Lunch Wrap: ASX struggles as resources gain but banks falter

With profit taking in banks and falling oil prices weighing heavy, the ASX is struggling not to slip below neutral. Pic: Getty Images

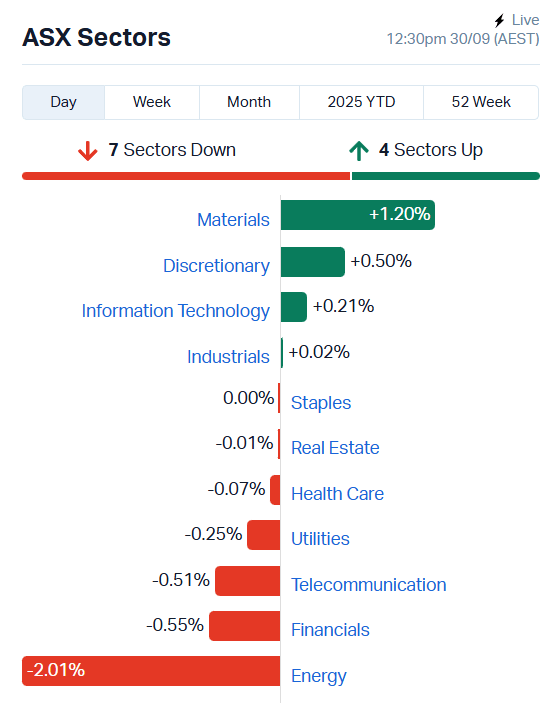

- ASX dead flat by 12.30pm AEST with seven sectors lower

- Energy and major banks applying downward pressure

- Strong gold and copper price movements power resources higher

Despite coming off a lovely 2% rally in gold prices yesterday, the ASX 200 has stumbled out the gate this morning, running pretty much dead flat by midday in the east.

Both Wall Street and European markets posted modest gains overnight, which were obviously not enough to put Aussie investors at ease.

Chip makers followed Nvidia higher as it lifted 2.1% and Robinhood jumped 12.3% after CEO Vladimir Tenev posted about the company’s strong event contract volumes on social media.

Major gaming publisher Electronic Arts jumped 4.5% on agreeing to go private in a US$55 billion (A$80bn) deal.

A consortium of private equity companies mostly based in Saudi Arabia are looking to buy the games publisher. One such company is backed by President Donald Trump’s son-in-law, Jared Kushner.

Should EA shareholders give their tick of approval, it’ll be one of the largest buyouts ever made by private equity.

According to the Financial Times, the private equity firms involved in the buyout are betting on artificial intelligence to cut costs and boost profits.

It remains to be seen how effective that will be – gamers have already been pushing back hard against AI in video games, and Electronic Arts has been taking a lot of reputational damage in recent years.

Also in the US, Vice President Vance said the US Government was headed for a shutdown – again – after a meeting between top Democrats and Republicans at the White House went nowhere.

The Republicans are angling for a stopgap measure that would see federal funding continue at current levels until late in November.

Democrats say the Republicans are trying to push the bill through with zero input from them.

“That is never how we’ve done this before,” Senate Minority Leader and Democrat Chuck Schumer said. “It’s up to the Republicans whether they want a shutdown or not.”

OPEC+ set to increase output

While most major commodities moved higher overnight, oil and iron ore fell.

Iron ore slid just 0.1% to US$105.35 a tonne as steel demand remains subdued.

OPEC+ plans to increase oil production in November undid much of oil’s progress over the last few weeks. Brent crude slid 3.1% to US$67.51 a barrel.

Both Woodside (ASX:WDS) and Santos (ASX:STO) are down about 2.2% at time of writing.

The major banks are also struggling with a bit of profit taking after yesterday’s rally, with the ASX 200 Banks index down 0.73%.

All the majors aside from Macquarie (ASX:MQG) are lower. MQG added 0.57% while Commonwealth (ASX:CBA) led losses, down 1.22%.

Thankfully, there was a healthy 2.6% bump to copper futures overnight to US$10,414/t and continued strength in gold prices, hitting a record US$3850/oz.

The ASX materials sector is humming away in response, up 1.20%. Copper stocks are in particularly fine fettle.

