Lunch Wrap: ASX up on eased ‘Liberation Day’ worries; Gold Road shines after rejecting Gold Fields

Is this more than a 'relief rally'? Maybe this bloke knows. Pic: Getty Images

- ASX bounces up strongly after Wall Street vigour

- Gold Road share price hits an all-time high after rejecting Gold Fields offer

- IT and property stocks are leading the way today on the ASX

The ASX 200 got off to a cracking start this morning, thanks to some renewed vigour overnight on Wall Street. And that’s thanks to a slight sentiment shift regarding US President Donald Trump’s tariffs mayhem, set to be unleashed on April 2 on what the White House has dubbed ‘Liberation Day’.

Trump has indicated there may be some flexibility regarding the rollout of his reciprocal tariff plan despite earlier threats to crack down hard and broadly on countries with trade barriers against American exports.

“People are coming to me and talking about tariffs, and a lot of people are asking me if they could have exceptions,” said Trump. “And once you do that for one, you have to do that for all.”

But here was the wiggle-room statement that encouraged investors… (And for added effect, add your own Trump-style ‘accordian hands’ as you say this in your mind.)

“I don’t change. But the word flexibility is an important word,” he said. “Sometimes it’s flexibility. So there’ll be flexibility, but basically it’s reciprocal.”

The ASX 200 rose to 0.6% intraday earlier on the back of strong US gains, and a two-week high of 7987.4.

The tech-heavy Nasdaq made a 2.3 per cent jump overnight, while the S&P 500 and Dow Jones indexes rose 1.8 per cent and 1.4 per cent, respectively.

At the time of writing the ASX 200 has slipped back a tad to +0.47%, but the index might be in line for its first four-day rise in five weeks if things go well in the arvo session.

Meanwhile, the Aussie dollar is trading around US62.94c, and Bitcoin is taking advantage of the slightly improved macro sentiment – however long that lasts. The leading crypto surged up near US$89k in the wee hours, but has since pulled back to about US$87.5k.

ASX market news

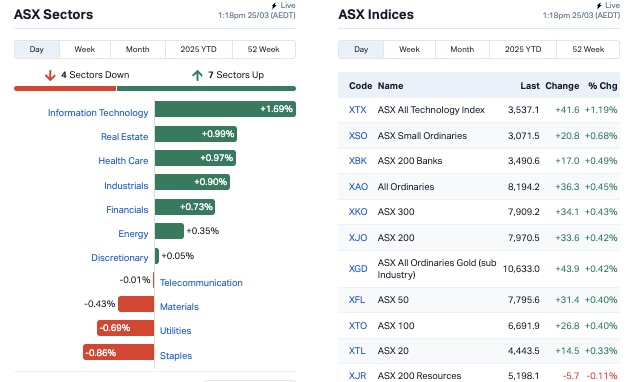

Seven of 11 ASX sectors are in the green at the time of writing, with tech, property and health care setting the pace, while utilities, materials/resources and consumer staples struggle for breath at the back of the pack.

What’s headlining amid flattening out trade? Gold Road Resources (ASX:GOR), largely.

Gold Road investors are frothing today, watching their beloved GOR share price surge 14.69%. That’s a pretty significant gain for a $3bn stock, which hit a record high of $2.81 a short while ago.

What’s occurred? A standoff of sorts between the miner and its WA project partner, South Africa’s Gold Fields.

Late yesterday, Gold Road confirmed it had rejected a $3.3bn takeover bid by Gold Fields, its 50 per cent partner in the Gruyere gold mine in WA. “Opportunistic,” it exclaimed in the classic parlance of a takeover target.

The South African entity wants all the cheese, essentially – it has been gunning to own 100 per cent of Gruyere and will also assume Gold Road’s other major asset – a 17 per cent stake in De Grey Mining, which is the target of a $5bn takeover play from Northern Star. Gold Fields doesn’t plan to interlope on NST’s De Grey play ahead of an April 16 shareholder vote though.

Meanwhile, James Hardie (ASX:JHX), which was hammered yesterday, is still taking a bit of a beating today, down by more than 5% intraday after it got a downgrade to ‘neutral’ from Macquarie following the Azek deal (see yesterday’s Lunch Wrap). Morgan Stanley, however, upgraded.

Per The Australian’s reporting this morning, Macquarie analysts said the takeover of Azek is a “disappointing outcome” for the suitor’s shareholders, diluting returns. “We see it weighing on valuation,” Macquarie’s note said, cutting the broker’s target price on James Hardie to $44, from $65 previously.

Here’s what the ASX sectors look like at about 1.20pm.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 25 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SRH | Saferoads Holdings | 0.165 | 302% | 75,000 | $1,791,922 |

