Lunch Wrap: Trump’s metals tariff drags ASX; WiseTech addresses new allegations

Trump’s tariff talk hits ASX. Picture via Getty Images

- Trump’s fresh tariff talk hits ASX, US stocks tumble

- Star casino jumps after rejecting takeover offer

- Pilbara warns of losses while WiseTech sinks on scandal

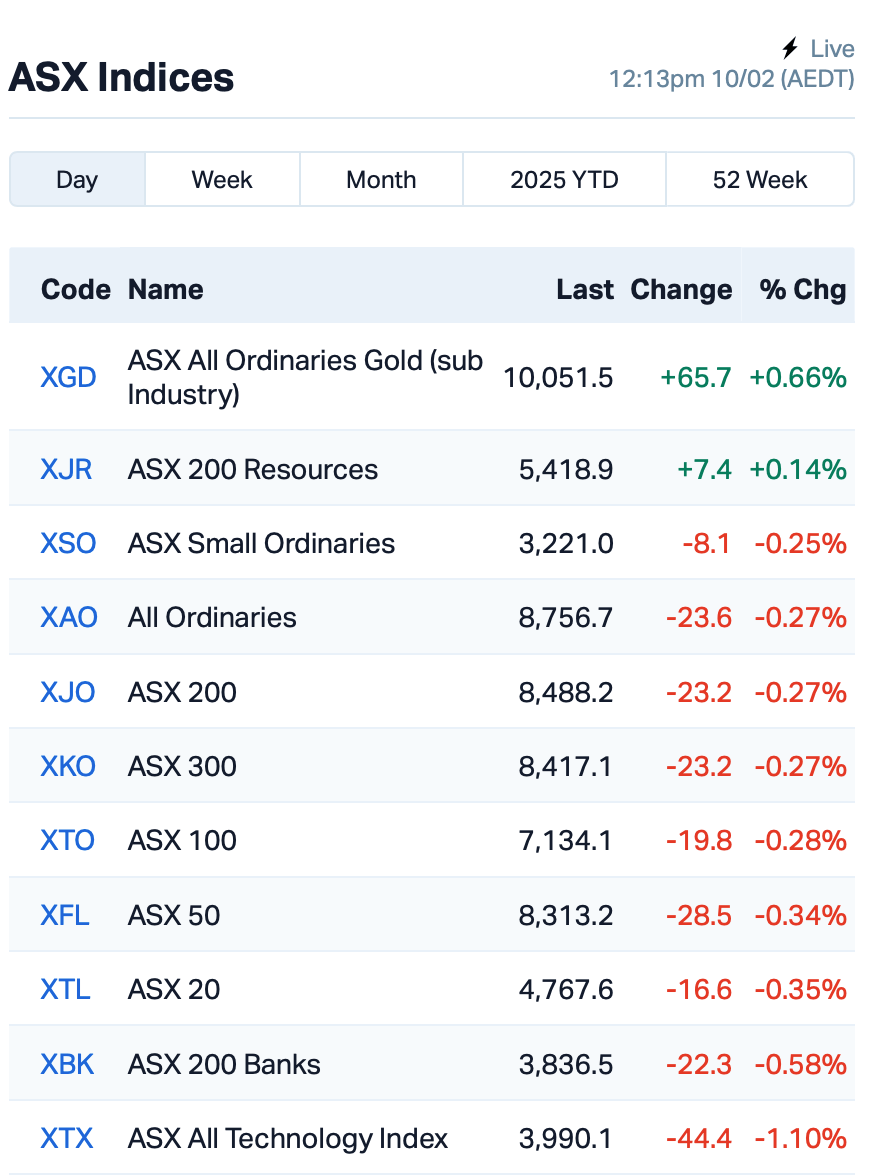

The ASX dropped 0.3% this morning, with mood in the market dampening after a rise in US job growth and President Trump’s decision to slap a 25% tariff on steel and aluminium imports.

Speaking aboard Air Force One as he headed to the NFL Super Bowl in New Orleans, Trump said,”Any steel coming into the United States is going to have a 25 per cent tariff. Aluminium, too.”

Trump also told reporters he’ll announce reciprocal tariffs, meaning if other countries charge the US, they’ll get a taste of their own medicine.

