Lunch Wrap: GYG plunges despite $1bn sales, Zip rockets on Nasdaq buzz

Zip rockets higher again. Picture via Getty Images

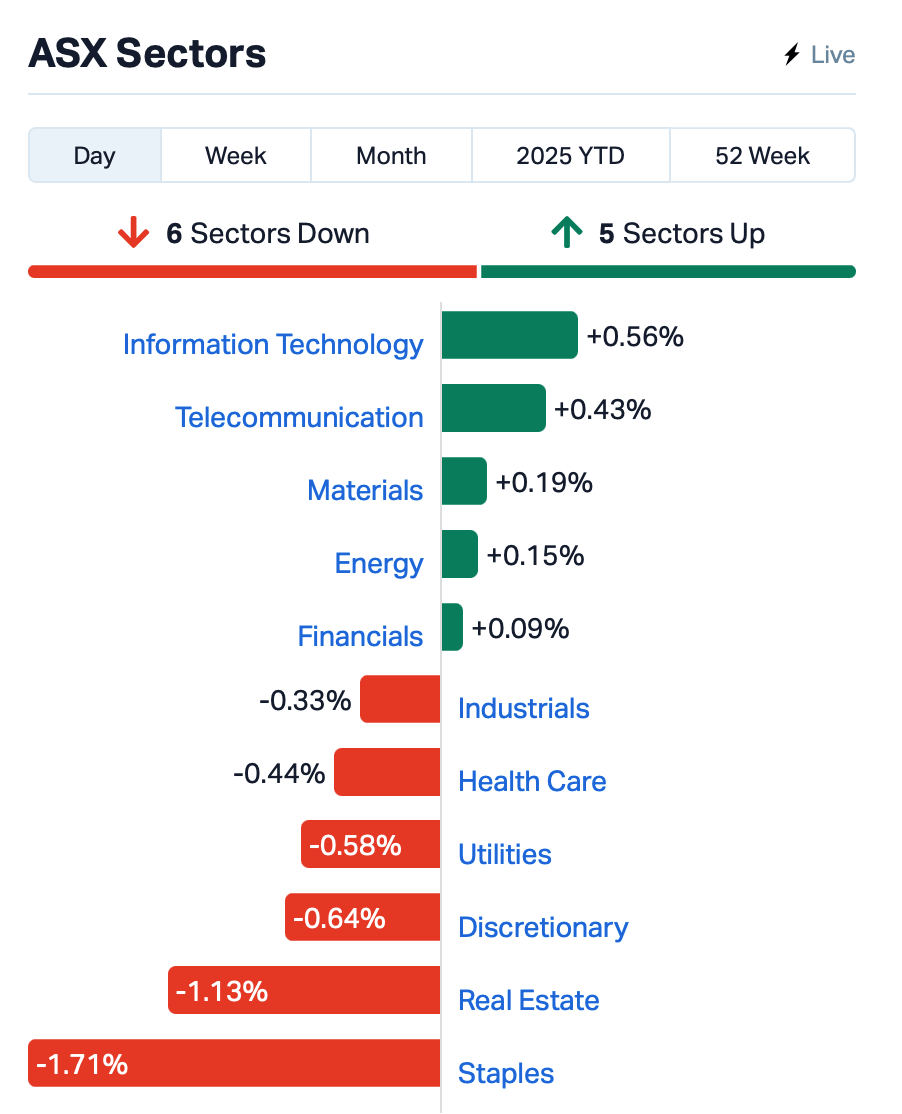

- ASX dips as miners lift, staples sink

- GYG, Ingham’s, Accent, Monash tank on earnings

- Zip rockets, while Jackson Hole looms

By Friday lunchtime in the east, the ASX was down 0.2%, coming off the dizzy high of cracking 9,000 points earlier in the week.

Wall Street had already soured the mood overnight, stumbling on wobbly retail numbers and tech fatigue.

But once again, ASX miners strapped the market on their backs and hauled it forward. Iron ore ticked past US$101 a tonne, as BHP (ASX:BHP) wasted no time putting on a 0.75% gain.

