Lunch Wrap: ASX hits the brakes, rotating into defensive stocks

The ASX 200 is spinning its wheels in negative territory at the moment, taking stock as a shock rate hold and fresh tariffs add to uncertainty. Pic: Getty Images

- Copper prices surge as Trump threatens 50pc import tariff

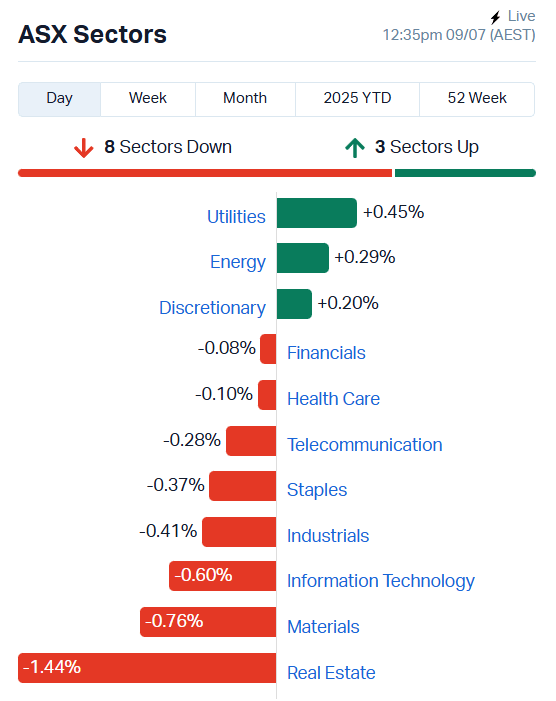

- ASX slides into defensive stocks, down 0.31pc

- Utilities lead gains as oil touches two-week high overnight

ASX slides as US markets trade sideways

The ASX 200 is down about 0.31% as of lunchtime AEST, as investors digest the week’s events.

While we’re well past the panicked selling after US President Trump’s initial salvo of tariff threats kicked off, US markets crab walked to the end of the trading day last night, mostly moving lower.

With less than a month until the August 1 deadline increases tariffs for dozens of countries, promised trade deals are showing few signs of eventuating.

Copper prices surged almost 10% overnight as Trump revealed plans for a 50% tariff on the red metal, reviving the spectre of semiconductor and pharmaceutical import taxes in the same breath.

Back home, markets and analysts alike were taken by surprise when the RBA left interest rates on hold yesterday despite an overwhelming expectation of a cut, citing continued global instability.

That’s taken the shine off any risky moves for traders today, which have rotated into defensive stocks like utilities and away from rate-exposed real estate stocks.

At the big end of town, Woodside Energy (ASX:WDS) has gained 1%, responding to a two-week high in oil prices, which reached US$70.15 a barrel of Brent last night before retreating marginally in trade today.

Pilbara Minerals (ASX:PLS) has also added 2.2%, while Evolution Mining (ASX:EVN) moved in the opposite direction, shedding 8.7%.

Telix Pharmaceuticals (ASX:TLX) is almost 6% higher at present, having secured a permanent healthcare system code from the US Centers for Medicare & Medicaid Services for its PSMA PET imaging agent, Gozellix, as it brings its new imaging agent to market.

ASX SMALL CAP WINNERS

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| REY | REY Resources Ltd | 0.028 | 155% | 333210 | $2,327,170 |

| PFE | Pantera Lithium | 0.027 | 125% | 77269353 | $5,685,404 |

| VFX | Visionflex Group Ltd | 0.002 | 100% | 9506255 | $3,367,860 |

| AYM | Australia United Min | 0.003 | 50% | 1026314 | $3,685,155 |

| PEC | Perpetual Res Ltd | 0.016 | 45% | 18884353 | $9,605,510 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 18293113 | $8,996,849 |

| RGL | Riversgold | 0.004 | 33% | 8867833 | $5,051,138 |

| AMS | Atomos | 0.005 | 25% | 1705687 | $4,860,074 |

| AUK | Aumake Limited | 0.0025 | 25% | 7516024 | $6,046,718 |

| BIT | Biotron Limited | 0.0025 | 25% | 16569 | $2,654,492 |

| CTN | Catalina Resources | 0.005 | 25% | 250000 | $9,704,076 |

| GGE | Grand Gulf Energy | 0.0025 | 25% | 1000067 | $5,640,850 |

| JAV | Javelin Minerals Ltd | 0.0025 | 25% | 6785014 | $12,504,450 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | 3000 | $1,556,978 |

| QXR | Qx Resources Limited | 0.005 | 25% | 383873 | $5,241,315 |

| D3E | D3 Energy Limited | 0.22 | 22% | 844416 | $14,305,501 |

| CAN | Cann Group Ltd | 0.018 | 20% | 1365090 | $9,542,642 |

| RMI | Resource Mining Corp | 0.018 | 20% | 44698 | $11,016,800 |

| TSL | Titanium Sands Ltd | 0.006 | 20% | 1503 | $11,723,736 |

| ZEU | Zeus Resources Ltd | 0.02 | 18% | 15817818 | $12,196,423 |

| ILA | Island Pharma | 0.17 | 17% | 2262848 | $34,233,490 |

| AS2 | Askarimetalslimited | 0.007 | 17% | 259586 | $2,425,024 |

| SHP | South Harz Potash | 0.0035 | 17% | 40000 | $3,849,186 |

| HCF | Hghighconviction | 0.03 | 15% | 199251 | $504,568 |

| VSR | Voltaic Strategic | 0.0135 | 13% | 4400000 | $6,810,603 |

In the news…

Pantera Lithium (ASX:PFE) is about to be $40m richer in cash and stock consideration, after offloading its Smackover lithium project in the US to Energy Exploration Technologies Inc.

