Lunch Wrap: ASX sluggish as BHP slashes dividend; traders await RBA’s big call

ASX starts weak, while eyes are on the RBA decision today. Picture via Getty Images

- ASX starts weak, eyes on RBA rate cut today

- Europe braces for big defence spend

- BHP dividend drops, Seek and Hub24 rally

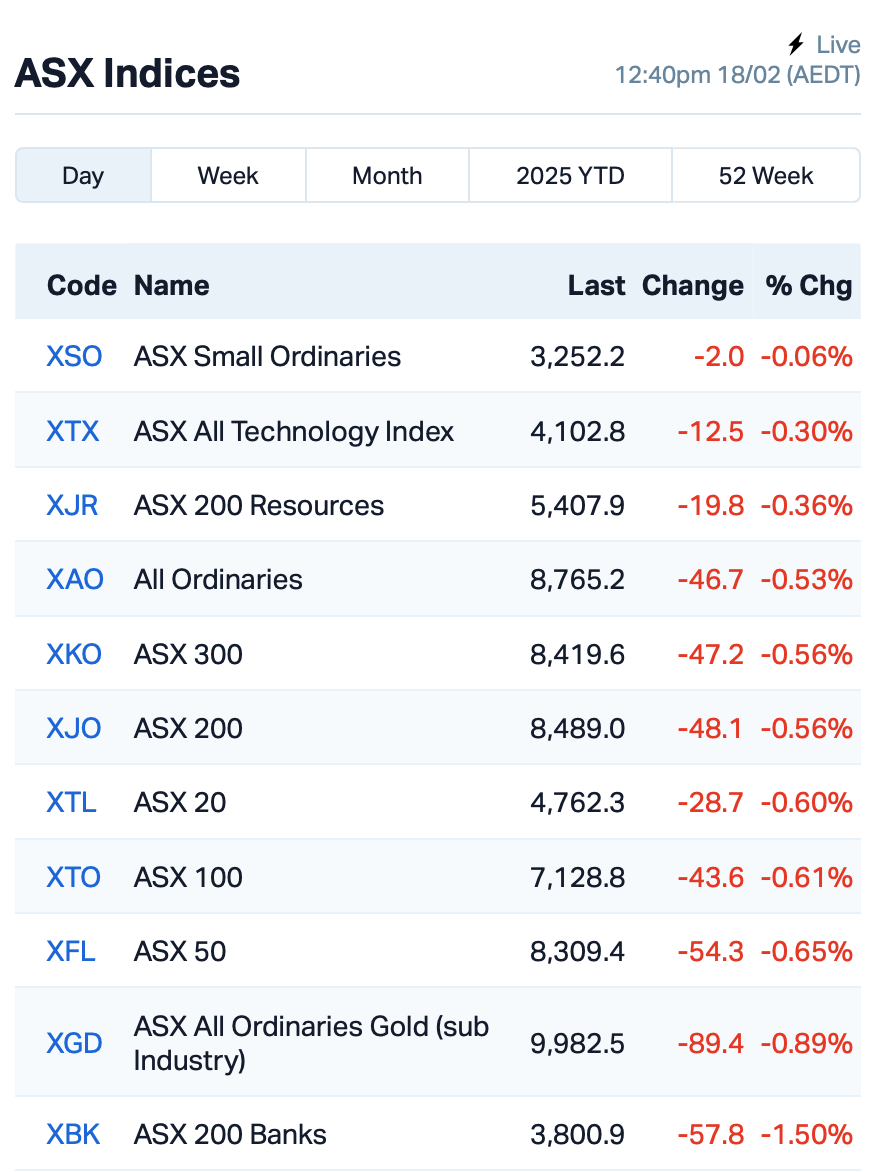

The ASX started Tuesday on a bit of a downer, with the S&P/ASX 200 slipping 0.4%, even though futures had pointed to a higher open.

There’s plenty of nervous energy in the air, with all eyes on today’s Reserve Bank of Australia (RBA) rates decision at 2.30pm AEDT and a speech from Governor Michele Bullock.

Today will be a key moment for Bullock, especially with global economic pressures such as tariffs still looming large. Will she deliver the expected rate cut, or will the RBA surprise us?

Scott Solomon, co-portfolio manager at T. Rowe Price, shared his thoughts: “We expect the RBA to meet market expectations and cut 25bps. Not cutting would mean a significant blow to credibility… inflation is now below the midpoint of the 2-3% band.”

Over in the US, Wall Street took a break for Presidents’ Day last night, so no fresh data there.

But in Europe, shares mostly rose despite a growing sense that the EU is going to need to bump up its defence spending big time.

