Lunch Wrap: ASX dunks another record, as earnings mayhem delivers more surprises

Another record slammed home for the ASX. Picture via Getty Images

- ASX hits record as Brambles and Goodman shine

- Super Retail rockets, while James Hardie sinks deeper

- Gold glitters for Northern Star but Megaport crashes

The ASX came out swinging on Thursday, up a thumping 1.07% by lunchtime in the east and brushing past a fresh record high.

All this played out as Wall Street stumbled overnight, with the Nasdaq down another 0.7%.

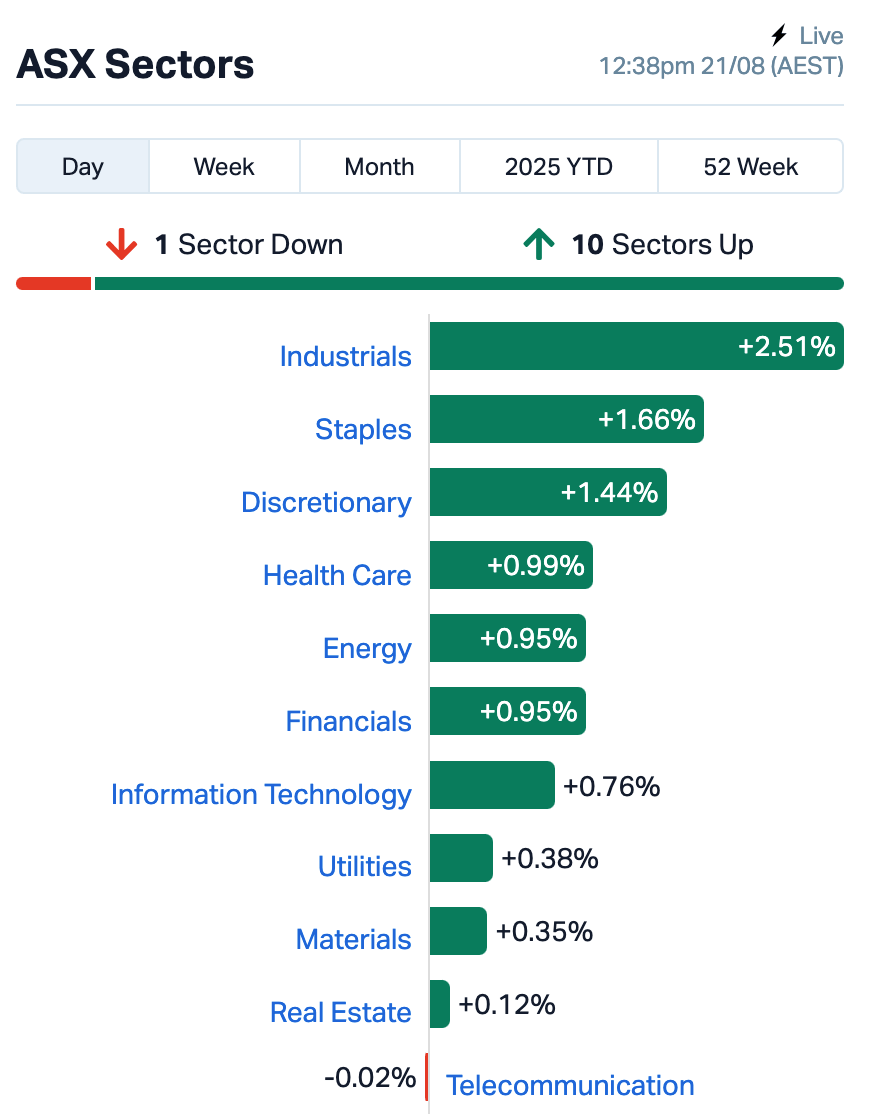

On the ASX, 10 out of 11 sectors were in the green. Investors weren’t chasing moonshots today as industrials and staples led the charge.

CSL (ASX:CSL), after being belted earlier in the week and wiping billions off its market cap, finally found some dip buyers. The stock climbed 2.5% as bargain hunters decided maybe the panic was a touch overcooked.

James Hardie (ASX:JHX), though, was today’s market villain again. After Wednesday’s brutal 28% collapse on weak US earnings, the brokers piled on with fresh downgrades. The stock slumped another 11%, leaving investors wondering if there’s a second act to this horror show.

ASX earnings highlights

Earnings season rolls on, and here are some of the highlights from this morning.

Pallets and logistics firm Brambles (ASX:BXB) didn’t muck around in its full-year numbers, throwing US$400 million at a buyback and lifting its final dividend 10% after profits climbed 15%. That was enough to send the stock surging 10% and drag the whole industrials sector higher.

Goodman Group (ASX:GMG) pulled off a $1.67 billion profit swing, flipping last year’s $98.9 million loss into the black. Goodman’s property portfolio has its fingers in all the right pies: warehouses, logistics, data centres.

Super Retail Group (ASX:SUL) rocketed 14% to a record high after posting $4.1 billion in full-year sales, proving Aussies still love sweating it out in Rebel’s Lycra.

Bega Cheese (ASX:BGA) clawed back credibility, climbing 8% as its bulk dairy division finally swung back into profit. That eased pressure on the higher-margin branded business, where Vegemite continues doing its patriotic duty.

Northern Star Resources (ASX:NST) glittered as well, handing investors a 37% dividend increase on the back of surging bullion prices. Profits doubled to $1.34 billion, one of the fattest hauls ever recorded by an Aussie gold miner.

Whitehaven Coal (ASX:WHC) rose 1% despite weaker prices chewing into profits. Coal isn’t dead, but it’s definitely lost some fizz.

