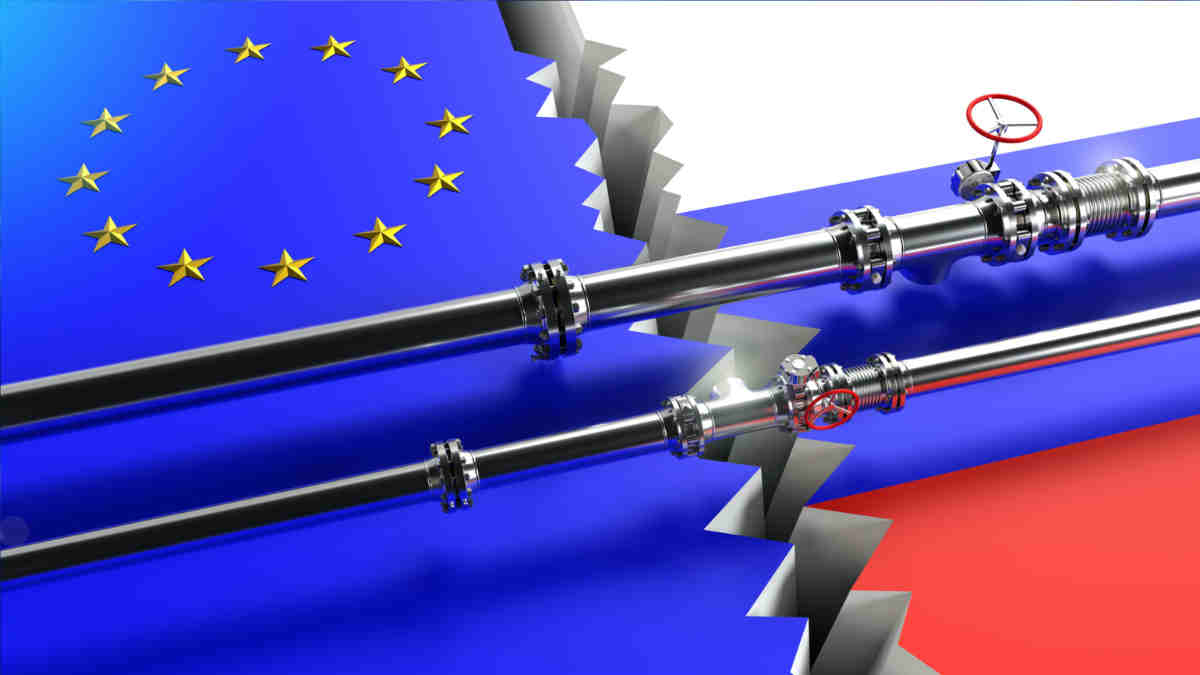

Russia has cut off LNG supply to two EU countries. Picture: Getty

- ASX to rise after falling for the last three days

- LNG price surges after Russian cuts off supply to two EU countries

- Aussie bond market is pricing in a 20bp rate hike in Mayy

ASX to rise, LNG prices jump 23%

After falling for the last three days, the ASX 200 is set to open higher this morning, with the ASX 200 June futures contract up by 1.05% at 8am AEDT.

Overnight, Wall Street finished marginally higher after some mixed quarterly updates from Big Tech.

Alphabet fell 4% after revenues fell short of expectations, while Meta soared more than 15% after the platform gained more users than projected for the quarter.

Meanwhile, ASX energy stocks could benefit from rising LNG prices after Russian President Vladimir Putin cut off supplies of LNG to two EU countries, Poland and Bulgaria, overnight.

The move sent natgas futures in Europe jumping by as much as 23%.

“If Russian gas is shut, LNG prices could go up a further $US50 per mbtu,” said Credit Suisse analyst, Saul Kavonic, via The Australian. “This is a very real prospect in the wake of the tragic situation in Europe.”

As a counter move, President Biden has approved more LNG export projects within the US.

Closer to home, market analysts are eying a 20bp move by the RBA in the next May meeting.

This follows a higher than expected 5.1% CPI print yesterday, with the bond market now pricing in rate expectations of as high as 2.5% by year end.

5 ASX small caps to watch today

Keypath Education (ASX:KED)

Keypath’s revenue for Q3 was $87.8m, up by 29% on a constant currency basis. Its course enrolments were over 79k, up 20% on pcp.

Beforepay (ASX:B4P)

Beforepay has delivered strong growth and significant uplift in net transaction margin in Q3 FY22, the company said. Pay advances were $87.9m in the quarter, up 213% from pcp. Its net transaction loss declined to 2.2%, down 58% YoY and 29% QoQ, driven by ongoing refinements to the risk model according to the company.

Botanix Pharma (ASX:BOT)

The US FDA has granted Botanix new Qualified Infectious Disease Product (QIDP) designation for its investigational antibacterial product, BTX 1801. The new QIDP status applies to the use of BTX 1801 to potentially “reduce the risk of staphylococcus aureus bloodstream infections”.

Fluence Corp (ASX:FLC)

Fluence’s Q1 Revenue was $34.5m, up 116% on pcp. The company’s outlook guidance is for a full year revenue of $144m, up 40% from $103m in 2021.

hiPages (ASX:HPG)

Australia and NZ’s largest online tradie marketplace reported total revenue of $15.9m, up 11% on pcp. Its recurring revenue was $14.7m, up 9% on pcp.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.