Lunch Wrap: ASX smashes fresh record as earnings season runs hot

The ASX is in all-time high territory again. Picture via Getty Images

- ASX hits fresh high as Origin powers up

- Westpac jumps on big quarter

- Bitcoin smashes record, Ethereum eyes personal best next

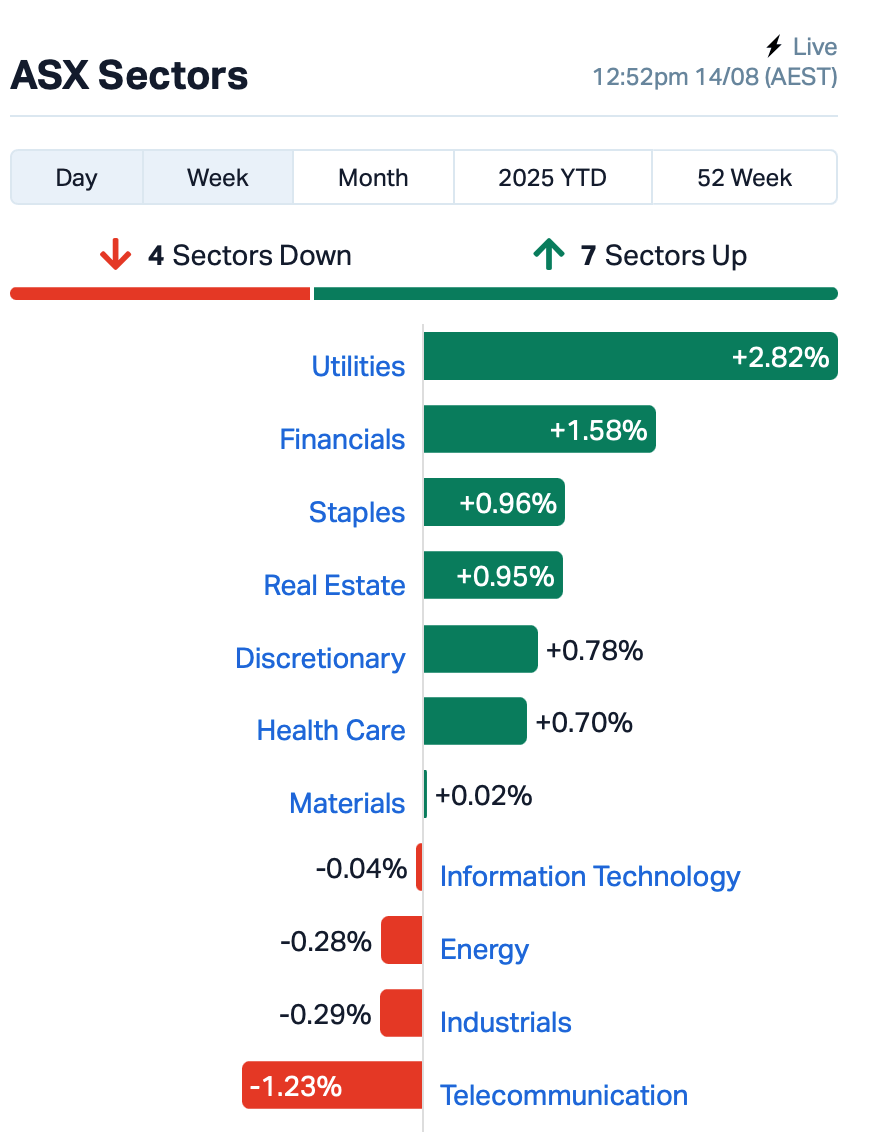

The ASX was strutting into Thursday lunchtime in the east with a 0.7% lift, rewriting the record books yet again.

Wall Street also rallied overnight, buoyed by the growing belief the Fed’s about to hand out rate cuts like a spring clearance sale.

Bitcoin burst into the party, too, clocking another all-time high and flexing at US$123,675 at the time of writing, while Ethereum is lurking just shy of its own record of US$4,878 (set four years ago).

