Lunch Wrap: ASX slides on CSL’s shock guidance cut and WiseTech raid

WiseTech gets raided by AFP. Pic: Getty Images

- CSL tanks on profit warning

- WiseTech smashed after ASIC and AFP raid

- Domino’s Pizza goes ballistic

The ASX drifted 0.3% lower by Tuesday lunchtime in the east, ignoring Wall Street’s rally.

The S&P 500 and Nasdaq hit fresh record highs overnight, after Trump hinted at a “fair deal” with China’s Xi during his upcoming meeting in South Korea.

But with US earnings from the Big Five tech giants looming, nobody wants to be caught long if the music stops.

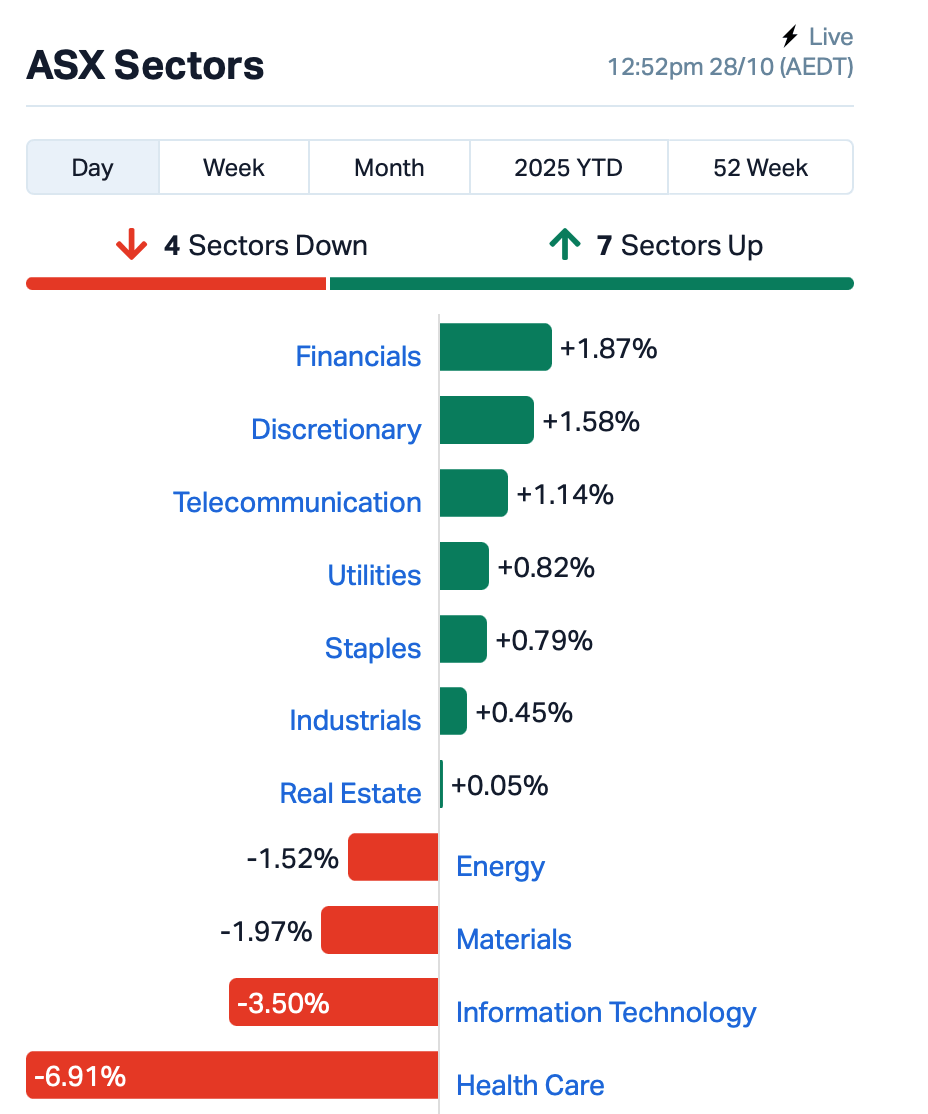

This morning, health and tech sectors were the clear laggards on the ASX.

The former was weighed down by CSL (ASX:CSL)’s guidance cut. CSL plunged 15% after slashing earnings guidance and shelving the demerger of its Seqirus vaccine business.

Falling US vaccination rates and a second strike on executive pay have made it a rough season for the biotech heavyweight.

CEO Paul McKenzie now expects profit growth of 4–7% for FY26, down from the 7–10% forecast in August.

