Lunch Wrap: ASX snuggles up to Wall Street high as ‘big beautiful bill’ passes

Trump’s 'big beautiful bill' will be signed into law. Picture via Getty Images

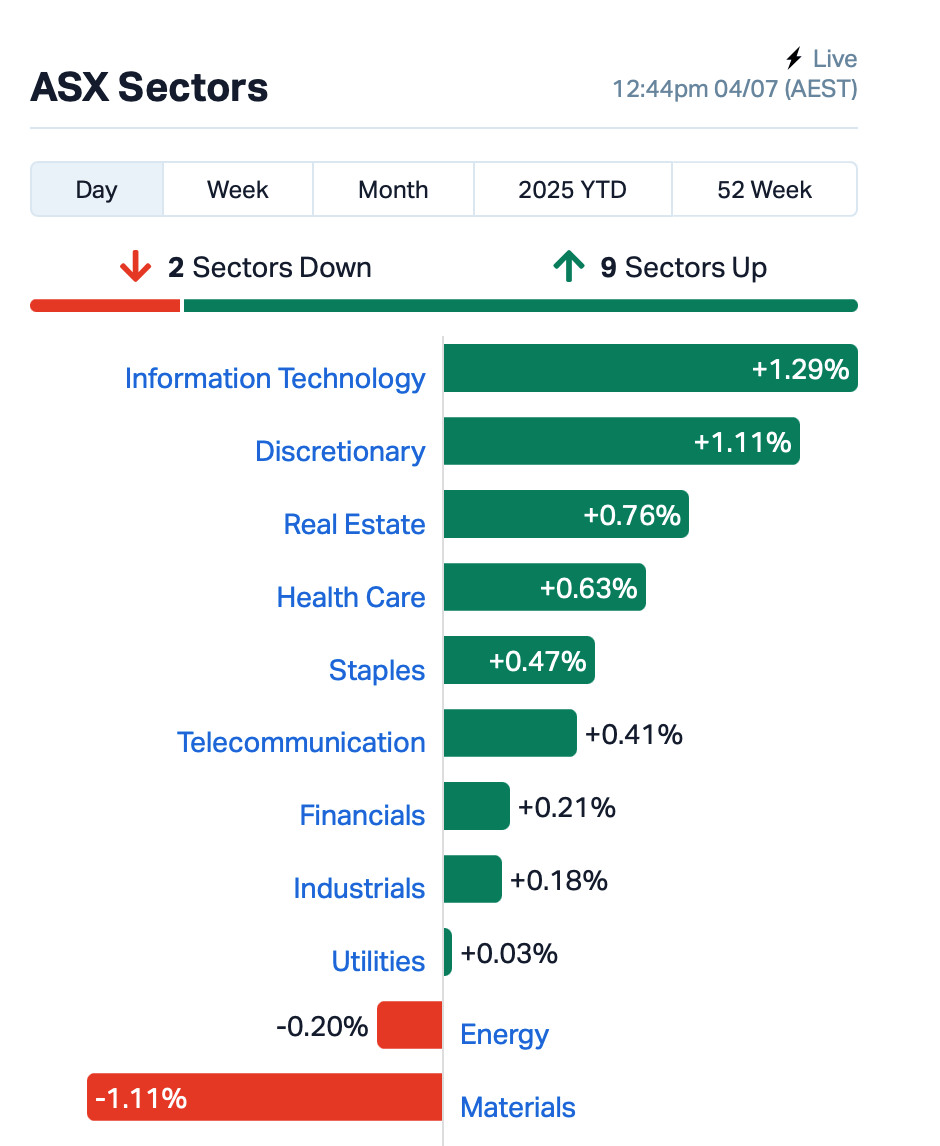

- Tech and retailers jump this morning

- Trump teases tariff letters as “big beautiful bill” passes

- Cleanaway and Santos ink deals; Magellan shrugs off outflows

It’s lunchtime in the east and the local market is tucking into a modest rally. The benchmark ASX 200 is 0.15% stronger, eyeing that mid-week record.

