Lunch Wrap: ASX wobbly despite cooling US inflation; Boss eyes Queensland uranium

The ASX has slipped modestly, still shaky from the last two sessions. Picture via Getty Images

- ASX extends losses, still shaky from last two sessions

- US inflation drops, but chaos lingers

- Nine announces a new CEO

The ASX has slipped again, down 0.3% by Thursday lunchtime (AEDT), extending its losses for the week.

As you’ll well know, the market had taken a beating over the last two days, with investors spooked by Trump’s tariffs war. And it looks like the bargain hunters haven’t showed up today.

Over in the US last night, traders took a breath of relief after a cooler-than-expected inflation report eased some nerves.

The US CPI (Consumer Price Index) came in lower than expected at 2.8% (annual), which shows signs of easing from January’s 3%.

But, of course, even with that relief, the political and tariff chaos continues to stir the pot, with Trump’s trade war heating up and tensions rising with Canada and the EU.

“As soon as US data was out that inflation fell to its lowest level in four months, investors bought the dip,” said Moomoo’s Jessica Amir.

“But as Treasury Secretary Scott Bessent said, the US is going through a detox and could roll.”

On the equities front, there were some interesting moves. Intel’s shares jumped by 11% after it announced Lip-Bu Tan as its new CEO.

Separately, oil prices were up 2% overnight, which was a nice boost for oil stocks.

“But don’t expect oil prices or stocks to maintain those gains, as output is still rising and demand is expected to soften as economic growth grinds lower,” warned Amir.

