Lunch Wrap: Miners, REITs lift ASX this morning; Qantas hit by cybercrooks

The ASX has climbed on Wednesday with diggers and property stocks leading the charge. Picture via Getty Images

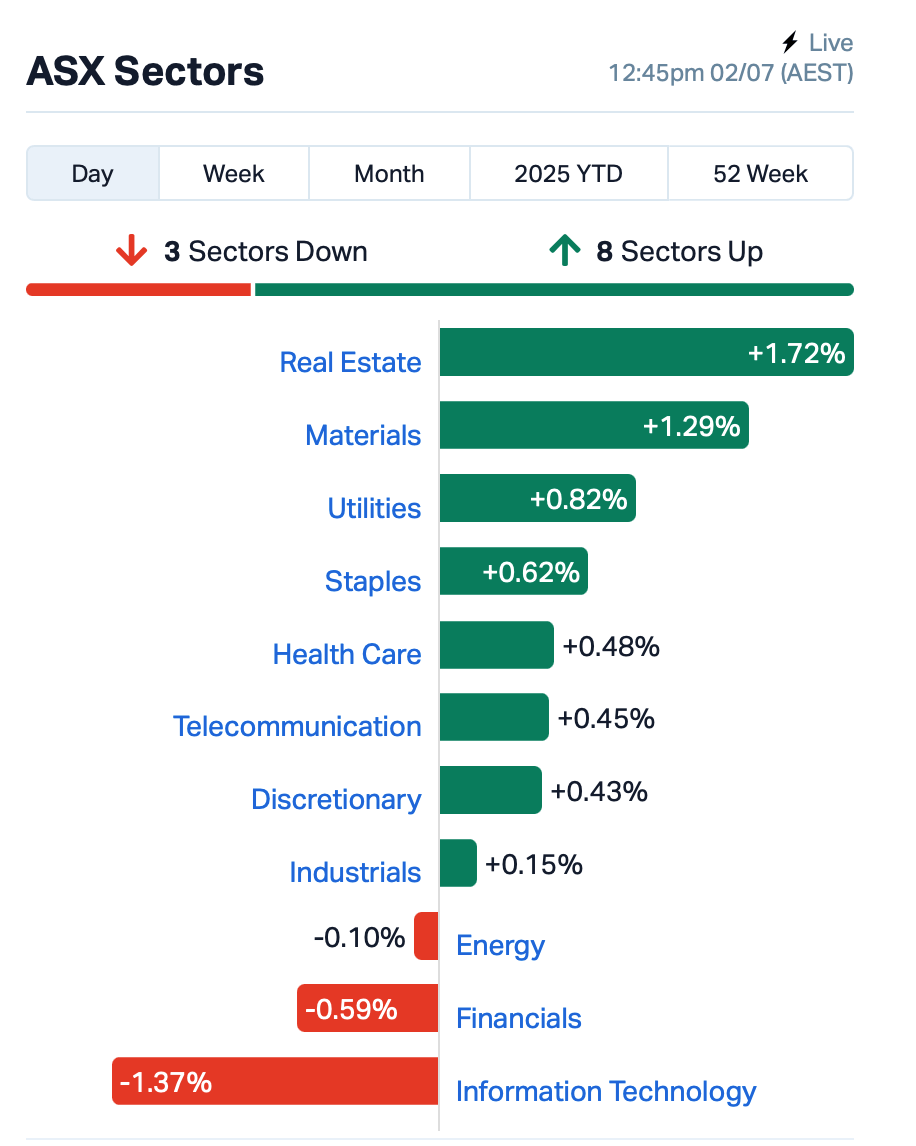

- ASX lifts as miners, REITs rally

- Trump smacks Musk and warns Japan as tariff deadline looms

- Qantas cops cyber hit, and Domino’s CEO walks

ASX traders were in a decent mood by Wednesday lunch, lifting the benchmark ASX200 index 0.2% as the east-coast coffee kicked in.

Though in Sydney, anyone slogging through the rain and wind gusts probably deserved something stiffer than a flat white.

Overnight, the Dow Jones rallied 0.9% while a burst of small-cap buying sent the Russell 2000 sprinting past the Nasdaq 100 for the first time in weeks.

Tesla was smacked by 5% after Donald Trump who, mid-flight on Air Force One, accused Elon Musk of being “the most subsidised human in history”.

Trump threatened to unleash the Department of Government Efficiency (DOGE) on every dollar of federal support Musk’s empire enjoys.

Musk fired back on X: “I am literally saying CUT IT ALL.”

Trump also doubled down on his July 9 tariff deadline, telling reporters he had “no time for pauses” and singling out Japan for a potential 24% slug if automotive trade doesn’t tilt his way.

