Lunch Wrap: ASX up, but James Hardie crumbles and CSL keeps bleeding

ASX rises today as banks, retailers lift. Picture via Getty Images

- ASX holds firm, miners sink

- James Hardie crashes, CSL keeps bleeding

- Papyrus triples after locking in a $4.2m contract

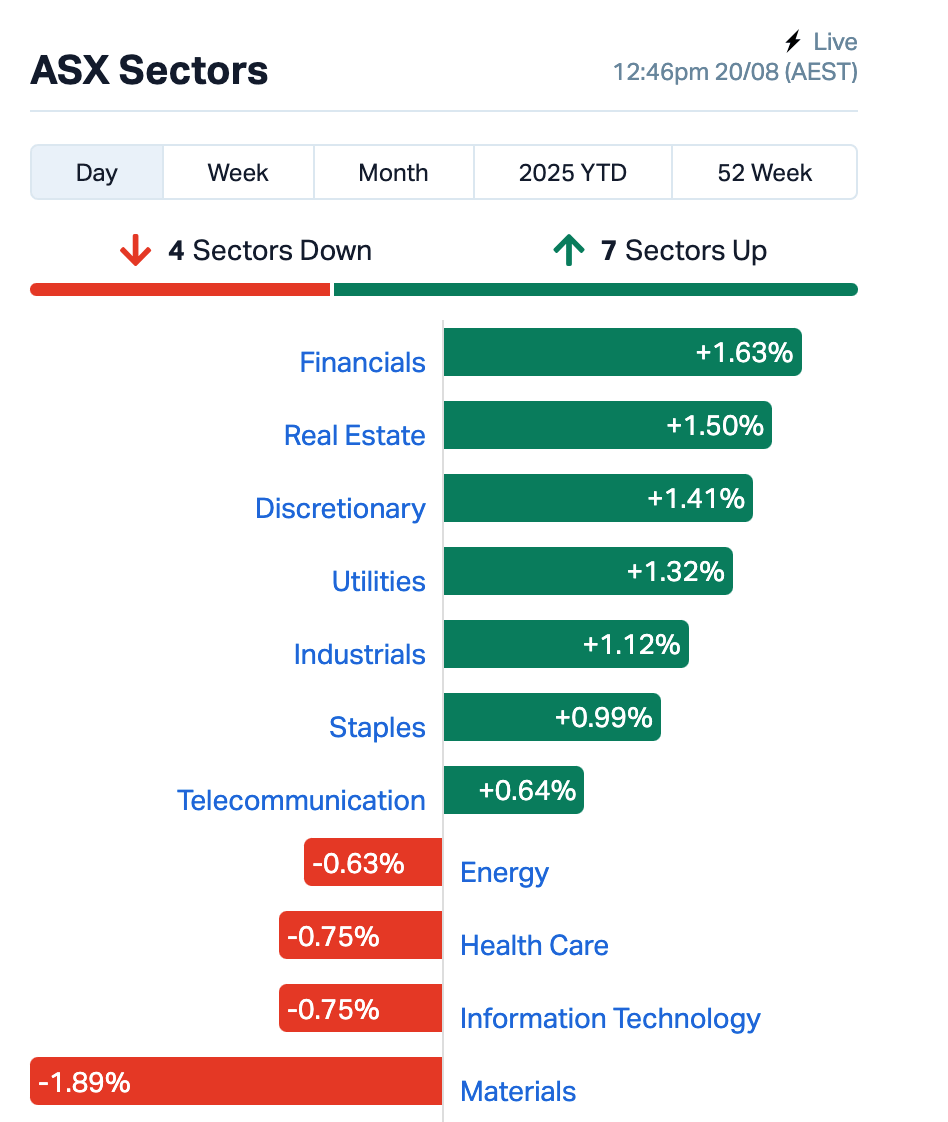

By Wednesday lunch in the east, the ASX was up about 0.5%. Not bad, considering the Nasdaq got hammered 1.5% last night.

Banks and real estate were doing the heavy lifting this morning. Every time talk of rate cuts circles, these two sectors get a little swagger back.