PFE will walk away with $6m in cash and the rest in EET shares, maintaining exposure to the recovering lithium market through EnergyX’s three lithium projects in the Americas while freeing up operational capacity and capital for its own critical mineral ambitions.

Perpetual Resources (ASX:PEC) has hit a 200-metre-wide LCT pegmatite in maiden drilling at the Igrejinha project in Brazil’s Lithium Valley.

PEC reckons it’s a great result, as the new mineralisation sits below an outcrop which produced rock chip samples of up to 7.5% lithium. The company has opted to fast-track assays, with results expected in batches through July and August.

Catalina Resources (ASX:CTN) is at the other end of the drill bit, preparing to mobilise rigs to gold targets at the Laverton project.

CTN is chasing up air core drilling results of 28m at 1.09 g/t gold from 57m of depth using a reverse circulation rig to penetrate deeper into the host rock, exploring for extensions along strike and at depth.

The company is also looking for rare earth element mineralisation, having struck a very-high grade zone of 4m at 13,406 parts per million total rare earth oxides within a larger intersection of 9m at 7565ppm TREO from 47m of depth.

Island Pharmaceuticals (ASX:ILA) has expanded its therapeutic portfolio with the addition of the Galidesivir program, a broad-acting antiviral with a strong development history.

The US government has already sunk $US70m into developing the therapy, which is currently being investigated as a treatment for Marburg virus, a disease with a fatality ratio of up to 88%.

ASX SMALL CAP LAGGARDS

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TX3DA | Trinex Minerals Ltd | 0.07 | -45% | 11487 | $2,212,652 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 250000 | $3,225,642 |

| AQC | Auspaccoal Ltd | 0.019 | -27% | 6575412 | $18,212,157 |

| AQX | Alice Queen Ltd | 0.003 | -25% | 668783 | $4,998,560 |

| LOC | Locatetechnologies | 0.12 | -23% | 724350 | $36,293,910 |

| ROG | Red Sky Energy. | 0.004 | -20% | 1757007 | $27,111,136 |

| BMM | Bayanminingandmin | 0.046 | -19% | 2617413 | $5,868,458 |

| RNT | Rent.Com.Au Limited | 0.026 | -19% | 138248 | $27,294,098 |

| OKJ | Oakajee Corp Ltd | 0.036 | -18% | 200000 | $4,023,625 |

| BLU | Blue Energy Limited | 0.005 | -17% | 1228 | $11,105,842 |

| PRM | Prominence Energy | 0.0025 | -17% | 22473 | $1,459,411 |

| SPX | Spenda Limited | 0.005 | -17% | 1673107 | $27,691,293 |

| SIX | Sprintex Ltd | 0.042 | -16% | 144123 | $31,432,295 |

| TNY | Tinybeans Group Ltd | 0.11 | -15% | 200010 | $19,228,357 |

| AON | Apollo Minerals Ltd | 0.006 | -14% | 829443 | $6,499,198 |

| KGD | Kula Gold Limited | 0.006 | -14% | 825294 | $6,448,776 |

| LU7 | Lithium Universe Ltd | 0.006 | -14% | 193319 | $6,551,857 |

| EVR | Ev Resources Ltd | 0.0095 | -14% | 8328762 | $24,502,537 |

| CDE | Codeifai Limited | 0.026 | -13% | 8490830 | $14,069,660 |

| PNT | Panthermetalsltd | 0.013 | -13% | 25630839 | $4,513,568 |

| WNX | Wellnex Life Ltd | 0.27 | -13% | 7509 | $21,009,174 |

| DAL | Dalaroometalsltd | 0.027 | -13% | 368132 | $7,965,510 |

| ICR | Intelicare Holdings | 0.007 | -13% | 550000 | $3,889,505 |

| WEC | White Energy Company | 0.035 | -13% | 1000 | $12,464,796 |

| VIG | Victor Group Hldgs | 0.065 | -12% | 7712 | $48,264,774 |

IN CASE YOU MISSED IT

Break it Down: QMines (ASX:QML) has upgraded the Mount Mackenzie gold and silver resource base and further raised the bar on its production aspirations in Central Queensland.

DigitalX (ASX:DCC) has secured $20.7 million in strategic investment from a cohort of global digital asset leaders.

Locksley Resources (ASX:LKY/OTCQB:LKYRF) is preparing to test high-grade antimony zones at the Desert Antimony Mine after receiving the green light from the Bureau of Land Management.

DY6 Metals (ASX:DY6) is dramatically expanding the scale of its rutile holdings in Cameroon and investors are champing at the bit to grab a slice of the action.

StockTake: HyTerra (ASX:HYT) is preparing to spud the McCoy-1 well at its Nemaha helium project in Kansas, USA.

Island Pharmaceuticals (ASX: ILA) has signed an asset purchase agreement to buy the Galidesivir antiviral program targeting high-priority threat viruses.

LAST ORDERS

Vertex Minerals (ASX:VTX) is on track to begin churning out high-grade gold from the underground portion of the Reward gold mine, set to begin formally mining the 225k oz at 16.7 g/t resource within weeks.

At Stockhead, we tell it like it is. While Vertex Minerals, Perpetual Resources and Island Pharmaceuticals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.