Lunch Wrap: Stocks slip lower at lunch, market operator ASX plunges as monopoly under threat

ASX dives as monopoly grip gets shaky. Picture via Getty Images

- Market operator ASX plunges as monopoly days look numbered

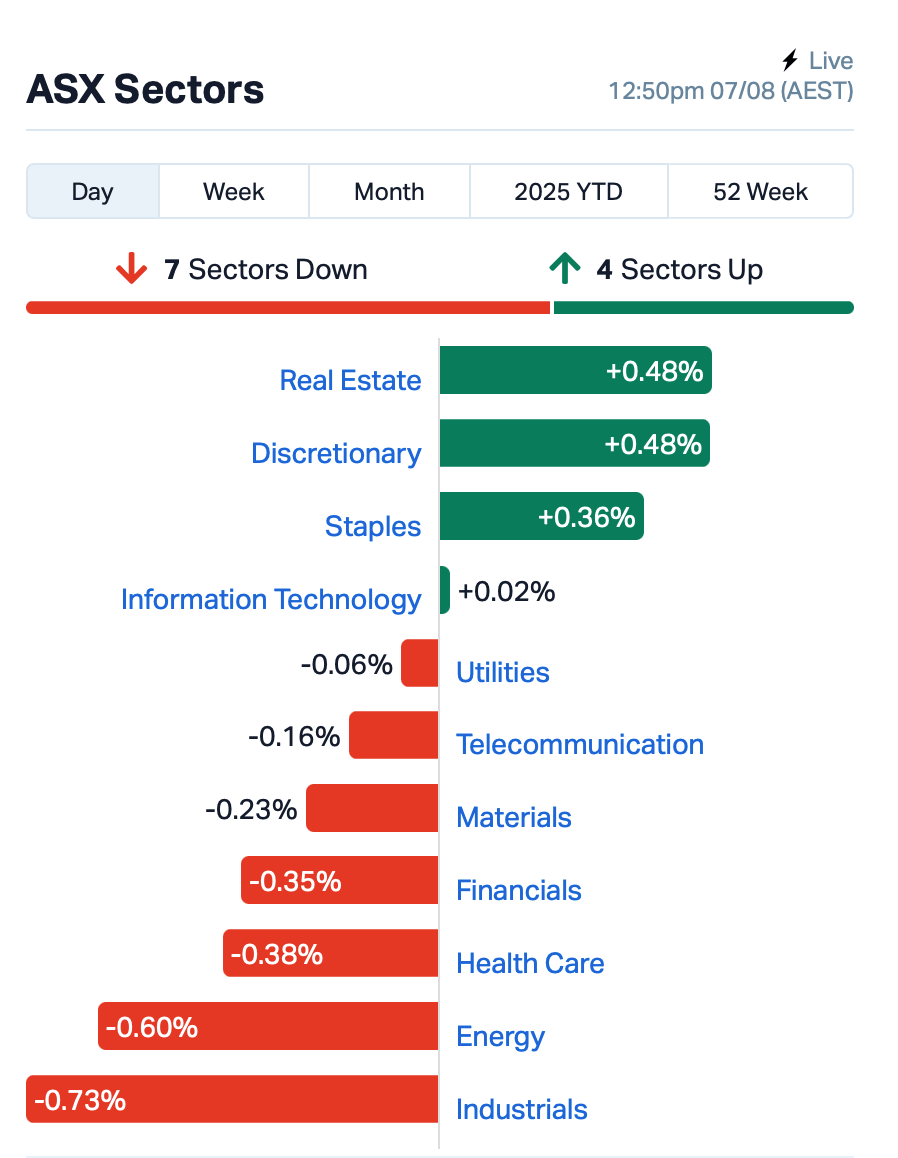

- Tech and real estate perk up on rate cut whispers

- Rio and Fortescue wobble as China property hopes fade

By Thursday lunchtime in the east, the ASX was slipping a bit further into the red, down by 0.25%.

Banks lagged, but retailers and real estate led the winners – those rate-sensitive beasts that perk up fast when rumours of rate cuts start floating in from Wall Street.

And float in they did. Overnight, the Fed Reserve’s Neel Kashkari cracked the door open, saying a rate cut might arrive “soon”.