Tech heavyweight WiseTech Global (ASX:WTC), meanwhile, plunged 16% after an ASIC and AFP raid on its Sydney HQ.

The investigation centres on alleged trading by founder Richard White and three employees, though no charges have been laid and the company insists it’s cooperating fully.

Even so, the raid dragged the broader tech sector down with it.

Appen (ASX:APX) and Life360 (ASX:360) both slipped 2%, as investors remembered that regulatory risk isn’t just for the crypto crowd.

Elsewhere, gold miners also copped a big selloff.

Gold prices slumped 3% as easing US-China trade tensions dulled the safe-haven shine. That’s a 10% drop from last week’s record highs, with prices threatening to cross below the psychological US$4000/oz barrier.

In other large cap news, Liontown Resources (ASX:LTR) crashed 12% despite reporting steady operational progress.

The lithium miner ended the quarter with $420 million in cash, hit its 1Mtpa underground run rate, and continues ramping up at Kathleen Valley.

But with lithium prices still soft and investors suffering EV fatigue, good execution is barely moving the needle.

Ramelius Resources (ASX:RMS) found itself 3.5% down after releasing a five year strategic outlook, which will see it grow production from 185-205,000oz in FY26 to 500-550,000oz from FY30 once the Dalgaranga and Rebecca-Roe mines are developed, generating upwards of $1bn free cash per year on modelled Aussie gold prices of A$4500/oz.

In sad news, Polymetals Resources (ASX:POL) entered a trading halt after reports in multiple media of the deaths of two workers at the Endeavor silver mine near Cobar in New South Wales. A man and a woman were killed in an explosion at the mine.

And… the big sizzler of the morning was Domino’s Pizza Enterprises (ASX:DMP), which rocketed almost 17% before entering a trading halt. The company had issued no announcements.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.003 | 50% | 10,832,179 | $15,140,450 |

| ASH | Ashley Services Grp | 0.220 | 38% | 1,180,364 | $23,036,145 |

| BIT | Biotron Limited | 0.004 | 33% | 199,999 | $4,578,998 |

| C7A | Clara Resources | 0.004 | 33% | 1,345,839 | $2,544,885 |

| RWL | Rubicon Water | 0.185 | 28% | 173,702 | $34,900,789 |

| SHO | Sportshero Ltd | 0.039 | 26% | 50,000 | $24,966,405 |

| ADR | Adherium Ltd | 0.005 | 25% | 2,113,766 | $7,452,698 |

| RFT | Rectifier Technolog | 0.005 | 25% | 400,000 | $5,527,936 |

| MRD | Mount Ridley Mines | 0.006 | 20% | 15,971,572 | $5,968,408 |

| TMX | Terrain Minerals | 0.006 | 20% | 2,039,679 | $13,409,071 |

| XPN | Xpon Technologies | 0.012 | 20% | 9,541,512 | $4,903,564 |

| CNQ | Clean Teq Water | 0.495 | 19% | 191,879 | $29,980,556 |

| IXC | Invex Ther | 0.135 | 17% | 128,213 | $8,642,693 |

| DMP | Domino Pizza Enterpr | 18.130 | 17% | 1,683,907 | $1,461,603,032 |

| FLC | Fluence Corporation | 0.110 | 17% | 882,841 | $102,258,990 |

| NES | Nelson Resources. | 0.007 | 17% | 3,948,386 | $13,179,566 |

| SPX | Spenda Limited | 0.004 | 17% | 1,317,546 | $14,183,146 |

| WEC | White Energy Company | 0.037 | 16% | 21,422 | $9,971,837 |

| AQX | Alice Queen Ltd | 0.005 | 13% | 84,651 | $5,538,785 |

| MSG | Mcs Services Limited | 0.009 | 13% | 37,691 | $1,584,797 |

| PCL | Pancontinental Energ | 0.009 | 13% | 442,513 | $66,288,642 |

| FML | Focus Minerals Ltd | 2.370 | 11% | 1,674,889 | $610,369,914 |

| EVZ | EVZ Limited | 0.223 | 11% | 274,468 | $24,403,183 |

Javelin Minerals (ASX:JAV) said it has done a deep dive into historic data at its Coogee project, about 50km south of Kalgoorlie, and turned up some big new gold and copper targets. The anomalies line up with known mineralisation and historic drilling hits, adding serious exploration upside to an already established JORC resource.

With $4.5 million freshly raised and drilling locked in for early 2026, it’s gearing up to test what could be the next chapter in Coogee’s gold story.

Clara Resources Australia (ASX:C7A) has sold a 28-hectare block within its Kildanga exploration tenement near Gympie for $230k, with the sale handled by a local agent. The deal doesn’t affect its exploration rights on the site.