Back home, it was the utilities sector leading the charge, up on the back of Origin Energy’s (ASX:ORG) blockbuster 5% surge.

Origin’s LNG cash machine kept humming in FY25, lifting profit, fattening franked dividends, and easily outshining softer energy retail as it handed shareholders a juicier 60c payout.

Banks also staged a comeback after Wednesday’s bruising.

Westpac (ASX:WBC) was the headline act, rocketing 7% thanks to a 14% jump in third-quarter profit and a cool $10 billion lift in deposits.

Suncorp Group (ASX:SUN) rose 3% on a 52% profit leap in its full-year results thanks to its ANZ bank sale gains.

Elsewhere in earnings season madness, Telstra (ASX:TLS) was the lone sector buzzkill for telcos, down 3% despite a 31% jump in annual profit to $2.34 billion and a $1 billion share buyback.

Pro Medicus (ASX:PME) impressed with a 40% profit jump in its full-year numbers and $520 million in fresh US contracts, lifting shares 5%.

Temple & Webster (ASX:TPW) jumped 7% after full-year revenue grew 21%. Apparently we still can’t resist a good online furniture binge.

But not everyone was kicking goals.

South32 (ASX:S32) slid 5% after slapping a US$372 million impairment on its Mozal aluminium smelter in Mozambique. Without a new power deal, the operation could shut in March, it said.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| GGE | Grand Gulf Energy | 0.002 | 100% | 800,584 | $2,820,425 |

| MRD | Mount Ridley Mines | 0.005 | 80% | 30,230,623 | $1,946,223 |

| ATV | Activeportgroupltd | 0.016 | 68% | 59,216,662 | $6,526,282 |

| MEL | Metgasco Ltd | 0.003 | 50% | 100,000 | $3,674,173 |

| OD6 | Od6Metalsltd | 0.100 | 47% | 19,995,087 | $10,911,821 |

| BPH | BPH Energy Ltd | 0.013 | 44% | 19,133,068 | $10,964,095 |

| BPP | Babylon Pump & Power | 0.007 | 40% | 7,930,629 | $19,034,455 |

| CR9 | Corellares | 0.004 | 33% | 750,000 | $3,021,809 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 250,000 | $10,026,464 |

| KNG | Kingsland Minerals | 0.185 | 28% | 352,638 | $10,521,332 |

| BMM | Bayanminingandmin | 0.165 | 27% | 5,500,122 | $14,196,703 |

| FRB | Firebird Metals | 0.175 | 25% | 3,055,947 | $19,930,596 |

| ARV | Artemis Resources | 0.005 | 25% | 3,261,000 | $11,462,689 |

| DTM | Dart Mining NL | 0.003 | 25% | 10,091,666 | $2,396,111 |

| OSX | Osteopore Limited | 0.010 | 25% | 933,405 | $1,898,080 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 25,681 | $18,739,398 |

| SLM | Solismineralsltd | 0.135 | 23% | 1,380,384 | $15,518,820 |

| BM8 | Battery Age Minerals | 0.082 | 22% | 11,644,677 | $10,170,722 |

| BMG | BMG Resources Ltd | 0.012 | 21% | 10,315,111 | $8,059,773 |

| MMR | Mec Resources | 0.006 | 20% | 6,840,475 | $9,248,829 |

| SPQ | Superior Resources | 0.006 | 20% | 1,487,217 | $11,854,914 |

| TML | Timah Resources Ltd | 0.031 | 19% | 164 | $2,307,754 |

ActivePort Group (ASX:ATV) has switched on Australia’s first private-cloud superhighway, landing DigiCo, Equinix and NextDC as early customers just weeks after launch. Its Private-Cloud Connect gives on-demand fibre links between branch offices and private clouds in top Aussie data centres, built for the AI boom in local hosting.

