Lunch Wrap: It’s a sea of red on the ASX; staples and banks battered

The ASX is having another 'one of those days'. Cheers, Donald. Picture via Getty Images

- The ASX slips again as trade war drama rages on

- WiseTech plans new appointments

- Virgin’s got a new boss as Emerson steps up

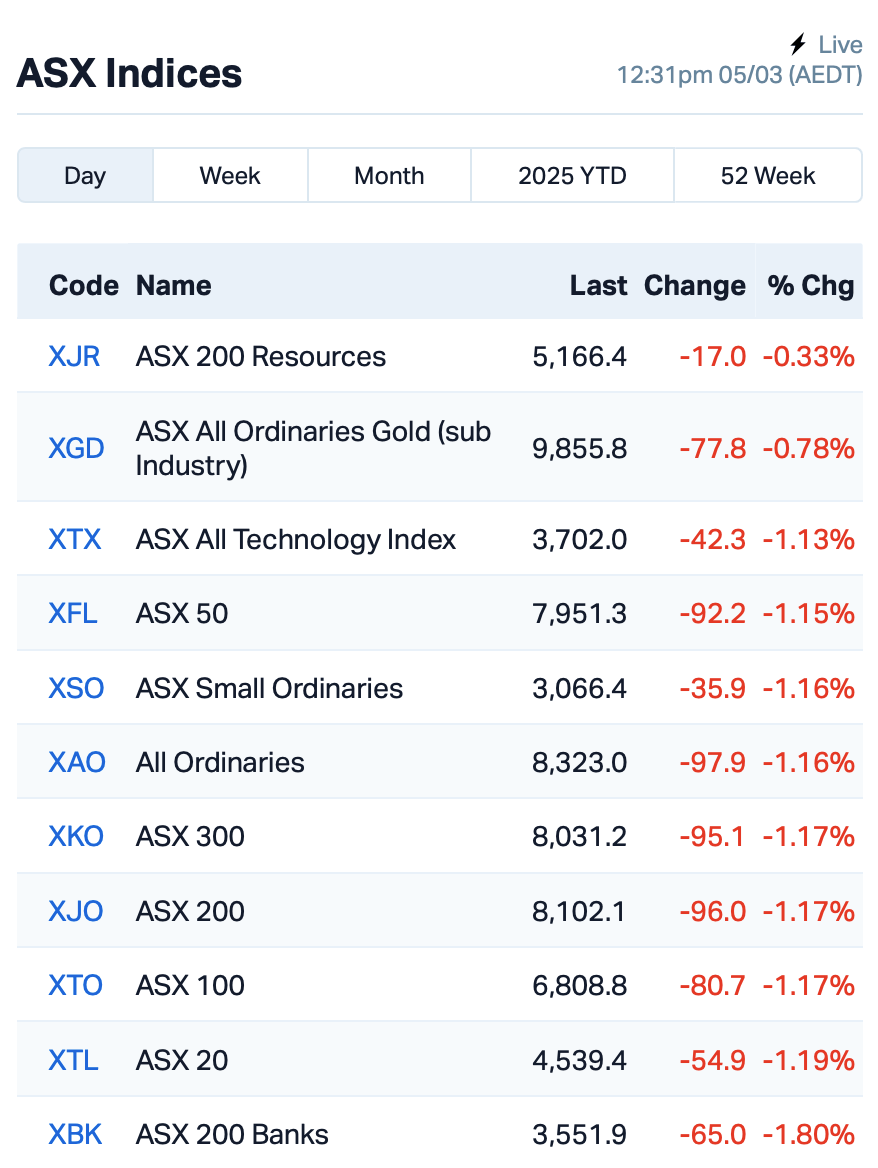

The ASX slipped heavily again on Wednesday morning, this time by 1.1% following a chaotic session on Wall Street overnight.

Traders were clearly on edge, waiting to see how the ongoing trade war would play out, especially now that Trump’s tariffs have officially come into effect.

The US market had sharp dips and rebounds as traders tried to make sense of the situation.

But just as things were looking grim, US Commerce Secretary Howard Lutnick hinted at a possible compromise with Canada and Mexico, sparking a bit of optimism and a late rally in stocks.

“However, uncertainty lingers as a 10% tariff on Chinese goods is set to take effect tomorrow, which could provide temporary relief to the currency,” said Joseph Dahrieh at online trading platform, Tickmill.

