Lunch Wrap: ASX wobbles on bond fears but Bitcoin looks spicy on its ‘Pizza Day’

May 22 is Bitcoin Pizza Day – a messy one so far for other markets. Picture via Getty Images

- ASX drifts lower as Wall Street wobbles on bond fears

- Bitcoin rockets past $110k as risk appetite returns on ‘Pizza Day’

- Mayne Pharma sinks again as takeover deal unravels

It’s one of those mornings where you refresh your trading app and let out a sigh. [Ed: Unless you’re a Bitcoin ‘hodler’, that is.]

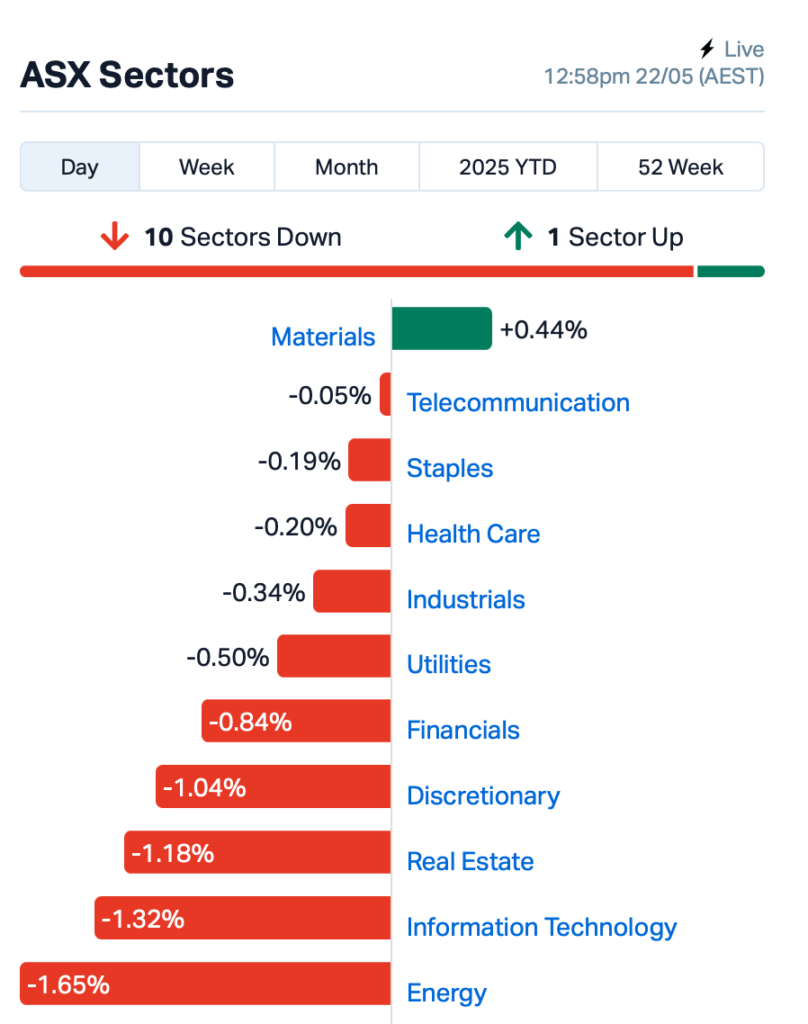

By lunch time AEST, the ASX 200 index was down 0.55%, a slow bleed that followed a rough night on Wall Street. Investors weren’t panicking, just quietly pulling back.

The culprit was mainly bonds – a messy US$16 billion auction of 20-year US Treasuries flopped last night, with buyers demanding over 5%, the highest since 2020.

Moody’s had already slapped a downgrade on US debt, and now Trump’s fresh tax-and-spend plan was rubbing salt into the wound.

So, Wall Street tumbled. The S&P 500 dropped 1.6%, the Dow shed nearly 2%, and the Nasdaq joined the slide.

But while equities were licking their wounds, Bitcoin was charging ahead to new highs.

BTC climbed past US$110,000 mark, a fresh all-time high, with its market cap topping USD$2.15 trillion.

At the time of writing, however, it’s cruising at a US$110,668 altitude.

Bitcoin’s bull run had kicked off under Trump’s crypto-friendly watch, but nearly came off the rails when his trade war with China spooked the market.

