Lunch Wrap: ASX steady despite CPI surprise, MinRes sinks again on iron downgrade

ASX holds firm as inflation sticks at 2.4pc. Picture via Getty Images

- ASX holds firm as inflation sticks at 2.4pc

- MinRes cops another whack on fresh iron ore downgrade

- Web Travel flies, Myer goes glam

The ASX managed to hold its ground on Wednesday morning despite April CPI coming in a touch hotter than forecast.

Fresh numbers from the ABS showed consumer prices rose 2.4% over the year to April, steady on March, but above market hopes of a dip to 2.3%.

It’s still within the RBA’s 2-3% target band.

Investors have been banking on a smooth descent in inflation following the RBA’s rate cut last week, but today’s stickiness could be enough to make the RBA glance twice.

Over on Wall Street last night, sentiment was upbeat after a pop in US consumer confidence, lifting the S&P 500 and Nasdaq by more than 2%.

Investors are also watching for Nvidia’s earnings later tonight (AEST), hoping for signs that the AI chip boom is still powering ahead. A strong print here could light a fire under the sector.

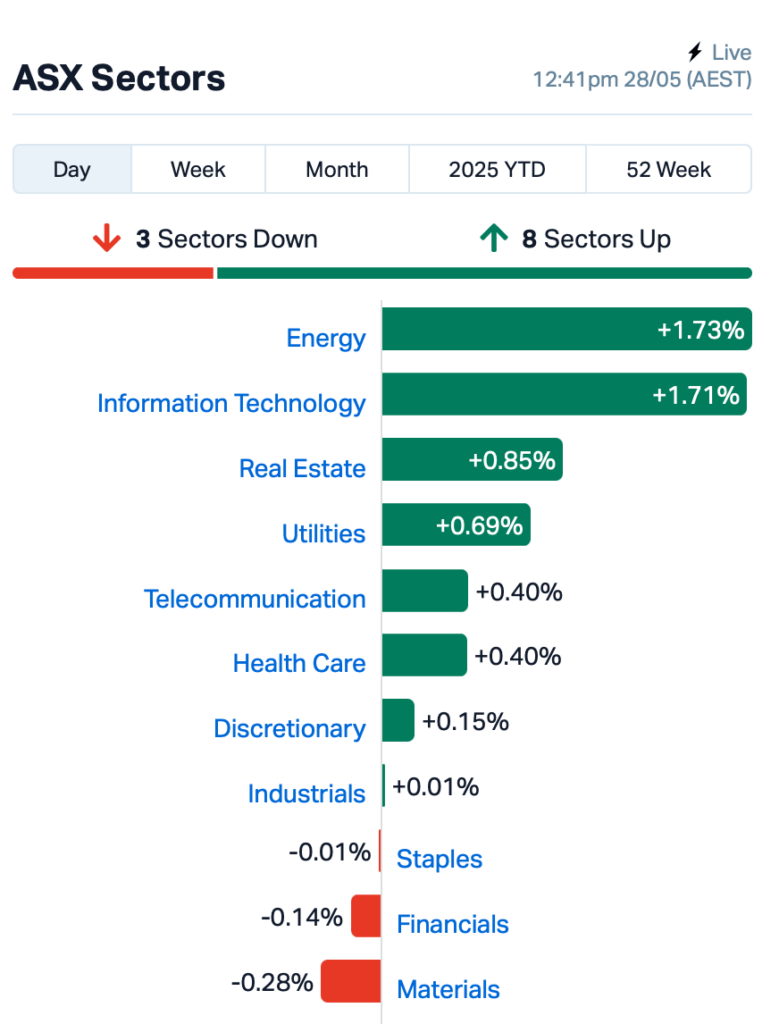

Now back home where the wave from Wall Street rippled into the ASX this morning.

Aussie tech names like NextDC (ASX:NXT) and WiseTech Global (ASX:WTC) tracked the US surge.

Energy stocks rebounded on the back of higher crude prices.

But a 6.5% sell-off in mining heavyweight Mineral Resources (ASX:MIN) has deepened a rout that’s seen the stock shed over 70% in the past year.

The selling accelerated after MinRes cut its iron ore guidance for the second time in a month, now expecting between 7.8 million and 8 million tonnes, down as much as 10%.

In other large cap news, Web Travel Group (ASX:WEB) soared 15% after telling investors it’s “recalibrated and back on track.” WEB’s transaction values jumped 22% to $4.9 billion, and bookings rose 20% over the year to March.

Property giant Goodman Group (ASX:GMG) rose 0.6% after sticking to its full-year outlook, though it did warn that some global tenants are dragging their feet on lease decisions.

Fisher & Paykel Healthcare (ASX:FPH) fell 5% despite delivering a 43% jump in full year net profit to NZ$377.2 million.

And, Myer (ASX:MYR) climbed 1% after holding an Investor Day and announced a fresh push into in-store beauty.

