Lunch Wrap: Goldies and Bitcoin surge; Broncos look flush; ASX touches 9000

Broncos star Reece Walsh flushed away his doubters on Sunday evening. Pic: Getty Images

- Gold glitters while tech stocks tank

- Bitcoin makes another personal best

- Broncos blitz the market after GF triumph

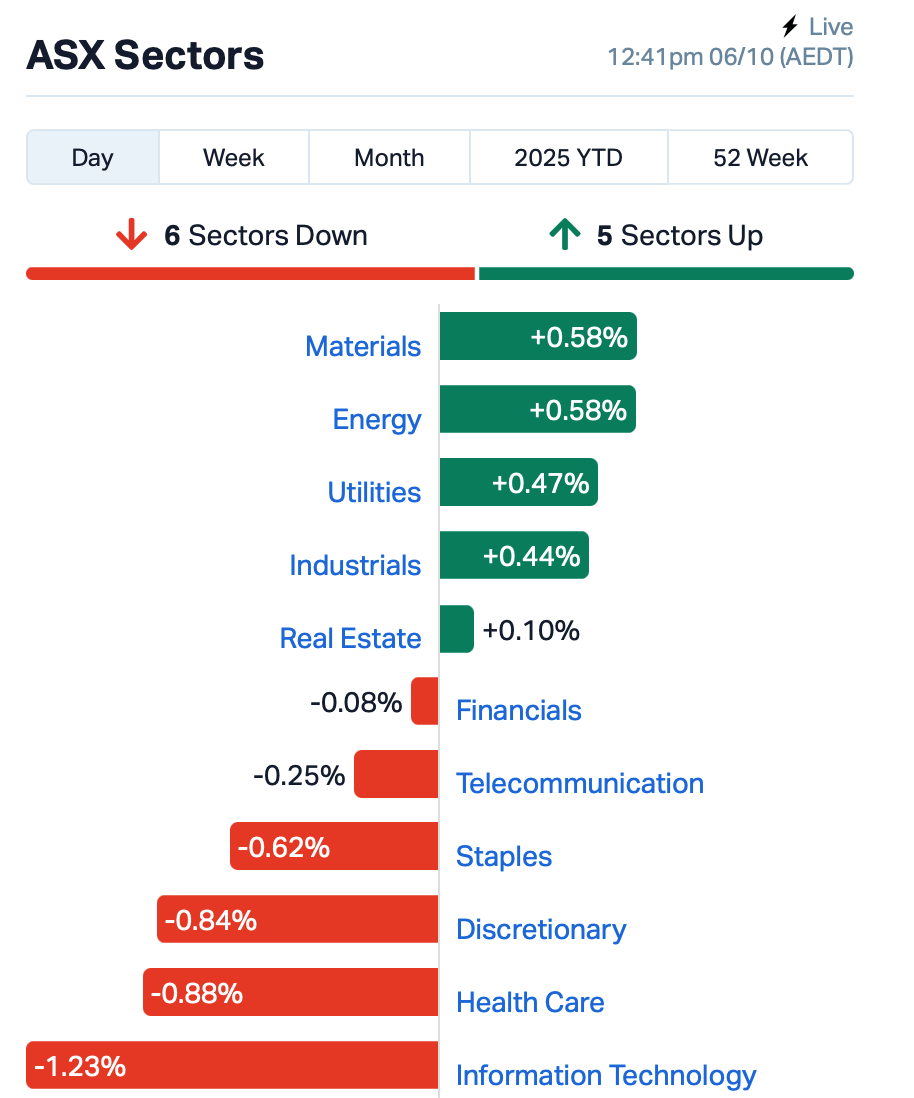

The ASX was down 0.13% at lunchtime in the eastern states, after having briefly poked its head above the 9000 mark again.

On Friday, the Dow Jones pushed through 47,000, while the S&P500 kissed another record.

The US government, meanwhile, is still in lockdown with no economics data releases, leaving the markets “flying blind.”

Back home, the glimmer came from gold as the XGD index rose 1% this morning.

Bullion has hit an all-time high of US$3,922 an ounce, just shy of the psychological US$4,000 mark.

Some analysts says the move speaks less to exuberance and more to exhaustion, with investors simply running out of things they trust.