“However, market concerns have eased following a recent breakthrough in trade negotiations, which includes a 90-day agreement to reduce mutual tariffs,” said Alex Nagorskii, Portfolio manager at DigitalX.

By the way, for the trivia nerds and crypto tragics, today, May 22, is Bitcoin Pizza Day (Australian time zone edition), marking the moment in 2010 when a bloke swapped 10,000 BTC for two pizzas in Florida.

Laszlo Hanyecz posted on a crypto forum and got someone to order him two Papa John’s pizzas in exchange for 10,000 BTC, a deal that kickstarted Bitcoin’s journey into the real world.

It cost him $41. Today, that’d amount to a 1.16 BILLION DOLLAR feed, USD. Call it the most expensive takeaway order in history.

Back on home turf, the ASX’s mood was mostly glum, but not without a few bright spots in the large caps space.

Mining firm Evolution Mining (ASX:EVN) was up 3% after naming ex-BHP heavyweight Frances Summerhayes as its new CFO. Investors seemed to like the idea of an old hand steering the ship.

Nufarm (ASX:NUF) kept sliding today, down another 8%, after yesterday’s 30% thumping.

The wellness and agri firm copped it after slashing its full-year earnings outlook, with half-year profit tanking on the back of weak fish oil prices and rising costs.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 22 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NWC | New World Resources | 0.047 | 66% | 169,611,968 | $99,155,888 |

| CP8 | Canphosphateltd | 0.031 | 55% | 625,676 | $6,135,211 |

| HTA | Hutchison | 0.032 | 52% | 607,075 | $285,022,680 |

| MRD | Mount Ridley Mines | 0.003 | 50% | 1,202,236 | $1,556,978 |

| CRB | Carbine Resources | 0.004 | 33% | 100,015 | $1,655,213 |

| SHP | South Harz Potash | 0.005 | 25% | 1,029,710 | $4,410,915 |

| HMD | Heramed Limited | 0.011 | 22% | 2,974,676 | $7,880,425 |

| D3E | D3 Energy Limited | 0.073 | 22% | 8,157 | $4,768,500 |

| SKS | SKS Tech Group Ltd | 1.860 | 22% | 687,045 | $172,996,915 |

| AUN | Aurumin | 0.080 | 21% | 3,125,096 | $32,621,170 |

| AI1 | Adisyn Ltd | 0.069 | 21% | 2,097,330 | $41,218,159 |

| GBE | Globe Metals &Mining | 0.029 | 21% | 110,000 | $16,671,672 |

| POD | Podium Minerals | 0.030 | 20% | 2,482,963 | $17,035,265 |

| OMA | Omega Oil and Gas | 0.250 | 19% | 788,569 | $72,056,713 |

| HIO | Hawsons Iron Ltd | 0.016 | 19% | 8,106,072 | $13,722,768 |

| THB | Thunderbird Resource | 0.013 | 18% | 4,333,234 | $4,067,156 |

| STM | Sunstone Metals Ltd | 0.017 | 18% | 21,182,457 | $83,788,251 |

| WEC | White Energy Company | 0.033 | 18% | 100 | $8,725,357 |

| ADX | ADX Energy Ltd | 0.035 | 17% | 178,262 | $17,279,182 |

| FNR | Far Northern Res | 0.140 | 17% | 60,062 | $4,831,899 |

| CRR | Critical Resources | 0.004 | 17% | 332,089 | $7,842,664 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 132,430 | $8,996,849 |

| LSR | Lodestar Minerals | 0.007 | 17% | 692,857 | $1,910,543 |

| OVT | Ovanti Limited | 0.004 | 17% | 1,750,015 | $8,380,545 |

Hutchison Telecom (ASX:HTA) says it’s received a takeover offer from its major shareholder, HTABV, which already owns nearly 88% of the company. HTABV wants to buy the rest at 3.2 cents a share. HTA’s independent board committee is still weighing up the offer and is telling shareholders to take no action for now. A full response, including an independent expert’s report, will land once the offer formally opens by 5 June.

SKS Technologies (ASX:SKS) has landed a massive $100 million job to kit out a new data centre in Melbourne’s west for a global tech giant. It’s the third building it’s worked on at the site, after already delivering Buildings A and B for the same client. With this deal, SKS now has $220 million worth of work on the books, and says the pipeline’s still looking strong, with nearly half a billion bucks’ worth of jobs currently up for grabs.

