Lunch Wrap: ASX on fire at record 8900, energy stocks soar ahead of Trump-Putin talks

Oil stocks have been on fire today. Picture via Getty Images

- ASX hits record 8,900 points and keeps going

- Energy stocks on fire on the eve of Trump-Putin talks

- ANZ cashes in, and Baby Bunting surges

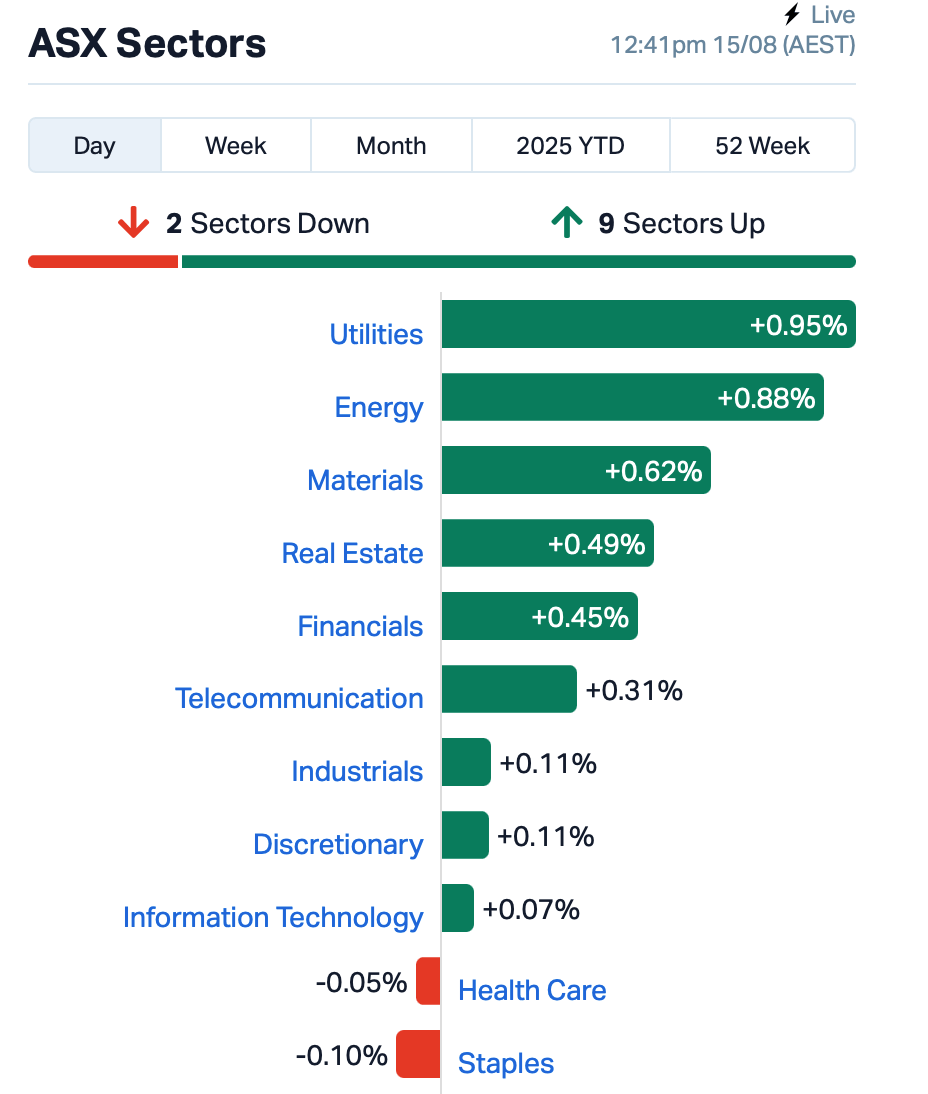

The ASX 200 was up 0.42% by the middle of the day in the east, hitting fresh record highs above 8,900 points.

Over on Wall Street last night, the mood had cooled a touch.

US producer prices (PPI) came in hotter than expected, which took some fizz out of the “rates are definitely coming down” party.

Bitcoin, meanwhile, took a 4% haircut after Thursday’s record surge past US$124,000. The hotter PPI data cooled hopes of aggressive Fed cuts, sending crypto punters back to their seats.

Back home, the utilities sector was leading the pack as Origin Energy (ASX:ORG) lit up once again. Its share price has jumped another 2% after unveiling a strong FY26 outlook yesterday.

The energy sector was also leaping ahead, helped along by rising oil prices (+2%) after Trump warned Putin of “severe consequences” if today’s talks in Alaska flop.

Meanwhile in earnings season news, Australia and New Zealand Banking Group (ASX:ANZ) gave the market something to chew on after booking a $19 billion bounce in customer deposits for the June quarter, mostly from institutional clients.

Loans were up $16 billion, too, proving there’s still plenty of activity in the engine room. ANZ shares were up 1%.

Cochlear (ASX:COH) dropped its full-year numbers and tried to play the “steady as she goes” tune, but the market wasn’t exactly dancing.

Net profit came in at $392 million, technically up 1%, but still shy of the $400 million consensus. Cochlear’s shares were down 0.85%.

Still in large caps, property developer Mirvac (ASX:MGR) slipped 1% despite swinging back into profit with $68 million in net earnings, as revenue fell 10% for the year.

Packaging giant Amcor (ASX:AMC) plunged a brutal 10%, even with sales surging 43% thanks to its Berry Global acquisition.

And finally, fundie WAM Capital (ASX:WAM) found itself in the slightly awkward position of underperforming its benchmark, but still bumping its dividend to 9.4 cents.