Meanwhile, the consumer staples sector, the so-called defensive haven, looked anything but safe.

It was down 2% this morning, with Coles Group (ASX:COL) and Woolworths (ASX:WOW) slipping lower by around 2%.

ASX earnings wrap for Friday

Earnings season was the headline again. Here are some of the highlights from this morning:

Guzman y Gomez (ASX:GYG) plunged 21% despite hitting the magic $1 billion in full-year sales. But analysts were looking past that and eyeing the weak margins and soft start to FY26. Investors don’t care how many tacos you sell if you can’t fatten the profit.

Inghams’s (ASX:ING) got its wings clipped, tumbling 20% after delivering a full-year profit of $90 million, down more than 10%, and landing at the bottom of its guidance range.

Sneakers outfit Accent Group (ASX:AX1) slipped 13% after its full-year profit fell 3% to $57.7m, as endless discounting chewed through margins and forced the dividend down to 1.5 cents from 4.5 cents.

Regis Resources (ASX:RRL) coughed up record full-year earnings of $780 million, and flipped last year’s loss into a $254 million profit. It wiped its debt clean, and still had enough left over to sprinkle a 5 cent dividend. Shares were down 7%.

But it wasn’t all carnage.

Zip Co (ASX:ZIP) suddenly looked like it found a second engine, rocketing 20% after blowing past expectations and dangling the prospect of a Nasdaq dual-listing. Considering 80% of its earnings now come from the US, it’s less of a “buy now, pay later” play and more of a “buy us now” pitch. Zip’s stock price is up 75% this year.

Webjet Group (ASX:WJL), meanwhile, was more grounded, buying a travel tech outfit called Locomote and flinging $25 million back to shareholders, perhaps to remind everyone it’s not just a takeover target. Shares were up 3%.

And … hovering over all that is Jackson Hole.

Powell takes the mic on Saturday morning AEST, and one stray line could ricochet through every market under the sun.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 0.820 | 332% | 5,163,038 | $28,006,069 |

| GNM | Great Northern | 0.054 | 200% | 37,312,739 | $2,783,323 |

| GLA | Gladiator Resources | 0.015 | 88% | 27,901,540 | $6,066,375 |

| CC9 | Chariot Corporation | 0.120 | 54% | 843,730 | $12,098,094 |

| AOK | Australian Oil. | 0.003 | 50% | 210,131 | $2,075,566 |

| ERA | Energy Resources | 0.003 | 50% | 368,097 | $810,792,482 |

| SFG | Seafarms Group Ltd | 0.002 | 50% | 29,000 | $4,836,599 |

| WEC | White Energy Company | 0.040 | 43% | 14,072 | $8,725,357 |

| ASR | Asra Minerals Ltd | 0.002 | 33% | 5,133,439 | $6,000,297 |

| BMM | Bayanminingandmin | 0.185 | 28% | 2,846,204 | $15,894,234 |

| RPG | Raptis Group Limited | 0.145 | 26% | 128,055 | $40,328,758 |

| CAV | Carnavale Resources | 0.005 | 25% | 3,900,000 | $16,360,874 |

| DTM | Dart Mining NL | 0.003 | 25% | 33,000 | $2,396,111 |

| FIN | FIN Resources Ltd | 0.005 | 25% | 50,003 | $2,779,554 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 3,693,299 | $13,483,725 |

| ZIP | ZIP Co Ltd.. | 3.760 | 21% | 41,716,467 | $4,027,399,668 |

| CCL | Cuscal Limited | 3.540 | 20% | 616,116 | $565,108,646 |

| LU7 | Lithium Universe Ltd | 0.015 | 20% | 14,593,967 | $17,949,745 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 973,817 | $3,605,582 |

| HHR | Hartshead Resources | 0.006 | 20% | 1,820,000 | $14,043,411 |

| JAY | Jayride Group | 0.006 | 20% | 134,323 | $7,139,445 |

| LTP | Ltr Pharma Limited | 0.430 | 19% | 1,470,826 | $40,306,667 |

| HPG | Hipages Group | 1.290 | 18% | 445,018 | $146,779,687 |

| AYA | Artryalimited | 2.100 | 17% | 1,407,825 | $204,219,519 |

| DAL | Dalaroo Metals | 0.042 | 17% | 837,987 | $10,611,069 |

Kaili Resources (ASX:KLR)’ shares were halted after a 300% morning surge this morning. The rare-earth hopeful lit up the boards last week after getting the go-ahead for drilling in SA’s Limestone Coast, and investors have since been piling in. Shares are up around 1,900% over the past five days.