Tech stocks, by contrast, fell the hardest today as the Nasdaq’s weakness rippled through local names.

Bitcoin, meanwhile, broke to fresh record highs above US$125,000, buoyed by institutional inflows and a soft US dollar. At the time of writing it’s settled down a bit and is changing hands for about US$124k.

deVere Group founder and analyst Nigel Green called it “a structural shift”, noting Bitcoin is coming of age as a legitimate macro instrument.

In large cap news, gold explorer Predictive Discovery (ASX:PDI) surged 12% after unveiling a $2.3 billion “merger of equals” with Canada’s Robex Resources.

On paper, it’s the making of a West African gold powerhouse – 400,000 ounces by 2029 and ASX 200 inclusion potential.

KFC, Taco Bell, Pizza Hut franchisee Restaurant Brands New Zealand (ASX:RBD) gained 1.5% after its Mexican parent Finaccess Restauracion lobbed a $4.46 per share takeover offer.

The board told shareholders to hold fire for now.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EQS | Equitystorygroupltd | 0.028 | 180% | 3,859,097 | $1,768,479 |

| EUR | European Lithium Ltd | 0.205 | 86% | 47,134,304 | $159,137,114 |

| 14D | 1414 Degrees Limited | 0.048 | 50% | 2,487,237 | $10,476,241 |

| PRX | Prodigy Gold NL | 0.003 | 50% | 121,157 | $13,483,725 |

| TD1 | Tali Digital Limited | 0.002 | 50% | 100,000 | $4,672,682 |

| BM8 | Battery Age Minerals | 0.140 | 43% | 6,906,045 | $17,825,399 |

| QUE | Queste Communication | 0.055 | 38% | 79,095 | $1,082,893 |

| LM1 | Leeuwin Metals Ltd | 0.260 | 37% | 886,238 | $19,153,213 |

| ASP | Aspermont Limited | 0.008 | 33% | 40,000 | $15,842,955 |

| MRD | Mount Ridley Mines | 0.004 | 33% | 330,000 | $2,972,151 |

| BBL | Brisbane Broncos | 1.750 | 33% | 28,480 | $129,413,633 |

| PL3 | Patagonia Lithium | 0.058 | 29% | 135,664 | $8,060,199 |

| COB | Cobalt Blue Ltd | 0.100 | 27% | 8,120,059 | $39,067,744 |

| T3D | 333D Limited | 0.150 | 25% | 1,308,819 | $23,862,457 |

| ERA | Energy Resources | 0.003 | 25% | 1,172,173 | $810,792,482 |

| FBR | FBR Ltd | 0.005 | 25% | 35,852,156 | $26,207,891 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 447,911 | $13,655,414 |

| NPM | Newpeak Metals | 0.020 | 25% | 2,317,207 | $5,266,293 |

| DAL | Dalaroometalsltd | 0.056 | 24% | 1,770,131 | $13,353,837 |

| NVX | Novonix Limited | 0.575 | 21% | 23,111,038 | $321,338,278 |

| ZNC | Zenith Minerals Ltd | 0.180 | 20% | 3,177,800 | $79,418,325 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 4,150,845 | $5,503,085 |

| VFX | Visionflex Group Ltd | 0.003 | 20% | 1,000,000 | $8,447,870 |

| AVM | Advance Metals Ltd | 0.160 | 19% | 13,218,244 | $40,169,386 |

Equity Story Group (ASX:EQS) tripled today on no fresh news, but Friday’s announcement likely set the stage. The company locked in a $650,000 strategic investment from property developer Alex Brinkmeyer via a convertible loan, with Brinkmeyer also stepping in as non-executive chair. The deal gives EQS fresh capital and a path to expand its funds management arm into the property sector, alongside its existing equities and litigation funds.

European Lithium (ASX:EUR) jumped on the back of Friday’s news that it plans to launch an on-market share buy-back of up to 135 million shares – about 10% of its stock worth roughly $12.6 million at current prices. Executive chairman Tony Sage said the market’s undervaluing the company, pointing out EUR’s stake in US-listed Critical Metals Corp is worth around $678 million. He reckons the buy-back is a rare chance to scoop up shares at a deep discount and lift value for those who stay in.

