Lunch Wrap: Copper stocks lift after Freeport’s Grasberg force majeure

ASX up, copper stocks rally. Picture via Getty Images

- ASX edges higher as copper prices rip

- Crypto faces new rules and big fines in Australia

- Liontown sinks deeper into lithium loss

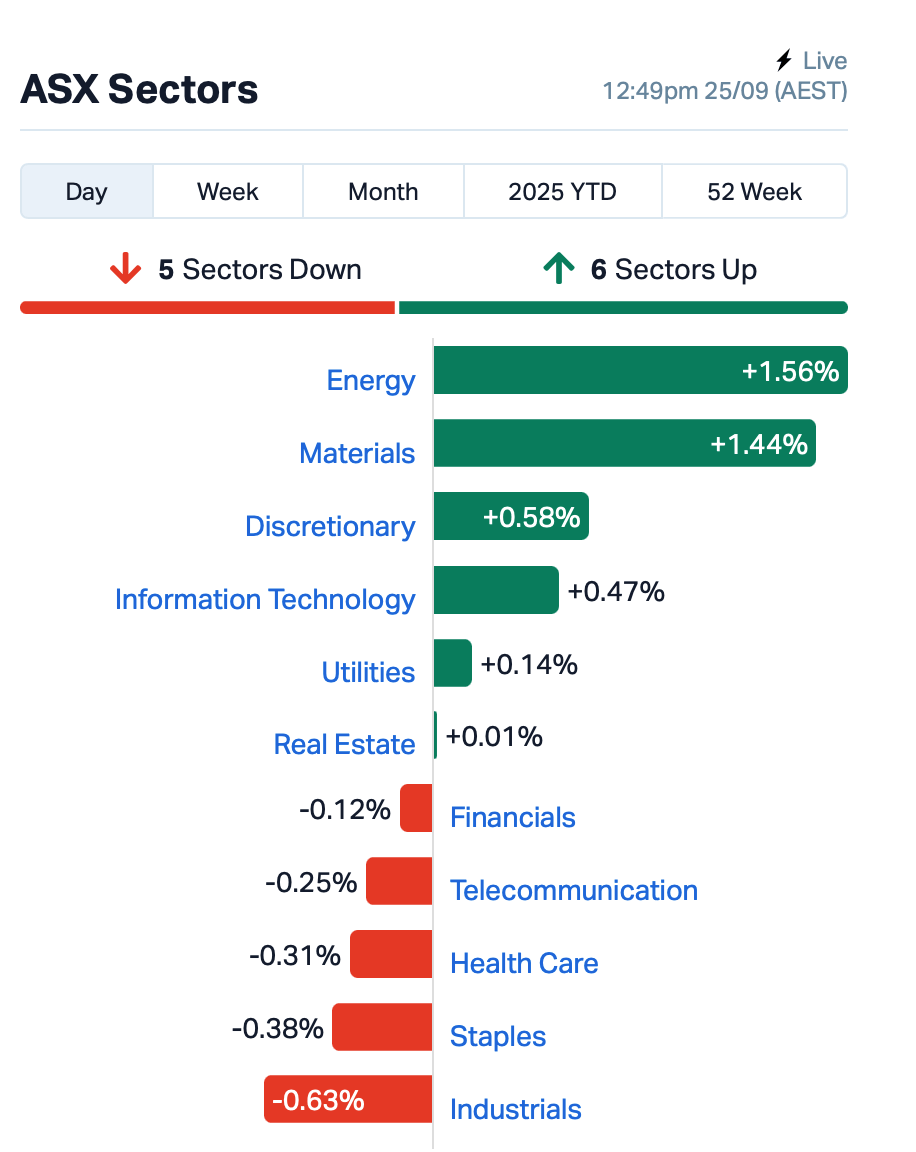

It was a volatile morning but by Thursday lunchtime in the east, the ASX was clinging to a modest gain of around 0.30%.

Wall Street gave us another cold handover overnight: the Dow, S&P 500, Nasdaq all dropped around half a percent.