The ongoing strategic review of the Kildanga Co-Ni-Au-Cu Project also remains underway as it weighs divestment or JV options. Clara is still pushing ahead with its Ashford Coking Coal project and looking at wider critical minerals potential.

And, with demand for gallium accelerating, Mount Ridley Mines (ASX:MRD) has picked the perfect time to unveil a significant maiden resource of the critical mineral at its namesake project in WA’s Esperance region.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DTR | Dateline Resources | 0.248 | -35% | 47,550,205 | $1,297,853,576 |

| AAJ | Aruma Resources Ltd | 0.016 | -30% | 7,193,549 | $9,426,332 |

| CRB | Carbine Resources | 0.006 | -25% | 767,987 | $9,534,926 |

| PIM | Pinnacleminerals | 0.130 | -24% | 851,604 | $17,078,780 |

| ABX | ABX Group Limited | 0.092 | -23% | 3,099,955 | $35,761,143 |

| VML | Vital Metals Limited | 0.205 | -23% | 775,508 | $38,820,932 |

| GLA | Gladiator Resources | 0.028 | -22% | 5,066,088 | $29,298,686 |

| LSR | Lodestar Minerals | 0.032 | -22% | 31,693,564 | $35,281,625 |

| TAS | Tasman Resources Ltd | 0.025 | -22% | 686,836 | $8,939,288 |

| HRZ | Horizon | 0.055 | -21% | 31,371,614 | $209,632,090 |

| LRD | Lordresourceslimited | 0.022 | -21% | 4,171,071 | $4,956,057 |

| WYX | Western Yilgarn NL | 0.054 | -21% | 946,631 | $10,698,151 |

| BEZ | Besragoldinc | 0.059 | -20% | 998,109 | $30,747,294 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 13,004,515 | $5,142,663 |

| CR9 | Corellares | 0.004 | -20% | 2,307,213 | $5,037,849 |

| FBR | FBR Ltd | 0.004 | -20% | 458,404 | $32,759,864 |

| GRL | Godolphin Resources | 0.016 | -20% | 3,384,848 | $13,923,133 |

| QXR | Qx Resources Limited | 0.004 | -20% | 200,000 | $9,213,317 |

| RNX | Renegade Exploration | 0.004 | -20% | 12,430,748 | $10,348,984 |

| WEL | Winchester Energy | 0.002 | -20% | 494,000 | $3,407,547 |

| OCT | Octava Minerals | 0.045 | -20% | 826,815 | $6,216,521 |

| T92 | Terra Critical | 0.056 | -19% | 1,917,124 | $10,113,713 |

| VKA | Viking Mines Ltd | 0.007 | -19% | 2,469,697 | $10,878,036 |

IN CASE YOU MISSED IT

Medallion (ASX:MM8) has aligned with major industry partner Trafigura to move Ravensthorpe and Forrestania towards commercial gold production.

Javelin Minerals (ASX:JAV) says a historical data review has highlighted new gold and copper targets for drilling at its promising Coogee project in WA.

Astral Resources (ASX:AAR) is preparing for a rapid ascent to producer status at the Mandilla gold project, selecting experienced executives to lead the development process.

Preliminary results from airborne electromagnetic surveying carried out by Terrain Minerals (ASX:TMX) has identified an extensive regolith-hosted rare earths target zone.

Taruga Minerals’ (ASX:TAR) survey has identified the heightened potential for gold within the southern target at its Thowagee project in WA.

Victory Metals (ASX:VTM) has appointed former White House advisor to President Trump, Emma Doyle, as Senior Advisor for US Strategic Engagement.

LAST ORDERS

Sovereign Metals (ASX:SVM) says it will be unaffected by a recent mineral export prohibition implemented by the newly elected President of Malawi, home to its Kasiya rutile and graphite project.

SVM’s project is exempt as the ban only applies to minerals that have not been processed, refined or value-added in Malawi. All extracted mineralisation at Kasiya will be feedstock for titanium metal products or graphite concentrates, targeting aerospace, defence and battery markets.

West Coast Silver (ASX:WCE) has added David Lewis and Ian Stockton to its newly formed technical advisory board, silver specialists with more than 20+ years’ experience in structurally controlled gold and silver systems.

Their appointment will support drill target refining and optimisation at Elizabeth Hill, where WCE intends to build out a coherent structural model to accelerate discovery along the Munni Munni corridor.

At Stockhead, we tell it like it is. While Sovereign Metals and West Coast Silver are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.