Bougainville Copper (ASX:BOC) has added 6.8%, Aeris Resources (ASX:AIS) 5.4% and Capstone Copper (ASX:CSC) 4.6%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SFG | Seafarms Group Ltd | 0.002 | 100% | 901310 | $4,836,599 |

| WSI | Weststar Industrial | 0.091 | 60% | 11598914 | $7,339,619 |

| RBD | Restaurant Brands NZ | 4.28 | 59% | 30863 | $336,848,012 |

| SKK | Stakk Limited | 0.053 | 56% | 2.26E+08 | $70,552,709 |

| NES | Nelson Resources. | 0.006 | 50% | 12986473 | $8,687,711 |

| NTM | Nt Minerals Limited | 0.003 | 50% | 167000 | $2,421,806 |

| TMK | TMK Energy Limited | 0.003 | 50% | 1501357 | $23,794,766 |

| WSR | Westar Resources | 0.009 | 38% | 4290151 | $2,591,711 |

| RNX | Renegade Exploration | 0.0095 | 36% | 74404167 | $14,364,211 |

| ATC | Altech Batt Ltd | 0.044 | 33% | 10137842 | $83,658,066 |

| CT1 | Constellation Tech | 0.002 | 33% | 375000 | $2,212,101 |

| MEG | Megado Minerals Ltd | 0.032 | 28% | 604290 | $16,142,082 |

| AVW | Avira Resources Ltd | 0.014 | 27% | 305523 | $2,530,000 |

| SP8 | Streamplay Studio | 0.014 | 27% | 16273299 | $14,095,010 |

| ERA | Energy Resources | 0.0025 | 25% | 1363811 | $810,792,482 |

| HFY | Hubify Ltd | 0.01 | 25% | 1250068 | $4,089,090 |

| PIL | Peppermint Inv Ltd | 0.0025 | 25% | 540103 | $4,943,648 |

| TKL | Traka Resources | 0.0025 | 25% | 10371931 | $4,844,278 |

| VEE | Veem Ltd | 1.865 | 24% | 1244723 | $205,330,013 |

| SMM | Somerset Minerals | 0.016 | 23% | 60662016 | $10,482,558 |

| CLA | Celsius Resource Ltd | 0.012 | 20% | 17519758 | $31,354,885 |

| MRD | Mount Ridley Mines | 0.003 | 20% | 200000 | $2,476,793 |

| AAJ | Aruma Resources Ltd | 0.013 | 18% | 2220639 | $3,607,346 |

| HHR | Hartshead Resources | 0.007 | 17% | 12698103 | $16,852,093 |

| JAV | Javelin Minerals Ltd | 0.0035 | 17% | 1767508 | $22,710,675 |

WestStar Industrial (ASX:WSI) has won a contract to provide procurement and construction services for Alcoa’s (ASX:AAI) Pinjarra alumina refinery through a subsidiary.

The $115 million deal includes structural mechanical and piping, electrical and instrumentation and civil supply, construction and commissioning works for the refinery’s residue filtration stage 2 project.

Restaurant Brands New Zealand (ASX:RBD) has received a takeover notice from Finaccess Restauración, S.L. of the company’s intention to acquire all ordinary shares in RBD.

Finaccess says its final offer is NZ$5.05 per share, payable in cash. RBD management says it will issue a company statement within 10 days should Finaccess make a formal offer.

Renegade Exploration (ASX:RNX) has been hit with a trading halt from the ASX. RNX is trading up 35% at present on news from yesterday that it would acquire a sizeable landholding not far from the now famous Mountain Pass mine.

Trading in the company’s shares will be paused as RNX seeks clarification the status of its recently lodged mining claims.

Embedded finance company Stakk (ASX:SKK) has secured a major contract win, inking a three-year agreement with T-Mobile USA. The deal will see SKK’s image capture, authentication, OCR and document/data orchestration capabilities integrated into T-Mobile’s new app.