In the mining space, iron ore names like Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) came under pressure after UBS walked back its call on China’s property rebound.

Analyst John Lam now reckons the turnaround won’t hit until mid-to-late 2026, later than the early 2026 bounce he tipped just a few months ago.

Without fresh stimulus, the sales slump is likely to linger. That’s bad news for iron ore demand, and markets know it.

This is where things stood at about 12:50pm AEST:

In the large caps space, the embattled market operator, ASX (ASX:ASX), took a spectacular nosedive, down 9%, after Treasurer Jim Chalmers suggested he would move to end its long-standing monopoly.

The timing couldn’t have been worse.

ASX had just told investors it’s about to book up to $35 million in unexpected compliance and legal costs next financial year, as ASIC pokes deeper into its governance and systems.

And to add insult to injury, it just came off a bungled announcement yesterday that mistakenly linked TPG Telecom (ASX:TPG) to a takeover bid, causing chaos and a $400 million hit to its market cap.

Australia’s corporate cop, ASIC, already said it was in the “final stages” of weighing up a move that could finally let US exchange giant Cboe go toe-to-toe with the ASX.

This would give local companies the option to list somewhere that isn’t, well… the ASX.

Still in large caps, AMP (ASX:AMP) rose 1% despite revealing a statutory net profit of $98 million, down nearly 5% year-on-year.

One notable move this morning was gaming giant Light & Wonder (ASX:LNW), which announced it will officially delist from Nasdaq and go all-in on the ASX.

After mulling it over for months, the Las Vegas-based company says the ASX will become its sole listing by November 2025. LNW’s shares plunged 5%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AYM | Australia United Min | 0.003 | 50% | 60,959 | $3,685,155 |

| MOM | Moab Minerals Ltd | 0.002 | 50% | 500,000 | $1,874,666 |

| RLC | Reedy Lagoon Corp. | 0.003 | 50% | 300,000 | $1,553,413 |

| EDEDA | Eden Inv Ltd | 0.044 | 33% | 456,555 | $6,781,304 |

| BLZ | Blaze Minerals Ltd | 0.004 | 33% | 690,000 | $5,335,392 |

| XRG | Xreality Group Ltd | 0.041 | 32% | 14,188,502 | $23,049,973 |

| PFT | Pure Foods Tas Ltd | 0.025 | 25% | 188,405 | $2,808,512 |

| AUQ | Alara Resources Ltd | 0.040 | 25% | 3,392,548 | $25,698,801 |

| BIT | Biotron Limited | 0.003 | 25% | 239,090 | $2,654,492 |

| MOH | Moho Resources | 0.005 | 25% | 600,982 | $2,981,656 |

| PER | Percheron | 0.010 | 25% | 838,751 | $8,699,501 |

| ERD | Eroad Limited | 1.795 | 25% | 1,628,836 | $269,956,591 |

| MQR | Marquee Resource Ltd | 0.014 | 23% | 17,340,817 | $6,453,911 |

| 4DX | 4Dmedical Limited | 0.480 | 22% | 3,548,357 | $183,888,487 |

| AMS | Atomos | 0.006 | 20% | 36,646 | $6,075,092 |

| AOK | Australian Oil. | 0.003 | 20% | 20,000 | $2,594,457 |

| IMI | Infinitymining | 0.012 | 20% | 606,928 | $4,230,158 |

| RAS | Ragusa Minerals Ltd | 0.024 | 20% | 475,984 | $3,563,976 |

| OEC | Orbital Corp Limited | 0.190 | 19% | 512,941 | $26,364,755 |

| AN1 | Anagenics Limited | 0.007 | 17% | 81,674 | $2,977,922 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 652,112 | $11,167,964 |

| TSL | Titanium Sands Ltd | 0.007 | 17% | 169,905 | $14,068,483 |

| CC5 | Clever Culture | 0.036 | 16% | 6,801,427 | $55,271,853 |

| EOS | Electro Optic Sys. | 5.085 | 15% | 6,956,139 | $850,918,757 |

XReality Group (ASX:XRG) has scored a $5.7m contract with the Texas Department of Public Safety, its biggest Operator XR order yet. The deal covers VR training systems, rollout, and support, with delivery due in Q2 FY26. Back home, XRG has also picked up a $2.1m government grant to ramp up AI across the platform.

