Lunch Wrap: Tariff storm sinks ASX again, but Orthocell powers ahead with FDA approval

Orthocell hits big with US FDA approval. Picture via Getty Images

- ASX hit hard, around $30 billion wiped off

- Wall street crashes, tech giants plummet, fear gauge soars

- Orthocell gets US FDA approval

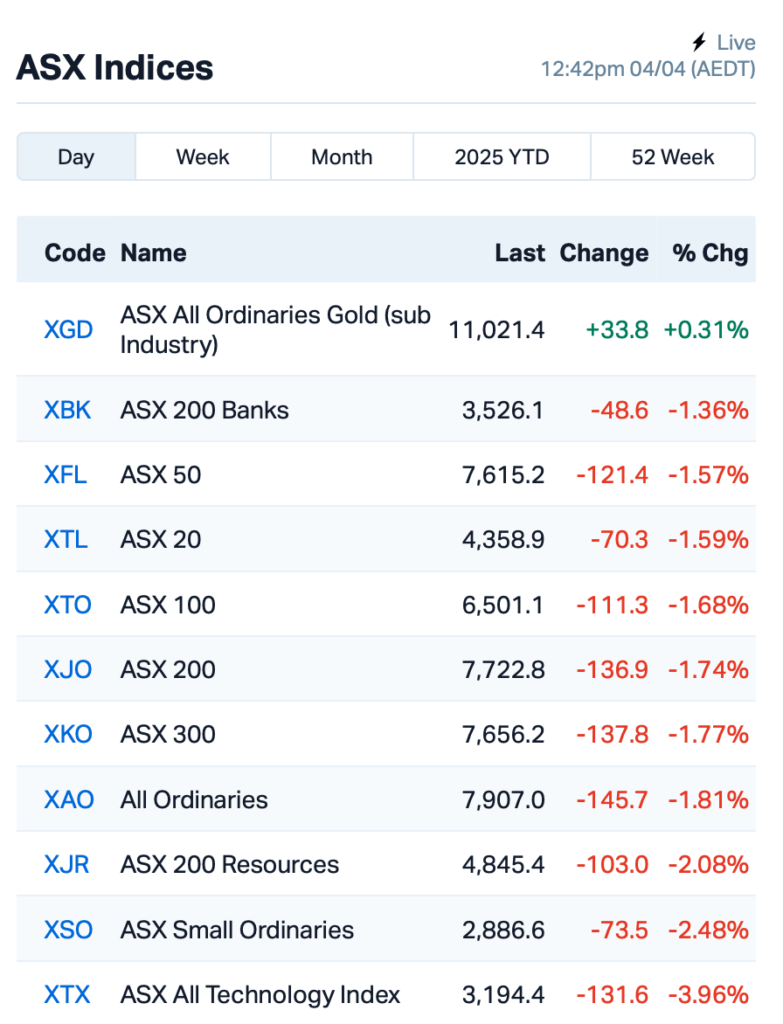

The ASX 200 took another big hit on Friday, down by 1.7% at lunch AEDT as the market erased a further $30 billion-ish from the index on the back of tariff worries.

Overnight, Wall Street had its biggest fall since the pandemic’s early days of June 2020, with the S&P 500 plummeting 4.8% and Nasdaq by 5.97%.

The selloff has officially sent the US main index into a technical correction. Small-cap stocks were also hit hard, with the Russell 2000 index dropping 6.6%, entering a technical bear market.

Tech giants like Amazon and Nvidia crashed by 8-9%, while Apple was down by 9.25%.

The VIX index, which is Wall Street’s so called “fear gauge”, shot up to its highest point since August 2024.

The selling wasn’t limited to the US, though, as global markets, including Europe, were also rocked by the tariff news, with oil prices dropping and the US dollar weakening.

Brent is now trading below US$70/barrel, after copping a solid one-two punch from the tariffs and OPEC+ speeding up its plan to crank out more oil in May.

As recession fears keep creeping in, bond yields have taken a sharp dive (bond prices rise). The three-year US Treasury yield dropped a massive 29 basis points, while the 10-year yield slipped 18 basis points.

But the most concerning part is, the market could be grappling with more uncertainty ahead.

Experts believe the stagflationary shock means markets are likely to stay in risk-off mode for now.

Many are waiting to see how the tariff situation develops in the coming weeks – whether retaliation will trigger a new wave of escalation or if countries will take a more diplomatic approach.

The fear is that these tariffs could drag down growth across the globe, and ultimately hurt earnings across the world.

