Lunch Wrap: ASX spirals down 1pc as Wall Street panics again; gold goes through the roof

ASX spirals as Wall Street panics again. Picture via Getty Images

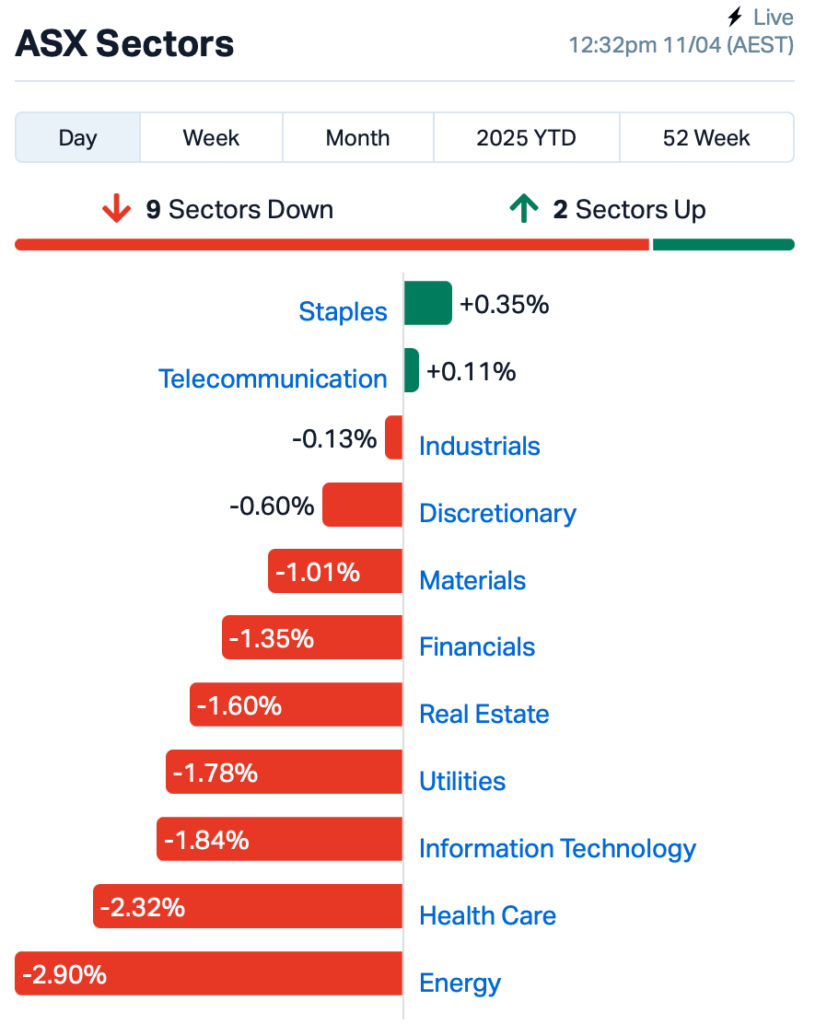

- ASX slips 1pc on Wall Street sell-off

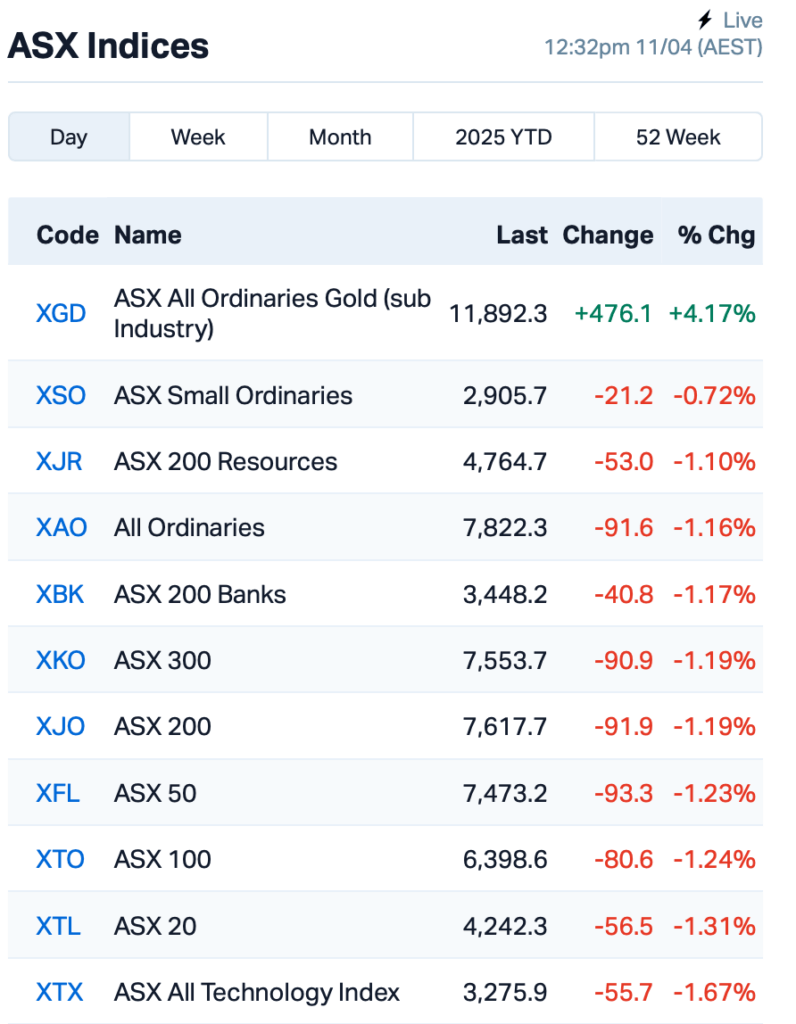

- Investors ditch stocks for gold as safe haven hits record highs

- Mayne Pharma cops legal heat and Ramsay Healthcare shuffles C-suite

The ASX shed over 1% by lunch time Friday, wiping out a big chunk of the gains it made on Thursday.

Just a day after Trump tried to ease markets with a backpedal on his tariff blitz, Wall Street went back into full panic mode again.

Overnight, the S&P 500 was down by 3.5%, and the tech-heavy Nasdaq Composite took a hit of over 4%.

In just two days, the market’s gone through levels of volatility we haven’t seen since the GFC or the pandemic.

Wall Street traders, who once bet big on Trump’s second term bringing in tax cuts and growth, are now bracing for a drawn-out trade war, job cuts, and rising recession risk.

Analysts from Rabobank have sounded off this warning: “The trade war is now turning into a direct confrontation between the US and China … we could again be seeing escalation and de-escalation at the same time, pulling markets in different directions.”

Other experts reckon the US Fed Reserve might have to step in if things keep spiralling.

But Richard Weiss at American Century is a calm voice amid the storm.

While fear and FOMO take hold on trading floors and social media, Weiss’ message is: don’t panic, don’t guess, and don’t ditch your plan.

“Consistent investing – in good markets and in bad – allows you to average your purchase prices over time,” he advised.

“Known as dollar-cost averaging, this strategy helps you manage variable market conditions over the life of your portfolio.”

Meanwhile, as stocks stumbled, investors flocked to the safe haven of gold, pushing its price to a new record high. At the time of writing, gold is trading at US$3,210 an ounce.

“I definitely see investors taking money off US assets and looking for safe haven, which might be more cash/gold than anything else,” wrote Xin-Yao Ng at Aberdeen.

Back to the ASX, oil stocks dragged the bourse down this morning on the back of falling crude prices.