Alara Resources (ASX:AUQ) has flicked the switch on new tailings filter presses at its Al Wash-hi Majaza copper-gold plant in Oman, boosting production capacity from around 65% to a projected 85-90%. The interim units, sourced from China, are already lifting output, with monthly concentrate expected to hit 3000-3200 dry tonnes. A permanent press is on the way, which should push the plant closer to full throttle.

Marquee Resources (ASX:MQR) has struck antimony in every hole from its first drill campaign at Mt Clement, confirming extensions and uncovering new structures. The project sits next to Australia’s largest undeveloped antimony resource, and a maiden mineral resource estimate is due by August-end, with phase 2 drilling to kick off this quarter.

Infinity Mining (ASX:IMI) has confirmed more high-grade gold at its Sir Walter Scott prospect in northern NSW, with nine out of 12 rock chips grading over 1 g/t, including a standout 68.6 g/t. The samples were taken along a 1km corridor, building on earlier results and aligning with historical high-grade production from the late 1800s.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SRN | Surefire Rescs NL | 0.001 | -50% | 578,000 | $6,457,219 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 22,040,000 | $9,671,169 |

| GGE | Grand Gulf Energy | 0.002 | -25% | 20,565 | $5,640,850 |

| RPG | Raptis Group Limited | 0.123 | -21% | 27,636 | $54,356,152 |

| WBE | Whitebark Energy | 0.004 | -20% | 28,334 | $3,502,788 |

| SRJ | SRJ Technologies | 0.005 | -17% | 10,484 | $4,168,480 |

| TOU | Tlou Energy Ltd | 0.022 | -15% | 467,000 | $33,763,192 |

| IDT | IDT Australia Ltd | 0.077 | -14% | 1,144,398 | $38,593,518 |

| ANX | Anax Metals Ltd | 0.006 | -14% | 100,000 | $6,179,653 |

| NAE | New Age Exploration | 0.003 | -14% | 20,347,856 | $9,470,690 |

| RGL | Riversgold | 0.003 | -14% | 337,000 | $5,892,994 |

| UNT | Unith Ltd | 0.006 | -14% | 4,949,609 | $10,351,498 |

| SLX | Silex Systems | 4.010 | -13% | 3,225,219 | $1,102,429,502 |

| TMG | Trigg Minerals Ltd | 0.096 | -13% | 29,704,429 | $124,836,991 |

| BLU | Blue Energy Limited | 0.007 | -13% | 48,206 | $14,807,789 |

| BNL | Blue Star Helium Ltd | 0.007 | -13% | 8,254,343 | $21,559,082 |

| CHM | Chimeric Therapeutic | 0.004 | -13% | 3,312,305 | $12,996,494 |

| ASE | Astute Metals NL | 0.015 | -12% | 9,877,115 | $10,508,545 |

| SMM | Somerset Minerals | 0.015 | -12% | 2,301,278 | $10,966,369 |

| SRK | Strike Resources | 0.031 | -11% | 210,733 | $9,931,250 |

| HYD | Hydrix Limited | 0.016 | -11% | 19,797 | $4,909,839 |

| BCK | Brockman Mining Ltd | 0.017 | -11% | 56,742 | $176,324,410 |

IN CASE YOU MISSED IT

Maronan Metals (ASX:MMA) has entered into an MoU with Austral Resources (ASX:AR1) to toll treat ore at Austral’s Rocklands processing facility.

Green Technology Metals (ASX:GT1) and partner EcoPro Innovation have produced lithium hydroxide averaging more than 94% recoveries using ore from the company’s Seymour project in Canada.

Locksley Resources (ASX:LKY/OTCQB: LKYRF) has appointed cornerstone investor Tribeca Capital as its strategic advisor to support a critical minerals growth strategy focused on the US.

Gold producer Ariana Resources is looking to dual-list on the ASX with plans to raise between $10-15 million.

Re-assaying of infill drilling by RareX (ASX:REE) has returned the highest-grade gallium intersections at Cummins Range to date, highlighting its clear value.

Norfolk Metals (ASX:NFL) is preparing for its maiden drilling at the Carmen copper project in Chile, with operations fully funded for a big campaign.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.