Market Highlights and 5 ASX Small Caps to watch on Friday

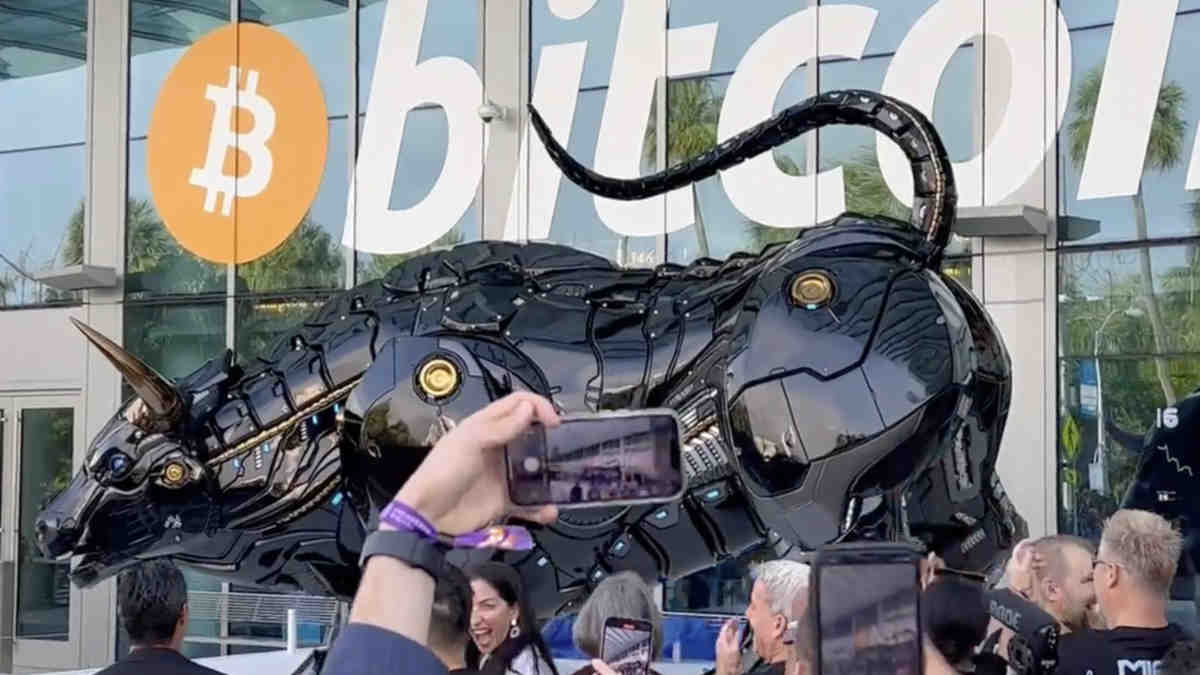

“Miami Bull” on Wall Street via Getty.

- ASX to rise as Wall Street bounces back

- Warren Buffet becomes HP’s biggest shareholder

- Oil prices retreat further

ASX heads for gains as Wall Street rebounds

Aussie shares are set to follow Wall Street into the green today, with the ASX 200 April futures pointing up by 0.28% at 8am AEDT.

Overnight, US stocks rebounded modestly after two consecutive days of losses.

The S&P 500 was up by 0.43%, the Dow Jones by 0.25%, and the tech heavy Nasdaq lifted by 0.23%.

Hewlett Packard (NYSE:HPQ) was the best performing stock, rising by 14.75% after Warren Buffet’s Berkshire Hathaway took an 11% stake and became its largest shareholder.

— Elon Musk (@elonmusk) April 7, 2022

Over the Atlantic, minutes from the European Central Bank (ECB) meeting revealed increased hawkishness, with several policymakers makers seeing the need to immediately roll back monetary stimulus.

This echoes the minutes from the US Fed meeting, which showed that board members planned to reduce the central bank’s massive bond holdings at $US95 billion a month starting in May.

Oil prices are now inching back down towards the US$100 level, with Brent crude trading at US$101 a barrel.

This comes as members of the International Energy Agency (IEA) agreed to join in the largest-ever US oil reserves release. Member countries of IEA have agreed to release a combined 120 million additional barrels of oil from strategic reserves.

Meanwhile, Bitcoin has slipped marginally and is trading at $43,583 at 8.30am AEDT.

A new crypto trading education platform that doubles as a general self-improvement group has been ploughing through its growth targets, according to one of the two Melbournians who launched it just over two months ago.

Read the rest of that story here on Coinhead.

5 ASX small caps to watch today

McGrath Holding (ASX:MEA)

The residential real estate group named its founder, John McGrath, to become CEO and managing director effective today. McGrath replaces Eddie Law, who has guided the company through the partial selldown of Oxygen Home Loan, and the acquisition of digital start-up Honey Insurance.

Twenty Seven Co (ASX: TSC)

The company said that with immediate effect, it has terminated the consultancy agreement under which the services of Simon Phillips are provided as CEO. The Board said it is confident the transition will cause minimal disruption to the ongoing business of TSC.

My Food Bag Group (ASX:MFB)

MFB has performed solidly in FY22, with revenue of $193.9 million, up +1.7% on FY21. Pro forma EBITDA was $34.2 million, up +17.9% on FY21.

Australasian Metals (ASX:A8G)

The company has identified further lithium mineralisation at the Mt. Peake Lithium Project in the NT. 1.15% Li2O (and 226 ppm Ta) was returned from the ongoing rock chip sampling program.

GME Resources (ASX:GME)

Updated Pre-Feasibility Study (PFS) for the NiWest Nickel Project has commenced. NiWest is believed to host one of the highest-grade undeveloped nickel laterite mineral resources in Australia, estimated to contain 85 million tonnes averaging 1.03% Nickel and 0.065% Cobalt.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.