Sonic Healthcare (ASX:SHL), the second biggest healthcare stock on the ASX, stumbled 7% after its result underwhelmed. Revenues and profit were higher, but when you’ve been priced to perfection, “decent” isn’t going to cut it.

Meanwhile, Megaport (ASX:MP1) was down 2% after telling the market FY26 is going to be a slog. The cloud connector actually beat expectations in FY25.

Sounds good, right? The catch is, its operating expenses are set to balloon 35% as the company pours cash into sales and marketing, leaving EBITDA trailing below consensus.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| OMG | OMG Group Limited | 0.013 | 79% | 56,959,791 | $5,098,064 |

| ERA | Energy Resources | 0.003 | 50% | 1,854 | $810,792,482 |

| JNS | Janus Electric | 0.145 | 46% | 2,661,587 | $8,981,385 |

| TON | Triton Min Ltd | 0.007 | 40% | 692,306 | $7,841,944 |

| AYA | Artrya | 1.795 | 38% | 3,364,393 | $148,315,852 |

| BMO | Bastion Minerals | 0.002 | 33% | 265,000 | $3,307,430 |

| T3D | 333D Limited | 0.012 | 33% | 60,714 | $1,699,684 |

| OCT | Octava Minerals | 0.050 | 32% | 10,535,873 | $2,897,854 |

| RDX | Redox Limited | 2.635 | 25% | 1,830,519 | $1,102,670,999 |

| 1AD | Adalta Limited | 0.005 | 25% | 482,000 | $4,618,599 |

| BP8 | Bph Global Ltd | 0.003 | 25% | 12,350,000 | $2,101,969 |

| QXR | Qx Resources Limited | 0.005 | 25% | 49,360 | $5,241,315 |

| TKL | Traka Resources | 0.003 | 25% | 15,000 | $6,055,348 |

| GED | Golden Deeps | 0.043 | 23% | 4,900,420 | $6,199,400 |

| HMY | Harmoney Corp Ltd | 0.795 | 22% | 665,902 | $67,636,864 |

| BPM | BPM Minerals | 0.074 | 21% | 2,518,971 | $5,325,320 |

| TMB | Tambourahmetals | 0.057 | 21% | 3,068,894 | $7,777,374 |

OMG Group (ASX:OMG) has landed a big boost from Woolworths, with its 1L Barista Oat Milk set to hit 900 stores from November, up from 544 today. It comes on top of fresh wins in the petrol and convenience channel, with products already moving through 7-Eleven, Quikstop and Canteen One, and adds to record online sales momentum.

Janus Electric Holdings (ASX:JNS) has signed an MOU with EVUNI, giving EVUNI exclusive rights to roll out its electric drivetrain technology across Africa. The deal includes up to a $5 million equity investment into Janus at $0.20 a share, tied to milestones, and a commitment for at least 250 truck conversion modules a year over five years.

Artrya (ASX:AYA) has secured FDA 510(k) clearance for its Salix Coronary Plaque module, a major milestone in its US rollout. The AI-powered tool gives clinicians near real-time detection of high-risk plaque and plugs straight into the Salix Coronary Anatomy platform already live with Tanner Health. Artrya said it is now able to charge per CCTA scan assessed at a US Category 1 reimbursement rate of about US$950 each.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 0.370 | -66% | 6,979,658 | $159,192,392 |

| PPY | Papyrus Australia | 0.021 | -34% | 5,578,840 | $19,292,215 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 480,333 | $20,225,588 |

| C7A | Clara Resources | 0.003 | -25% | 6,137 | $2,973,180 |

| CHM | Chimeric Therapeutic | 0.003 | -25% | 1,597,558 | $13,018,235 |

| ICU | Investor Centre Ltd | 0.002 | -25% | 480 | $609,023 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 41,524,585 | $10,000,495 |

| DTM | Dart Mining NL | 0.002 | -20% | 1,200,360 | $2,995,139 |

| WEL | Winchester Energy | 0.002 | -20% | 49,068 | $3,407,547 |

| IPH | IPH Limited | 4.560 | -18% | 7,794,235 | $1,456,442,928 |

| AZI | Altamin Limited | 0.020 | -17% | 5,567 | $13,788,069 |

| NAE | New Age Exploration | 0.003 | -17% | 574,000 | $8,117,734 |

| OVT | Ovanti Limited | 0.010 | -17% | 53,312,341 | $51,291,883 |

| RC1 | Redcastle Resources | 0.010 | -17% | 4,070,602 | $8,922,803 |

| TMK | TMK Energy Limited | 0.003 | -17% | 1,336,666 | $30,667,149 |

| VEN | Vintage Energy | 0.005 | -17% | 4,477,198 | $12,521,482 |

| RAU | Resouro Strategic | 0.195 | -15% | 22,600 | $11,013,256 |

| D3E | D3 Energy Limited | 0.280 | -15% | 11,365 | $26,226,752 |

IN CASE YOU MISSED IT

Australian Mines (ASX:AUZ) appears set to add to a sizeable gold resource at the Boa Vista project with high-grade results up to2m at 52.1 g/t.

Ausgold’s (ASX:AUC) plans to develop its Katanning gold project in WA’s Great Southern region have received a shot in the arm after it acquired a substantial parcel of freehold land.

LAST ORDERS

Ballard Mining (ASX:BM1) has kicked off several work streams at the Mt Ida project, initiating infill and extensional drilling of existing resources, exploration drilling and water supply drilling.

Four drill rigs are already turning, focused on the Dickson, Neptune and Pulsar prospects on the Baldock Thrust and Ballard Fault formations alongside eighteen high priority exploration targets.

At Stockhead, we tell it like it is. While Ballard Mining is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.