Some analysts are saying it could cost Europe’s major powers an extra US$3.1 trillion over the next decade to keep things secure and to help out Ukraine.

Back to the ASX, eight out of 11 sectors were in the red this morning, with energy and financial stocks getting hammered.

Woodside Energy Group (ASX:WDS) dragged down the energy sector after slipping by 2%. The stock continued to drop from yesterday after hinting its final dividend might come in up to 20% below expectations.

BHP (ASX:BHP) was up 0.4% despite announcing its lowest interim dividend in eight years, citing slowing Chinese steel demand.

BHP generated US$2.6 billion in free cash flow for the half year, but that’s a 30% drop from last year. As a result, BHP slashed its fully franked interim dividend by 30.5%, now sitting at 50 US cents per share.

The mining giant, however, raked in US$12.4 billion in underlying EBITDA for the half, and net profit of US$5.1 billion.

Still in large caps, jobs platform Seek (ASX:SEK) fell 1% despite strong outlook for fiscal 2025 and a big dividend bump.

Investment platform Hub24 (ASX:HUB) leapt 8% after reporting a 54% increase in profit, helping to soften the index’s losses this morning.

And, Meridian Energy (ASX:MEZ) has scored approval for its 90MW Mt Munro Wind Farm in NZ, set to generate enough renewable energy for 42,000 homes. The wind farm is part of a $3 billion plan to expand New Zealand’s electricity supply by 2030. Shares were down over 2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 18 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| DBO | Diablo Resources | 0.032 | 60% | 31,212,286 | $2,061,429 |

| ENL | Enlitic Inc. | 0.076 | 31% | 2,747,960 | $33,385,339 |

| IPB | IPB Petroleum Ltd | 0.007 | 30% | 3,450,000 | $3,532,015 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 17,017,426 | $4,063,446 |

| ECT | Env Clean Tech Ltd. | 0.003 | 25% | 806,659 | $6,343,621 |

| EMT | Emetals Limited | 0.005 | 25% | 200,079 | $3,400,000 |

| MSG | Mcs Services Limited | 0.005 | 25% | 1,156,422 | $792,399 |

| GHM | Golden Horse Mineral | 0.335 | 24% | 2,112,571 | $30,654,083 |

| EV1 | Evolutionenergy | 0.018 | 20% | 55,055 | $5,439,757 |

| CDT | Castle Minerals | 0.003 | 20% | 509,722 | $4,742,035 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 720,825 | $9,662,517 |

| LML | Lincoln Minerals | 0.006 | 20% | 557,833 | $10,281,298 |

| MTB | Mount Burgess Mining | 0.006 | 20% | 1,640,594 | $1,697,687 |

| VFX | Visionflex Group Ltd | 0.003 | 20% | 170,000 | $8,419,651 |

| CLU | Cluey Ltd | 0.110 | 20% | 433,814 | $32,459,784 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 400,000 | $3,448,673 |

| JAV | Javelin Minerals Ltd | 0.004 | 17% | 162,500 | $18,135,447 |

| OSL | Oncosil Medical | 0.007 | 17% | 602,844 | $27,639,481 |

| SRN | Surefire Rescs NL | 0.004 | 17% | 1,684,250 | $7,248,923 |

| TMK | TMK Energy Limited | 0.004 | 17% | 877,024 | $27,976,695 |

| CGR | Cgnresourceslimited | 0.087 | 16% | 106,489 | $6,808,364 |

| PFT | Pure Foods Tas Ltd | 0.023 | 15% | 279,693 | $2,708,512 |

| PER | Percheron | 0.008 | 14% | 6,703,928 | $7,612,063 |

| HTG | Harvest Tech Grp Ltd | 0.017 | 13% | 566,078 | $13,314,010 |

| HMC | HMC Capital Limited | 11.215 | 13% | 1,572,978 | $4,082,412,560 |

Diablo Resources (ASX:DBO) has just locked in the Lisbon Valley Copper Project, a high-grade near-mine copper opportunity in Utah’s world-class Lisbon Valley Mining District. Initial sampling has shown rock chip assays hitting up to 45.7% copper and an average of 6.29%. With 750m of strike and copper mineralisation identified, DBO said it’s on track to explore and drill the area in 2025.

Enlitic (ASX:ENL) is teaming up with global player GE HealthCare and its subsidiary Laitek to revolutionise medical imaging migrations using AI. The collaboration will speed up the transition to GE HealthCare’s latest Enterprise Imaging and PACS solutions. With AI-powered tools, Enlitic said the migration process will optimise data quality and improve care decisions for healthcare providers worldwide.

