Lunch Wrap: ASX softens on Trump’s Fed pick; gold miners savour another rally

Will drink to that: Goldies toast another rally. Picture via Getty Images

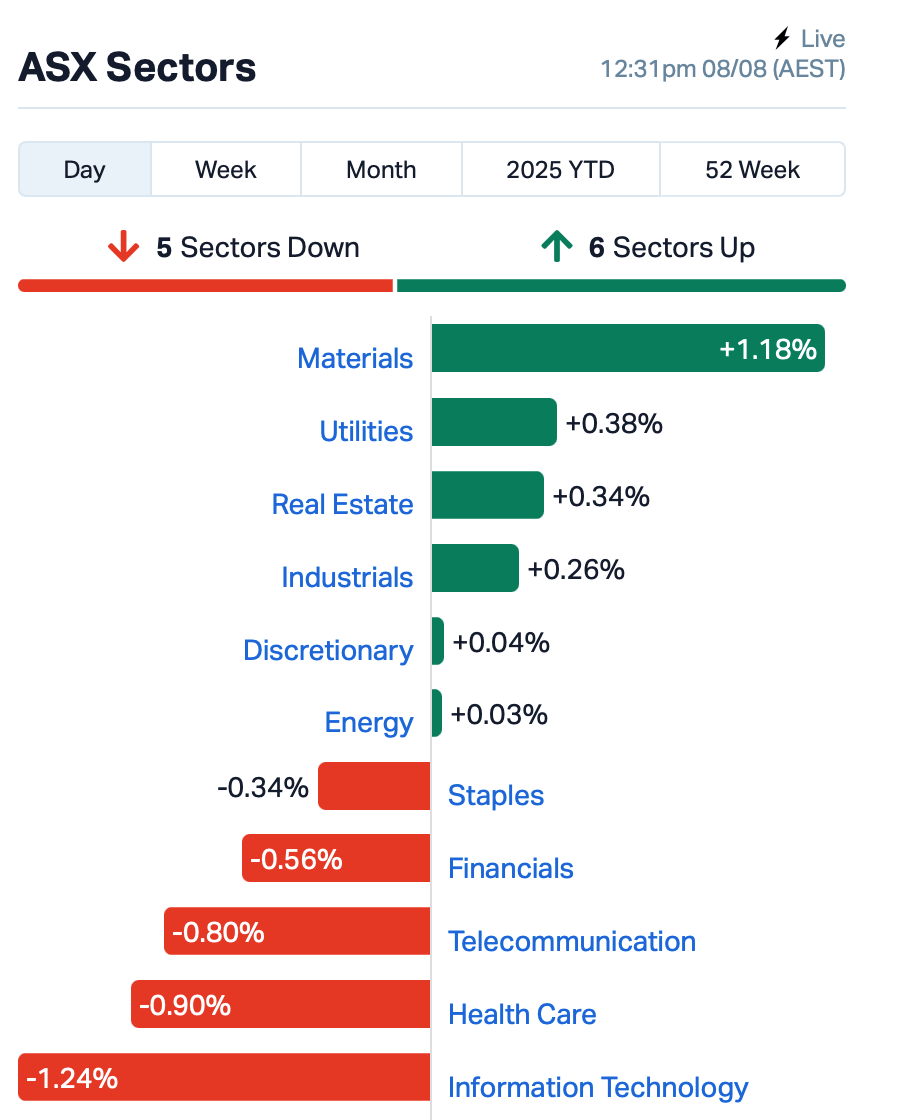

- ASX drifts lower as Trump eyes Fed shake-up

- Gold rockets past US$34,00 lifting miners

- Iress jumps on fresh private equity talks

At Friday lunchtime in the east, the ASX was down 0.1% and looking like it just wanted to slide into the weekend early.

The mood was nervy, and a lot of it had to do with the latest power plays out of Washington.

Trump has slipped Stephen Miran into a vacant Fed seat until January next year, a short-term warm-up act while the main event brews.

That main event could potentially be Christopher Waller – a current Fed governor and, according to the Trump camp, just the kind of operator they want to see steering the ship as Fed Chairman.

Plus, he’s not Jerome Powell, and in Trump’s books, that’s a strength.

Back home, the ASX wasn’t all gloom.

The miners were leading the pack, and it’s easy to see why.

Gold has cracked US$3,400 an ounce, hitting a two-week high and pulling ASX goldies higher with it.

The rest of the market, though, was less shiny.

Energy stocks fell as oil prices are limped toward their biggest weekly loss since June, with Brent now trading under US$66.

In large cap news, Fortescue (ASX:FMG) edged up 0.75% after locking in a chunky 14.2 billion yuan ($3 billion) syndicated term loan with backing from Chinese, Australian and global banks.

Fundie GQG Partners (ASX:GQG), on the other hand, had a shocker, down 14% after US$1.4 billion walked out the door in July, US$1 billion of it from one big client.

Then there was market data outfit Iress (ASX:IRE), which went vertical, up 11% after confirming it had been approached by US private equity heavyweight Blackstone at $10.50 a share earlier in the year.

That offer’s gone cold, but Iress said talks are still on with both Blackstone and fellow PE giant Thoma Bravo to see if a new, board-blessable bid can be tabled.

And, in the biotech lane, Neuren Pharmaceuticals (ASX:NEU) added SYNGAP1-related disorder to its NNZ-2591 pipeline after positive pre-clinical results.