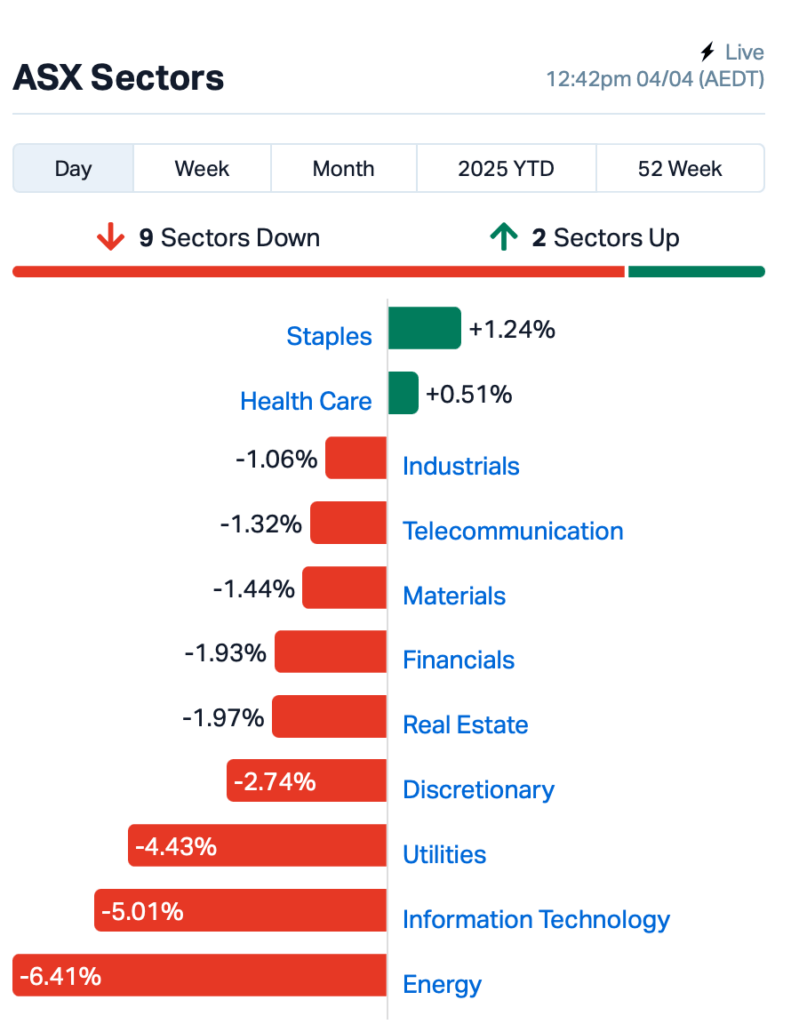

Back home on the ASX, only Staples and Healthcare managed to survive the carnage this morning.

Woodside Energy Group (ASX:WDS) and Santos (ASX:STO), the big hitters on the Energy index, sank around 7% each.

But while everyone else was losing their heads over the market’s wild ride, Orthocell (ASX:OCC) has just come out of a trading halt with a groundbreaking announcement.

The company’s flagship nerve repair product, Remplir, has just snagged US FDA 510(k) clearance, which will open the door to a massive US market worth around $1.6 billion.

Remplir is a collagen wrap used in nerve repair surgery to help surgeons fix damaged nerves.

With this approval, Orthocell is now ready to roll out sales in the US, and the company’s been preparing for this moment by ramping up production. Its Perth facility can produce 100,000 units a year, and with $32 million in cash reserves, the biotech is fully funded for the launch.

Read more about it here > Level achieved: Orthocell gains FDA approval for flagship nerve repair product

Meanwhile in the large caps space, Amotiv (ASX:AOV), a car accessories manufacturer, saw its share price drop by 16% as it warned that revenue and earnings would likely take a hit in FY25.

The company said sales of 4WD accessories have been hit by a slump in new vehicle sales, and caravans and trucks sales aren’t looking great, either.

Despite this, Amotiv said it’s confident the new US tariffs won’t have a big impact, as its US exposure is low.

On a more positive note, Ansell (ASX:ANN), the protective gear maker, saw its stock rise by 4% after it promised to fully offset the impact of the tariffs through price increases.

“We expect the timing of tariff increases and pricing adjustments to be broadly similar, and so are maintaining our guidance range for FY25 Adjusted EPS at US118c to US128c,” said the company.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 4 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ENT | Enterprise Metals | 0.003 | 20% | 32,400 | $2,945,793 |

| AJL | AJ Lucas Group | 0.008 | 33% | 1,506,517 | $8,254,378 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 4,013,780 | $8,179,556 |

| CVR | Cavalierresources | 0.220 | 26% | 35,009 | $10,122,388 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 407,975 | $12,314,111 |