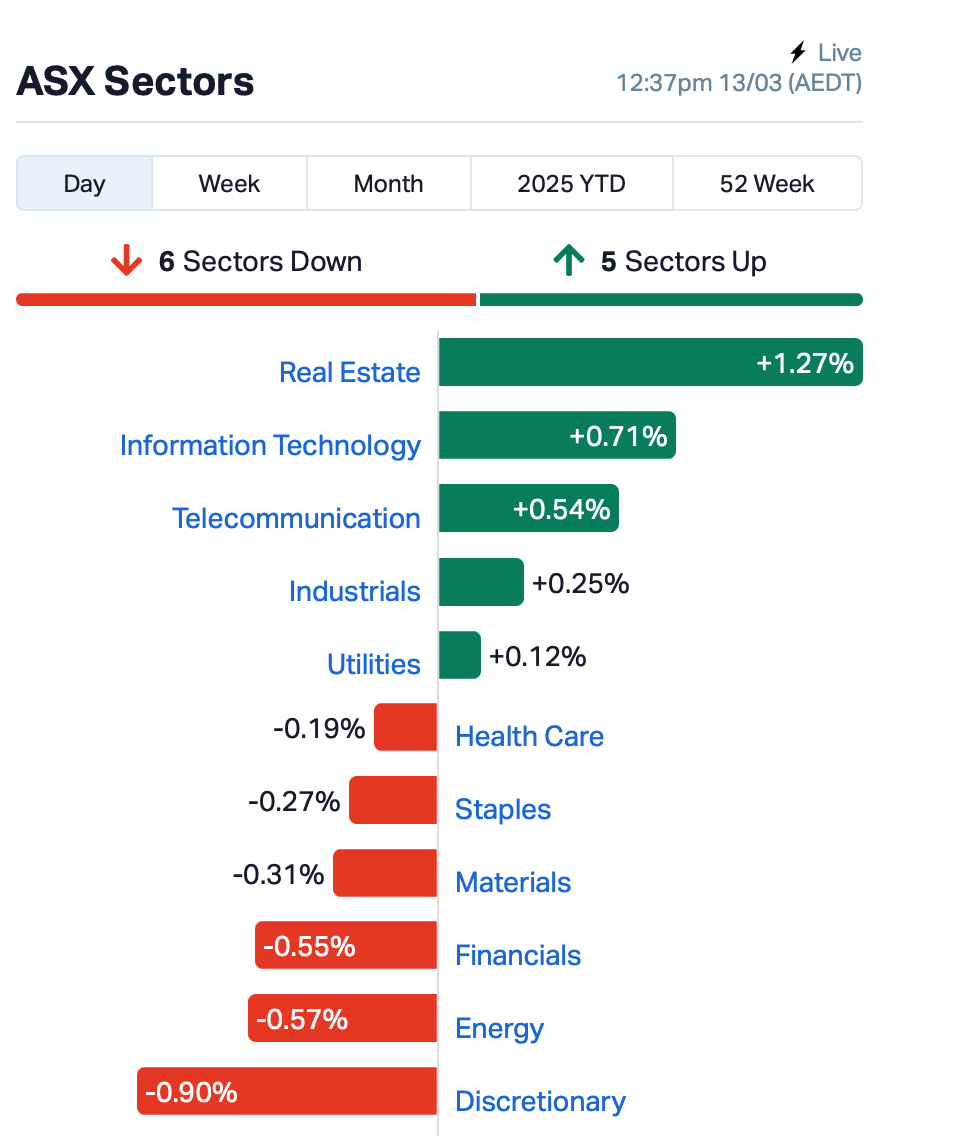

Meanwhile back on the ASX, only five of 11 sectors stayed in the green this morning.

Gold stocks were well bid up after the bullion spot price shot up above US$2,930/oz, with the softer US CPI report raising hopes for Fed rate cuts.

In the large caps space, Nine Entertainment Company (ASX:NEC) announced Matthew Stanton as its new CEO after a thorough search for the right candidate. Stanton has been acting CEO since October 2024 and has a solid track record in leading transformations at companies like Woolworths and Bauer Media. Shares were flat.

And, Bell Potter’s analysts are still backing agribusiness company Elders (ASX:ELD) with a ‘buy’ rating, though they’ve slightly dropped the price target to $9.40 from $9.45. The analysts reckon the issues that hit Elders in 1Q24 are mostly sorted, so earnings should return to normal in FY25. ELD’s shares were up 1%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 13 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CR9 | Corellares | 0.004 | 100% | 2,670,799 | $935,487 |

| SCP | Scalare Partners | 0.195 | 50% | 174,206 | $4,534,764 |

| WOA | Wide Open Agricultur | 0.023 | 44% | 24,742,894 | $8,538,986 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 49,871 | $1,824,924 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 3,609,410 | $7,254,899 |

| ETM | Energy Transition | 0.090 | 27% | 13,151,951 | $110,064,816 |

| ALR | Altairminerals | 0.003 | 25% | 305,443 | $8,593,488 |

| BLZ | Blaze Minerals Ltd | 0.003 | 25% | 31,250 | $3,133,896 |

| BUY | Bounty Oil & Gas NL | 0.003 | 25% | 929,794 | $3,122,944 |

| ERA | Energy Resources | 0.003 | 25% | 236,390 | $810,792,482 |

| FAU | First Au Ltd | 0.003 | 25% | 10,365,475 | $4,143,987 |

| OSL | Oncosil Medical | 0.005 | 25% | 4,380,000 | $18,426,321 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 39,333 | $9,346,989 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 2,020,369 | $2,873,894 |

| ASR | Asra Minerals Ltd | 0.003 | 20% | 6,001,309 | $5,932,817 |

| TYX | Tyranna Res Ltd | 0.006 | 20% | 580,000 | $16,439,627 |

| DY6 | Dy6Metalsltd | 0.040 | 18% | 141,368 | $1,713,968 |

| AVW | Avira Resources Ltd | 0.007 | 17% | 28,571 | $881,638 |

| EM2 | Eagle Mountain | 0.007 | 17% | 1,180,715 | $6,810,224 |

| GRL | Godolphin Resources | 0.014 | 17% | 32,500 | $4,309,184 |

| ICR | Intelicare Holdings | 0.007 | 17% | 883,364 | $2,917,129 |

| PIL | Peppermint Inv Ltd | 0.004 | 17% | 150,707 | $6,634,438 |

| SKK | Stakk Limited | 0.007 | 17% | 800,000 | $12,450,478 |

| ZMI | Zinc of Ireland NL | 0.014 | 17% | 590,713 | $6,804,128 |

Boss Energy (ASX:BOE) has snapped up 23.5 million shares in Laramide Resources (ASX:LAM), boosting its stake to 18.4%. The $15.5 million deal, paid in cash and shares, secures Boss a chunk of Laramide’s Westmoreland uranium project in Queensland, which could be a big win if the state lifts its uranium mining ban. Meanwhile, Boss said it will continue to focus on ramping up production at its Honeymoon uranium project in South Australia.