After a quick sugar hit midweek, oil futures tumbled again last night.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 11 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| RDS | Redstone Resources | 0.004 | 33% | 110,000 | $2,776,135 |

| TAS | Tasman Resources Ltd | 0.004 | 33% | 184,995 | $2,415,749 |

| ADN | Andromeda Metals Ltd | 0.009 | 29% | 3,691,864 | $24,001,094 |

| R8R | Regener8Resourcesnl | 0.100 | 25% | 22,207 | $2,600,200 |

| JGH | Jade Gas Holdings | 0.041 | 24% | 6,166,623 | $55,665,528 |

| TYP | Tryptamine Ltd | 0.036 | 24% | 3,478,281 | $40,282,409 |

| SHP | South Harz Potash | 0.006 | 20% | 85,500 | $5,412,894 |

| STM | Sunstone Metals Ltd | 0.012 | 20% | 16,846,051 | $59,543,536 |

| SRL | Sunrise | 0.365 | 20% | 182,497 | $27,519,387 |

| LGM | Legacy Minerals | 0.305 | 20% | 1,415,993 | $31,852,898 |

| NVO | Novo Resources Corp | 0.115 | 19% | 120,405 | $11,025,866 |

| GUL | Gullewa Limited | 0.075 | 17% | 166,905 | $13,953,419 |

| GHM | Golden Horse Mineral | 0.420 | 17% | 773,125 | $41,095,311 |

| TMX | Terrain Minerals | 0.004 | 17% | 412,572 | $6,010,670 |

| OZM | Ozaurum Resources | 0.115 | 16% | 3,350,514 | $22,443,485 |

| AUA | Audeara | 0.036 | 16% | 2,777 | $5,577,966 |

| LSR | Lodestar Minerals | 0.019 | 16% | 2,500,099 | $5,094,781 |

| EV1 | Evolutionenergy | 0.015 | 15% | 50,000 | $4,714,456 |

| SPA | Spacetalk Ltd | 0.195 | 15% | 170,697 | $10,841,981 |

| ARV | Artemis Resources | 0.008 | 14% | 63,376 | $17,699,705 |

| MKL | Mighty Kingdom Ltd | 0.008 | 14% | 250 | $1,512,444 |

| PXX | Polarx Limited | 0.008 | 14% | 2,001,072 | $16,628,507 |

| RML | Resolution Minerals | 0.008 | 14% | 237,500 | $3,680,508 |

| A1G | African Gold Ltd. | 0.125 | 14% | 3,148,858 | $52,802,181 |

| AON | Apollo Minerals Ltd | 0.017 | 13% | 121,154 | $13,926,853 |

Jade Gas Holdings (ASX:JGH) has nailed its second gas production well in Mongolia, hitting over 800m of gassy coal and confirming strong gas potential, better than the first well. Both wells are now getting set up and should start pumping gas in three to four weeks. With the early success, Jade said it’s already in talks to kick off commercial production.

