Lunch Wrap: ASX slumps as Viva and Domino’s hit hard; WOA jumps 160pc on China approval

Viva and Domin’s hit hard today. Picture via Getty Images

- ASX drops after weak lead from Wall Street

- Block, Viva Energy and Domino’s see big losses

- Woodside and Sims post strong results despite challenges

The ASX got off to a shaky start on Tuesday, dropping 0.75% after a rough patch in US markets.

Overnight, the S&P/ASX 200 fell by 0.5% and the Nasdaq by 1.2%. It was a tough day across the board, with most sectors on Wall Street feeling the pinch, especially consumer discretionary stocks.

Investors were keeping an eye on Nvidia, which slid 3% ahead of its first earnings update (slated for Wednesday US time) since the Chinese startup DeepSeek launched an AI model that could give US tech a run for its money.

Block Inc’s shares on the NYSE also had a rough day after its Q4 earnings report fell short of what analysts were expecting. The company, which owns Afterpay, saw its shares plummet nearly 18% – the biggest drop in almost five years.

There were also concerns about global trade, especially after US President Trump confirmed that tariffs on Mexico and Canada were still set to hit next month, sparking more unease in the markets.

Back on the ASX, things weren’t looking too great for some big names.

Viva Energy’s (ASX:VEA) shares tanked by 25% after reporting a 20% drop in profits for the full year. The company is struggling due to lower-than-expected demand in its convenience business, impacted by cost-of-living pressures.

Domino’s Pizza Enterprises (ASX:DMP) wasn’t much better, with a 11% fall as the company faced hefty restructuring costs. Domino’s closed 205 underperforming stores as part of a cost-saving initiative to streamline operations. It still declared an interim dividend of 55.5 cents per share.

Construction company, Johns Lyng Group (ASX:JLG), plummeted by 30% after downgrading its 2025 earnings forecast. It now expects earnings of $126.5 million, down from $132.5 million.

WiseTech Global (ASX:WTC) dropped another 2%, building on a more than 20% plunge on Monday, following the resignation of four directors who raised concerns about founder Richard White’s continued involvement in the company.

A couple of large cap stocks stood out this morning, though.

Woodside Energy Group (ASX:WDS) managed to climb 2.5% after doubling its net profit for the year, despite a 13% drop in underlying profit due to lower oil and gas prices.

Metals recycling company Sims Metal Management (ASX:SGM) jumped by 0.5% after a huge 184% jump in underlying earnings in the half.

Zip Co (ASX:ZIP), the buy now, pay later company, also had a good day, jumping 15% after more than doubling its cash earnings in H1.

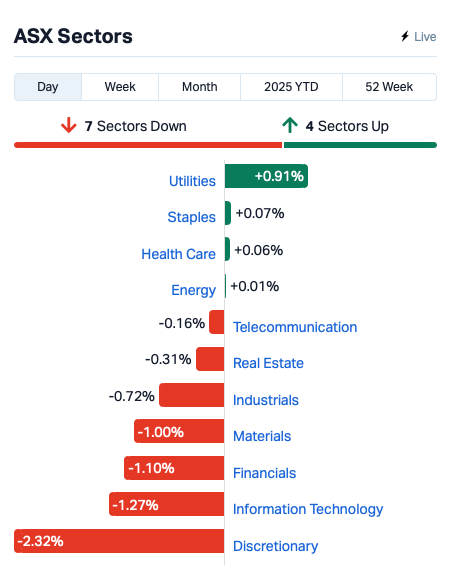

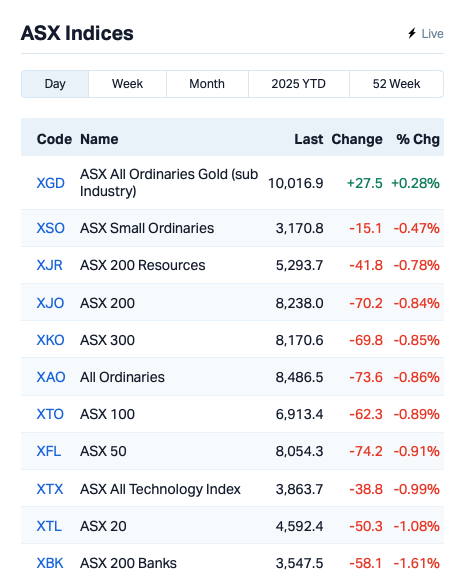

This is where things stood at around lunch time, AEDT:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 25 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| WOA | Wide Open Agricultur | 0.013 | 160% | 94,503,940 | $2,668,433 |

| EVS | Envirosuite Ltd | 0.083 | 93% | 5,892,347 | $61,949,498 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 3,837,663 | $28,933,812 |

| LNR | Lanthanein Resources | 0.003 | 50% | 300,000 | $4,887,272 |

| WEL | Winchester Energy | 0.002 | 50% | 111,111 | $1,363,019 |

| CMB | Cambium Bio Limited | 0.555 | 42% | 350,057 | $5,515,776 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 470,491 | $3,632,709 |

| OB1 | Orbminco Limited | 0.002 | 33% | 250,000 | $3,249,885 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 353,547 | $7,254,899 |