Great Northern Minerals (ASX:GNM) has struck a deal to buy 100% of the Catalyst Ridge Project in California’s world-class Mountain Pass rare earths district. The project holds 119 mineral claims prospective for rare earths, antimony and gold, and sits right alongside MP Materials, a US$12bn heavyweight backed by the Pentagon and Apple.

GNM has just raised $2.6m to fast-track work, appointing a GM to lead the push as it builds out a US critical metals strategy.

Gladiator Resources (ASX:GLA) has signed a deal with Apex USA Resources to hunt down and develop rare earths tenements in the US. Apex brings deep REE industry know-how, while Gladiator sees the move as smart diversification alongside its Tanzanian uranium projects. Under the agreement, Apex will pocket up to 200 million options if milestones are hit.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HLX | Helix Resources | 0.001 | -33% | 134,456 | $5,046,291 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 100,000 | $6,994,230 |

| SRN | Surefire Rescs NL | 0.001 | -33% | 1,740,000 | $5,822,789 |

| TMK | TMK Energy Limited | 0.002 | -33% | 1,250,000 | $30,667,149 |

| BMO | Bastion Minerals | 0.002 | -25% | 16,384,000 | $4,409,906 |

| SKC | Skycity Ent Grp Ltd | 0.643 | -24% | 3,759,324 | $693,687,253 |

| GYG | Guzman Y Gomez Ltd | 22.920 | -21% | 1,095,573 | $2,979,870,076 |

| OMG | OMG Group Limited | 0.012 | -20% | 9,693,382 | $10,924,423 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 2,251,145 | $11,584,182 |

| FBR | FBR Ltd | 0.004 | -20% | 3,708,398 | $29,581,288 |

| ING | Inghams Group | 2.850 | -20% | 11,491,140 | $1,319,462,584 |

| EMT | Emetals Limited | 0.005 | -17% | 1,533,186 | $5,100,000 |

| FAU | First Au Ltd | 0.005 | -17% | 8,013,502 | $15,098,908 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 397,998 | $18,756,675 |

| RHY | Rhythm Biosciences | 0.090 | -16% | 2,539,731 | $30,538,667 |

| AX1 | Accent Group Ltd | 1.420 | -14% | 8,505,756 | $997,968,219 |

| EVR | Ev Resources Ltd | 0.009 | -14% | 18,744,724 | $23,388,785 |

| AN1 | Anagenics Limited | 0.006 | -14% | 766,692 | $3,474,243 |

| BEL | Bentley Capital Ltd | 0.012 | -14% | 14,532 | $1,065,791 |

| CCO | The Calmer Co Int | 0.003 | -14% | 42,000 | $10,539,736 |

| ROG | Red Sky Energy. | 0.003 | -14% | 479,704 | $18,977,795 |

| MGL | Magontec Limited | 0.200 | -13% | 9,563 | $13,101,220 |

| CRR | Critical Resources | 0.007 | -13% | 2,510,000 | $22,160,684 |

| CXU | Cauldron Energy Ltd | 0.007 | -13% | 3,043,500 | $14,329,288 |

IN CASE YOU MISSED IT

Tryptamine Therapeutics (ASX:TYP) has entered an exclusive agreement with world-leading psychedelic researchers to develop a first-of-its-kind EEG-based brain entropy biomarker.

An Aussie innovator, Micro-X (ASX:MX1), has shrunk the X-ray into a portable platform, now edging its Head CT into trials and proving its tech can win big in the US.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.