Lunch Wrap: ASX tumbles; Apple deal lifts rare earth stocks and Lumos soars 150pc

Rare earths soar with Apple's big US deal. Pic: Getty Images

- ASX dips on US CPI jitters, miners struggle

- Rare earths soar with Apple’s big US deal

- Gold stocks feel the pinch, but outlook still sweet

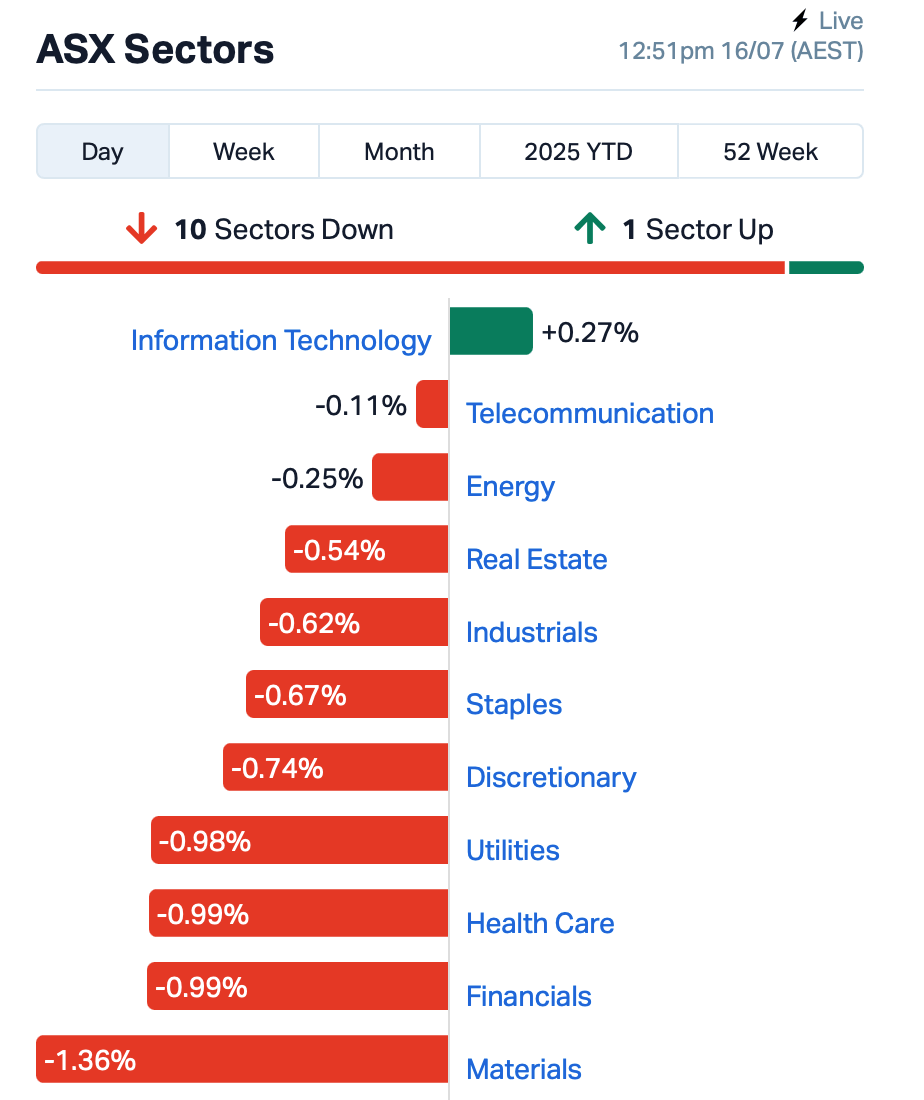

The ASX 200 took a bit of a tumble today, down 0.85% at lunch time in the east.

The market is on edge after a strong US CPI print overnight put a dampener on the idea of a Fed interest rate cut anytime soon.

The mining sector copped the biggest hit this morning, tracking iron ore prices downward after China’s steel output had a hiccup.

BHP (ASX:BHP) slid 1%, and even Rio Tinto (ASX:RIO), despite reporting a solid June quarter (more on this later), was down 0.3%.

But while most miners were down in the dumps, there was a party happening in the rare earths space.

Those stocks surged after Apple announced a massive $US500 million deal with an American mob called MP Materials.

MP Materials is the only rare earth mining company in the US, and this deal was a ripper.

Apple is said to be coughing up a pre-payment of $US200 million for these rare earth magnets, with deliveries set to kick off in 2027.

They’re even going to team up and build a factory in the US, setting up recycled production lines specifically for the neodymium magnets needed in Apple’s products.

So, while most miners were feeling the squeeze, Iluka Resources (ASX:ILU) and Lynas (ASX:LYC), our local rare earth champions, were among the top gainers this morning,

Elsewhere though, ASX gold stocks were under pressure.