During his first term, Trump had slapped hefty tariffs on steel and aluminium, but later made some deals to grant a few countries, like Canada and Mexico, some duty-free leeway.

The tariff news had local investors, in particular uneasy, as it could impact Aussie exports. The US dollar jumped, while the Aussie and Canadian dollars took a hit following Trump’s comments.

Meanwhile, data on Friday showed that US job growth slowed down in January, but the unemployment rate stayed steady at 4%.

“This report cements the view that the Fed could be on hold for a considerable time before cutting rates again,” said Scott Anderson at BMO Capital Markets.

The S&P 500 lost ground by 1%, and the tech-heavy Nasdaq by 1.4% on Friday.

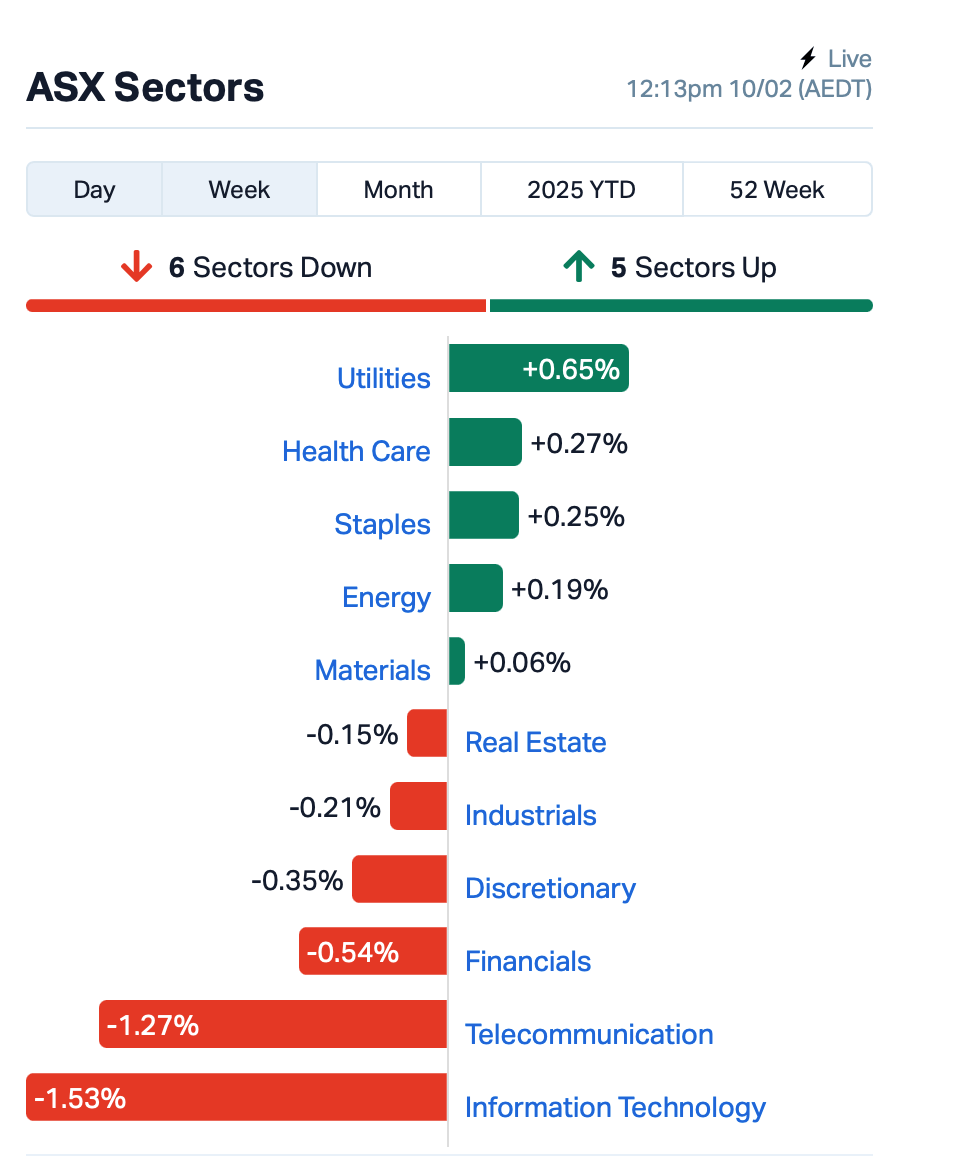

Back home, Tech and Telco sectors led the laggards this morning:

In the large caps space, Star Entertainment Group’s (ASX:SGR) stock surged by 15.5% after it rejected takeover proposals from Chow Tai Fook Enterprises and Far East Consortium for its stake in the Queen’s Wharf complex in Brisbane.