Local traders took their cue from an abbreviated but exuberant session on Wall Street overnight, where traders clocked off at 1 pm for the Fourth of July holiday.

The S&P 500, Nasdaq and Dow still managed to bang out fresh records.

A “big, beautiful” US$3.4 trillion fiscal bill has now slid through the House. The US Senate passed it 51–50 (VP Vance casting the tie‑breaker), the House followed 218–214 last night, and Trump will sign it later tonight.

Trump also hinted at unilateral “reciprocal” tariffs if trading partners don’t play nice by July 9.

He threatened to start firing off letters, ‘maybe 10 a day’, spelling out who’s going to pay what to do business with the US.

Elsewhere in the commodities space, iron ore has clambered back over US$96/t in Singapore as Beijing vows to stamp out “disorderly” low-price steel competition.

Gold eased nearly 1% after a strong US jobs data overnight torpedoed immediate Fed-cut dreams, though bullion’s still up 25% year-to-date.

Back home on the ASX, the baton has been passed from miners to tech this morning.

Local software names shadowed the Nasdaq. Appen (ASX:APX) was up 8%, Life360 (ASX:360) by 3%.

RBA rate-cut rumours for next week put a spring in shoppers’ steps too. Wesfarmers (ASX:WES) and Myer (ASX:MYR) jumped 1% each.

In the large caps news, Cleanaway (ASX:CWY) spiked 2% after the ACCC gave the nod to its $377m swoop on Contract Resources. Regulator Philip Williams said he didn’t see competition issues in industrial services.

Engineering contractor Monadelphous Group (ASX:MND) nudged 1.5% higher after locking in over $100 million worth of work with Technip Energies.

And, Santos (ASX:STO) inked a mid-term deal with QatarEnergy Trading for roughly half a million tonnes of LNG a year over two years. STO shares were down 0.3%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 4 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.002 | 100% | 105,995,646 | $5,619,759 |

| GLL | Galilee Energy Ltd | 0.008 | 60% | 1,794,993 | $3,535,964 |

| DY6 | Dy6Metalsltd | 0.210 | 35% | 2,190,750 | $11,541,688 |

| AOA | Ausmon Resorces | 0.002 | 33% | 3,402,438 | $1,966,820 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 456,473 | $7,254,899 |

