Lunch Wrap: ASX slumps on new China tariffs; Star in dire straits

Any luck the Star had left may have dried up. Picture via Getty Images

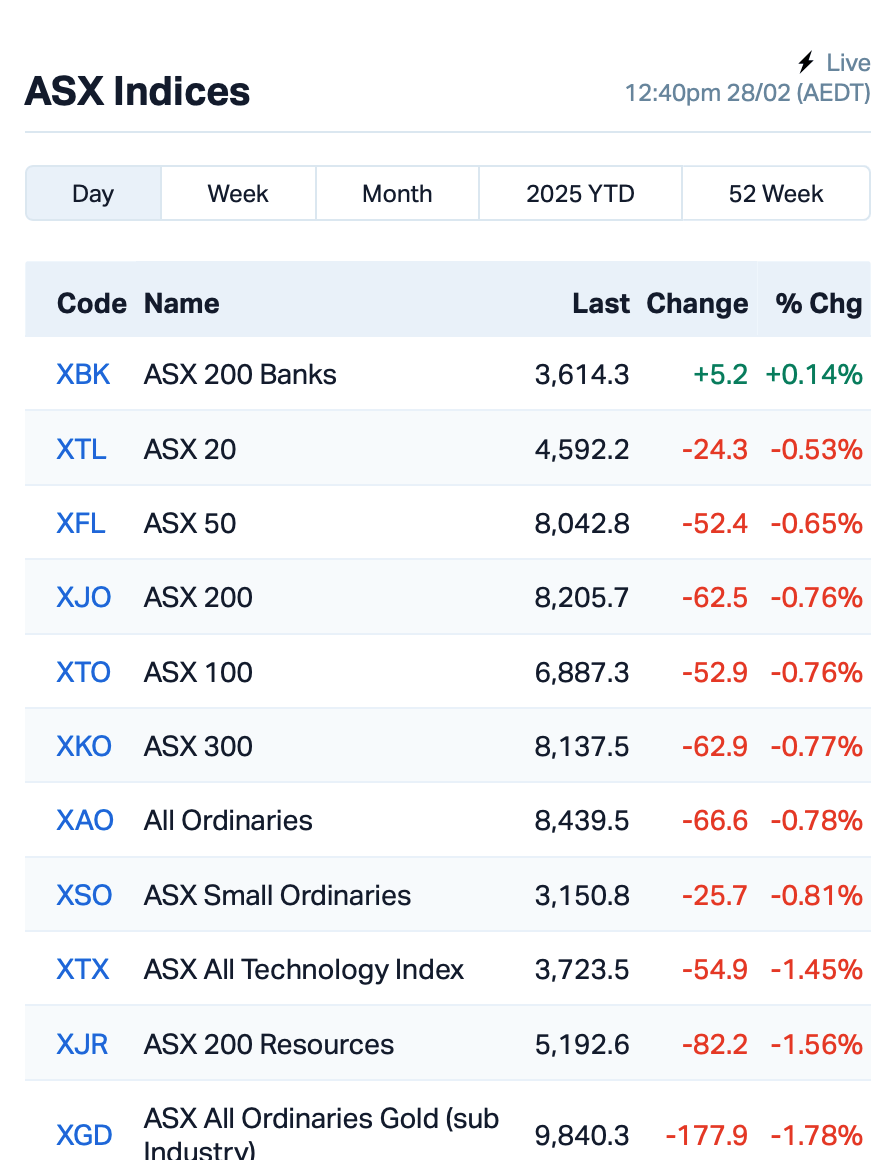

- ASX tumbles on tariff fears

- Star Entertainment suspended amid cash woes

- Webjet hit with $9m fine over misleading ads

It’s a rough ride again for the ASX, with the market plunging by 0.8% on Friday morning as traders scrambled to ditch Aussie shares.

The threat of an additional 10% tariff by Trump on imports from China had traders twitching.

Trump’s call for an additional 10% levy on Chinese goods, which hasn’t been announced before, could apparently take effect as early as next Tuesday.

Naturally, this news sparked fears that demand for Aussie commodities – iron ore, gold, you name it – would take a hit. The fear of weaker demand also pushed the Aussie dollar to slide towards US62 cents.

Overnight on Wall Street, the mood was equally grim.

US stocks tumbled, with the US benchmark S&P 500 falling 1.6%, the Nasdaq by 2.8%; while Bitcoin briefly dropped below US$84k and heading back to the lows we saw in November.

