Lunch Wrap: Qantas steals the show as ASX juggles earnings season

Qantas soars in today’s earnings circus. Picture via Getty Images

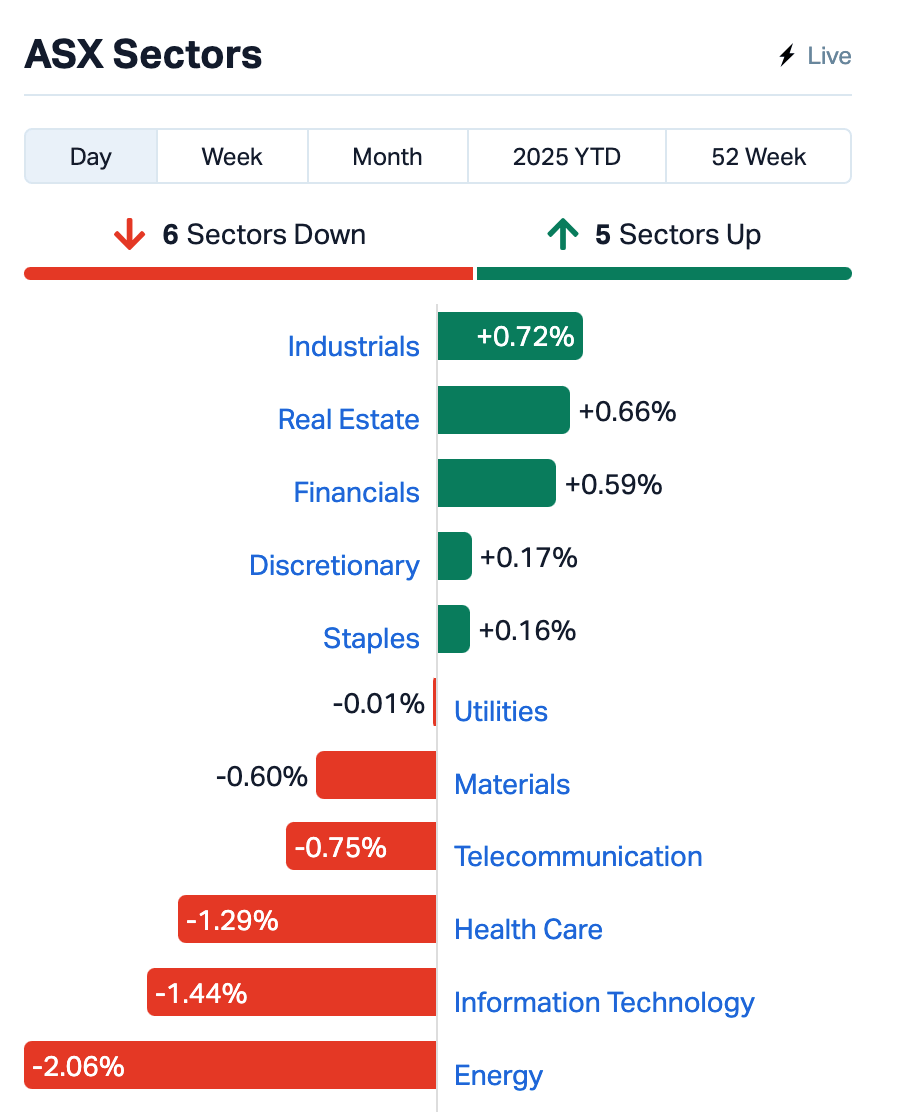

- ASX stalls as energy sinks

- Qantas, Wesfarmers shine in earnings circus

- Ramsay, Telix dumped while IDP and Eagers soar

The ASX looked lively for all of five minutes this morning, opening 0.1% stronger, before running out of puff by lunchtime in the east.

The index sat flat at 1pm AEST, weighed down by a few heavy hitters on what’s turned into one of the busiest days of reporting season.

Wall Street had handed us a slightly green lead overnight, with the S&P 500 nudging nigher to a fresh record.

The real show was Nvidia.

The AI darling pumped out US$46.7 billion in quarterly revenue, guidance that looked bulletproof, and even dangled a US$60 billion buyback.