Everyone is now eagerly waiting’s Trump address to the joint session of Congress, which will start in the next half hour.

The S&P 500 ended last night’s session down 1.2%, while the tech-heavy Nasdaq shed 0.35%.

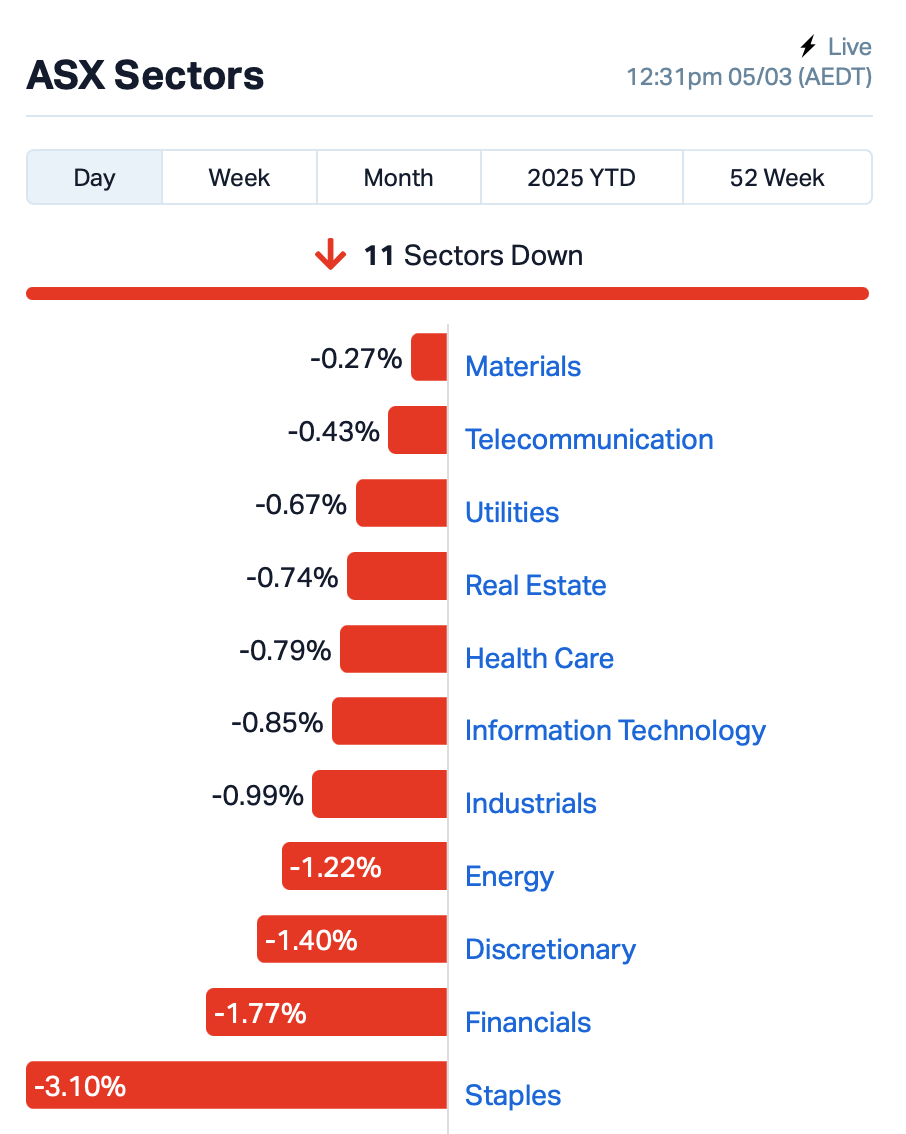

Back home, it was a sea of red across the ASX, too.

Woolworths (ASX:WOW) and Coles Group (ASX:COL) both dipped by over 3%, dragging the staples sector much lower.

The banks didn’t fare much better, either, with the big four all down by well over 1%. The miners, however, stepped up a little to cushion the blow.

“Australian investors will consider how the 20% tariffs on China will impact their superannuation and investments for the year ahead,” said Moomoo’s Jessica Amir.

“In the last Trump-China trade war, the ASX 200 fell about 15% from its record high to a new low. If history repeats, the market could fall another 10%.”