| WMG | Western Mines | 0.250 | 25% | 266,072 | $19,357,669 |

| MSG | Mcs Services Limited | 0.005 | 25% | 250,001 | $792,399 |

| TEM | Tempest Minerals | 0.005 | 25% | 100,589 | $4,407,180 |

| SLH | Silk Logistics | 2.105 | 22% | 590,694 | $140,261,869 |

| OKJ | Oakajee Corp Ltd | 0.040 | 21% | 12,200 | $3,017,719 |

| KPO | Kalina Power Limited | 0.006 | 20% | 2,541,951 | $14,664,978 |

| AUG | Augustus Minerals | 0.032 | 19% | 551,238 | $4,588,554 |

| CR1 | Constellation Res | 0.130 | 18% | 2,800 | $6,934,315 |

| ICE | Icetana Limited | 0.087 | 18% | 1,021,675 | $39,355,118 |

| CVR | Cavalierresources | 0.235 | 18% | 175,056 | $11,568,443 |

| ATX | Amplia Therapeutics | 0.275 | 17% | 4,960,449 | $91,168,877 |

| 3DP | Pointerra Limited | 0.062 | 17% | 1,670,193 | $42,669,070 |

| ENL | Enlitic Inc. | 0.035 | 17% | 1,715,848 | $24,768,486 |

| CAV | Carnavale Resources | 0.004 | 17% | 496,875 | $12,270,655 |

| MGU | Magnum Mining & Exp | 0.007 | 17% | 1,000,000 | $13,908,223 |

| PUA | Peak Minerals Ltd | 0.050 | 16% | 27,063,376 | $120,714,815 |

| FCL | Fineos Corp Hold PLC | 2.730 | 16% | 215,651 | $795,474,213 |

| 5GG | Pentanet | 0.030 | 15% | 821,149 | $11,262,463 |

| MAG | Magmatic Resrce Ltd | 0.060 | 15% | 2,399,751 | $22,997,037 |

The ACCC said it won’t oppose DP World Australia’s proposed takeover of Silk Logistics Holdings (ASX:SLH), clearing a key hurdle for the deal. After digging into the details, the watchdog found the merger is unlikely to hurt competition, even if DP World gains control of Silk’s trucking and warehousing arm. So, for now, it’s game on, with final approvals still needed from FIRB, shareholders and the court.

Medical AI company Enlitic (ASX:ENL) said it’s now met the financial requirements under its MOU with GE HealthCare, after completing a $10 million capital raise in June. It has signed an Advanced Payment Agreement, unlocking a US$2 million upfront payment from GE and clearing the way for their strategic collaboration to move forward. Enlitic’s US arm Laitek is expected to deliver up to $46 million in data migration work over the next five years.

Mining-software outfit RPM Global (ASX:RUL) said a busy second half lifted its FY25 total contracted value to $100.8m, up 31%, with subscription licences surging. RUL has booked $69.1m in ARR and a record $200m non-cancellable backlog, 24 % higher than a year ago.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 4 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HLX | Helix Resources | 0.001 | -50% | 58,000 | $6,728,387 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 109,654 | $10,027,021 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 740,000 | $9,525,167 |

| IPB | IPB Petroleum Ltd | 0.005 | -29% | 1,029,310 | $4,944,821 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 4,206,979 | $6,507,557 |

| RLC | Reedy Lagoon Corp. | 0.002 | -25% | 152,677 | $1,553,413 |

| LKO | Lakes Blue Energy | 0.750 | -25% | 682,656 | $58,770,705 |

| HPC | Thehydration | 0.011 | -21% | 784,289 | $5,408,213 |

| DDT | DataDot Technology | 0.004 | -20% | 350,001 | $6,054,764 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 3,754,989 | $17,069,268 |

| AR9 | Archtis Limited | 0.215 | -19% | 1,971,854 | $76,653,102 |

| NHE | Nobleheliumlimited | 0.029 | -17% | 665,136 | $20,983,375 |

| CDE | Codeifai Limited | 0.044 | -17% | 7,147,484 | $23,475,738 |

| RPG | Raptis Group Limited | 0.075 | -17% | 45,742 | $31,561,637 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 2,033,841 | $11,104,423 |

| ALY | Alchemy Resource Ltd | 0.005 | -17% | 77,904 | $7,068,458 |

| FBR | FBR Ltd | 0.005 | -17% | 2,361,139 | $34,136,713 |

| AKN | Auking Mining Ltd | 0.006 | -14% | 111,904 | $4,023,451 |

| EMT | Emetals Limited | 0.003 | -14% | 213,214 | $2,975,000 |

| OVT | Ovanti Limited | 0.006 | -14% | 39,046,423 | $29,850,265 |

| RC1 | Redcastle Resources | 0.007 | -13% | 910,000 | $5,948,535 |

| MDR | Medadvisor Limited | 0.057 | -12% | 2,261,562 | $40,611,029 |

| CGR | Cgnresourceslimited | 0.070 | -11% | 115,219 | $7,171,477 |

IN CASE YOU MISSED IT

Drilling at Nimy Resources’ (ASX:NIM) Mons project in WA has extended known gallium mineralisation to a 450m by 300m area after returning further high-grade intersections.

Canaccord Genuity has upgraded its price target for Ausgold (ASX:AUC) to $1.65 following a “compelling” DFS for its Katanning gold project.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.