Lunch Wrap: Coles the lone saviour as ASX wilts in earnings bloodbath

Coles saves the day at lunch, but there's a ways to go yet. Picture via Getty Images

- ASX slides as Wall Street fizz fades

- Coles lifts the market with $44.5b sales

- Earnings bloodbath as FMG and Viva Energy report

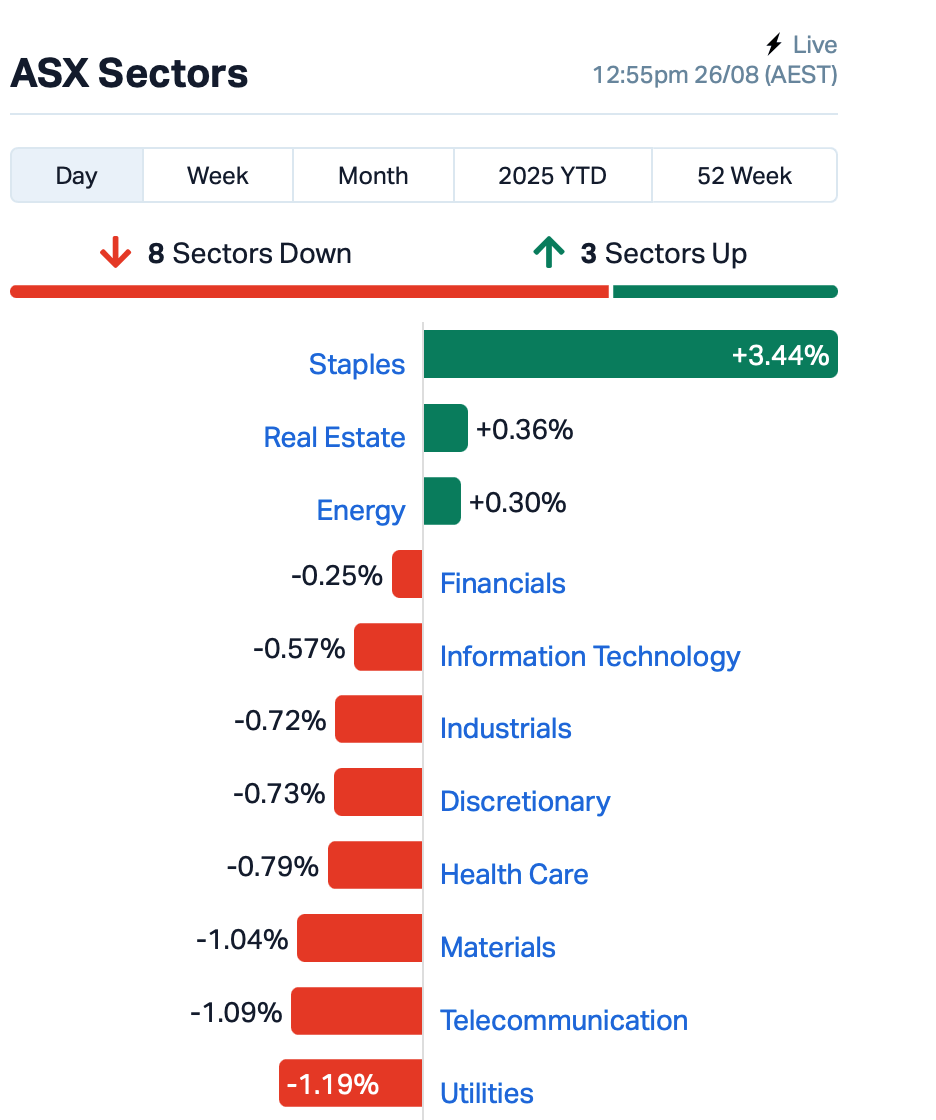

The ASX was down 0.49% by Tuesday lunchtime in the east, with losses deepening since 10am.

Wall Street offered little more than a limp handoff, with the major US indices sliding overnight.

Meanwhile, Trump is busy turning the Fed into a circus act. He has just given the order to sack Fed governor Lisa Cook in a “legally dubious move”, as some experts quoted.

Elsewhere, Defence Minister Richard Marles flew to Washington chasing Trump and the US Secretary of Defense, Pete Hegseth, but got the cold shoulder and was fobbed off to Stephen Miller instead, Trump’s loyal enforcer.

To make things worse, Australia Post has just announced that it was immediately suspending all US deliveries following tariff changes.

To cryptos, and a whale has apparently dumped 24,000 BTC overnight, wiping out $900m in leveraged bets and sending the BTC price spiralling down 3%.

The selloff triggered a US$4K drop in minutes, causing a liquidation cascade. BTC is trading at at US$ 109,679 the time of writing.