In large caps news this morning, WiseTech Global (ASX:WTC) has updated the market on its compliance with ASX listing rules.

Following the resignation of four directors on February 26, the company now only has two independent directors, which means its Audit & Risk Committee doesn’t meet ASX Listing Rule 12.7’s requirement of having at least three non-executive directors.

WiseTech said it plans to appoint more independent directors within four weeks to get back in line with the rule before the full-year financials are due.

Meanwhile, over in the insurance sector, Insurance Australia (ASX:IAG) is feeling the heat from Cyclone Alfred, which is on track to hit the Sunshine Coast soon.

But AIG said it has reinsurance arrangements in place to protect shareholders from big losses, and it’s got a government-backed reinsurance pool to cover for cyclone-related damage. Shares were flat.

In the unlisted space, Virgin Australia has got a new CEO, with Dave Emerson stepping up to take over from Jayne Hrdlicka. Emerson, who’s been the airline’s chief commercial officer since 2021, will officially take the top job on March 14.

In other news, China is setting its sights on 5% economic growth for 2025, keeping the same target as last year. The country has also just set a 2% inflation target for the year.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 5 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.0015 | 50% | 357,655 | $6,151,216 |

| IND | Industrialminerals | 0.2200 | 38% | 191,671 | $12,851,600 |

| CT1 | Constellation Tech | 0.0020 | 33% | 612,000 | $2,212,101 |

| OB1 | Orbminco Limited | 0.0020 | 33% | 100,000 | $3,249,885 |

| PRM | Prominence Energy | 0.0040 | 33% | 1,451,505 | $1,167,529 |

| 14D | 1414 Degrees Limited | 0.0220 | 29% | 98,941 | $4,892,243 |

| ZEU | Zeus Resources Ltd | 0.0090 | 29% | 3,034,448 | $4,484,712 |

| LMS | Litchfield Minerals | 0.1200 | 26% | 1,045,310 | $2,680,078 |

| ERA | Energy Resources | 0.0025 | 25% | 923,199 | $810,792,482 |

| RML | Resolution Minerals | 0.0100 | 25% | 2,250,317 | $2,386,113 |

| RGT | Argent Biopharma Ltd | 0.1800 | 24% | 129,194 | $8,594,479 |

| CMB | Cambium Bio Limited | 0.3600 | 20% | 24,580 | $4,242,905 |

| ADD | Adavale Resource Ltd | 0.0030 | 20% | 500,000 | $5,683,198 |

| SPA | Spacetalk Ltd | 0.3000 | 18% | 678 | $16,262,972 |

| BNL | Blue Star Helium Ltd | 0.0070 | 17% | 908,061 | $16,169,312 |

| ODY | Odyssey Gold Ltd | 0.0230 | 15% | 658,930 | $17,977,423 |

| BIT | Biotron Limited | 0.0040 | 14% | 465,851 | $3,158,340 |

| NTM | Nt Minerals Limited | 0.0040 | 14% | 250,000 | $4,238,160 |

| XRG | Xreality Group Ltd | 0.0400 | 14% | 182,778 | $19,984,380 |

| DGR | DGR Global Ltd | 0.0090 | 13% | 150,000 | $8,349,568 |

| AQD | Ausquest Limited | 0.0370 | 12% | 4,915,822 | $44,171,540 |

| INF | Infinity Lithium | 0.0280 | 12% | 76,963 | $11,564,802 |

| WC1 | Westcobarmetals | 0.0190 | 12% | 3,520,773 | $2,990,511 |

| AQN | Aquirianlimited | 0.3000 | 11% | 186,734 | $21,803,572 |

| KLI | Killiresources | 0.0500 | 11% | 164,456 | $6,310,068 |

Litchfield Minerals (ASX:LMS) has uncovered a major chargeability target at its Oonagalabi project, with two large sulphide-bearing anomalies stretching over 1km and going more than 500m deep. These chargeable zones, never drilled before, could indicate a higher-grade core to the system, and with strong chargeability responses extending along a 3km soil anomaly, there’s big potential for a major discovery, said the company. A drill-for-equity deal with Bullion Drilling will fast-track drilling, and the company has also secured an Environmental Mining Licence for the project.

