Lunch Wrap: ASX glitters as gold miners strike back, while retail stocks retreat

Halloween Friday has been reasonably golden so far. Pic: Getty Images

- ASX climbs as gold regains its shine

- Origin Energy slips as utilities lose spark

- ResMed soars on quarterly report

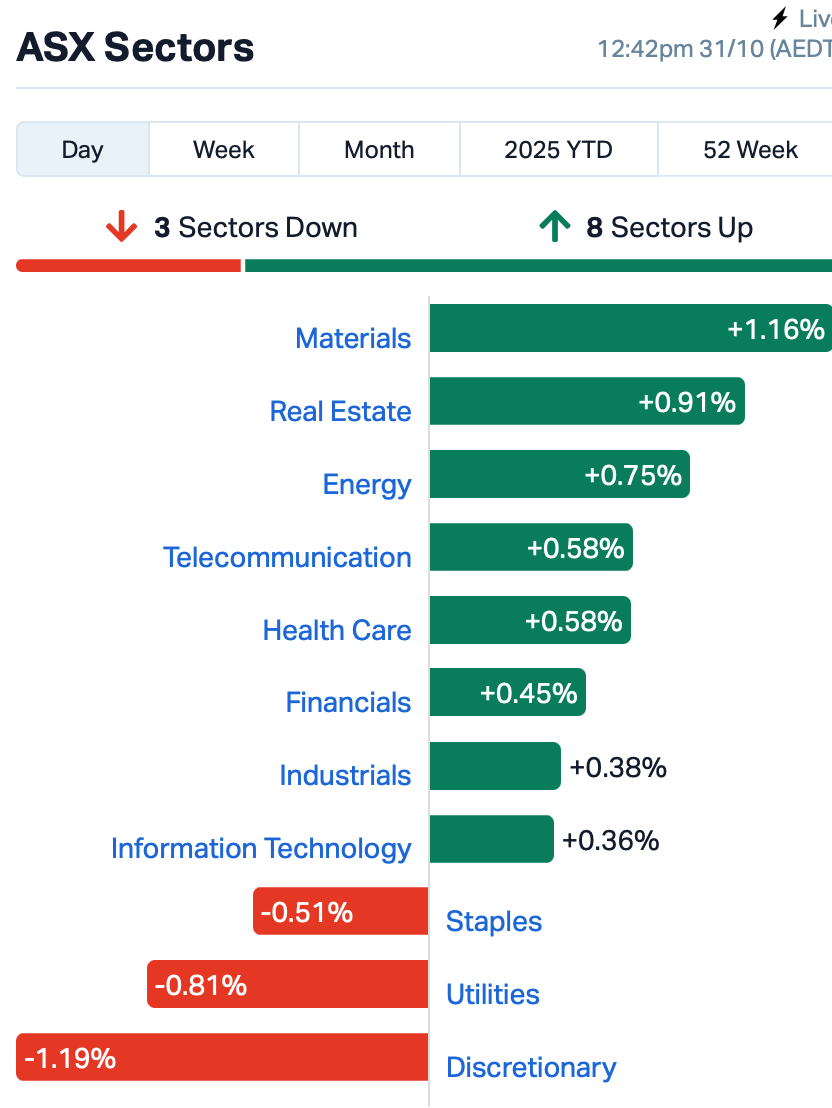

The ASX rose by around 0.45% on Friday lunchtime in the east, shaking off Wall Street’s wobble overnight.

Both the S&P 500 and Nasdaq fell, but Apple has just reported a record September quarter, and the stock popped 4% after-hours.

Amazon also surged 10% in the past hour after its AWS arm grew 20% during the quarter.

Back on home soil, it was the miners doing the heavy lifting this morning.

Gold stocks in particular were glittering again, after bullion prices rebounded 2% overnight.

That came hot on the heels of the Trump-Xi “truce” – an “amazing meeting,” said Trump.

China agreed to pause rare-earth export curbs, the US halved tariffs on fentanyl, and both sides walked away smiling like a couple still insisting dinner wasn’t awkward.

Investors didn’t buy it, of course. They bought gold. And plenty of it.

Both Newmont Corporation (ASX:NEM) and Bellevue Gold (ASX:BGL) were up 4%.