Back to the ASX, where consumer staples were the rare bright spot, all thanks to Coles Group (ASX:COL).

Coles jumped over 9% after reporting $44.5b in full-year sales, with supermarkets up 4.3% to $40b and EBIT beating forecasts. Shoppers might wonder if those “everyday low prices” are just funding the rally.

Meanwhile, Corporate Travel Management (ASX:CTD) has requested a trading halt after auditor Deloitte flagged issues in its European division.

CTD swears it’s nothing sinister. But the stock is now in voluntary suspension until late September.

Today’s ASX earnings wrap

Fortescue (ASX:FMG)’s profit sank 41% as iron ore prices slipped, and dividends were cut to the lowest level in seven years. Of course, Andrew and Nicola Forrest still pocketed $1.24b for the year.

Viva Energy (ASX:VEA) was another bloodbath. First-half profit collapsed 67% thanks to weak refining margins, and a shutdown outage. The interim dividend was chopped to 2.83c from 6.7c.

Tyro Payments (ASX:TYR)’s gross profit was up 4.4%, and transactions grew. But net profit fell 30% to $5.1m. Investors didn’t stick around for the fine print; the stock slipped 4% as the market lost patience.

Web Travel (ASX:WEB) managed to talk up record bookings. Its WebBeds business is heading for a record $3.1b in TTV for the first half of FY26, yet the stock still fell 5%.

Nanosonics (ASX:NAN) was the standout in the pack, lifting revenue 17% to $198.6m and profit 59% to $20.7m. The infection-control company doubled its full-year ebit. This is what the market likes: a business that sells the razor and the blades. Shares rose 7%.

G8 Education (ASX:GEM) is still in damage control after the horror headlines of an alleged paedophile working in its centres. It rolled out CCTV across all childcare sites and hired trauma specialists to try and convince parents the kids are safe. Full-year profit rose 12% to $22.5m, but revenue fell 3.7%. Investors know the reputational hole will take longer to fill than the financial one.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.023 | 53% | 1,860,090 | $2,832,807 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 700,000 | $3,253,779 |

| MOM | Moab Minerals Ltd | 0.002 | 50% | 600,066 | $1,874,666 |

| SRN | Surefire Rescs NL | 0.002 | 50% | 1,701,111 | $3,906,859 |

| GML | Gateway Mining | 0.040 | 43% | 16,643,982 | $11,446,968 |

| QXR | Qx Resources Limited | 0.006 | 38% | 6,189,083 | $5,241,315 |

| FL1 | First Lithium Ltd | 0.135 | 35% | 79,714 | $7,965,360 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 1,043,604 | $7,254,899 |

| ACE | Acusensus Limited | 1.145 | 26% | 206,844 | $127,596,434 |

| ERA | Energy Resources | 0.003 | 25% | 250,202 | $810,792,482 |

| WEL | Winchester Energy | 0.003 | 25% | 100 | $2,726,038 |

| EMD | Emyria Limited | 0.055 | 20% | 19,995,016 | $28,126,747 |

| AQI | Alicanto Min Ltd | 0.033 | 18% | 309,131 | $23,748,003 |

| OMA | Omegaoilgaslimited | 0.365 | 18% | 2,198,924 | $106,369,434 |

| BTM | Breakthrough Minsltd | 0.135 | 17% | 275,301 | $7,908,630 |

| MPP | Metro Perf.Glass Ltd | 0.041 | 17% | 2,969 | $6,488,233 |

| SHP | South Harz Potash | 0.042 | 17% | 149,502 | $3,532,137 |

| ROG | Red Sky Energy. | 0.004 | 17% | 496,396 | $16,266,682 |

| SRJ | SRJ Technologies | 0.007 | 17% | 1,853,295 | $6,545,415 |

| KLS | Kelsian Group Ltd | 4.660 | 16% | 1,102,572 | $1,094,317,702 |

| AHK | Ark Mines Limited | 0.410 | 15% | 1,455,194 | $23,487,048 |

| MPW | Metal Powdworks Ltd | 3.680 | 15% | 191,635 | $334,238,864 |

| AM5 | Antares Metals | 0.008 | 14% | 52,000 | $3,603,970 |

| MMR | Mec Resources | 0.008 | 14% | 300,000 | $12,948,361 |

| BMM | Bayanminingandmin | 0.280 | 14% | 4,489,820 | $26,938,970 |

Gold explorer Gateway Mining (ASX:GML) has shuffled the board as it kicks off a new exploration push at its Yandal gold project. Andrew Bray steps in as executive chairman, bringing deep Yandal experience, while Anthony McClure joins as non-executive director. Out go Trent Franklin and Peter Lester, both leaving due to other commitments, with Peter Langworthy sliding back to a non-executive role after a stint as cxecutive Chairman. Bray said he sees big discovery potential at Yandal, pointing to his past work with McClure at Strickland.