Newmont Corporation (ASX:NEM), for example, dropped a chunky 5%, partly due to its chief financial officer, Karyn Ovelmen, doing a runner and a similar selloff on Wall Street.

This is despite the World Gold Council saying gold price outlook still looks strong for the back half of 2025.

And this is where things stand for the ASX at about 12:50pm, AEST:

Miners quarterly updates

A bunch of mining stocks have dropped updates this morning.

First up, Mt Gibson, primarily an iron ore miner, said it was branching out. With its Koolan Island mine winding down, Gibson has chucked $50m at Northern Star Resources (ASX:NST) for a share in the Central Tanami Gold Project.

It will join 50% partner Tanami Gold (ASX:TAM) in the project. Both count Hong Kong’s APAC Resources as their major shareholder.

Nothing too earth-shattering, but the big news is that Rio is expecting to ship 500,000 to 1 million tonnes of iron ore from Simandou in Guinea next year, with the first exports due in November.

Rio’s copper output was a ripper, 13% above consensus. It’s guiding copper and bauxite now to the top end of its original ranges.

The company recovered from a cyclone impacted March quarter with its strongest Q2 for iron ore shipments since 2018, though at 79.9Mt, that remained 2% below consensus. The updates come after Rio appointed iron ore chief Simon Trott as the miner’s newest CEO following the resignation of Jakob Stausholm.

The Aussie lad from the small farming community of Wickepin will start on August 25, with cost discipline and M&A likely to be big focuses.

The gold and copper miner reported quarterly and group cash flow of $308 million and $787 million respectively for the June quarter and the full financial year.

It clocked in 751,000 ounces of gold and 76,000 tonnes of copper for the year.

Its all-in sustaining costs (AISC) were $1572 an ounce for the year, with about $40-$45 of that due to higher royalty payments, a direct result of the gold price going gangbusters.

EVN has finished the year with a whopping $760 million in the bank, an 88 per cent jump from last year.

But its FY26 guidance for AISC is a bit higher, and its capital expenditure will drop by about $200 million.

Argonaut, who’s a bit bearish on Evolution, reckons that capex guidance is materially higher than it expected, while Alex Barkley at RBC calling the AISC numbers for FY26 a negative. So, a bit of a mixed bag there, but mostly good news.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 16 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LDX | Lumos Diagnostics | 0.072 | 148% | 42,792,405 | $21,707,168 |

| SFG | Seafarms Group Ltd | 0.002 | 100% | 2,129,973 | $4,836,599 |

| SKN | Skin Elements Ltd | 0.003 | 50% | 230,300 | $2,150,428 |

| MCM | Mc Mining Ltd | 0.130 | 37% | 3,769 | $61,150,757 |

| CTN | Catalina Resources | 0.004 | 33% | 38,241,265 | $7,278,057 |

| AT1 | Atomo Diagnostics | 0.021 | 31% | 14,110,727 | $12,333,519 |

| MHM | Mount Hope | 0.200 | 29% | 97,279 | $4,314,425 |

| UBI | Universal Biosensors | 0.027 | 29% | 874,836 | $6,259,416 |

| NOX | Noxopharm Limited | 0.061 | 27% | 308,256 | $14,027,422 |

| AR3 | Austrare | 0.094 | 27% | 3,482,081 | $15,687,065 |

| BCM | Brazilian Critical | 0.015 | 25% | 6,725,028 | $15,726,399 |

| ERA | Energy Resources | 0.003 | 25% | 314,895 | $810,792,482 |

| HCD | Hydrocarbon Dynamics | 0.003 | 25% | 36,432 | $2,156,219 |

| JAV | Javelin Minerals Ltd | 0.003 | 25% | 70,732 | $12,504,450 |

| LCY | Legacy Iron Ore | 0.010 | 25% | 418,918 | $78,096,341 |

| TMX | Terrain Minerals | 0.003 | 25% | 850,000 | $5,063,629 |

| NHE | Nobleheliumlimited | 0.038 | 23% | 2,089,899 | $18,585,275 |

| CPV | Clearvue Technologie | 0.200 | 21% | 1,592,780 | $45,973,153 |

| 14D | 1414 Degrees Limited | 0.023 | 21% | 872,287 | $5,540,878 |

| ARR | American Rare Earths | 0.415 | 20% | 4,159,055 | $175,061,038 |

| ARV | Artemis Resources | 0.006 | 20% | 2,481,612 | $12,678,361 |

| AUK | Aumake Limited | 0.003 | 20% | 3,293,399 | $7,558,397 |

| AZL | Arizona Lithium Ltd | 0.006 | 20% | 2,222,740 | $26,351,572 |

| VFX | Visionflex Group Ltd | 0.003 | 20% | 1,000 | $8,419,651 |

Lumos Diagnostics (ASX:LDX) has just inked a massive 6-year, exclusive deal worth up to US$317m with PHASE Scientific for its FebriDx test in the US, pending a crucial CLIA waiver. Lumos pockets US$2m straightaway, with another US$1.5m coming its way once the CLIA waiver application hits the FDA, expected within three months.