There’s no approved treatment for the condition, which affects about 1 in 16,000 people. Neuren’s shares were up 0.2%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AFA | ASF Group Limited | 0.004 | 33% | 30,000 | $2,377,193 |

| BNL | Blue Star Helium Ltd | 0.008 | 33% | 12,088,282 | $20,207,312 |

| CT1 | Constellation Tech | 0.002 | 33% | 26,333 | $2,212,101 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 66,168 | $4,230,637 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 87,500 | $8,179,556 |

| CPM | Coopermetalslimited | 0.068 | 28% | 785,066 | $4,152,849 |

| ARV | Artemis Resources | 0.005 | 25% | 610,730 | $11,462,689 |

| PER | Percheron | 0.011 | 22% | 12,227,610 | $9,786,939 |

| JAV | Javelin Minerals Ltd | 0.003 | 20% | 4,185,348 | $15,630,562 |

| LIO | Lion Energy Limited | 0.012 | 20% | 19,833 | $4,521,677 |

| RAN | Range International | 0.003 | 20% | 2,263,348 | $2,348,226 |

| OEC | Orbital Corp Limited | 0.220 | 19% | 1,593,966 | $30,484,248 |

| WCE | Westcoastsilver Ltd | 0.165 | 18% | 7,290,832 | $44,479,664 |

| SRJ | SRJ Technologies | 0.007 | 17% | 3,348,071 | $4,168,480 |

| KNG | Kingsland Minerals | 0.115 | 15% | 15,000 | $7,256,091 |

| CLA | Celsius Resource Ltd | 0.008 | 14% | 14,782,351 | $21,948,419 |

| W2V | Way2Vatltd | 0.008 | 14% | 25,001 | $11,896,288 |

| DM1 | Desert Metals | 0.025 | 14% | 6,993,283 | $9,730,305 |

| LMG | Latrobe Magnesium | 0.017 | 13% | 302,553 | $39,517,487 |

| ALR | Altairminerals | 0.009 | 13% | 22,214,987 | $34,373,953 |

| BYH | Bryah Resources Ltd | 0.005 | 13% | 298,832 | $4,114,130 |

PYC Therapeutics (ASX:PYC) has the green light to move to the highest dose in its Phase 1a single ascending dose trial of PYC-003, a potential treatment for Polycystic Kidney Disease. The Safety Review Committee signed off after reviewing safety data from the first three healthy volunteer cohorts. PYC has also begun dosing PKD patients in Part B of the study, and remains on track to start repeat-dose trials in Q4 2025.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SHP | South Harz Potash | 0.002 | -33% | 1,233,333 | $4,415,170 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 1,000,000 | $13,368,619 |

| ERA | Energy Resources | 0.002 | -20% | 416,983 | $1,013,490,602 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 35,201,000 | $16,854,657 |

| TKL | Traka Resources | 0.002 | -20% | 380,000 | $5,314,476 |

| 1AI | Algorae Pharma | 0.005 | -17% | 727,148 | $10,124,368 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 10,837,820 | $13,492,060 |

| SER | Strategic Energy | 0.005 | -17% | 6,545,448 | $5,029,750 |

| X2M | X2M Connect Limited | 0.016 | -16% | 866,600 | $8,266,080 |

| AVH | Avita Medical | 1.470 | -15% | 2,136,212 | $126,677,480 |

| GQG | GQG Partners | 1.730 | -14% | 20,516,184 | $5,969,687,327 |

| OVT | Ovanti Limited | 0.006 | -14% | 577,860 | $29,920,265 |

| UNT | Unith Ltd | 0.006 | -14% | 688,633 | $10,351,498 |

| NMT | Neometals Ltd | 0.055 | -14% | 6,147,276 | $49,311,459 |

| M4M | Macro Metals Limited | 0.007 | -13% | 2,832,446 | $31,819,340 |

| MEM | Memphasys Ltd | 0.004 | -13% | 1,050,016 | $7,934,392 |

| GBZ | GBM Rsources Ltd | 0.029 | -12% | 8,644,391 | $46,723,417 |

| BCC | Beam Communications | 0.120 | -11% | 1,400 | $11,666,959 |

| EPX | EPX Limited | 0.032 | -11% | 50,650 | $23,748,376 |

| RDN | Raiden Resources Ltd | 0.004 | -11% | 301,110 | $15,529,011 |

| RMX | Red Mount Min Ltd | 0.008 | -11% | 1,990,335 | $5,036,174 |

| SW1 | Swift Networks Group | 0.008 | -11% | 23,301 | $8,179,288 |

Avita Medical (ASX:AVH) shares slid after it cut its full-year revenue guidance to $76-81m from $100-106m, blaming a temporary reimbursement snag that’s dented demand for its RECELL system by about 20%, and wiped $10m off first-half sales. The Medicare payment gap is now being resolved, with demand expected to rebound in the second half. But Avita said cash flow break-even and profitability targets have been pushed back to 2026.

LAST ORDERS

Zenith Minerals (ASX:ZNC) has offloaded its Kavaklitepe gold project in Turkey in return for $820k. The company says it has no further liability toward the project as a share transfer relating to a disposal of a 20% interest in the asset is also complete.

The fresh cash will go to the consolidated Dulcie gold project and Red Mountain copper-gold project.

Miramar Resources (ASX:M2R) has extended the closing date for a share purchase plan, now ending Monday, August 18, at 5:00 pm AWST.

Management says its extended the deadline as M2R is waiting on results from drilling at the Gidji JV project’s 8 Mile prospect, and for preliminary results from an airborne electromagnetic survey underway at the Bangemall nickel-copper-platinum group element project.

At Stockhead, we tell it like it is. While Zenith Minerals and Miramar Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.