QX Resources (ASX:QXR) is moving on the Madaba Uranium Project in Tanzania, paying about $800k cash for full ownership and pointing to similarities with the giant Nyota deposit nearby. Historic drilling has already thrown up some eye-catching grades. To fund it, the company is raising $2.3m – $1.5m through a placement, with directors tipping in $200k, and another $818k via a fully underwritten rights issue. Adding to the firepower, uranium veteran Russell Bradford will join the board, bringing experience from his time developing Nyota before its $1.2bn sale.

Emyria (ASX:EMD) is ramping up its Perth clinic after demand for PTSD therapy surged, with August sessions tipped to top the past four months combined. The milestone comes as the first Medibank-funded patients start treatment. This is the first time psychedelic-assisted care has ever been covered by private health insurance in Australia. Capacity is being expanded with new staff and facilities, while a Brisbane launch with Avive Health is on the way.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 0.590 | -28% | 5,577,924 | $120,868,298 |

| BLZ | Blaze Minerals Ltd | 0.003 | -25% | 9,933,333 | $11,500,000 |

| XGL | Xamble Group Limited | 0.019 | -21% | 1,570,342 | $8,136,342 |

| DTM | Dart Mining NL | 0.002 | -20% | 300,000 | $2,995,139 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 500 | $16,854,657 |

| TKL | Traka Resources | 0.002 | -20% | 10,920,300 | $6,055,348 |

| PFT | Pure Foods Tas Ltd | 0.025 | -17% | 9,466 | $4,212,769 |

| 8IH | 8I Holdings Ltd | 0.010 | -17% | 29,269 | $4,177,930 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 4,357,751 | $18,756,675 |

| NAE | New Age Exploration | 0.003 | -17% | 313,036 | $8,117,734 |

| RDS | Redstone Resources | 0.005 | -17% | 11,852,289 | $6,205,604 |

| LIT | Livium Ltd | 0.011 | -15% | 4,444,038 | $22,127,393 |

| RIM | Rimfire Pacific | 0.011 | -15% | 5,898,120 | $35,423,621 |

| GBE | Globe Metals &Mining | 0.061 | -15% | 15,000 | $50,015,017 |

| BNL | Blue Star Helium Ltd | 0.006 | -14% | 1,089,076 | $23,575,197 |

| CCO | The Calmer Co Int | 0.003 | -14% | 4,956,327 | $10,539,736 |

| AUA | Audeara | 0.026 | -13% | 468,753 | $5,398,031 |

| IMD | Imdex Limited | 2.975 | -13% | 1,982,459 | $1,755,617,446 |

| SFM | Santa Fe Minerals | 0.205 | -13% | 160,895 | $17,112,415 |

| AOA | Ausmon Resorces | 0.004 | -13% | 3,272,525 | $5,244,854 |

| CXU | Cauldron Energy Ltd | 0.007 | -13% | 2,113,739 | $14,329,288 |

| ENV | Enova Mining Limited | 0.007 | -13% | 2,106,080 | $12,632,229 |

| REC | Rechargemetals | 0.014 | -13% | 194,206 | $4,111,839 |

| SKK | Stakk Limited | 0.007 | -13% | 347,066 | $16,600,637 |

IN CASE YOU MISSED IT

Renascor Resources (ASX:RNU) is close to making its dream of a downstream graphite processing plant in South Australia come true, with construction to start next month.

True North Copper (ASX:TNC) has strengthened its board by appointing former BHP senior executive Andrew Mooney as a non-executive director.

Miramar Resources (ASX:M2R) and Japan’s Sumitomo have struck a multi-year, multi-million-dollar JV to explore the Bangemall nickel-copper-PGE asset in WA’s Gascoyne region.

LAST ORDERS

Bayan Mining and Minerals (ASX:BMM) has brought a former senior US official onto its team as a strategic adviser to advance the US-based Desert Star critical mineral projects in the Mountain Pass district of California.

Dr Steve Feldgus, BMM’s new adviser, most recently served as Principal Deputy Assistant Secretary for Land and Minerals Management in the US Department of the Interior.

In his role there, Dr Feldgus oversaw the Bureau of Land Management (BLM), Bureau of Ocean Energy Management, Bureau of Safety and Environmental Enforcement, and the Office of Surface Mining Reclamation and Enforcement.

He will aid BMM in engaging with the Department of Energy, Department of Defense, and the Export-Import Bank regarding funding pathways for critical mineral initiatives.

At Stockhead, we tell it like it is. While Bayan Mining and Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.