CLIA waiver means a test has been deemed simple to perform, with a very low risk of getting a wrong result. If that waiver gets the green light, there’s another US$5 million pre-paid purchase commitment. Lumos is pushing hard on the CLIA waiver study, with 105 of 120 bacterial positive patients already enrolled as of July 9, anticipating completion in August and submission to the FDA about a month later.

Catalina Resources (ASX:CTN) has just kicked off drilling at its Laverton project, less than 2km from Lynas’s world-class Mt Weld rare earth mine. The focus is on expanding a high-grade rare earth intersection of over 10,000ppm TREO, with a cracking NdPr ratio similar to Mt Weld itself. This drilling will also chase some solid gold intercepts already found.

Noxopharm (ASX:NOX) has just kicked off its HERACLES clinical trial, giving the first patient a dose of its novel drug candidate, SOF-SKN. This trial, happening right here in Australia, is about checking the drug’s safety and how well it’s tolerated across four increasing doses. It’s a massive step for Noxopharm, as it pushes into the over US$3 billion global lupus market.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 16 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.002 | -33% | 4,240,062 | $18,316,891 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 1,100,000 | $2,811,999 |

| BLZ | Blaze Minerals Ltd | 0.003 | -25% | 400,000 | $7,113,856 |

| SHP | South Harz Potash | 0.003 | -25% | 110,045 | $5,132,248 |

| IMI | Infinitymining | 0.008 | -20% | 287,037 | $4,230,158 |

| PIL | Peppermint Inv Ltd | 0.002 | -20% | 350,000 | $5,752,724 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 3,500,000 | $7,937,639 |

| SIS | Simble Solutions | 0.004 | -20% | 1,991,422 | $5,411,652 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 1,401,167 | $12,091,165 |

| IPB | IPB Petroleum Ltd | 0.005 | -17% | 68,400 | $4,238,418 |

| WSR | Westar Resources | 0.005 | -17% | 1,300,001 | $2,392,349 |

| OCT | Octava Minerals | 0.033 | -15% | 202,225 | $2,379,363 |

| PPG | Pro-Pac Packaging | 0.017 | -15% | 96,927 | $3,633,754 |

| LML | Lincoln Minerals | 0.006 | -14% | 19,269 | $14,717,988 |

| RKT | Rocketdna Ltd. | 0.012 | -14% | 399,859 | $12,817,325 |

| RMI | Resource Mining Corp | 0.012 | -14% | 2,841,511 | $10,282,347 |

| SPX | Spenda Limited | 0.006 | -14% | 185,537 | $32,306,508 |

| OSX | Osteopore Limited | 0.013 | -13% | 3,215,557 | $3,107,092 |

| EAX | Energy Action Ltd | 0.340 | -13% | 12,699 | $15,202,762 |

| DGR | DGR Global Ltd | 0.007 | -13% | 500,020 | $8,349,568 |

| LU7 | Lithium Universe Ltd | 0.007 | -13% | 10,475,916 | $7,487,837 |

| LOC | Locatetechnologies | 0.145 | -12% | 83,500 | $38,803,766 |

| IMU | Imugene Limited | 0.375 | -12% | 1,735,053 | $93,345,216 |

| AS2 | Askarimetalslimited | 0.008 | -11% | 231,814 | $3,637,536 |

| WTM | Waratah Minerals Ltd | 0.285 | -11% | 181,176 | $74,723,925 |

IN CASE YOU MISSED IT

West Coast Silver (ASX:WCE) has uncovered shallow, high-grade silver in the first two drill holes at the Elizabeth Hill project, making a solid start to its maiden drilling.

Prescient Therapeutics (ASX:PTX) has initiated its first US site for the Cutaneous T-cell lymphoma Phase 2a trial of PTX-100.

Lumos Diagnostics (ASX:LDX) has inked a US$317 million agreement with PHASE Scientific to support FebriDx commercialisation.

Javelin Minerals (ASX:JAV) has lifted the indicated resource at the Eureka Gold Project in WA 27% to 78,768oz.

LAST ORDERS

Alice Queen (ASX:AQX) has appointed Paul Williams as non-executive director, replacing outgoing director Michele Alessandro Bina, who has relocated to Europe.

Williams rings more than 30 years’ legal and commercial experience, having served as chief executive officer of Eastern Corporation and general counsel at Mitsui Coal Holdings, where he was involved in the supervision of coal mining interests and business development for the Mitsui & Co group.

At Stockhead, we tell it like it is. While Alice Queen and Lumos Diagnostics are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.