Pilbara Minerals (ASX:PLS) warned of a potential net loss of between $5 million and $7 million for its upcoming half-year results. Shares were down 1%.

JB HiFi (ASX:JBH) gained 1% after reporting nearly 10% growth in sales during the first half, defying market expectations.

Protective wear company, Ansell (ASX:ANN), soared over 6% after announcing price hikes to deal with rising US tariffs.

Meanwhile, WiseTech Global (ASX:WTC) dropped 4% after founder Richard White got slammed with fresh allegations of inappropriate conduct.

Two new complaints, one from an employee and another from a supplier, have been made against him. The company’s board is looking into it, but for now, both WiseTech and White are sticking to their plan from October 2024, which included him taking on a new consultancy role in the firm.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 10 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| GRL | Godolphin Resources | 0.025 | 56% | 45,843,746 | $5,745,578 |

| DTR | Dateline Resources | 0.004 | 33% | 48,420 | $7,548,781 |

| MMR | Mec Resources | 0.004 | 33% | 77,248 | $5,549,298 |

| CRS | Caprice Resources | 0.026 | 24% | 4,007,083 | $9,303,773 |

| EMU | EMU NL | 0.032 | 23% | 928,405 | $5,001,859 |

| NVU | Nanoveu Limited | 0.058 | 21% | 8,670,377 | $26,603,689 |

| TEM | Tempest Minerals | 0.006 | 20% | 1,045,847 | $3,172,649 |

| MYX | Mayne Pharma Ltd | 5.590 | 19% | 406,269 | $380,230,470 |

| OZM | Ozaurum Resources | 0.155 | 19% | 7,465,408 | $25,637,500 |

| SGA | Sarytogan | 0.071 | 18% | 629,043 | $9,974,453 |

| OKJ | Oakajee Corp Ltd | 0.013 | 18% | 54,500 | $1,005,906 |

| CCX | City Chic Collective | 0.135 | 17% | 1,268,769 | $44,293,146 |

| EVR | Ev Resources Ltd | 0.004 | 17% | 256,225 | $5,797,510 |

| STM | Sunstone Metals Ltd | 0.007 | 17% | 1,612,802 | $30,900,022 |

| OMX | Orangeminerals | 0.036 | 16% | 493,755 | $3,444,171 |

| SGR | The Star Ent Grp | 0.128 | 16% | 28,416,031 | $315,554,896 |

| AAJ | Aruma Resources Ltd | 0.011 | 16% | 1,052,734 | $2,109,553 |

| MM8 | Medallion Metals. | 0.150 | 15% | 1,344,422 | $53,224,128 |

| HOR | Horseshoe Metals Ltd | 0.015 | 15% | 1,154,356 | $8,622,662 |

| SRR | Sarama Resources | 0.031 | 15% | 345,133 | $6,995,253 |

Godolphin Resources’ (ASX:GRL) Lewis Ponds Gold & Silver Project is looking promising after the first two drill holes of a new program showed solid results. Hole GLPDD006 hit 49.6m at 3.53g/t gold equivalent (AuEq) from 210m, with a high-grade core of 28.2m at 5.76g/t AuEq. The drilling has also uncovered more mineralisation in the Torphy’s Lode.

Mayne Pharma (ASX:MYX) expects 1H FY25 revenues between $210-$215 million, marking 12-14% growth from the same period last year. The company also anticipates a significant 275-300% increase in underlying EBITDA. For the second half of FY25, Mayne predicts continued growth but also some seasonal cost impacts.

PYC Therapeutics (ASX:PYC) has just received the green light from the US FDA to start human trials for its promising drug candidate, PYC-003, aimed at treating Polycystic Kidney Disease (PKD). PKD, a condition affecting over 5 million people globally, causes kidney cysts that grow over time, leading to kidney failure. There are currently no current treatments targeting the disease’s root cause.