Meanwhile, Australia’s crypto scene is about to get some fences put up.

The government has just unveiled draft legislation that will force exchanges to hold an AFSL and play by the same rules as traditional finance, or face penalties of up to 10% of turnover.

Coinbase and Kraken welcomed the move, calling it overdue clarity.

Back to the ASX, where the only thing keeping the local bourse above water was the miners and the energy patch.

And for once, it wasn’t iron ore or gold hogging the headlines, it was copper.

Prices for the red metal spiked to a one-year high in London after Freeport-McMoRan declared force majeure at Grasberg in Indonesia, the world’s second-largest copper mine, following a deadly mudslide that’s left workers missing.

With supply suddenly in question, BHP (ASX:BHP) and Rio Tinto (ASX:RIO) both jumped around 3%, while the pure-play names like Sandfire Resources (ASX:SFR) and Capstone Copper Corp (ASX:CSC) lit up the board, spiking 8% or more.

Copper stocks haven’t had this much fun since China was hoovering up every spare tonne in the early pandemic days.

But while copper was king, gold went begging this morning.

With the US dollar flexing to its strongest level since early September, the yellow metal sagged and so did local stocks.

Oil, meanwhile, stayed perky after its biggest jump since July.

Trump, in true Trump fashion, suggested NATO should start shooting down Russian aircraft. Traders took that as a green light to pile back into crude.

In large cap news, Premier Investments (ASX:PMV) climbed 3% even though profit from continuing operations fell 22.5% to $144 million.

Liontown Resources (ASX:LTR), meanwhile, was a reminder that lithium’s still in the doghouse.

Its annual loss ballooned to $193 million, triple last year’s, as spodumene prices stayed weak.

The company pocketed $298 million in revenue, but at an average price of just US$673 a tonne, a world away from the frothy highs of 2022. Shares fell 1%.

Still in large caps, Nine Entertainment Company (ASX:NEC) ‘s Catherine West announced she’ll hand over the chairman’s seat at the next AGM to Peter Tonagh, a veteran of News Corp and Foxtel.

West stepped up last year after Peter Costello’s infamous journalist-shoving exit.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| FDR | Finder Energy | 0.405 | 119% | 15,749,110 | $70,761,761 |