JB HiFi (ASX:JBH) and its discretionary mates also caught a bid, because Aussies still seem happy to throw cash at gadgets.

The mining sector, though, fell about 2%, with BHP (ASX:BHP) and Fortescue (ASX:FMG) slipping as China’s outlook soured again.

Iron ore prices remain soft, and investors are losing patience with the endless “wait and see” narrative on Chinese stimulus.

Building materials firm James Hardie (ASX:JHX), however, was the headline act, and not in a good way.

Shares collapsed 26% at this time of writing after quarterly earnings plunged 60% and guidance disappointed.

That’s nearly three years of gains wiped out in a morning, proof that one weak quarter can knock the house down faster than a dodgy reno job.

CSL (ASX:CSL), once the “set and forget” darling of the ASX, is now everyone’s punching bag.

The stock fell as much as 4% today, extending Tuesday’s brutal 17% rout. In just 48 hours, more than $20 billion has been wiped.

Not all doom and gloom, though.

The The Lottery Corporation (ASX:TLC) jumped nearly 9%; ironic, given full year profits actually fell 12%.

But who needs earnings when you can dangle four separate $100 million jackpots across Powerball and Oz Lotto in front of punters?

Every time there’s a giant jackpot, Aussies who’d normally baulk at spending an extra tenner at Woolies are happy to hand it over for a ticket.

ASX large cap earnings wrap

The earnings season is in full swing. Here are some of the other highlights:

Magellan Financial Group (ASX:MFG)

Magellan was the surprise riser, up 6% despite a 31% full year profit slide.

The dividend cheered investors, who seem happy to overlook the earnings wobble as long as cash keeps flowing.

Breville couldn’t keep investors interested even with record coffee machine sales.

Shares fell 3% as management warned of “significant” US cost pressures.

The toll operator rose 3% despite profits halving for the year.

Toll roads are the ultimate annuity.

Motorists grumble, but no one’s ditching the freeway for a back road.

Cleanaway, meanwhile, was trading flattish despite a strong a full year net profit of $289.5 million, up nearly 30% from a year earlier.

Rubbish might be recession-proof, but investors weren’t in the mood to pay up for it today.

Bendigo and Adelaide Bank (ASX:BEN)

And, Bendigo Bank dipped 0.5% as news of a hefty impairment and branch closures stung regional communities.

Add to that $9 million in restructuring costs from shutting 10 corporate branches, as well axing 100+ roles.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| PPY | Papyrus Australia | 0.032 | 220% | 17,550,348 | $6,028,817 |

| BEL | Bentley Capital Ltd | 0.015 | 50% | 564,545 | $761,279 |

| OVT | Ovanti Limited | 0.012 | 50% | 194,988,743 | $34,194,589 |

| PIL | Peppermint Inv Ltd | 0.003 | 20% | 200,000 | $5,828,525 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 4,570,000 | $16,854,657 |

| AQX | Alice Queen Ltd | 0.004 | 33% | 33,458,988 | $4,154,089 |

| RC1 | Redcastle Resources | 0.012 | 33% | 3,991,411 | $6,692,102 |

| SMS | Starmineralslimited | 0.050 | 28% | 8,132,773 | $7,297,159 |

| ESK | Etherstack PLC | 0.600 | 28% | 274,846 | $62,374,641 |

| LGL | Lynch Group Holdings | 2.170 | 24% | 4,716,550 | $213,615,696 |

| I88 | Infini Resources Ltd | 0.235 | 24% | 195,421 | $9,950,304 |

| EM2 | Eagle Mountain | 0.006 | 20% | 126,390 | $5,675,186 |

| SPQ | Superior Resources | 0.006 | 20% | 833,333 | $11,854,914 |

| ROG | Red Sky Energy. | 0.004 | 17% | 271,495 | $16,266,682 |

| SNX | Sierra Nevada Gold | 0.029 | 16% | 799,468 | $4,116,478 |

| HMC | HMC Capital Limited | 3.790 | 16% | 4,606,176 | $1,349,253,440 |

| BPH | BPH Energy Ltd | 0.015 | 15% | 6,603,219 | $15,837,027 |

Papyrus Australia (ASX:PPY) tripled after locking in a binding three-year, $4.2m contract with TBS Mining Solutions, a unit of Aquirian, to supply a biodegradable version of TBS’s Collar Keeper. The boards will be made in Adelaide using Papyrus’s patented waste-to-board tech, with production slated to start once the new site is commissioned in Q4 FY26. Testing has already been ticked off, and both parties aim to sign a definitive agreement by October.