The real litmus test for investors, though, lands Thursday night Australian time with US non-farm payrolls. Bulls are praying for just enough labour-market softness to keep the bond rally alive (yields lower).

Back home, it was the diggers and property stocks doing most of the heavy lifting this morning.

Iron-ore names firmed on higher Shanghai futures, while the REITs caught a tail-wind from falling local bond yields.

Copper stocks also had a good morning after the copper price spiked through US $10,000 a tonne, its best level in three months as Chinese factory data hinted at a modest manufacturing rebound.

In the large caps space, the biggest news came out of Qantas (ASX:QAN).

The airline slipped more than 3% after admitting a cybercrook had pinched personal details – names, birth dates, contact info, frequent-flyer numbers – from about six million customers via a third-party call-centre platform.

CEO Vanessa Hudson apologised “for the uncertainty this will cause”, and stressed no passwords or credit-card details were touched.

The airline called in the AFP and set up a help-line, insisting flight safety and schedules were unaffected.

Mortgage-insurer Helia Group (ASX:HLI) had a far rougher morning, nosediving 24% after ING confirmed it is shopping for a new insurance partner and could walk away well before its June 2026 contract expiry.

Helia’s other big client CBA is already heading for the door in December, so Helia’s board has kicked off a “comprehensive business review”, which is normally code for belt-tightening.

Domino’s Pizza Enterprises (ASX:DMP) also plunged 26% after CEO Mark van Dyck handed in his notice less than a year into the job.

Billionaire chair Jack Cowin will step in as executive chair while a global head-hunter looks for a new skipper.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 2 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LLM | Loyal Metals Ltd | 0.230 | 77% | 5,163,097 | $13,095,298 |

| LAT | Latitude 66 Limited | 0.038 | 65% | 1,232,505 | $3,298,216 |

| EWC | Energy World Corpor. | 0.072 | 50% | 12,130,707 | $147,788,220 |

| PKO | Peako Limited | 0.003 | 50% | 120,000 | $2,975,484 |

| T92 | Terrauraniumlimited | 0.040 | 38% | 2,117,765 | $2,955,546 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 792,525 | $4,880,668 |

| IS3 | I Synergy Group Ltd | 0.002 | 33% | 1,049,155 | $2,253,285 |

| SRN | Surefire Rescs NL | 0.002 | 33% | 1,748,880 | $3,729,668 |

| BCA | Black Canyon Limited | 0.180 | 33% | 880,707 | $17,502,844 |

| AN1 | Anagenics Limited | 0.005 | 25% | 2,249 | $1,985,281 |

| DDT | DataDot Technology | 0.005 | 25% | 75,858 | $4,843,811 |

| GGE | Grand Gulf Energy | 0.003 | 25% | 975,833 | $5,640,850 |

| TSL | Titanium Sands Ltd | 0.006 | 20% | 833,333 | $11,723,736 |

| ILA | Island Pharma | 0.155 | 19% | 575,198 | $30,692,094 |

| TEE | Topendenergylimited | 0.050 | 19% | 244,248 | $11,729,813 |

| HMX | Hammer Metals Ltd | 0.033 | 18% | 776,590 | $24,857,244 |

| RPG | Raptis Group Limited | 0.083 | 17% | 24,747 | $24,898,625 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 221,851 | $3,448,673 |

| AMS | Atomos | 0.004 | 17% | 2,730,026 | $3,645,055 |

| MBK | Metal Bank Ltd | 0.014 | 17% | 32,000 | $5,969,508 |

| AKO | Akora Resources | 0.110 | 16% | 225,660 | $13,052,490 |

| DY6 | Dy6Metalsltd | 0.135 | 15% | 1,958,527 | $8,749,344 |

| MCE | Matrix C & E Ltd | 0.270 | 15% | 732,204 | $52,595,627 |

| GBZ | GBM Rsources Ltd | 0.016 | 14% | 5,828,093 | $19,822,056 |

Loyal Lithium (ASX:LLM) has secured the rights to acquire the Highway Reward Copper Gold Mine in Queensland, once one of the highest-grade copper mines in the world, but untouched since operations wrapped up in 2005. Back in its heyday, the mine churned out 3.65 million tonnes at 5.7% copper and 260,000 tonnes at 4.5 grams per tonne gold. With $4.4 million in the bank and a toolkit of modern exploration tech, it’s gearing up to probe deeper and further than the original miners ever did. The site’s just outside Charters Towers, close to key ports and processors.