Meanwhile, Origin Energy (ASX:ORG) dipped as much as 5% after reporting flat gas output and a 12% drop in retail gas volumes in the quarter.

Investors didn’t like it, and the utilities sector ended the morning as one of the market’s biggest losers.

In other large cap news, sleep-tech heavyweight ResMed (ASX:RMD) reported a 9% lift in quarterly earnings to US$1.3 billion, with profits and margins both ticking higher. Shares jumped 3%.

Booze-baron Endeavour Group (ASX:EDV) took one on the chin, down 2% after Dan Murphy’s and BWS sales fell 1%. EDV shares were up 1%, but other retail stocks were dumped.

And, AGL Energy (ASX:AGL) said it was spending $185 million on four Siemens turbines for its new Kwinana Swift Gas 2 project in WA, the company’s first gas power station in the state.

It’s due online by 2027, right in time to fill the hole left by WA’s retiring coal fleet. Traders welcomed the news and AGL’s shares were bid up by 2%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| Security | Description | Last | % | Volume | MktCap |

| TMK | TMK Energy Limited | 0.002 | 100% | 16,235,984 | $11,897,383 |

| AUR | Auris Minerals Ltd | 0.040 | 48% | 6,163,697 | $14,799,236 |

| AUH | Austchina Holdings | 0.002 | 33% | 6,543,097 | $4,538,075 |

| FBR | FBR Ltd | 0.004 | 33% | 9,333,927 | $19,655,919 |

| SPQ | Superior Resources | 0.012 | 33% | 4,309,289 | $21,365,845 |

| MRD | Mount Ridley Mines | 0.033 | 32% | 86,666,243 | $29,842,042 |

| NSB | Neuroscientific | 0.125 | 25% | 191,173 | $33,257,571 |

| RNX | Renegade Exploration | 0.005 | 25% | 7,752,052 | $8,279,187 |

| SCP | Scalare Partners | 0.100 | 23% | 109,445 | $6,747,816 |

| FIN | FIN Resources Ltd | 0.011 | 22% | 2,794,002 | $6,253,996 |

| FRX | Flexiroam Limited | 0.011 | 22% | 2,859,963 | $13,656,587 |

| AMS | Atomos | 0.023 | 21% | 3,229,094 | $23,259,580 |

| PGD | Peregrine Gold | 0.265 | 20% | 271,488 | $21,666,503 |

| ENT | Enterprise Metals | 0.006 | 20% | 99,415 | $7,470,753 |

| EUR | European Lithium Ltd | 0.245 | 20% | 19,300,536 | $317,602,187 |

| PVW | PVW Res Ltd | 0.025 | 19% | 440,261 | $5,225,450 |

| LRM | Lion Rock Minerals | 0.032 | 19% | 9,122,129 | $82,725,763 |

| SBR | Sabre Resources | 0.013 | 18% | 42,916 | $4,339,081 |

| NVA | Nova Minerals Ltd | 0.960 | 18% | 1,807,406 | $334,568,239 |

| AGD | Austral Gold | 0.093 | 18% | 75,472 | $48,372,597 |

| COB | Cobalt Blue Ltd | 0.140 | 17% | 1,871,443 | $61,413,097 |

| IPB | IPB Petroleum Ltd | 0.007 | 17% | 5,928,385 | $4,238,418 |

AustChina Holdings (ASX:AUH) is back on the ground in Tassie, kicking off fieldwork at its Sulphide Creek gold-antimony project where it mapped a 500m alteration zone and uncovered a new adit hinting at a fresh mineralisation model.

Prep’s also underway at the Mersey VMS project, with mapping, sampling and EM surveys to follow. Post-quarter, it signed a Heads of Agreement for a new high-grade minerals portfolio and a $1.5m LOI with Bluestone Energy.

Superior Resources (ASX:SPQ) has bulked up its Greenvale Project, expanding its footprint by 56% to 3,602km² and locking in district-scale exposure to copper-gold systems across 150km of strike.

