Lunch Wrap: ASX tech stocks jump on Nvidia frenzy, Liontown explodes higher

Nvidia explodes after another strong quarter. Pic: Getty Images

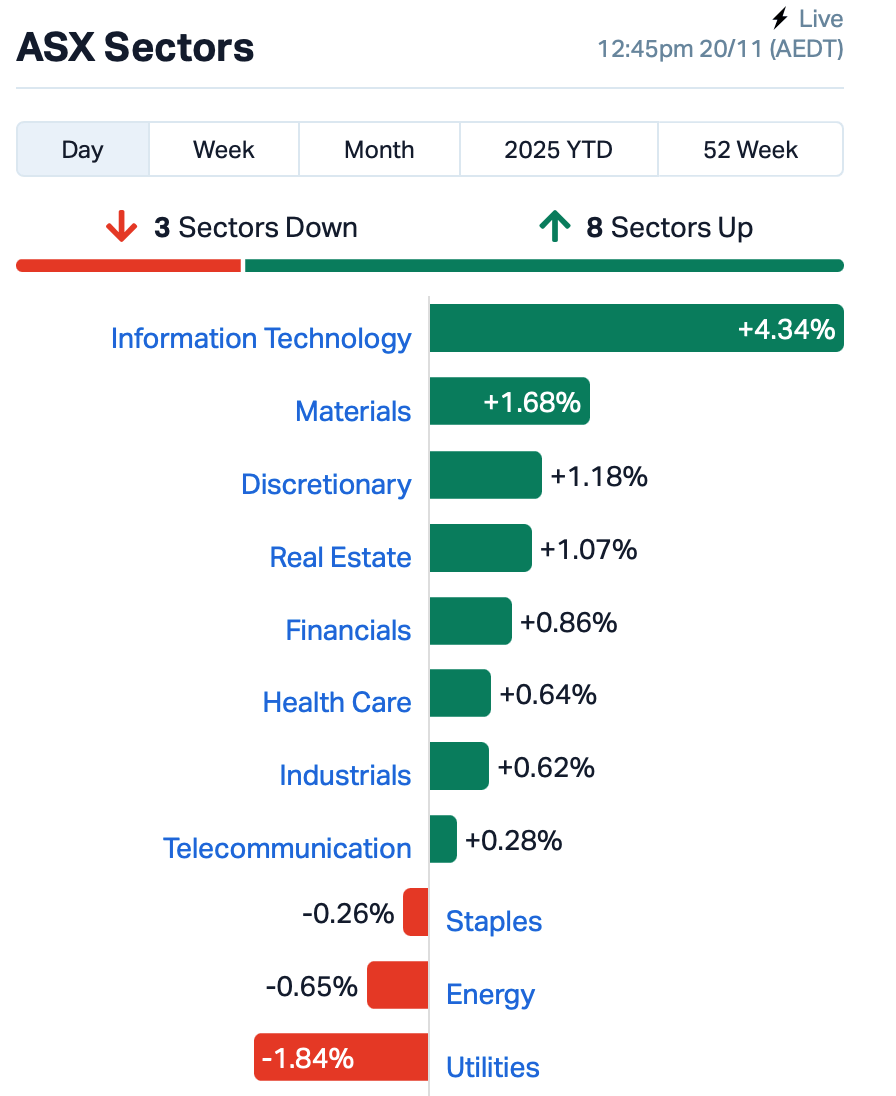

- ASX rides Nvidia wave, surges by more than 1% at lunch time

- Nvidia fireworks ignite tech and gold

- DroneShield stumbles as Liontown shines

Local traders woke up on Thursday and decided to forget yesterday ever happened.

By mid-morning, the ASX was up around 1% in the eastern states, a sharp rebound from the near six-month low it flirted with only 24 hours earlier.

That’s what happens when Wall Street futures rip higher and everyone remembers Nvidia is basically the financial equivalent of a life raft for global tech.

The ASX tech index (XIJ) surged more than 5% as local traders did what they always do when Nvidia beats: they buy anything remotely AI-adjacent.

Nvidia has reported US$57 billion in quarterly revenue, beat expectations and casually guided to US$65 billion next quarter like it was ordering lunch. Gross margins came near 75%.

If Nvidia was a mining company, it wouldn’t be just selling the shovels – it would own the mine, the land and the water rights. After-hours, the stock popped by 5% and immediately dragged global futures with it.

eToro’s Farhan Badami said Nvidia proved “this isn’t a bubble popping”. Hard to argue when the company reports US$51.2 billion in data-centre sales and tells you cloud GPUs are sold out.

Nvidia’s surge lit a fire under local big names.

WiseTech Global (ASX:WTC), Xero (ASX:XRO) and Technology One (ASX:TNE) all came out swinging.

Gold stocks also joined the party this morning, with rallies across the board.