| REE | Rarex Limited | 0.02 | 150% | 53,833,970 | $6,406,767 |

| BRX | Belararox | 0.22 | 76% | 5,680,449 | $17,995,514 |

| LNR | Lanthanein Resources | 0.003 | 50% | 201,261 | $4,887,272 |

| ERW | Errawarra Resources | 0.079 | 46% | 2,783,230 | $5,179,716 |

| HAR | Haranga Resources | 0.077 | 38% | 10,914,325 | $5,111,645 |

| ASR | Asra Minerals Ltd | 0.004 | 33% | 1,700,494 | $7,119,380 |

| AGD | Austral Gold | 0.064 | 25% | 171,119 | $31,227,879 |

| ASQ | Australian Silica | 0.025 | 25% | 6,460 | $5,637,208 |

| CUL | Cullen Resources | 0.005 | 25% | 500,000 | $2,773,607 |

| RMI | Resource Mining Corp | 0.005 | 25% | 1,592,929 | $2,609,391 |

| RPG | Raptis Group Limited | 0.01 | 25% | 111,111 | $507,891 |

| HIQ | Hitiq Limited | 0.034 | 21% | 43,918 | $10,263,749 |

| EM2 | Eagle Mountain | 0.006 | 20% | 242,500 | $5,675,186 |

| HLX | Helix Resources | 0.003 | 20% | 260,000 | $8,410,484 |

| SER | Strategic Energy | 0.006 | 20% | 44,251 | $3,355,167 |

| CXL | Calix Limited | 0.435 | 18% | 1,459,116 | $79,419,246 |

| LAT | Latitude 66 Limited | 0.076 | 17% | 643,798 | $9,321,046 |

| M2R | Miramar | 0.0035 | 17% | 60,000 | $1,369,040 |

| SRN | Surefire Rescs NL | 0.0035 | 17% | 225,000 | $7,248,923 |

| E79 | E79 Gold Mines | 0.052 | 16% | 2,167,770 | $5,746,648 |

| CAZ | Cazaly Resources | 0.015 | 15% | 3,831,969 | $5,996,939 |

| BKY | Berkeley Energia Ltd | 0.575 | 15% | 180,167 | $222,898,358 |

| BMO | Bastion Minerals | 0.004 | 14% | 150,000 | $2,956,536 |

| BNL | Blue Star Helium Ltd | 0.008 | 14% | 349,355 | $18,864,197 |

Haranga Resources (ASX: HAR) is up 38% in morning trade after inking a deal with Seduli Holdings (Australia) Ltd to acquire 100% of the equity of Seduli Sutter Operations Corporation, the owner of the Lincoln Gold Project in Sutter Creek in California.

Resource Mining Corporation (ASX:RMI) has lifted 25% after signing a funding agreement with Ven Capital Pty Ltd for a loan facility up to $250,000. RMI can drawdown $50,000 upon signing the agreement and then weekly with a fee amounting to either a cash deduction or share issuance.

And Cazaly Resources (ASX:CAZ) has risen 15% after exercising the option to proceed with an earn-in joint venture with Brightstar Resources (ASX: BTR) at the Goongarrie Gold Project in WA. Under terms CAS will spend an initial $1m on exploration within 12 months to earn a 25% interest, a further $1m within 18 months to earn a 51% interest and then another $1m within 18 months to earn to an 80% interest.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 25 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TX3 | Trinex Minerals Ltd | 0.001 | -33% | 1,270 | $2,817,978 |

| VPR | Volt Group | 0.001 | -33% | 10,477 | $16,074,312 |

| IRX | Inhalerx Limited | 0.025 | -29% | 115,280 | $7,470,688 |

| GUL | Gullewa Limited | 0.04 | -27% | 825,449 | $11,991,219 |

| EQS | Equity Story Group | 0.028 | -22% | 400,000 | $5,969,534 |

| ASP | Aspermont Limited | 0.004 | -20% | 818 | $12,350,058 |

| AMS | Atomos | 0.005 | -17% | 38,650 | $7,290,111 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 14,816 | $3,895,612 |

| VML | Vital Metals Limited | 0.0025 | -17% | 938,370 | $17,685,201 |

| CAE | Cannindah Resources | 0.078 | -16% | 3,631,004 | $67,711,436 |

| KZR | Kalamazoo Resources | 0.077 | -14% | 604,401 | $18,845,417 |

| RAG | Ragnar Metals Ltd | 0.018 | -14% | 11,546 | $9,953,706 |

| PLC | Premier1 Lithium Ltd | 0.013 | -13% | 5,666,515 | $5,520,909 |

| BDX | Bcal Diagnostics | 0.1 | -13% | 331,672 | $42,086,307 |

| RNT | Rent.Com.Au Limited | 0.018 | -13% | 110,504 | $15,668,286 |

| W2V | Way2Vatltd | 0.007 | -13% | 125,000 | $7,472,001 |

| NUC | Nuchev Limited | 0.175 | -13% | 22,849 | $29,267,861 |

| FUL | Fulcrum Lithium | 0.145 | -12% | 7,147 | $12,457,500 |

| LVE | Love Group Global | 0.12 | -11% | 30,317 | $5,472,113 |

| LEG | Legend Mining | 0.008 | -11% | 50,000 | $26,185,295 |

| VRL | Verity Resources | 0.016 | -11% | 1,000,647 | $3,318,130 |

| WHK | Whitehawk Limited | 0.008 | -11% | 691,405 | $5,844,564 |

| ATH | Alterity Therapeutics | 0.009 | -10% | 2,695,074 | $66,568,489 |

| DTR | Dateline Resources | 0.0045 | -10% | 2,070,400 | $12,827,843 |

| FGH | Foresta Group | 0.009 | -10% | 19,628 | $26,529,065 |

IN CASE YOU MISSED IT

The Tennant Creek Alliance – made up of CuFe (ASX: CUF), Tennant Minerals (ASX: TMS), and Emmerson Resources (ASX: ERM) – is moving forward with a scoping study for a shared copper-gold-critical minerals processing facility in the Barkly region of the Northern Territory. With government backing, the Alliance is focused on resource updates, metallurgical testing, and logistical planning to streamline operations and reduce costs.

At Stockhead, we tell it like it is. While CuFe is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.