Nanoveu has sealed the deal on its acquisition of Embedded A.I. Systems (EMASS), a leading semiconductor design firm. With the integration of EMASS’s technology, Nanoveu aims to innovate in wearables, drones, IoT devices and more, while reducing energy use and carbon footprints.

Sarytogan Graphite (ASX:SGA) received $2.36 million from the European Bank for Reconstruction and Development (EBRD) as part of its Tranche 2 equity investment, raising the bank’s stake to 17.3% of the company. The investment, made at $0.16 per share, is a 166% premium on last week’s closing price. This follows a previous $2.64 million investment in November 2024. EBRD also conducted a positive peer review of the Pre-Feasibility Study for Sarytogan’s graphite project, identifying some risks but concluding the project holds significant promise.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 10 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.001 | -50% | 50,000 | $12,302,431 |

| AOK | Australian Oil. | 0.002 | -33% | 30,131 | $3,005,349 |

| AOA | Ausmon Resorces | 0.002 | -25% | 200,000 | $2,179,455 |

| GGE | Grand Gulf Energy | 0.002 | -25% | 6,971,011 | $4,900,774 |

| MOM | Moab Minerals Ltd | 0.002 | -25% | 859,233 | $3,133,999 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 3,807,516 | $6,129,741 |

| OB1 | Orbminco Limited | 0.002 | -25% | 350,000 | $4,333,180 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 2,997,852 | $9,289,380 |

| WNX | Wellnex Life Ltd | 0.735 | -19% | 97,326 | $28,872,873 |

| ANX | Anax Metals Ltd | 0.009 | -18% | 510,000 | $9,640,969 |

| TRM | Truscott Mining Corp | 0.074 | -18% | 29,000 | $17,230,370 |

| ASP | Aspermont Limited | 0.005 | -17% | 100,000 | $14,820,070 |

| BGE | Bridgesaaslimited | 0.020 | -17% | 10,003 | $4,796,621 |

| ERA | Energy Resources | 0.003 | -17% | 352,178 | $1,216,188,722 |

| FTC | Fintech Chain Ltd | 0.005 | -17% | 9,523 | $3,904,618 |

| GES | Genesis Resources | 0.005 | -17% | 250,933 | $4,697,048 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 63,094 | $9,597,195 |

| SPQ | Superior Resources | 0.005 | -17% | 25,000 | $13,019,183 |

| TIG | Tigers Realm Coal | 0.003 | -17% | 3,176 | $39,200,107 |

| E79 | E79Goldmineslimited | 0.033 | -15% | 12,516,779 | $3,984,343 |

| ZAG | Zuleika Gold Ltd | 0.011 | -15% | 658,876 | $9,644,439 |

| BUX | Buxton Resources Ltd | 0.034 | -15% | 43,932 | $8,891,299 |

IN CASE YOU MISSED IT

Summit Minerals (ASX:SUM) has appointed Dr Matthew Cobb as CEO to lead the company’s Equador niobium and rare earths project in Northeast Brazil. Cobb is a geologist by trade with 20 years of experience in the mining industry – including in exploration, project development and mines operation.

Cobb has previously worked in senior roles across multiple commodities in Australia, Africa and South America, including positions with Fortuna Mining, Silver Lake Resources, CSA Global and Consolidated Minerals where he has contributed to significant discoveries.

At a time of record gold prices, West Australian explorer Star Minerals (ASX:SMS) has reiterated its commitment to advancing the Tumblegum South gold project. By the end of this year, SMS intends to complete exploration drilling, infill drilling, a feasibility study and engage contractors at Tumblegum. Longer term goals include permitting and environmental and heritage surveying.

Trigg Minerals (ASX:TMG) has appointed Andre Booyzen to its board as a non-executive director. Booyzen previously served as vice president for Mandalay Resources and has already been working with Trigg as a strategic advisor. Booyzen’s work with Mandalay helped lead the Costerfield gold-antimony mine in Victoria – currently Australia’s only producer of antimony concentrate.

At Stockhead, we tell it like it is. While Summit Minerals, Star Minerals and Trigg minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.