| TIG | Tigers Realm Coal | 0.004 | 33% | 1,119,039 | $39,200,107 |

| 3DP | Pointerra Limited | 0.090 | 27% | 12,880,583 | $57,160,453 |

| FAU | First Au Ltd | 0.003 | 25% | 1,000,000 | $4,143,987 |

| CSX | Cleanspace Holdings | 0.480 | 23% | 363,861 | $30,475,938 |

| BTN | Butn Limited | 0.115 | 21% | 196,984 | $26,537,734 |

| GLL | Galilee Energy Ltd | 0.006 | 20% | 800,000 | $2,785,964 |

| TEG | Triangle Energy Ltd | 0.006 | 20% | 152,500 | $10,446,170 |

| BDG | Black Dragon Gold | 0.049 | 20% | 299,969 | $12,452,359 |

| HMD | Heramed Limited | 0.020 | 18% | 16,909,773 | $14,885,247 |

| NSX | NSX Limited | 0.020 | 18% | 338,455 | $7,782,277 |

| M2R | Miramar | 0.004 | 17% | 45,000 | $1,369,040 |

| VRC | Volt Resources Ltd | 0.004 | 17% | 750,000 | $13,588,180 |

| HLI | Helia Group Limited | 5.615 | 16% | 1,356,560 | $1,318,778,564 |

| PFT | Pure Foods Tas Ltd | 0.044 | 16% | 592,407 | $5,146,174 |

| EOL | Energy One Limited | 10.900 | 16% | 272,955 | $295,426,048 |

| PHL | Propell Holdings Ltd | 0.015 | 15% | 36,619 | $3,618,396 |

Wide Open Agriculture (ASX:WOA) skyrocketed after receiving approval to export its high-protein lupin protein isolate to China. The Chinese plant-based protein market is growing fast and is expected to reach $12.1 billion by 2030. WOA’s lupin protein is a non-GMO, sustainable alternative to soy protein, and is used in products like protein powders, plant-based milks, and yogurts. The company is working with a local distributor to enter the Chinese market and expand into protein powder and dairy alternatives.

Envirosuite (ASX:EVS) has received an unsolicited, non-binding offer from Ideagen to buy the company for $0.10 per share. This offer is a 133% premium to Envirosuite’s current share price. The deal is still conditional on due diligence, shareholder approval, and the company plans to engage with Ideagen further. The Envirosuite board believes it’s in the best interest of shareholders to explore this opportunity.

Cambium Bio (ASX:CMB) has received FDA approval for the phase 3 clinical trial protocol of its Elate Ocular treatment for moderate to severe dry eye disease. The trials, which will take place in the US, Australia, and other countries, will involve 800 patients. The goal is to evaluate Elate Ocular’s safety and efficacy compared to a placebo, with a focus on improving corneal staining and eye discomfort. The approval follows the FDA’s Fast Track designation for the treatment.

Cleanspace (ASX:CSX) saw strong growth in H1 FY25, with revenue rising 26% to $9.2 million, driven by its industrial-led strategy. Gross margin improved to 74%, and the company controlled costs, reducing expenses by 6%. The company has healthy cash reserves of $8.3 million and expects a $1 million R&D tax refund in H2.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 25 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BUY | Bounty Oil & Gas NL | 0.002 | -33% | 33,000 | $4,684,416 |

| JLG | Johns Lyng Group | 2.700 | -29% | 7,018,556 | $1,069,333,045 |

| RCR | Rincon | 0.014 | -26% | 11,182,858 | $5,558,686 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 6,676,481 | $13,149,361 |

| VEA | Viva Energy Group | 1.800 | -25% | 18,039,506 | $3,827,538,492 |

| CLA | Celsius Resource Ltd | 0.012 | -20% | 24,864,950 | $40,038,577 |

| 1TT | Thrive Tribe Tech | 0.002 | -20% | 4,499,395 | $5,079,308 |

| AJX | Alexium Int Group | 0.008 | -20% | 458,000 | $15,765,114 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 1,947,958 | $15,000,000 |

| CYC | Cyclopharm Limited | 1.530 | -19% | 504,712 | $211,160,015 |

| GNM | Great Northern | 0.017 | -19% | 1,470,876 | $3,247,211 |

| AMO | Ambertech Limited | 0.135 | -18% | 163,378 | $15,741,789 |

| FRX | Flexiroam Limited | 0.005 | -17% | 7,846 | $9,104,392 |

| PLC | Premier1 Lithium Ltd | 0.010 | -17% | 5,246,361 | $4,416,727 |

| SER | Strategic Energy | 0.005 | -17% | 20,000 | $4,026,200 |

| WBE | Whitebark Energy | 0.005 | -17% | 2,209,519 | $1,849,255 |

| DDB | Dynamic Group | 0.200 | -15% | 28,500 | $33,643,018 |

| PNV | Polynovo Limited | 1.520 | -15% | 4,151,522 | $1,233,154,739 |

| BCB | Bowen Coal Limited | 0.006 | -14% | 564,959 | $75,429,481 |

| CTN | Catalina Resources | 0.003 | -14% | 450,980 | $4,606,917 |

| RLL | Rapid Lithium Ltd | 0.003 | -14% | 100,000 | $3,613,556 |

| PPS | Praemium Limited | 0.748 | -14% | 3,903,347 | $415,612,201 |

| PPG | Pro-Pac Packaging | 0.019 | -14% | 2,000 | $3,997,130 |

| WYX | Western Yilgarn NL | 0.026 | -13% | 1,690 | $3,714,286 |

IN CASE YOU MISSED IT

Elevate Uranium (ASX:EL8) joint venture partner, Energy Metals, has reported a 12% lift in the mineral resource estimate for the Bigrlyi uranium project in the Northern Territory. Managing Director Shubiao Tao said the expansion to 10.9kt U₃O₈ highlights Bigrlyi’s growth potential and reaffirmed the company’s commitment to further drilling in 2025 to test high-priority zones.

At Stockhead, we tell it like it is. While Elevate Uranium is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.