And yet, the stock still dipped 2% after-hours, because when you’re priced for godhood, “almost perfect” doesn’t cut it.

Back home, our market’s biggest loser by a mile was energy.

Woodside Energy Group (ASX:WDS) tumbled 3% after crude oil slipped 0.5% overnight. That was enough to pull the whole sector down.

Thursday’s earnings season wrap

If you thought today was going to be a quiet scroll through the news, you picked the wrong Thursday.

Reporting season has turned Bridge Street into a carnival.

Qantas (ASX:QAN) strutted in as ringmaster, leaping 9% after clocking its second-highest profit on record – $2.39 billion, up $316 million on last year. A fat dividend, 20 shiny new Airbus orders, and free shares for staff gave investors plenty to clap about.

Wesfarmers (ASX:WES), owner of Bunnings and Kmart, kept the crowd onside too, lifting full year profit 14.4% to $2.93 billion and throwing in a $1.7 billion capital return. Apparently even in a cost-of-living squeeze, there’s always room in the trolley for a $9.99 flannelette.

But the tent isn’t all fireworks.

Ramsay Health Care (ASX:RHC) was carted off, tumbling 11.5%, as its UK mental health unit and European hospitals dragged on otherwise sturdy Aussie numbers. Turns out you can patch a knee, not a balance sheet.

And then there was Telix Pharmaceuticals (ASX:TLX), which got flattened by 19%. The FDA poked holes in its Zircaix cancer diagnostic submission, and the market treated it like a rug pull.

IDP Education (ASX:IEL) turned out to be the day’s Houdini, surging 32% despite a 14% revenue fall. The international student crackdown torpedoed volumes, but because the market expected even worse, traders piled in.

Then came Eagers Automotive (ASX:APE), roaring 13% after a modest 2.3% profit lift to $119 million.

Mineral Resources (ASX:MIN) fell 3% after coughing up a near-$900 million loss, while South32 (ASX:S32) slipped 5% even after flipping back into the black with US$213 million profit.

A special mention goes to Macquarie Telecom Group (ASX:MAQ), which was whacked 10% after telling the market FY26 EBITDA will only creep slightly higher. Rising staff costs, shrinking voice margins, and heavy investment plans don’t exactly scream “growth story”.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| TG1 | Techgen Metals Ltd | 0.051 | 155% | 63,549,825 | $3,173,314 |

| JAY | Jayride Group | 0.008 | 60% | 11,328,067 | $7,139,445 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 265,994 | $2,101,969 |

| CAE | Cannindah Resources | 0.031 | 41% | 1,066,360 | $16,017,759 |

| RB6 | Rubixresources | 0.140 | 33% | 520,714 | $6,452,250 |

| LSR | Lodestar Minerals | 0.024 | 33% | 2,888,924 | $7,195,029 |

| IEL | Idp Education Ltd | 6.000 | 32% | 9,771,666 | $1,263,646,398 |

| IVZ | Invictus Energy Ltd | 0.170 | 31% | 58,567,037 | $208,452,631 |

| CCX | City Chic Collective | 0.098 | 29% | 4,364,530 | $29,271,992 |

| DTM | Dart Mining NL | 0.003 | 25% | 10,094,666 | $2,396,111 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 1,013,442 | $13,483,725 |

| FDR | Finder | 0.120 | 24% | 1,436,172 | $36,529,812 |

| MOH | Moho Resources | 0.006 | 20% | 5,370,590 | $3,727,070 |

| NAE | New Age Exploration | 0.003 | 20% | 3,476,080 | $6,764,779 |

| LNQ | Linqmineralslimited | 0.200 | 18% | 2,001,680 | $10,514,500 |

| AJX | Alexium Int Group | 0.007 | 17% | 1,241 | $9,518,572 |

| ANX | Anax Metals Ltd | 0.007 | 17% | 871,928 | $5,296,845 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 1,752,395 | $20,207,312 |