At Hall’s Reward, rock chips hit grades up to 46.5% Cu, 6.6g/t Au and 24.5g/t Ag, with drilling now being planned around the old workings and a potential 2km lode. Nearby at Telegraph, assays also impressed with copper above 10%.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 8IH | 8I Holdings Ltd | 0.031 | -37% | 1,955,354 | $17,059,882 |

| RBR | RBR Group Ltd | 0.001 | -33% | 2,000,000 | $5,161,927 |

| MYX | Mayne Pharma Ltd | 4.200 | -32% | 2,215,778 | $503,724,127 |

| LIB | Liberty Metals | 0.003 | -25% | 7,248,139 | $23,931,732 |

| MEM | Memphasys Ltd | 0.003 | -25% | 617,565 | $8,964,392 |

| POL | Polymetals Resources | 0.945 | -24% | 2,457,608 | $333,428,028 |

| SRN | Surefire Rescs NL | 0.002 | -20% | 400,000 | $10,064,023 |

| VEN | Vintage Energy | 0.004 | -20% | 5,952,887 | $10,434,568 |

| BTM | Breakthrough Minsltd | 0.190 | -17% | 312,566 | $15,817,260 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 955,946 | $22,841,346 |

| ERA | Energy Resources | 0.003 | -17% | 1,548,318 | $1,216,188,722 |

| TMX | Terrain Minerals | 0.005 | -17% | 5,775,963 | $16,090,886 |

| EYE | Nova EYE Medical Ltd | 0.135 | -16% | 1,393,889 | $45,571,405 |

| OLY | Olympio Metals Ltd | 0.065 | -16% | 298,257 | $8,124,475 |

| TG6 | Tgmetalslimited | 0.200 | -15% | 866,405 | $24,051,896 |

| AVD | Avada Group Limited | 0.180 | -14% | 54,406 | $17,836,355 |

| M4M | Macro Metals Limited | 0.006 | -14% | 85,882 | $30,242,396 |

| RDN | Raiden Resources Ltd | 0.006 | -14% | 703,726 | $24,156,240 |

| TEG | Triangle Energy Ltd | 0.003 | -14% | 460,000 | $7,704,319 |

| EXL | Elixinol Wellness | 0.013 | -13% | 446,485 | $4,154,871 |

| ENV | Enova Mining Limited | 0.007 | -13% | 19,206 | $12,632,229 |

| NES | Nelson Resources. | 0.007 | -13% | 1,201,784 | $17,572,755 |

| PER | Percheron | 0.007 | -13% | 782,644 | $8,699,501 |

IN CASE YOU MISSED IT

Rhythm Biosciences (ASX:RHY) says its ColoSTAT blood test continues to deliver strong, consistent results across ages and genders, and early data suggests it could even help detect bowel cancer in patients under 50.

RareX (ASX:REE) has signed an MOU with US Strategic Metals to advance critical minerals processing and supply chains between Australia and the US – with its Cummins Range project set to play a key role.

RLF AgTech (ASX:RLF) delivered record September-quarter cash receipts of $5.3m, with LiquaForce revenue up 39% and a new national Nutrien deal boosting reach across 700+ outlets.

Everest Metals Corporation (ASX:EMC) has secured a WA government co-funded drilling grant of up to $90k under Round 32 of the Exploration Incentive Scheme to fast-track gold drilling at its Mt Dimer project.

LAST ORDERS

Terrain Minerals (ASX:TMX) raised $1.17m at $0.0045 a share, led by GBA Capital, to fund drilling at its Smokebush Project, targeting high-grade gold and silver at Lightning and Wildflower.

Locksley Resources (ASX:LKY) has begun a high-res heli-mag and radiometrics survey at its Mojave Project in California to fast-track new REE and antimony targets.

Terra Metals (ASX:TM1) has strengthened its technical team at the Dante Project in WA, appointing Dr Solomon Buckman as Chief Geologist and Dr Evan Kirby as Chief Metallurgist.

They are two highly credentialed experts set to drive the project’s next development phase.

White Cliff Minerals (ASX:WCN) has received the final $1m from Bain Global for Reedy South, wrapping up its Aussie exit to focus on its Rae Copper-Silver Project in Canada.

At Stockhead, we tell it like it is. While Locksley Minerals, Terra Metals, Terrain Minerals and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.