Omega Oil & Gas (ASX:OMA) says fresh results from its Canyon-2 well have confirmed a large oil and gas system in Queensland’s Taroom Trough, strengthening the case that it’s sitting on a serious commercial opportunity.High-quality logging has revealed thicker and better-quality reservoir zones than first thought, with both oil and gas intervals now clearly identified.

Hawsons Iron (ASX:HIO) says fresh test work has backed its plan to use 100% dry processing at its NSW project, a cleaner, cheaper alternative to the traditional wet method. The independent report from Stantec confirms the dry circuit is not only viable but also cuts costs and improves environmental outcomes. It’s also opened the door to potential side products like silica sand.

And, Novonix (ASX:NVX) also surged ahead, thanks to a bit of geopolitical tailwind from across the Pacific. With the US planning tariffs on Chinese graphite, Novonix, who makes the stuff for lithium batteries, says it is in a pretty enviable spot.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 22 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.001 | -50% | 200,000 | $2,949,467 |

| BP8 | Bph Global Ltd | 0.002 | -33% | 467,992 | $3,152,954 |

| AAU | Antilles Gold Ltd | 0.003 | -25% | 685,000 | $8,505,471 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 2,594,198 | $9,673,198 |

| SIS | Simble Solutions | 0.003 | -25% | 200,123 | $3,505,321 |

| TMK | TMK Energy Limited | 0.003 | -25% | 4,790,121 | $40,889,532 |

| VTM | Victory Metals Ltd | 0.770 | -25% | 1,361,615 | $112,240,282 |

| RMI | Resource Mining Corp | 0.020 | -23% | 5,669,639 | $17,300,549 |

| EQR | Eq Resources Limited | 0.038 | -22% | 640,448 | $115,641,590 |

| AQX | Alice Queen Ltd | 0.004 | -20% | 891,321 | $5,734,450 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 90,909 | $6,916,340 |

| PFT | Pure Foods Tas Ltd | 0.016 | -20% | 212,102 | $2,708,512 |

| ROG | Red Sky Energy. | 0.004 | -20% | 3,511,822 | $27,111,136 |

| DUB | Dubber Corp Ltd | 0.014 | -18% | 22,185,621 | $44,597,247 |

| CCO | The Calmer Co Int | 0.003 | -17% | 51,847 | $9,033,947 |

| RC1 | Redcastle Resources | 0.005 | -17% | 2,945,771 | $4,461,401 |

| 1AI | Algorae Pharma | 0.006 | -14% | 500,000 | $11,811,763 |

| FME | Future Metals NL | 0.012 | -14% | 1,176,821 | $10,063,209 |

| MVL | Marvel Gold Limited | 0.012 | -14% | 623,615 | $15,116,337 |

| TMS | Tennant Minerals Ltd | 0.006 | -14% | 904,357 | $6,691,233 |

| TSL | Titanium Sands Ltd | 0.006 | -14% | 34,502 | $16,357,230 |

| EMN | Euromanganese | 0.190 | -14% | 448,789 | $8,922,448 |

| CR1 | Constellation Res | 0.130 | -13% | 81,001 | $9,455,884 |

| PCL | Pancontinental Energ | 0.010 | -13% | 12,856,199 | $93,570,737 |

Mayne Pharma (ASX:MYX) continued its nosedive,falling another 3% after a regulator query over whether it had kept shareholders properly informed. This followed a 30% plunge yesterday.

The selloff on Mayne was triggered by US-based Cosette Pharmaceuticals reconsidering its $672 million acquisition of Mayne, citing a “material adverse change” in Mayne’s business and finances.

This reevaluation came after Mayne issued weaker-than-expected earnings guidance and disclosed a potential US regulatory issue with one of its key products.

IN CASE YOU MISSED IT

Dimerix (ASX:DXB) has received the greenlight to continue its ACTION3 clinical trial unchanged, after the completion of a sixth independent data monitoring committee review.

The IDMC said there were no safety concerns to date, with the next scheduled meeting planned for the fourth quarter of 2025.

“This encouraging recommendation of the IDMC confirms the strong emerging safety profile of DMX-200 and suggests that DMX-200 does not add a burden of side effects to patients, compared to commonly used treatments such as high dose steroids and immunosuppressants,” Dimerix chief medical officer Dr David Fuller said.

At Stockhead, we tell it like it is. While Dimerix is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.