Myer said it will be rolling out blow-dry bars, nail stations, and revamping its loyalty program to reel in younger shoppers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 28 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| IFG | Infocus Group | 0.011 | 120% | 58,368,339 | $1,312,134 |

| AAU | Antilles Gold Ltd | 0.006 | 100% | 14,488,082 | $6,379,103 |

| BMO | Bastion Minerals | 0.0015 | 50% | 3,500,000 | $903,628 |

| DTM | Dart Mining NL | 0.004 | 33% | 14,968,168 | $3,594,167 |

| TKL | Traka Resources | 0.002 | 33% | 500,000 | $3,188,685 |

| VPR | Voltgroupltd | 0.002 | 33% | 650,000 | $16,074,312 |

| DTR | Dateline Resources | 0.072 | 31% | 102,352,401 | $155,089,566 |

| SHN | Sunshine Metals Ltd | 0.0085 | 21% | 8,287,232 | $14,613,514 |

| HIO | Hawsons Iron Ltd | 0.019 | 19% | 1,979,893 | $16,264,022 |

| A1G | African Gold Ltd. | 0.16 | 19% | 1,423,317 | $64,802,677 |

| DXN | DXN Limited | 0.035 | 17% | 2,032,316 | $8,961,109 |

| TMK | TMK Energy Limited | 0.0035 | 17% | 251,278 | $30,667,149 |

| YAR | Yari Minerals Ltd | 0.007 | 17% | 2,803,749 | $3,328,269 |

| AUG | Augustus Minerals | 0.029 | 16% | 408,484 | $2,979,786 |

| CVR | Cavalier Resources | 0.19 | 15% | 62,666 | $9,543,966 |

| D3E | D3 Energy Limited | 0.115 | 15% | 25,000 | $7,947,501 |

| OIL | Optiscan Imaging | 0.125 | 14% | 247,732 | $91,887,488 |

| SYA | Sayona Mining Ltd | 0.017 | 13% | 55,151,481 | $173,149,440 |

| BVR | Bellavista Resources | 0.35 | 13% | 16,993 | $31,273,592 |

| PCK | Painchek Ltd | 0.054 | 13% | 1,635,674 | $88,412,102 |

| SRI | Sipa Resources Ltd | 0.0135 | 13% | 4,952,177 | $4,996,780 |

| STK | Strickland Metals | 0.135 | 13% | 12,916,873 | $271,483,176 |

| TAT | Tartana Minerals Ltd | 0.045 | 13% | 44,444 | $8,565,836 |

| FBM | Future Battery | 0.018 | 13% | 536,953 | $10,700,895 |

Pivotal Metals (ASX:PVT) said it has uncovered bonanza-grade gold at its Lorraine prospect in Quebec, with one historical channel sample hitting 28 metres at 45.2g/t gold. A deeper drill hole pulled 0.97m at 56.2g/t, including a spicy 0.15m at 233.9g/t. The gold sits in a 600-metre corridor of copper-gold quartz veins, just 12km from the historic Belleterre mine. It’s largely untouched ground for gold, with previous efforts focused on copper and nickel. Pivotal’s now launching a full-blown field program to line up fresh drill targets. It reckons this could be the next big hit in its BAGB project, already home to high-grade copper and nickel.

Locksley Resources (ASX:LKY) has locked in $1.47 million through a well-supported placement at 4 cents a share to fund drilling at its Mojave Project in California. The cash will go straight into boots-on-ground exploration, with the team already mobilising. Drilling’s planned for the September quarter, targeting rare earths at El Campo (up to 12.1% TREO) and high-grade antimony at the Desert Antimony Mine (up to 46% Sb), pending final permits.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 28 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNR | Lanthanein Resources | 0.001 | -50% | 113,750 | $4,887,272 |

| AOK | Australian Oil | 0.002 | -33% | 726,153 | $3,005,349 |

| CZN | Corazon Ltd | 0.001 | -33% | 460,000 | $1,776,858 |

| ALM | Alma Metals Ltd | 0.003 | -25% | 325,110 | $6,345,381 |

| AW1 | American West Metals | 0.04 | -22% | 3,835,385 | $30,382,869 |

| HLX | Helix Resources | 0.002 | -20% | 465,000 | $8,410,484 |

| JAV | Javelin Minerals Ltd | 0.002 | -20% | 100,000 | $15,115,373 |

| FCT | Firstwave Cloud Tech | 0.014 | -18% | 258,457 | $29,129,818 |

| MEL | Metgasco Ltd | 0.0025 | -17% | 373,000 | $4,372,760 |

| OVT | Ovanti Limited | 0.0025 | -17% | 4,133,795 | $8,380,545 |

| VEN | Vintage Energy | 0.005 | -17% | 863,620 | $11,982,791 |

| VML | Vital Metals Limited | 0.0025 | -17% | 700,000 | $17,685,201 |

| BUS | Bubalusresources | 0.11 | -15% | 257,500 | $7,330,047 |

| CML | Connected Minerals | 0.14 | -15% | 70,873 | $6,824,105 |

| CBE | Cobre | 0.036 | -14% | 1,404,782 | $18,464,878 |

| AN1 | Anagenics Limited | 0.006 | -14% | 1,223,965 | $3,474,243 |

| ARV | Artemis Resources | 0.006 | -14% | 1,051,327 | $17,699,705 |

| FAU | First Au Ltd | 0.003 | -14% | 250,000 | $7,251,976 |

| GLL | Galilee Energy Ltd | 0.006 | -14% | 1,271,297 | $4,950,350 |

| RDN | Raiden Resources Ltd | 0.006 | -14% | 2,037,572 | $24,156,240 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 57,308 | $11,509,489 |

| ADG | Adelong Gold Limited | 0.007 | -13% | 2,094,296 | $11,179,890 |

| ADO | Anteotech Ltd | 0.007 | -13% | 1,544,048 | $21,642,403 |

| AX8 | Accelerate Resources | 0.007 | -13% | 110,300 | $6,377,510 |

Predictive Discovery’s (ASX:PDI) shares fell after Guinea’s government unexpectedly revoked over 100 exploration permits, including PDI’s Argo and Bokoro tenements. The company hadn’t been formally notified, but the permits were up for extension and PDI plans to appeal. The Bankan Gold Project though, home to the bulk of PDI’s 5.53Moz resource, wasn’t affected. Its exploitation permit is still progressing through the Guinean approval system.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.