Argent Biopharma (ASX:RGT) has teamed up with ECCPharm for a strategic manufacturing partnership where ECCPharm will handle all GMP manufacturing and batch release for Argent’s cannabinoid treatments, CannEpil and CogniCann. This move will let Argent focus on clinical development and regulatory expansion while cutting operational costs. The manufacturing will shift from Argent’s European facilities to ECCPharm’s state-of-the-art plant in North Macedonia, with the aim to meet rising global demand for these therapies in key EU markets.

Blue Star Helium (ASX:BNL) has spudded the Jackson 4 well at its Galactica helium project in Colorado, with drilling operations progressing toward the Lyons Formation. The well is part of the broader Galactica/Pegasus development, which has demonstrated strong helium flows and is advancing toward commercialisation.

XReality Group (ASX:XRG), a tech company focused on augmented reality (AR), has struck a deal with its largest shareholder, Birkdale Holdings, to convert about $4.6 million of debt into shares at a 39% premium. If shareholders approve the plan, Birkdale will receive over 92 million shares at $0.05 each.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 5 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.0020 | -33% | 701,176 | $10,074,012 |

| RLC | Reedy Lagoon Corp. | 0.0020 | -33% | 25,000 | $2,330,120 |

| RPG | Raptis Group Limited | 0.0070 | -30% | 500,000 | $634,864 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 8,925,125 | $57,867,624 |

| MOM | Moab Minerals Ltd | 0.0015 | -25% | 306,800 | $3,133,999 |

| MRQ | Mrg Metals Limited | 0.0030 | -25% | 1,400,000 | $10,906,075 |

| BGE | Bridgesaaslimited | 0.0240 | -20% | 90,002 | $5,995,776 |

| TOU | Tlou Energy Ltd | 0.0120 | -20% | 145,331 | $19,478,765 |

| OSL | Oncosil Medical | 0.0040 | -20% | 7,403,370 | $23,032,901 |

| AMS | Atomos | 0.0050 | -17% | 591,214 | $7,290,111 |

| MRD | Mount Ridley Mines | 0.0025 | -17% | 83,334 | $2,335,467 |

| BUX | Buxton Resources Ltd | 0.0270 | -16% | 9,000 | $7,113,039 |

| CR1 | Constellation Res | 0.1700 | -15% | 43,184 | $12,607,845 |

| BKT | Black Rock Mining | 0.0230 | -15% | 1,447,589 | $33,805,312 |

| CCO | The Calmer Co Int | 0.0060 | -14% | 108,695 | $17,807,707 |

| EE1 | Earths Energy Ltd | 0.0060 | -14% | 795,619 | $3,709,750 |

| IXR | Ionic Rare Earths | 0.0060 | -14% | 500,172 | $36,668,998 |

| KPO | Kalina Power Limited | 0.0060 | -14% | 1,235,119 | $19,179,956 |

| RAN | Range International | 0.0030 | -14% | 22,235 | $3,287,516 |

| SWP | Swoop Holdings Ltd | 0.1200 | -14% | 140,564 | $29,807,395 |

| SLM | Solismineralsltd | 0.0780 | -13% | 1,776,008 | $6,929,895 |

| AXN | Alliance Nickel Ltd | 0.0260 | -13% | 43,369 | $21,775,188 |

| OPT | Opthea Limited | 0.7525 | -13% | 4,839,177 | $1,065,060,937 |

| ALY | Alchemy Resource Ltd | 0.0070 | -13% | 1,944,024 | $9,424,610 |

IN CASE YOU MISSED IT

Impact Minerals’ (ASX:IPT) largest shareholder is committing to its full entitlement in the $5.2 million renounceable rights issue, with underwriting increased to $2 million. The funds will support exploration at the Arkun and Broken Hill projects, development of the Lake Hope HPA project, and general working capital.

AdAlta (ASX:1AD) has secured a $424,600 advance against its FY25 R&D tax incentive rebate to support its “East to West” cellular immunotherapy strategy. The funds will be used immediately to drive the company’s growth objectives.

Miramar Resources (ASX:M2R) has lodged tenement applications over several shallow historical gold drill intersections at its Randalls project near Kalgoorlie, WA. The company aims to establish a strategic land position along the highly prospective but underexplored Randall Fault.

At Stockhead, we tell it like it is. While Blue Star Helium, Impact Minerals, AdAlta and Miramar Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.