Latitude 66 (ASX:LAT) is offloading its 17.5% stake in the Greater Duchess copper-gold JV near Mount Isa, calling it a non-core asset. The deal, struck with Argonaut and Neon Space, includes $2 million upfront and a potential bonus if the full JV is sold within 90 days. Carnaby, the main partner, has first dibs and 30 days to make a move. Lat66 also lined up a $750k loan from Argonaut to keep things ticking over while it focuses on its Finnish and WA assets.

Terra Uranium (ASX:T92) is branching out from Canada’s uranium fields and snapping up the largest undeveloped tungsten-molybdenum project in NSW, grabbing 100% of Dundee Resources and its Glen Eden tenement. Glen Eden sits near Hillgrove and Taronga and comes with chunky drill hits, signs of a large system, and serious upside in tin, silver, molybdenum and tungsten which is now trading at 12-year highs. T92 is raising $865k to fund early work.

Surefire Resources (ASX:SRN) said it has knocked out 15 RC drill holes at its Yidby Gold Project so far, clocking up 1,909 metres across the Marshall and Fender prospects. One standout hit came from hole YBRC128, which pulled up a 65m stretch of visible sulphides, including pyrite and chalcopyrite, from 120m down. A total of 284 samples are already off to the lab, with more on the way. The rig’s now turning at the main Yidby prospect and will shift to the Money anomaly next, with first assay results due in the coming weeks.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 2 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AOA | Ausmon Resorces | 0.001 | -50% | 111,800 | $2,622,427 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 9,290 | $3,225,642 |

| DMP | Domino Pizza Enterpr | 14.930 | -26% | 5,447,684 | $1,902,188,480 |

| CZN | Corazon Ltd | 0.002 | -25% | 115,540 | $2,369,145 |

| HLI | Helia Group Limited | 4.150 | -24% | 2,672,864 | $1,493,223,625 |

| VHL | Vitasora Health Ltd | 0.031 | -22% | 5,998,618 | $61,504,061 |

| ERA | Energy Resources | 0.002 | -20% | 3,000 | $1,013,490,602 |

| MMR | Mec Resources | 0.004 | -20% | 814,645 | $9,248,829 |

| PIL | Peppermint Inv Ltd | 0.002 | -20% | 100,000 | $5,752,724 |

| AZL | Arizona Lithium Ltd | 0.005 | -17% | 559,561 | $31,621,887 |

| BNL | Blue Star Helium Ltd | 0.005 | -17% | 2,138,225 | $16,169,312 |

| CUS | Coppersearchlimited | 0.016 | -16% | 102,995 | $3,018,941 |

| YAR | Yari Minerals Ltd | 0.011 | -15% | 525,996 | $7,211,249 |

| AM5 | Antares Metals | 0.007 | -13% | 200,000 | $4,118,823 |

| KRR | King River Resources | 0.007 | -13% | 7,193,441 | $11,853,903 |

| PGY | Pilot Energy Ltd | 0.007 | -13% | 19,007 | $17,269,280 |

| RNX | Renegade Exploration | 0.004 | -13% | 2,091,683 | $5,153,454 |

| LOC | Locatetechnologies | 0.175 | -13% | 158,013 | $46,465,787 |

| ACM | Aus Critical Mineral | 0.052 | -12% | 2,586 | $2,716,053 |

| SPG | Spc Global Holdings | 0.300 | -12% | 106,015 | $65,613,840 |

| TZN | Terramin Australia | 0.053 | -12% | 75,000 | $126,993,763 |

| AVL | Aust Vanadium Ltd | 0.008 | -11% | 851,903 | $77,711,923 |

| BPH | BPH Energy Ltd | 0.008 | -11% | 106,859 | $10,964,095 |

| C29 | C29Metalslimited | 0.016 | -11% | 2,435,875 | $3,135,388 |

IN CASE YOU MISSED IT

St George Mining (ASX:SGQ) has launched a new phase of geophysics at its Araxá niobium and rare earths project in Minas Gerais, Brazil, to support resource expansion drilling.

EMVision Medical Devices (ASX:EMV) has begun enrolling and scanning patients at five of six sites for its first commercial device validation trial, testing the emu point-of-care bedside brain scanner for stroke diagnosis.

LAST ORDERS

QEM (ASX:QEM) has completed its leadership transition, with founder Gavin Loyden retiring and Robert Cooper taking up the mantle of CEO and managing director.

Cooper brings 30 years’ global mining experience to the table, having served most recently as CEO of New Century Resources (ASX:NCZ) and Round Oak Minerals, subsidiary of Washington H. Soul Pattinson (ASX:SOL).

At Stockhead, we tell it like it is. While QEM is a Stockhead advertiser, it did not sponsor this article. This article does not constitute financial product advice.

You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.