| MRQ | Mrg Metals Limited | 0.004 | 17% | 1,840,577 | $8,179,556 |

| PKO | Peako Limited | 0.004 | 17% | 125,000 | $4,463,226 |

| TYX | Tyranna Res Ltd | 0.004 | 17% | 18,908,681 | $10,026,464 |

| HMX | Hammer Metals Ltd | 0.029 | 16% | 640,231 | $22,193,968 |

| GLA | Gladiator Resources | 0.022 | 16% | 14,701,551 | $14,407,640 |

| RC1 | Redcastle Resources | 0.011 | 16% | 1,783,447 | $8,829,856 |

| OCN | Oceanalithiumlimited | 0.110 | 16% | 984,001 | $15,817,156 |

TechGen Metals (ASX:TG1) has wrapped up its first on-country heritage survey at the Blue Devil copper-gold-silver project near Halls Creek, with the final report now pending Jaru Board approval. With a Heritage Protection Agreement already signed, tenure is now just a formality. The fieldwork turned up something special: new parallel structural zones with rock chips grading as high as 52.3% copper and 5.35g/t gold. An IP survey is being lined up to refine drill targets across the already large 2.75km footprint.

Prodigy Gold (ASX:PRX) has kicked off its 2025 field season at Tanami North, starting with an IP survey at Hyperion to sharpen up drill targets. RC drilling at Hyperion and Tregony is locked in for early September, followed by co-funded diamond holes at Hyperion to chase last year’s standout hit of 10m at 15.9g/t gold. Extra diamond holes are also planned to supply samples for heap leach test work. The $7.1m raise completed in June means the program is fully funded.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BMO | Bastion Minerals | 0.001 | -33% | 100,000 | $3,307,430 |

| ICU | Investor Centre Ltd | 0.001 | -33% | 461 | $456,767 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 71,428 | $3,225,642 |

| AUR | Auris Minerals Ltd | 0.006 | -25% | 330,000 | $3,813,008 |

| WEL | Winchester Energy | 0.002 | -20% | 351,916 | $3,407,547 |

| PR2 | Piche Resources | 0.145 | -19% | 480,881 | $15,028,074 |

| TLX | Telix Pharmaceutical | 15.000 | -18% | 6,084,281 | $6,226,542,686 |

| AN1 | Anagenics Limited | 0.005 | -17% | 99,996 | $2,977,922 |

| BUY | Bounty Oil & Gas NL | 0.003 | -17% | 14,094 | $4,684,416 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 564,978 | $2,763,100 |

| GLH | Global Health Ltd | 0.092 | -16% | 25,000 | $6,443,199 |

| ORE | Orezone Gold Corp | 1.140 | -16% | 150,036 | $89,144,737 |

| AQD | Ausquest Limited | 0.032 | -16% | 10,260,032 | $52,914,755 |

| AIV | Activex Limited | 0.017 | -15% | 127,976 | $4,310,052 |

| BMT | Beamtree Holdings | 0.230 | -15% | 9,083,816 | $78,450,676 |

| KLR | Kaili Resources Ltd | 0.530 | -15% | 581,850 | $91,388,225 |

| AHN | Athena Resources | 0.006 | -14% | 39,230 | $15,861,699 |

| AQC | Auspaccoal Ltd | 0.006 | -14% | 663 | $4,903,273 |

| ENT | Enterprise Metals | 0.006 | -14% | 3,061,730 | $9,599,221 |

| DXN | DXN Limited | 0.056 | -14% | 748,440 | $19,415,737 |

| AHK | Ark Mines Limited | 0.355 | -13% | 1,242,591 | $27,125,886 |

| NOX | Noxopharm Limited | 0.100 | -13% | 92,406 | $33,607,364 |

| AGH | Althea Group | 0.020 | -13% | 1,723,831 | $19,445,742 |

IN CASE YOU MISSED IT

Brightstar Resources (ASX:BTR) has begun drilling to extend the life of the Fish underground mine at its Laverton gold project in WA.

Everest Metals Corporation (ASX:EMC) has landed a major funding boost from the WA Government to help pioneer Australia’s rubidium industry.

Rhythm Biosciences (ASX:RHY) enters co-marketing deal with Know Your Lemons Foundation, a global non-profit organisation dedicated to breast cancer education and early detection.

Sipa Resources’ (ASX:SRI) first foray into Nuckulla Hill has turned up some serious sparkle, with thick gold zones and grades reaching 16.2g/t.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.