Zinc of Ireland (ASX:ZMI) has locked in the green light for drilling at its Mt Clere project in WA after getting the Program of Work approval. The focus will be on the Robin 21 anomaly, a massive untested geophysical target with potential, and drilling is set to kick off in April. It’s a high-risk, high-reward move, said ZMI, targeting a large mineral system in a base metal-rich region that’s never been fully explored.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 13 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OB1 | Orbminco Limited | 0.001 | -40% | 49,927,044 | $3,610,839 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 400 | $2,600,499 |

| CDT | Castle Minerals | 0.002 | -25% | 1,083,179 | $3,855,646 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 600,737 | $6,716,008 |

| WYX | Western Yilgarn NL | 0.030 | -23% | 470,034 | $4,844,822 |

| CDR | Codrus Minerals Ltd | 0.017 | -23% | 40,407 | $3,638,525 |

| SLH | Silk Logistics | 1.550 | -22% | 402,177 | $161,464,244 |

| IMI | Infinitymining | 0.011 | -21% | 407,054 | $5,894,221 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 2,250,316 | $10,601,880 |

| HLX | Helix Resources | 0.002 | -20% | 25,000 | $8,410,484 |

| RNX | Renegade Exploration | 0.004 | -20% | 926,125 | $6,420,017 |

| HE8 | Helios Energy Ltd | 0.013 | -19% | 1,184,371 | $41,664,791 |

| REC | Rechargemetals | 0.015 | -17% | 322,962 | $4,616,819 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 1,000,000 | $18,138,447 |

| SHE | Stonehorse Energy Lt | 0.005 | -17% | 373,753 | $4,106,610 |

| STM | Sunstone Metals Ltd | 0.005 | -17% | 1,146,874 | $30,900,022 |

| 1AE | Auroraenergymetals | 0.036 | -16% | 112,955 | $7,699,741 |

| GEN | Genmin | 0.034 | -15% | 100,000 | $35,451,444 |

| COY | Coppermoly Limited | 0.012 | -14% | 932,985 | $12,287,204 |

| IPB | IPB Petroleum Ltd | 0.006 | -14% | 310,139 | $4,944,821 |

| MEG | Megado Minerals Ltd | 0.012 | -14% | 200,000 | $5,875,566 |

| RML | Resolution Minerals | 0.012 | -14% | 10,602,671 | $4,175,698 |

| VRL | Verity Resources | 0.013 | -13% | 1,439,514 | $2,380,733 |

| WAK | Wakaolin | 0.041 | -13% | 1,210,407 | $32,814,386 |

Silk Logistics (ASX:SLH) tanked 21% after the ACCC raised concerns about its proposed sale to DP World Australia. The competition watchdog released a Statement of Issues, questioning the deal’s impact on competition, and has asked for feedback by March 27. The final decision is expected by June 5, but Silk’s directors are still backing the deal, hoping to get approval from the ACCC and FIRB.

Infinity Mining (ASX:IMI) has just re-logged some drill core at the Cangai copper project in NSW and found magnetic pyrrhotite, which could point to more copper. With plans for a high-res drone magnetic survey, the company’s looking to find new drill targets and expand the project. This follows some solid earlier results, but the new survey is key to seeing if there’s more copper to be found. Shares, however, tanked 20% this morning.

IN CASE YOU MISSED IT

New World Resources (ASX:NWC) has completed its planned placement of 700 million shares at 0.2 cents each, raising $14 million. The board and management have also committed to a further $640,000 in a second tranche, subject to shareholder approval in late April.

At Stockhead, we tell it like it is. While New World Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.