In the large caps space, Liontown Resources (ASX:LTR) surged 9% after revealing an impressive US$1254 a tonne winning bid in its inaugural online spodumene auction.

The turnout was big, more than 50 qualified buyers from nine countries, and the result gave Liontown something the lithium sector desperately needed after a rough year.

DroneShield (ASX:DRO), meanwhile, fell into the naughty corner again.

The stock dropped a further 3.5% (it’s already down 50% in the past month) after the market digested the latest governance revelation: that the CEO and multiple directors sold shares right after the company accidentally released, then retracted, a $7.6 million US government contract announcement it had announced previously.

In less dramatic but equally eyebrow-raising corporate news, Magellan Financial Group (ASX:MFG)’s head of global equities, Arvid Streimann, resigned following an internal investigation into an alleged relationship with a junior employee. MFG shares fell 2%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ALV | Alvomin | 0.057 | 63% | 22,654,350 | $6,834,268 |

| MEM | Memphasys Ltd | 0.004 | 33% | 42,583 | $7,364,677 |

| WEL | Winchester Energy | 0.002 | 33% | 6,540,270 | $2,044,528 |

| GT1 | Greentechnology | 0.036 | 29% | 9,024,843 | $16,630,951 |

| MRD | Mount Ridley Mines | 0.028 | 27% | 20,710,579 | $26,331,718 |

| VBS | Vectus Biosystems | 0.200 | 25% | 22,275 | $8,533,333 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 500,000 | $6,336,765 |

| RLC | Reedy Lagoon Corp. | 0.005 | 25% | 1,000,000 | $3,106,827 |

| RNX | Renegade Exploration | 0.005 | 25% | 401,800 | $8,279,187 |

| CND | Condor Energy Ltd | 0.023 | 21% | 5,081,427 | $13,617,648 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 3,480,258 | $18,014,426 |

| LIB | Liberty Metals | 0.003 | 20% | 183,333 | $15,314,476 |

| SPX | Spenda Limited | 0.003 | 20% | 14,871,149 | $12,162,146 |

| MYX | Mayne Pharma Ltd | 5.720 | 19% | 973,158 | $389,167,511 |

| AXE | Archer Materials | 0.380 | 19% | 731,613 | $81,551,044 |

| CXO | Core Lithium | 0.260 | 18% | 44,924,106 | $585,313,509 |

| GW1 | Greenwing Resources | 0.036 | 16% | 534,161 | $11,710,813 |

| SKK | Stakk Limited | 0.051 | 16% | 49,238,055 | $108,519,747 |

| AMS | Atomos | 0.030 | 15% | 508,489 | $31,828,899 |

| GCM | Green Critical Min | 0.015 | 15% | 12,682,693 | $37,425,394 |

| WLD | Wellard Limited | 0.015 | 15% | 712,716 | $6,906,254 |

| KGD | Kula Gold Limited | 0.038 | 15% | 8,281,830 | $38,001,714 |

| ADG | Adelong Gold Limited | 0.012 | 15% | 11,464,884 | $25,668,364 |

| HWK | Hawk Resources. | 0.031 | 15% | 253,413 | $9,143,869 |

Renegade Exploration (ASX:RNX) says new rock chips, mapping and heli-mag work at its Yukon Project show the Myschka prospect carries the same RIRGS-style signature seen in the major Tintina Belt deposits, including Snowline’s 7.9Moz Valley discovery just 80km away.

The 2025 samples delivered high silver with solid gold and antimony hits, and Renegade is now planning a 2026 maiden drill program. Chair Robert Kirtlan says Yukon is an exploration hotspot and Canada remains a highly supportive place to fund and advance the project.

Archer Materials (ASX:AXE) has hit a key milestone by showing it can electrically control its quantum device, giving it cleaner, more accurate readouts of quantum information. This, it says, is a crucial step toward proving a single qubit.

The tests, done across a wide range of temperatures, confirmed consistent device behaviour and gave Archer the data it needs for scalable chip production. Early qubit readout tests in magnetic fields are already underway, with first results expected next month.

Greenwing Resources (ASX:GW1) says its San Jorge Lithium Project in Argentina’s Lithium Triangle is shaping up as a strategically valuable asset after a recent site visit and technical review. The project covers 38,000 hectares, including the San Francisco salar, and early drilling hit lithium-bearing brines in all six holes with grades increasing at depth.

San Jorge now carries a maiden 1.07Mt LCE resource at 195ppm, mostly in the indicated category, with large parts of the salar still untouched by drilling.

Software firm Stakk (ASX:SKK) has locked in another big US win, signing a multi-year deal with Stride Bank, a 110-year-old institution that powers major fintech names like Chime, Affirm, Stash and WisdomTree. The agreement will see Stakk roll out its Stakk IQ image capture, authentication and risk-intelligence tech to support Stride’s deposit and payments workflows.