Tech giant Nvidia also plunged 8% after reporting disappointing earnings post-market yesterday. But some experts believe this could be a buying opportunity.

“Nvidia could probably now enter another earnings upgrade cycle, which could inspire retail investors to buy in,” said Jessica Amir at Moomoo.

Back home, there is a lot of action on the ASX, too.

BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) all shed over 1% on the tariff news. Even gold miners couldn’t escape the sell-off.

In other large caps news, Star Entertainment Group’s (ASX:SGR) stock was down 15% after the casino operator said it might not make it through today unless a liquidity lifeline showed up. The casino is waiting on some proposals that could save the day, but no word yet if that will happen.

Star also said it might not be able to finalise its financial report for the first half of 2024 unless these proposals are sorted. Trading in SGR shares were temporarily paused this morning.

Harvey Norman Holdings (ASX:HVN) jumped 2% after its half-year sales revenue hit $4.8 billion.

Life360 (ASX:360), the family-tracking app, rose 5.5% after it hit earnings targets and bringing in nearly 80 million users in Q4.

Endeavour Group (ASX:EDV) – the owner of liquor retailers Dan Murphy’s and BWS – didn’t have such good news. Its profit slumped by 15.1% in the half, and the company had to lower its dividend by 12.6%. Shares dipped over 6%.

Endeavour is still on the lookout for a new CEO after its former chief flagged his departure last year.

Over at Webjet (ASX:WEB), the company copped a $9 million fine for misleading customers about airfares.

Webjet said it has reached a deal with the ACCC, which had raised concerns in the courts about how Webjet marketing handled things like fees in social media posts, emails, and on the website. WEB’s shares were up 0.5%.

And finally, Morningstar’s Lochlan Halloway is pointing out that despite the market’s drama over the last couple of weeks, the February 2025 reporting season isn’t as bad as it might seem.

“The share of companies we’ve downgraded also ticked up, to 10% from 4%,” Halloway noted.

“These proportions looks very similar to the average in recent years, so it looks like we’re on track for a pretty standard reporting season.”

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 28 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| PEB | Pacific Edge | 0.130 | 136% | 626,968 | $44,655,379 |

| FAU | First Au Ltd | 0.003 | 50% | 500,000 | $4,143,987 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 125,000 | $1,824,924 |

| VML | Vital Metals Limited | 0.002 | 33% | 5,195,013 | $8,842,600 |

| GG8 | Gorilla Gold Mines | 0.330 | 29% | 4,717,648 | $142,979,685 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 8,405,175 | $4,063,446 |

| ERA | Energy Resources | 0.003 | 25% | 387,441 | $810,792,482 |

| NAE | New Age Exploration | 0.005 | 25% | 8,726,262 | $8,625,596 |

| NRZ | Neurizer Ltd | 0.003 | 25% | 973,974 | $6,716,008 |

| ILA | Island Pharma | 0.195 | 22% | 309,498 | $30,773,648 |

| OVT | Ovanti Limited | 0.009 | 21% | 21,372,853 | $16,320,835 |

| ALR | Altairminerals | 0.003 | 20% | 798,919 | $10,741,860 |

| ORD | Ordell Minerals Ltd | 0.580 | 20% | 1,039,690 | $17,434,620 |

| HCL | Highcom Ltd | 0.200 | 18% | 314,837 | $17,456,054 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 1,502,001 | $16,169,312 |

| CTO | Citigold Corp Ltd | 0.004 | 14% | 1,319,750 | $10,500,000 |

| IPB | IPB Petroleum Ltd | 0.008 | 14% | 1,745,754 | $4,944,821 |

| ORN | Orion Minerals Ltd | 0.016 | 14% | 20,490 | $95,906,269 |

| MCO | Myeco Group Ltd | 0.020 | 14% | 124,700 | $10,440,675 |

| VGL | Vista Group Int Ltd | 3.300 | 13% | 48,921 | $694,014,510 |

| AJX | Alexium Int Group | 0.009 | 13% | 54,462 | $12,612,091 |

| AM5 | Antares Metals | 0.009 | 13% | 186,422 | $4,083,847 |

| LEG | Legend Mining | 0.009 | 13% | 83,333 | $23,275,817 |

| SPX | Spenda Limited | 0.009 | 13% | 43,261 | $36,921,724 |

| VRC | Volt Resources Ltd | 0.005 | 13% | 2,331,333 | $18,117,573 |

Pacific Edge (ASX:PEB) just got a big win with its Cxbladder Triage test being added to the American Urological Association’s (AUA) updated clinical guidelines. The new guidelines for managing microhematuria (blood in the urine) now recommend Cxbladder Triage as the only urine-based biomarker with strong ‘Grade A’ evidence. This is a huge deal because intermediate-risk patients make up around 70% of those with this condition. It’s expected that more US doctors will start using the test. Shares more than doubled after the news.