Leeuwin Metals (ASX:LM1) has struck shallow high-grade gold at its first drilling program in over 20 years at the Evanston prospect, part of the Marda Gold Project in WA.

Early results include hits of 9m at 5.23g/t gold and 8m at 6.05g/t, confirming strong near-surface mineralisation with plenty of room to grow along strike and at depth. A Down Hole Electromagnetic survey has also picked up a new target, suggesting the system could repeat below current drilling.

And… if you hadn’t noticed, the Brisbane Broncos (ASX:BBL) are on a bit of a high right now. Not just Reece Walsh and co – the BBL stock has surged 30% after the club’s NRL grand final win over the Storm. Investors are always chasing stories, and few stories sell better than a premiership parade.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.003 | -25% | 4,098,487 | $30,280,900 |

| PAB | Patrys Limited | 0.002 | -25% | 600,000 | $9,167,513 |

| RDS | Redstone Resources | 0.003 | -25% | 99,800 | $4,177,069 |

| 1AD | Adalta Limited | 0.002 | -20% | 609,999 | $3,650,513 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 1,547,562 | $5,142,663 |

| GES | Genesis Resources | 0.010 | -17% | 46,000 | $9,394,096 |

| TYX | Tyranna Res Ltd | 0.005 | -17% | 779,467 | $20,052,929 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 3,007,554 | $22,214,246 |

| IPT | Impact Minerals | 0.006 | -14% | 14,370,049 | $33,208,694 |

| NC1 | Nicoresourceslimited | 0.125 | -14% | 12,000 | $17,900,333 |

| TMB | Tambourahmetals | 0.130 | -13% | 11,683,960 | $25,046,792 |

| NFM | New Frontier | 0.014 | -13% | 482,098 | $25,683,402 |

| TDO | 3D Energi Ltd | 0.133 | -12% | 1,037,012 | $50,021,033 |

| BTE | Botalaenergyltd | 0.062 | -11% | 20,000 | $19,545,666 |

| MLS | Metals Australia | 0.031 | -11% | 2,786,431 | $25,610,183 |

| AGR | Aguia Res Ltd | 0.024 | -11% | 2,496,942 | $40,337,990 |

| LCY | Legacy Iron Ore | 0.008 | -11% | 442,304 | $87,858,383 |

| ODE | Odessa Minerals Ltd | 0.008 | -11% | 436,131 | $14,395,793 |

| WBE | Whitebark Energy | 0.004 | -11% | 455,000 | $3,165,807 |

| CMD | Cassius Mining Ltd | 0.033 | -11% | 170,703 | $25,686,101 |

| AEE | Aura Energy | 0.243 | -10% | 1,422,216 | $242,117,923 |

| NVA | Nova Minerals Ltd | 0.535 | -10% | 1,578,896 | $239,274,441 |

| ATP | Atlas Pearls Ltd | 0.180 | -10% | 594,938 | $87,808,516 |

IN CASE YOU MISSED IT

Locksley Resources (ASX:LKY) is shifting gears at its Mojave project in California, locking in approvals and drill rigs to fast-track the Desert Antimony Mine and El Campo target.

Trigg Minerals’ (ASX:TMG) 20 recently acquired Antimony Canyon patent claims have secured full ownership of both surface and mineral rights, de-risking its development pathway.

LAST ORDERS

Caspin Resources (ASX:CPN) has completed the first tranche of a $4.6 million capital raise at $0.075 per share.

CPN is channelling the fresh funding into upcoming drilling and work programs at the Weethalle gold project, followed shortly after by further programs at the Bygoo tin project.

Loyal Metals (ASX:LLM) has secured shareholder approval to acquire the Highway Reward copper-gold mine via an option agreement. The mine previously produced 3.65Mt at 5.7% copper and 260,000 tonnes at 4.5 g/t gold.

LTR Pharma (ASX:LTP) has increased its shareholding in LevOmega from 33% to 43% with a recent $1 million investment. LevOmega was co-founded by LTP with the foal of developing pharmaceutical-grade, nature-identical omega-3 ingredients.

At Stockhead, we tell it like it is. While Caspin Resources, Loyal Metals and LTR Pharma are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.