Investors always like a good dividend story, even if the short-term scoreboard doesn’t sparkle. WAM’s shares were up 0.5%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LU7 | Lithium Universe Ltd | 0.013 | 63% | 24,833,999 | $11,487,837 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 16,499,945 | $3,253,779 |

| AQX | Alice Queen Ltd | 0.004 | 33% | 150,526 | $4,154,089 |

| ASR | Asra Minerals Ltd | 0.002 | 33% | 209,898 | $6,000,297 |

| BPH | BPH Energy Ltd | 0.016 | 33% | 15,475,240 | $14,618,794 |

| C7A | Clara Resources | 0.004 | 33% | 2,027,954 | $1,764,813 |

| JAY | Jayride Group | 0.004 | 33% | 2,507,423 | $4,283,667 |

| PRM | Prominence Energy | 0.004 | 33% | 127,500 | $1,459,411 |

| BBN | Baby Bunting Grp Ltd | 2.460 | 33% | 3,199,126 | $249,601,932 |

| MGU | Magnum Mining & Exp | 0.009 | 29% | 502,325 | $16,226,260 |

| GTE | Great Western Exp. | 0.015 | 25% | 4,264,312 | $6,813,095 |

| ARV | Artemis Resources | 0.005 | 25% | 1,488,055 | $11,462,689 |

| QXR | Qx Resources Limited | 0.005 | 25% | 200,230 | $5,241,315 |

| EDE | Eden Inv Ltd | 0.050 | 24% | 259,995 | $13,269,699 |

| NOV | Novatti Group Ltd | 0.040 | 21% | 6,524,537 | $18,479,947 |

| BUY | Bounty Oil & Gas NL | 0.003 | 20% | 7,993,533 | $3,903,680 |

| DBO | Diabloresources | 0.024 | 20% | 7,387,064 | $3,362,317 |

| KP2 | Kore Potash PLC | 0.065 | 18% | 476,980 | $31,778,924 |

| ADD | Adavale Resource Ltd | 0.026 | 18% | 1,361,500 | $4,021,189 |

| ATV | Activeport Group | 0.027 | 17% | 70,942,070 | $15,800,473 |

| CGR | CGN Resources | 0.070 | 17% | 324,763 | $5,446,691 |

Alice Queen (ASX:AQX) has officially lodged and registered a 15-year mining lease application for its Horn Island gold project in Queensland’s Torres Strait. The application, through its 84.5%-owned arm Kauraru Gold, covers 445 hectares and targets gold, copper and silver. Managing director Andrew Buxton said the move comes as strong partner interest builds, with the lease marking the culmination of a decade of work now locked in as MLA 100454 – Horn Island.

Baby Bunting (ASX:BBN) closed FY25 with pro forma NPAT of $12.1m, up 228% and at the top of guidance, on record sales of $521.9m. Gross margin jumped to 40.2%, while its “Store of the Future” refurbs lifted sales 28%. Net debt fell to $4.6m, and FY26 profit is tipped to rise further to $17–20m as more refurbs and new stores roll out.

Great Western Exploration (ASX:GTE) has zeroed in on what looks like the potential core of a large VHMS copper-gold system at its Oval Targets, right near Sandfire’s old DeGrussa deposit. A close-spaced gravity survey lit up a strong anomaly that lines up perfectly with the most prospective horizon defined by earlier drilling, exactly where you’d expect a “black smoker” copper-gold system to sit. With $2.7 million cash in the tank, the company says it’s well set to push ahead.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PET | Phoslock Env Tec Ltd | 0.015 | -40% | 11,644,004 | $15,609,763 |

| LNU | Linius Tech Limited | 0.001 | -33% | 700,000 | $9,751,824 |

| BIT | Biotron Limited | 0.003 | -25% | 700,000 | $5,308,983 |

| MBK | Metal Bank Ltd | 0.010 | -17% | 1,024,858 | $5,969,508 |

| PIL | Peppermint Inv Ltd | 0.003 | -17% | 1,107,370 | $6,994,230 |

| VEN | Vintage Energy | 0.005 | -17% | 3,000,000 | $12,521,482 |

| BEL | Bentley Capital Ltd | 0.011 | -15% | 444,000 | $989,663 |

| DRE | Dreadnought Resources | 0.011 | -15% | 859,884 | $66,033,500 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 1,087,685 | $22,214,246 |

| CHM | Chimeric Therapeutic | 0.003 | -14% | 7,595,592 | $11,390,956 |

| ENV | Enova Mining Limited | 0.006 | -14% | 535,150 | $11,053,200 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 100,000 | $11,697,542 |

| VKA | Viking Mines Ltd | 0.006 | -14% | 37,000 | $9,407,641 |

| WA1 | Wa1Resourcesltd | 16.660 | -14% | 797,706 | $1,322,194,108 |

| TZL | TZ Limited | 0.050 | -14% | 97,390 | $16,275,618 |

| 1TT | Thrive Tribe Tech | 0.007 | -13% | 1,058,950 | $1,250,950 |

| MRD | Mount Ridley Mines | 0.004 | -13% | 13,382,536 | $3,113,956 |

| OMG | OMG Group Limited | 0.007 | -13% | 2,815,728 | $5,826,359 |

| RGL | Riversgold | 0.004 | -13% | 43,000 | $6,734,850 |

LAST ORDERS

Miramar Resources (ASX:M2R) has extended the closing date for a share purchase plant to 5:00pm AWST on Wednesday, August 27, 2025. Management says the SPP extensions offers shareholders an opportunity to subscribe for new shares at a 20% discount to M2R’s current 5-day VWAP.

Results are still pending from the company’s recent drilling at the 8 Mile prospect within the Gidji JV Gold project, as well as from a detailed airborne electromagnetic survey underway at the Bangemall nickel-copper-platinum group element project

At Stockhead, we tell it like it is. While Miramar Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.