Ovanti (ASX:OVT) has signed a 3-year partnership with NYSE-listed Shift4 Payments to launch its BNPL services across the US. Shift4 processes over US$260bn annually and serves more than 200,000 businesses, with Ovanti’s model set to roll out to over 100,000 merchants in North America. The deal marks Ovanti’s first major US agreement and a foundation for its BNPL expansion.

Alice Queen (ASX:AQX) has wrapped up its maiden drilling and sampling program at the 100%-owned Viani gold project in Fiji, with results pointing to a potentially very large, high-grade epithermal system running for about 5km. The first two holes hit pay dirt: 17.6 g/t Au in 24VDD001 and 26.4 g/t Au in 25VDD002. This proves the high-grade gold continues to depth, around 175m below surface. Follow-up holes returned more modest grades but confirmed the structure.

Redcastle Resources (ASX:RC1) has struck a JV with Kalgoorlie’s BML Ventures to fast-track gold production at its Queen Alexandra and Redcastle Reef deposits, with BML funding all costs to first revenue and running the mining. It’s also snapped up the 72km² TBone Belt, lifting its landholding six-fold to ~85km², including multiple mining leases and historic workings. A $4m raise at 0.9c a share, with $1.5m from BML, locks in the funding.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BCC | Beam Communications | 0.120 | -33% | 457,341 | $15,555,946 |

| JHX | James Hardie Indust | 32.635 | -26% | 4,933,503 | $19,061,852,064 |

| STP | Step One Limited | 0.510 | -26% | 3,076,716 | $126,958,099 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 927,001 | $11,584,182 |

| AOA | Ausmon Resorces | 0.004 | -20% | 12,554,556 | $6,556,067 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 670,000 | $23,424,247 |

| FNX | Finexia Financialgrp | 0.115 | -18% | 327,863 | $8,722,555 |

| LMS | Litchfield Minerals | 0.100 | -17% | 46,808 | $3,971,527 |

| RGT | Argent Biopharma Ltd | 0.125 | -17% | 175,474 | $10,827,473 |

| TAS | Tasman Resources Ltd | 0.015 | -17% | 36,007 | $5,028,349 |

| ATV | Activeportgroupltd | 0.020 | -17% | 5,252,533 | $16,487,450 |

| DTM | Dart Mining NL | 0.003 | -17% | 3,571,166 | $3,594,167 |

| VEN | Vintage Energy | 0.005 | -17% | 157,000 | $12,521,482 |

| ZNC | Zenith Minerals Ltd | 0.055 | -17% | 483,049 | $34,944,063 |

| HVY | Heavymineralslimited | 0.280 | -16% | 108,753 | $22,668,978 |

| C1X | Cosmosexploration | 0.067 | -16% | 500,985 | $8,568,862 |

| BLG | Bluglass Limited | 0.012 | -14% | 1,770,888 | $36,069,962 |

| JAY | Jayride Group | 0.006 | -14% | 3,420,769 | $9,995,224 |

IN CASE YOU MISSED IT

Pioneer Lithium (ASX:PLN) has lit up big radiometric anomalies at its Skull Creek uranium project in Colorado, pointing to large-scale mineralisation potential just as US policy swings toward securing domestic supply, with drilling targets now being locked in.

Tylah Tully takes stock of a series of high-grade Brightstar Resources (ASX:BTR) gold hits across multiple deposits at a Sandstone project which continues to grow in prominence in the East Murchison region of Western Australia.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.