Battery Age Minerals (ASX:BM8) has confirmed Falcon Lake is more than just a lithium play, with new assays showing high-grade rubidium, caesium, tantalum and gallium alongside its already strong spodumene hits. The latest drilling backs Falcon Lake as a multi-metal prize, with standout lithium intercepts including 54.1m at 1.74% Li₂O and 55.95m at 1.47% Li₂O.

With only five of 30 high-priority targets drilled and lithium prices starting to recover, the company said the project has plenty of runway for more discoveries and market upside.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.001 | -50% | 7,546,000 | $13,002,431 |

| ECT | Env Clean Tech Ltd. | 0.003 | -25% | 553,610 | $16,061,742 |

| PKO | Peako Limited | 0.003 | -25% | 10,670,597 | $5,950,968 |

| RKB | Rokeby Resources Ltd | 0.010 | -23% | 3,031,200 | $21,253,195 |

| CAV | Carnavale Resources | 0.004 | -20% | 858,307 | $20,451,092 |

| ERA | Energy Resources | 0.002 | -20% | 1,929,673 | $1,013,490,602 |

| CTM | Centaurus Metals Ltd | 0.368 | -18% | 1,344,178 | $223,515,546 |

| BUY | Bounty Oil & Gas NL | 0.003 | -17% | 870,000 | $4,684,416 |

| EMT | Emetals Limited | 0.005 | -17% | 1,069,204 | $5,100,000 |

| SER | Strategic Energy | 0.005 | -17% | 3,354,304 | $5,020,150 |

| SHP | South Harz Potash | 0.003 | -17% | 1,400,675 | $4,415,170 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 99,629 | $22,214,246 |

| CR1 | Constellation Res | 0.120 | -14% | 5,000 | $10,088,556 |

| CYQ | Cycliq Group Ltd | 0.006 | -14% | 93,818 | $3,223,617 |

| OVT | Ovanti Limited | 0.006 | -14% | 1,343,942 | $29,920,265 |

| TSL | Titanium Sands Ltd | 0.006 | -14% | 410,785 | $16,413,230 |

| BEL | Bentley Capital Ltd | 0.013 | -13% | 1,550,000 | $1,141,919 |

| ANR | Anatara Ls Ltd | 0.007 | -13% | 100,000 | $1,708,723 |

| AON | Apollo Minerals Ltd | 0.007 | -13% | 512,488 | $7,427,655 |

IN CASE YOU MISSED IT

RBA rate cut: Why the cost of doing nothing just got more expensive for property investors.

Parental safety and privacy concerns are fuelling growth for ASX tech stocks in the booming “anxiety economy”.

White Cliff Minerals’ (ASX:WCN) first round of drilling at Rae has identified a sediment-hosted copper system, underlain by semi-massive sulphide veining.

Albion Resources (ASX:ALB) has completed the sale of Mongers Lake to Capricorn Metals (ASX:CMM) for $100,000 cash and 1.4 million in shares.

LAST ORDERS

Lumos Diagnostics (ASX:LDX) is looking to expand its marketing presence in the US, inking a partnering agreement with US-based market access consultancy, PRO-spectus. PRO-spectus will support the marketing, market access, and reimbursement of LDX’s flagship point-of-care test, FebriDx®.

New Age Exploration (ASX:NAE) has welcomed financial market veteran Daniel Eddington to the board as an independent non-executive director.

Eddington also serves as a non-executive director for Osmond Resources (ASX:OSM) and Jade Gas (ASX:JGH) and as a director of Sparc Technologies (ASX:SPN).

VHM (ASX:VHM) is moving into a new stage of development for its heavy minerals and rare earths Goschen project, welcoming new CEO Andrew King and CFO Benjamin McCormick to the board effective October 1.

Current CEO Ron Douglas will subsequently resume his non-executive director position on the board as planned, after assisting in King’s transition over the next few months.

At Stockhead, we tell it like it is. While Lumos Diagnostics, VHM and New Age Exploration are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.