Vital Metals (ASX:VML) said it’s expanding its Tardiff Scoping Study in Canada to include niobium, which is found alongside rare earths at the site. Initial tests showed niobium can be recovered at a 15% rate, and with further work, it could add big value to the project. Niobium is used in things like aeronautic engines, electronics, and lithium-ion batteries, so the market is very keen on it. Vital is now on track to wrap up the study by late April.

Gorilla Gold Mines ‘(ASX:GG8) drilling at Lakeview is pulling up some cracking results, extending the mineralised zone to 400m and still open in all directions. The latest hits include 19m at 18.1g/t gold and 11m at 24.8g/t gold, showing the system is looking pretty good. Lakeview is located 97km north of Kalgoorlie, and Gorilla’s keen on this spot, with drilling still ongoing. The mineralisation’s hosted in a major fault, with similar structures to other big gold finds in the area.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 28 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NGS | NGS Ltd | 0.020 | -33% | 120,000 | $4,064,485 |

| RLL | Rapid Lithium Ltd | 0.004 | -30% | 18,046,515 | $6,169,898 |

| AFL | Af Legal Group Ltd | 0.105 | -28% | 1,214,627 | $13,238,385 |

| VBC | Verbrec Limited | 0.093 | -26% | 307,929 | $36,344,070 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 6,547,418 | $13,149,361 |

| TTI | Traffic Technologies | 0.003 | -25% | 4,496,736 | $4,614,933 |

| MM1 | Midasmineralsltd | 0.100 | -23% | 389,232 | $16,136,858 |

| BIT | Biotron Limited | 0.007 | -22% | 15,360,390 | $8,121,445 |

| AX8 | Accelerate Resources | 0.008 | -20% | 1,079,870 | $7,467,539 |

| PSL | Paterson Resources | 0.008 | -20% | 2,409,500 | $4,560,379 |

| BRN | Brainchip Ltd | 0.210 | -18% | 32,492,709 | $507,910,504 |

| RHT | Resonance Health | 0.050 | -17% | 1,736,124 | $27,576,968 |

| AMS | Atomos | 0.005 | -17% | 8,860 | $7,290,111 |

| BUY | Bounty Oil & Gas NL | 0.003 | -17% | 1,000,000 | $4,684,416 |

| OSL | Oncosil Medical | 0.005 | -17% | 1,081,824 | $27,639,481 |

| PKO | Peako Limited | 0.003 | -17% | 71,419 | $4,463,226 |

| ADR | Adherium Ltd | 0.011 | -15% | 5,560 | $9,861,540 |

| WWG | Wisewaygroupltd | 0.180 | -14% | 84,998 | $35,144,171 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 1,030,018 | $36,668,998 |

| ION | Iondrive Limited | 0.019 | -14% | 3,026,817 | $26,022,399 |

| CLU | Cluey Ltd | 0.100 | -13% | 741,041 | $40,574,731 |

| AYT | Austin Metals Ltd | 0.004 | -13% | 75,000 | $5,296,765 |

| RAS | Ragusa Minerals Ltd | 0.021 | -13% | 4,055 | $3,422,371 |

| MXO | Motio Ltd | 0.029 | -12% | 1,007,399 | $9,190,612 |

IN CASE YOU MISSED IT

Kingsrose Mining (ASX:KRM) is growing its footprint in Finland with the acquisition of the Jakon nickel-copper-cobalt project in Central Finland from Rio Tinto Exploration Finland Oy, through its Exploration Alliance with BHP. The 205 km² project boosts the company’s presence in the region, bringing its total landholding in Central Finland to 1198 km² under the Alliance.

LTR Pharma (ASX:LTP) is set to share Spontan’s groundbreaking clinical data at the Urological Society of Australia and New Zealand’s Annual Scientific Meeting in Perth. The data highlights how Spontan absorbs 470% faster than current erectile dysfunction (ED) treatments, illustrating its potential to disrupt the global ED market.

At Stockhead, we tell it like it is. While Kingsrose Mining and LTR Pharma are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.