The contract follows on from a similar one with major US trading platform Robinhood, which saw the company soar 267% in a single day. Both deals with derive revenue from a monthly platform fee as well as usage-based transaction fees.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AYT | Austin Metals Ltd | 0.003 | -25% | 262785 | $6,336,765 |

| DMG | Dragon Mountain Gold | 0.007 | -22% | 147500 | $3,552,045 |

| AGR | Aguia Res Ltd | 0.024 | -20% | 4460107 | $44,819,989 |

| CAV | Carnavale Resources | 0.004 | -20% | 348000 | $20,451,092 |

| SPX | Spenda Limited | 0.004 | -20% | 2032234 | $23,076,077 |

| 29M | 29Metalslimited | 0.4375 | -20% | 12519942 | $747,378,357 |

| CC9 | Chariot Corporation | 0.185 | -20% | 2007879 | $36,787,724 |

| SRH | Saferoads Holdings | 0.086 | -18% | 115182 | $4,589,068 |

| PRX | Prodigy Gold NL | 0.0025 | -17% | 3000000 | $20,225,588 |

| RLG | Roolife Group Ltd | 0.005 | -17% | 6452757 | $11,270,973 |

| ANO | Advance Zinctek Ltd | 0.85 | -15% | 11049 | $62,646,107 |

| KOB | Kobaresourceslimited | 0.057 | -15% | 139850 | $13,310,996 |

| TGN | Tungsten Min NL | 0.081 | -15% | 1130670 | $85,353,674 |

| C7A | Clara Resources | 0.003 | -14% | 419921 | $2,601,533 |

| ECS | ECS Botanics Holding | 0.006 | -14% | 368276 | $9,072,347 |

| SPD | Southernpalladium | 1.03 | -14% | 220180 | $127,805,250 |

| FCT | Firstwave Cloud Tech | 0.013 | -13% | 3977325 | $25,702,780 |

| ASP | Aspermont Limited | 0.007 | -13% | 376912 | $21,123,941 |

| IPB | IPB Petroleum Ltd | 0.007 | -13% | 90223 | $5,651,224 |

| SPQ | Superior Resources | 0.007 | -13% | 831636 | $18,967,862 |

| EMU | EMU NL | 0.021 | -13% | 29999 | $5,903,738 |

| AZI | Altamin Limited | 0.029 | -12% | 120800 | $23,481,756 |

| MPW | Metal Powdworks Ltd | 3.43 | -12% | 372648 | $424,068,462 |

| WNX | Wellnex Life Ltd | 0.22 | -12% | 57452 | $16,942,882 |

| MOV | Move Logistics Group | 0.19 | -12% | 2632 | $27,437,014 |

IN CASE YOU MISSED IT

Orthocell (ASX:OCC) has appointed its first Canadian distributor for Remplir, pushing into the US$75 million Canadian market.

Norwest Minerals’ (ASX:NWM) comprehensive review of historical drilling carried out at its Marymia East project during the early to mid-1990s has identified several compelling gold targets.

Broken Hill Mines (ASX:BHM) opens access to high-grade Main Lode at Rasp mine where drilling has returned up to 2.1m at 62.5% zinc Eq and 2103g/t silver Eq.

American Uranium (ASX:AMU) has received a 12-month share price target of 50c from East Coast Research, highlighting a 126pc upside.

Indiana Resources’ (ASX:IDA) extensional drilling at the flagship Minos gold project within the broader Gawler Craton project in South Australia continues to deliver the goods.

PainChek (ASX:PCK) has established its Canadian headquarters in the Edmonton Metropolitan Region of Canada as it looks to expand its global footprint.

LAST ORDERS

First Lithium (ASX:FL1) has finalised a loan of up to $800,000 and welcomed feedback from the Mali government on when it will issue license renewals.

FL1 has been completing mapping and survey work on both the Faraba and Blakala permits throughout the year with support from a letter from the National Director of Geology.

Magmatic Resources (ASX:MAG) has wrapped up a drilling program at the Weebo gold project in WA, advancing the Scone Stone and Ockerburry prospects.

MAG polished off 7 holes at Scone Stone and 27 at Ockerburry, and expects results within two weeks.

Red Metal (ASX:RDM) has similarly completed two proof-of-concept drilling programs on the Three Ways and Gulf copper-gold projects.

RDM funded the drilling with a $400,000 grant via the Queensland Government’s collaborative exploration initiative. The lab will test for base metals, gold and key trace elements.

At Stockhead, we tell it like it is. While First Lithium, Magmatic Resources and Red Metal are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.