Stakk says its US momentum has pushed annualised ARR beyond the previously projected US$8 million milestone, proving it can win across banks, fintechs and major enterprises.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BMO | Bastion Minerals | 0.001 | -33% | 68,000 | $3,849,675 |

| AUK | Aumake Limited | 0.003 | -25% | 737,540 | $12,093,435 |

| RNV | Renerve Limited | 0.120 | -23% | 3,487,137 | $17,177,254 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 750,000 | $17,588,018 |

| SFG | Seafarms Group Ltd | 0.002 | -20% | 139,142 | $12,091,498 |

| XGL | Xamble Group Limited | 0.013 | -19% | 645,350 | $7,232,303 |

| BUY | Bounty Oil & Gas NL | 0.003 | -17% | 325,000 | $4,684,416 |

| C7A | Clara Resources | 0.003 | -17% | 16,019,821 | $2,910,413 |

| ERA | Energy Resources | 0.003 | -17% | 4,490 | $1,216,188,722 |

| NAE | New Age Exploration | 0.003 | -17% | 631,260 | $9,923,996 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 27,578,289 | $20,705,349 |

| BSA | BSA Limited | 0.105 | -16% | 725,198 | $9,412,533 |

| ENV | Enova Mining Limited | 0.006 | -14% | 85,085 | $11,053,200 |

| ATS | Australis Oil & Gas | 0.013 | -13% | 504,623 | $20,006,466 |

| FRX | Flexiroam Limited | 0.013 | -13% | 511,153 | $22,760,979 |

| LCY | Legacy Iron Ore | 0.007 | -13% | 1,779,086 | $78,096,341 |

| SVY | Stavely Minerals Ltd | 0.015 | -12% | 285,000 | $11,641,368 |

| GBE | Globe Metals &Mining | 0.045 | -12% | 115,779 | $43,259,060 |

| 8IH | 8I Holdings Ltd | 0.016 | -11% | 93,386 | $6,266,895 |

| CZN | Corazon Ltd | 0.165 | -11% | 140,193 | $9,289,224 |

| GAL | Galileo Mining Ltd | 0.165 | -11% | 333,215 | $36,560,611 |

| EVE | EVE Health Group Ltd | 0.025 | -11% | 583,528 | $7,920,545 |

| SIO | Simonds Grp Ltd | 0.130 | -10% | 25,000 | $52,186,435 |

| TR2 | Tali Resources Ltd | 0.610 | -10% | 5,610 | $25,503,400 |

| NTD | Ntaw Holdings Ltd | 0.270 | -10% | 80,292 | $50,312,283 |

IN CASE YOU MISSED IT

Power Minerals (ASX:PNN) is preparing to cut the ribbon on the Rincon lithium project joint venture after finalising the holding entity’s documentation.

Brightstar Resources (ASX:BTR) has secured approval from the Supreme Court of Western Australia and Aurumin (ASX:AUN) shareholders to complete its acquisition and create a group resource of almost four million golden ounces.

Norwest Minerals (ASX:NWM) has wrapped up RC drilling at the Marymia East project with the rig now operating at the Bulgera gold project.

Harvest Technology Group (ASX:HTG) has partnered with Pyxis Controls, gaining deep reach across the Middle East, North Africa, India and Turkey.

Pure Hydrogen (ASX:PH2) is striving to expand its foray into the US hydrogen fuel cell market through a joint market development agreement with Utility Global.

Felix Gold (ASX:FXG) is reawakening a strategic US antimony district that supplied the military in WWII and the Korean War.

American Uranium (ASX:AMU) has begun hydrological testing at its Lo Herma ISR uranium project, aiming to assess aquifer performance and well efficiency.

Uvre (ASX:UVA) has been granted a prospecting permit for the historical Invincible gold project in the heart of New Zealand’s Otago Goldfields.

Alchemy Resources (ASX:ALY) has started an IP survey at Yellow Mountain copper-gold project in NSW aimed at refining targets for the next phase of drilling.

LAST ORDERS

New Age Exploration (ASX:NAE) has the RC drill rig on deck and is ready to rip into around 4000m of drilling to extend the strike and depth of the known Hemi-style gold mineralisation and test newly defined targets at its Wagyu gold project in the Pilbara.

Wagyu sits just 5km west of the famed 11.2Moz Hemi deposit and within the same mineralised Mallina Basin corridor, and NAE executive director Joshua Wellisch said it was exciting to see the program moving into a next phase of drill testing which will be critical in advancing its understanding of the system and potential resource growth.

Dart Mining’s (ASX:DTM) drilling at the Triumph gold project continues to expand the New Constitution ore body’s footprint, which has turned out to be much larger than first thought.

DTM is working with an exploration target of 6.9Mt at 2.29g/t gold for 506,800 ounces of gold for the base case, which would be a sizeable upgrade to the project’s current resource of 2.16Mt at 2.17g/t gold for 150koz.

At Stockhead, we tell it like it is. While New Age Exploration and Dart Mining are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.