| VML | Vital Metals Limited | 0.003 | 25% | 242,421 | $11,790,134 |

| OEQ | Orion Equities | 0.185 | 23% | 21,055 | $2,347,384 |

| EWC | Energy World Corpor. | 0.016 | 23% | 40,600 | $40,025,976 |

| INF | Infinity Lithium | 0.023 | 21% | 291,329 | $8,979,250 |

| HLX | Helix Resources | 0.003 | 20% | 153,937 | $8,410,484 |

| MRD | Mount Ridley Mines | 0.003 | 20% | 900,000 | $1,946,223 |

| KTA | Krakatoa Resources | 0.010 | 18% | 1,689,759 | $5,271,139 |

| DTR | Dateline Resources | 0.007 | 17% | 18,071,671 | $15,393,412 |

| KGD | Kula Gold Limited | 0.007 | 17% | 1,101,472 | $5,527,522 |

| TMX | Terrain Minerals | 0.004 | 17% | 1,018,984 | $6,010,670 |

| PVW | PVW Res Ltd | 0.015 | 15% | 245,792 | $2,585,762 |

| BIT | Biotron Limited | 0.004 | 14% | 550,000 | $3,158,340 |

| BNL | Blue Star Helium Ltd | 0.007 | 0% | 129,240 | $18,864,197 |

| EE1 | Earths Energy Ltd | 0.008 | 14% | 259,773 | $3,709,750 |

| LEG | Legend Mining | 0.008 | 14% | 25,000 | $20,366,340 |

| RDS | Redstone Resources | 0.004 | 14% | 300,000 | $3,238,825 |

| ORD | Ordell Minerals Ltd | 0.655 | 13% | 439,812 | $20,849,649 |

| HYD | Hydrix Limited | 0.018 | 13% | 56,306 | $4,364,302 |

Blue Star Helium (ASX:BNL) has successfully drilled the intermediate hole section of the Jackson 29 well at its Galactica project in Colorado. The casing is now set and cementing is underway. Once the cement bond is confirmed, Blue Star will continue drilling into the Lyons formation, and complete the well for production testing and future tie-in to facilities.

Synlait Milk (ASX:SM1) shares kept climbing after yesterday’s announcement, as the company reached a key milestone in locking down its future milk supply. Most of the cease notices, which were formal warnings from farmers to stop supplying milk, have been lifted, showing strong support and growing confidence in Synlait after its return to profitability. With plenty of interest from new farmers, Synlait said it’s on track to secure enough milk for FY26 and FY27.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 4 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -50% | 1,263,591 | $57,867,624 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 225,000 | $2,600,499 |

| PAB | Patrys Limited | 0.002 | -25% | 590,000 | $4,114,895 |

| FME | Future Metals NL | 0.010 | -23% | 1,469,982 | $7,475,526 |

| AM5 | Antares Metals | 0.007 | -22% | 1,910,000 | $4,633,676 |

| NTI | Neurotech Intl | 0.028 | -22% | 1,431,632 | $37,786,389 |

| BCB | Bowen Coal Limited | 0.004 | -20% | 7,586,748 | $53,878,201 |

| DDT | DataDot Technology | 0.004 | -20% | 225,001 | $6,054,764 |

| ERA | Energy Resources | 0.002 | -20% | 79,159 | $1,013,490,602 |

| FIN | FIN Resources Ltd | 0.004 | -20% | 213,235 | $3,246,344 |

| FRX | Flexiroam Limited | 0.004 | -20% | 28,571 | $7,586,993 |

| IPB | IPB Petroleum Ltd | 0.004 | -20% | 123,595 | $3,532,015 |

| MTB | Mount Burgess Mining | 0.004 | -20% | 3,929 | $1,697,687 |

| RGL | Riversgold | 0.004 | -20% | 16,665,612 | $8,418,563 |

| CPO | Culpeominerals | 0.013 | -19% | 684,272 | $3,519,396 |

| PPY | Papyrus Australia | 0.009 | -18% | 554,502 | $6,277,499 |

| CKA | Cokal Ltd | 0.025 | -17% | 1,133,033 | $32,368,469 |

| GTR | Gti Energy Ltd | 0.003 | -17% | 3,067 | $8,996,849 |

| SPQ | Superior Resources | 0.005 | -17% | 31,600 | $13,019,183 |

| AOV | Amotiv | 7.340 | -16% | 1,262,413 | $1,204,451,367 |

| ADX | ADX Energy Ltd | 0.026 | -16% | 144,864 | $17,830,869 |

| WWG | Wisewaygroupltd | 0.130 | -16% | 193,056 | $25,939,745 |

| FDR | Finder | 0.048 | -16% | 1,581,244 | $16,204,434 |

| EGG | Enero Group Ltd | 0.655 | -15% | 75,515 | $70,319,719 |

Tourism Holdings (ASX:THL) fell 5% after warning that the new US tariffs would further hit its already sluggish sales. The company’s seeing a slowdown in international bookings for RV rentals, with consumer sentiment for US travel dropping. While the company is still figuring out the full impact, especially with potential retaliatory tariffs from Canada, it’s keeping a close eye on the situation and said it expects more clarity by Q4 FY25.

IN CASE YOU MISSED IT

QMines (ASX:QML) has wrapped up diamond drilling at the Mt Chalmers Copper and Gold Project in Queensland, with visual examination of the drill core indicating the mineralisation is of high quality and consistency, although formal assays will be required to understand the true grade. The rig will now move to the Develin Creek Project, which recently produced a broad copper intersection of 114 metres at 1.64% from just 11 metres below surface.

At Stockhead, we tell it like it is. While QMines and Orthocell are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.