| ECT | Env Clean Tech Ltd. | 0.155 | 118% | 10,308,823 | $19,006,541 |

| CAN | Cann Group Ltd | 0.018 | 64% | 37,840,705 | $7,299,750 |

| M2R | Miramar | 0.003 | 50% | 6,498,406 | $2,389,846 |

| RMX | Red Mount Min Ltd | 0.021 | 40% | 74,662,266 | $9,417,564 |

| AYT | Austin Metals Ltd | 0.004 | 33% | 520,000 | $4,752,574 |

| EM2 | Eagle Mountain | 0.008 | 33% | 15,502,013 | $6,810,224 |

| PAB | Patrys Limited | 0.002 | 33% | 1,381,610 | $6,875,635 |

| EV8 | Everlast Minerals. | 0.650 | 27% | 521,897 | $27,031,540 |

| TMG | Trigg Minerals Ltd | 0.140 | 27% | 32,567,305 | $125,216,092 |

| M3M | M3Mininglimited | 0.033 | 27% | 665,906 | $2,503,940 |

| LMG | Latrobe Magnesium | 0.029 | 26% | 8,718,054 | $60,593,480 |

| AOK | Australian Oil. | 0.003 | 25% | 2,750,000 | $2,122,566 |

| DTM | Dart Mining NL | 0.003 | 25% | 170,355 | $2,749,113 |

| FBR | FBR Ltd | 0.005 | 25% | 1,286,909 | $25,900,711 |

| NTM | Nt Minerals Limited | 0.003 | 25% | 1,001,308 | $2,421,806 |

| PCL | Pancontinental Energ | 0.010 | 25% | 8,249,286 | $66,288,642 |

| QXR | Qx Resources Limited | 0.005 | 25% | 16,312,009 | $6,551,644 |

| RFT | Rectifier Technolog | 0.005 | 25% | 828,953 | $5,527,936 |

| AKG | Academies Aus Grp | 0.120 | 20% | 17,801 | $13,261,447 |

| JAY | Jayride Group | 0.006 | 20% | 167,280 | $7,139,445 |

| CCE | Carnegie Cln Energy | 0.125 | 19% | 1,254,164 | $42,811,386 |

| VML | Vital Metals Limited | 0.225 | 18% | 371,563 | $27,833,876 |

| AIV | Activex Limited | 0.020 | 18% | 656,438 | $3,663,544 |

Finder Energy Holdings (ASX:FDR) has locked in a binding farm-in Agreement with Timor-Leste’s national oil company Timor Gap, lifting the latter’s stake in PSC 19-11 from 24% to 34%. Under the deal, Timor Gap will tip in half the KTJ project’s development capex post-FID, up to US$338m, and also start sharing near-term costs with immediate funding support of up to US$15m. It keeps Finder in the driver’s seat with 66% and operatorship, but crucially de-risks First Oil by bringing in a deeper-pocketed partner and showing government-level backing.

Environmental Clean Technologies (ASX:ECT) has struck a binding deal to buy Terrajoule, giving it exclusive rights to Rice University’s flash joule heating tech for tackling PFAS (the so-called “forever chemicals”) and heavy metals. The process, known as Rapid Electrothermal Mineralisation, blasts contaminated soil with a short, intense electric pulse, smashing PFAS bonds and turning them into harmless calcium fluoride. ECT has a $3m placement already locked in to back the move.

Cannabis firm Cann Group (ASX:CAN) has finally cracked its first positive EBITDA month, in August, powered by strong B2B flower sales and the growing Botanitech range, while costs keep trending down at Mildura. Demand from wholesale customers is building, with new genetics and a fresh white-label deal highlighting the strength of Cann’s cultivars. Export talks are advancing in Germany, Poland, the UK and Malta, with pricing offshore looking better than local.

Red Mountain Mining (ASX:RMX) has snapped up the Yellow Pine antimony project in Idaho’s Stibnite District, less than 2km from Perpetua Resources’ federally cleared Stibnite gold-antimony development. The ground carries all the right ingredients for economic gold-antimony mineralisation, with prospective host rocks, major faulting and historical workings.

The deal complements Red Mountain’s Utah Antimony project and comes as Washington is throwing billions behind securing critical minerals supply. The acquisition was made directly by its US technical team and backed by an oversubscribed $1.5m raise, leaving Red Mountain well-funded for exploration and eyeing a potential US listing to ride growing interest in antimony.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 3,315,001 | $16,711,702 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 220,000 | $20,225,588 |

| 14D | 1414 Degrees Limited | 0.038 | -30% | 4,145,391 | $15,749,491 |

| GAS | State GAS Limited | 0.036 | -28% | 2,515,370 | $19,642,543 |

| IVZ | Invictus Energy Ltd | 0.165 | -27% | 20,373,529 | $360,784,055 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 11,348,501 | $6,507,557 |

| ORP | Orpheus Uranium Ltd | 0.032 | -22% | 522,417 | $11,549,582 |

| ERA | Energy Resources | 0.002 | -20% | 133,097 | $1,013,490,602 |

| RDN | Raiden Resources Ltd | 0.004 | -20% | 355,474 | $17,254,457 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 852,059 | $11,143,423 |