Environmental Clean Technologies (ASX:ECT) is raising $750k through a placement to support its COLDry Fertiliser Project, acquisitions, and working capital. The company has appointed Joseph van den Elsen as Non-Executive Chairman, with Jason Marinko stepping down to become Non-Executive Director. ECT is pushing forward with its zero-emissions COLDry fertiliser product, which reduces urea use and carbon emissions, and is conducting field trials across Australia.

Golden Horse Minerals (ASX:GHM) has received impressive assay results from its Phase 1 drilling at the Hopes Hill gold project in Southern Cross, including a standout 61m at 2.5 g/t Au from 91m. Other notable results include high-grade zones such as 8m at 9.2 g/t Au. These early findings confirm the strong potential of the area, with further assays expected shortly.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 18 [intraday]:

Code Name Price % Change Volume Market Cap BSA BSA Limited 0.165 -83% 18,146,553 $74,229,819 MOM Moab Minerals Ltd 0.001 -50% 196 $3,133,999 WEL Winchester Energy 0.001 -50% 625,000 $2,726,038 PHL Propell Holdings Ltd 0.012 -37% 910,215 $5,288,424 GGE Grand Gulf Energy 0.002 -33% 1,750,000 $7,351,161 NSC Naos Smlcap Com Ltd 0.310 -26% 940,947 $56,644,840 ERL Empire Resources 0.003 -25% 300,000 $5,935,653 SIT Site Group Int Ltd 0.002 -25% 14,548,335 $6,514,980 IXU Ixup Limited 0.008 -20% 200,001 $20,319,859 RWD Reward Minerals Ltd 0.050 -17% 120,000 $15,973,174 FAU First Au Ltd 0.003 -17% 742,200 $6,215,980 NES Nelson Resources. 0.003 -14% 16,356 $7,601,747 ODE Odessa Minerals Ltd 0.006 -14% 149,851 $11,196,728 SPQ Superior Resources 0.006 -14% 161,290 $15,189,047 STM Sunstone Metals Ltd 0.006 -14% 172 $36,050,025 VRC Volt Resources Ltd 0.003 -14% 227,541 $15,852,877 MLG Mlgozltd 0.595 -14% 926,689 $101,857,222 VRX VRX Silica Ltd 0.032 -14% 1,778,614 $27,518,079 LAT Latitude 66 Limited 0.061 -13% 295,079 $10,038,049 HGH Heartland Group 0.850 -13% 127,887 $913,983,797 RMC Resimac Grp Ltd 0.905 -13% 330,756 $413,998,255 ADN Andromeda Metals Ltd 0.007 -13% 1,195,989 $27,429,822 AEV Avenira Limited 0.007 -13% 199,803 $25,421,152 ASE Astute Metals NL 0.028 -13% 110,001 $19,465,959 SLZ Sultan Resources Ltd 0.007 -13% 12,500 $1,851,759

Baby Bunting (ASX:BBN) said it was cutting its interim dividend to save cash but sticking to its full-year growth targets.

The baby goods retailer saw a 2.4% rise in sales to $254.4 million and a 10.8% jump in earnings to $31.8 million for the first half of FY25. Net profit was up by 37.3%, hitting $4.8 million.

While trading’s slowed a bit in the new year, the company said it was still on track for growth of 0-3%.

IN CASE YOU MISSED IT

Miramar Resources (ASX: M2R) has secured a $291,413 R&D tax incentive for FY24, related to activities at its Whaleshark project in WA’s Ashburton region. The company views this tax credit, alongside recent funding from WA’s EIS, as a testament to the innovative exploration techniques being employed at Whaleshark.

Budding gold explorer Artemis Resources (ASX:ARV) has completed its $4 million raise, with the funds to support drilling at its Karratha project in WA. The company previously identified a number of priority targets, including the Marillion target, where drilling is resuming after being paused due to Cyclone Zelia.

Riversgold (ASX:RGL) has exercised its right to acquire 80% of the Kalgoorlie Gold – Northern Zone project, after exceeding the minimum dollar commitment announced in May 2023. The company is now focused on further drilling, with a rig booked to begin the 2025 drill program, aiming for a start in the coming weeks.

St George Mining (ASX:SGQ) is welcoming former industrial project specialist at CBMM, Carlos Alberto de Araújo, to its in-country management team to support the fast-tracked development of its high-grade niobium-REE Araxá project in Brazil. Araújo has extensive experience in niobium processing and phosphate operations, and will play a role in advising on plant design.

At Stockhead, we tell it like it is. While Miramar Resources, Artemis Resources, Riversgold and St George Mining are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.