Legacy Minerals Holdings (ASX:LGM) believes its Drake Project is looking like a winner, with fresh scoping study results showing top-shelf economics and big growth potential. The updated study points to strong gold production, a short 14-month payback, and heaps of free cash, up to $417m at higher gold prices. It’s planning open-pit mining over 5.5 years, with solid infrastructure already in place. And with a chunky 2025 resource update, there’s still plenty of gold and silver left to chase in the next stage, the company said.

Spacetalk’s (ASX:SPA) had a cracker of a quarter, with paid mobile subs jumping 47% year-on-year to 42.5k and revenue hitting $5.1m, up 26%. It’s pulling in more steady cash through subscriptions, with annual recurring revenue (ARR) now at $11.6m. Cash flow’s looking stronger too, and it’s trimmed operating costs while gearing up for global expansion in places like the UK, US and Singapore.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 11 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MVF | Monash IVF Group Ltd | 0.805 | -25% | 6,677,247 | $418,857,453 |

| LMS | Litchfield Minerals | 0.115 | -23% | 572,273 | $4,231,702 |

| AJX | Alexium Int Group | 0.007 | -22% | 2,619 | $14,277,858 |

| TOU | Tlou Energy Ltd | 0.019 | -21% | 820,429 | $31,166,024 |

| MTB | Mount Burgess Mining | 0.004 | -20% | 357 | $1,697,687 |

| AUQ | Alara Resources Ltd | 0.023 | -18% | 1,801,883 | $20,106,451 |

| BIT | Biotron Limited | 0.003 | -17% | 10,000,000 | $3,981,738 |

| EVR | Ev Resources Ltd | 0.005 | -17% | 700,130 | $11,915,020 |

| ROG | Red Sky Energy. | 0.005 | -17% | 11,524,426 | $32,533,363 |

| HHR | Hartshead Resources | 0.006 | -14% | 1,132,868 | $19,660,775 |

| SLZ | Sultan Resources Ltd | 0.006 | -14% | 38,776 | $1,620,289 |

| WC1 | Westcobarmetals | 0.013 | -13% | 152,712 | $2,687,348 |

| SHN | Sunshine Metals Ltd | 0.007 | -13% | 20,139,463 | $15,874,492 |

| ZEU | Zeus Resources Ltd | 0.007 | -13% | 3,770,380 | $5,125,385 |

| SWP | Swoop Holdings Ltd | 0.105 | -13% | 288,042 | $25,553,277 |

| A11 | Atlantic Lithium | 0.150 | -12% | 24,500 | $117,835,043 |

| NZK | NZK Salmon Ltd | 0.190 | -12% | 2,124 | $115,709,189 |

| CCG | Comms Group Ltd | 0.046 | -12% | 132,474 | $20,281,900 |

| MSB | Mesoblast Limited | 1.535 | -12% | 8,647,283 | $2,204,364,669 |

| OPL | Opyl Limited | 0.024 | -11% | 118,990 | $5,210,145 |

| POD | Podium Minerals | 0.024 | -11% | 52,831 | $18,398,086 |

| OM1 | Omnia Metals Group | 0.008 | -11% | 1,190,474 | $1,953,825 |

| RGL | Riversgold | 0.004 | -11% | 297,376 | $7,576,707 |

| VRC | Volt Resources Ltd | 0.004 | -11% | 26,470 | $21,081,501 |

Monash IVF Group (ASX:MVF) has confirmed a serious incident at its Brisbane clinic where one patient’s embryo was mistakenly transferred to another, leading to the birth of a child. The company said it was a human error and has launched an independent investigation led by Fiona McLeod AO SC. It’s supporting the affected families, flagged the issue with regulators and plans to follow all recommendations. While it’s a major incident, Monash IVF doesn’t think it’ll hit its FY25 financials.

IN CASE YOU MISSED IT

Targeting gold, nickel and copper, Miramar Resources (ASX:M2R) has secured $1.8 million in a capital raise, as well as just over $150,000 from drilling co-funded by an exploration incentive scheme grant.

A further $180,000 is available from the grant – together with the funding from the capital raise, Miramar intends to resume drilling at the Gidji joint venture gold project and continue exploration for copper and nickel at the Bangemall project.

With gold once again reaching new heights at more than US$3,200 today, Mithril Resources (ASX:MTH) has unearthed multiple high-grade gold and silver results in channel sampling at the Copalquin District project in Mexico, with results up to 2m 26.8 g/t gold and 1,004 g/t silver.

At Stockhead, we tell it like it is. While Miramar Resources and Mithril Silver and Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.