| PKO | Peako Limited | 0.003 | -17% | 7,181,988 | $4,463,226 |

| TEG | Triangle Energy Ltd | 0.003 | -17% | 433,000 | $6,567,702 |

| TMX | Terrain Minerals | 0.003 | -17% | 9,336,601 | $8,045,443 |

| VAR | Variscan Mines Ltd | 0.005 | -17% | 20,572,420 | $5,401,718 |

| VEN | Vintage Energy | 0.005 | -17% | 5,695,531 | $12,521,482 |

| AMU | American Uranium | 0.225 | -15% | 1,176,176 | $28,386,075 |

| ADG | Adelong Gold Limited | 0.006 | -14% | 1,660,546 | $17,967,855 |

| ARV | Artemis Resources | 0.006 | -14% | 6,466,599 | $26,396,455 |

| BIT | Biotron Limited | 0.003 | -14% | 50,000 | $4,645,360 |

| SLZ | Sultan Resources Ltd | 0.006 | -14% | 1,294,285 | $1,827,585 |

| SPQ | Superior Resources | 0.006 | -14% | 654,285 | $16,596,879 |

| WCE | Westcoastsilver Ltd | 0.165 | -13% | 6,847,025 | $61,493,383 |

| LKY | Locksleyresources | 0.475 | -13% | 11,834,780 | $138,772,287 |

| AM5 | Antares Metals | 0.007 | -13% | 566,804 | $4,118,823 |

LAST ORDERS

Bubalus Resources (ASX:BUS) has a ~1000m drilling campaign underway at its Crosbie North prospect, following up on strong chargeability anomalies geologically analogous to zones at the nearby Forsterville gold mine and rock chips going up to 12.1g/t gold and 2.02% antimony.

Bubalus managing director Brendan Borg said the company was pleased to have been able to get cracking over the exciting target on time and looked forward to providing further updates as the campaign progressed.

Godolphin Resources’ (ASX:GRL) ongoing metallurgical testing at its Lewis Ponds gold, silver, and base metals project in the firing Lachlan Fold Belt of NSW has suggested that mineralisation is soft and amenable to low-energy milling.

Godolphin expects it to translate into reduced operating costs and capital expenditure, and managing director Jeneta Owens said it was a very positive outcome and strong foundation for a pending scoping study, with the company very well placed to unlock considerable value from the project.

American Uranium (ASX:AMU) has the approval for a resource-expanding and infill drill campaign over a flagship Lo Herma project in Wyoming which stands as one of few near-term in-situ uranium projects in the US.

CEO and executive director Bruce Lane said the company was delighted the campaign is now approved, and that the work is expected to feed into an updated resource estimate and scoping study next year – positioning it to deliver value from an American nuclear revival.

GoldArc Resources (ASX:GA8) has established a share sale facility of its fully paid ordinary shares to allow smaller shareholders to sell without need for a broker or brokerage or handling fees, providing an opportunity for holders of less than marketable parcels to dispose in a cost-effective manner.

Lumos Diagnostics (ASX:LDX) has released a poster reporting on nearly two years of real-world use of FebriDx, showing reduced antibiotic use and cost savings for the rapid point-of-care test which uses a fingerstick blood sample to aid in the differentiation between bacterial infection and non-bacterial etiology.

The poster demonstrated a measurable reduction in antibiotic prescribing, improved patient experience, significant cost savings to the health system and more, with SVP of commercial operations Paul Kase saying the paper has underscored what it has seen on the ground – that when given rapid, reliable, viral versus bacterial confirmation, clinicians are more confident in their decisions.

IN CASE YOU MISSED IT

RareX (ASX:REE) has secured a $50m funding facility from international investment firm GEM Global Yield upon the successful acquisition of the Mrima Hill critical minerals project in Kenya.

Vertex Minerals (ASX:VTX) is moving to high-grade production at its Reward gold mine as stoping gets underway at the 1670 airleg stope.

Around 125 tonnes have been mined and processed over the last five days, and multiple mining fronts are being developed along more than 400m of strike to achieve continuous feed to the plant.

And finally … the darlings of the tech sector have long been rapidly scaling up software companies, many emerging from the comfort of the founder’s home before booming in glossy headquarters. But another breed of innovation is starting to attract some serious attention and capital.

At Stockhead, we tell it like it is. While Bubalus Resources, Godolphin Resources, American Uranium and Lumos Diagnostics are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.