Lunch Wrap: ASX cruises as CATL mine closure sends lithium into overdrive

Lithium stocks rocket as CATL mine shuts. Picture via Getty Images

- Lithium stocks rocket as CATL mine shuts

- JB Hi-Fi and Car Group CEOs call time

- Capstone, Eagers and DroneShield drop big moves

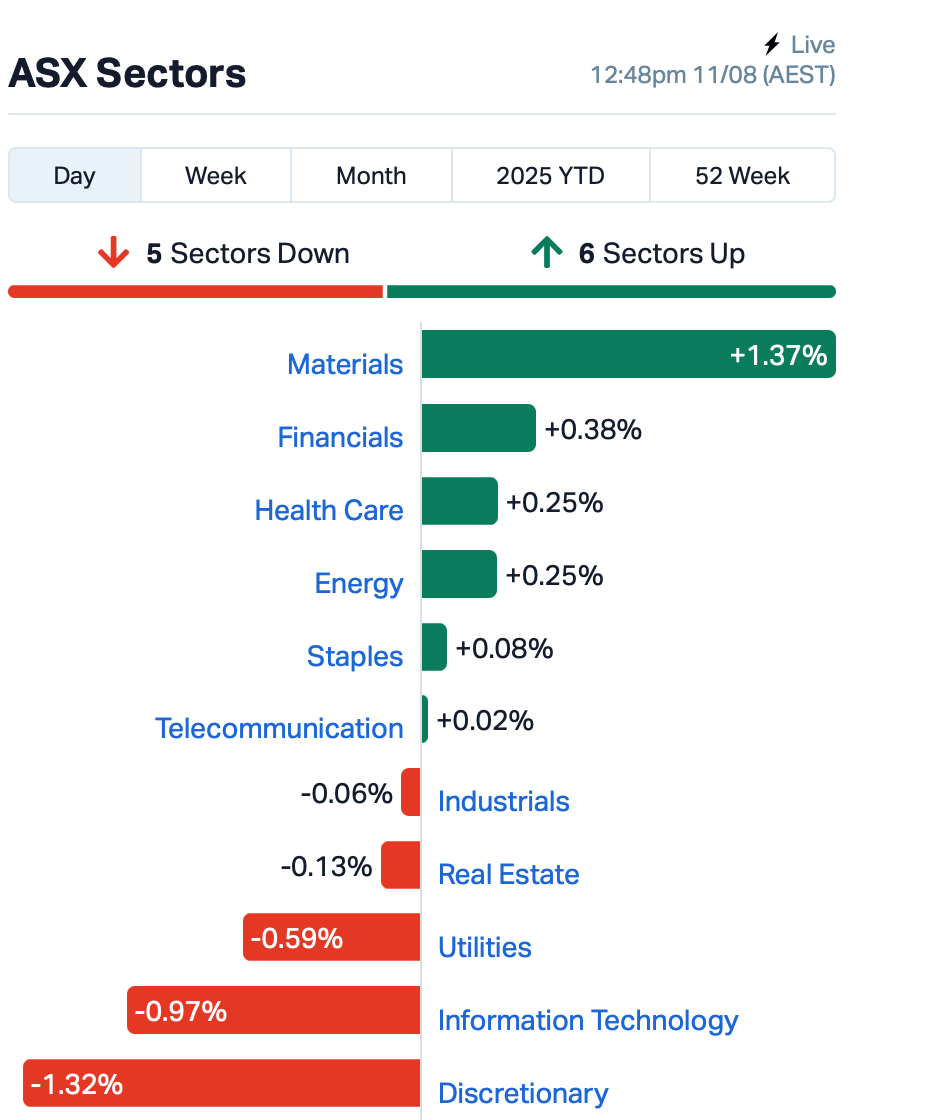

By Monday lunchtime in the east, the ASX was cruising 0.25% higher, catching a lift from Wall Street’s record-breaking finish on Friday.

Bitcoin is also up 4% in the past 24 hours and closing in on its all time high again, while altcoins have been buzzing, too, after Ripple’s US$200 million Rail acquisition sent XRP, Ethereum and Solana higher.

But it was the mining sector doing most of the heavy lifting this morning, mostly because lithium just found itself a fresh jolt of adrenaline.

There’s been a lithium frenzy after a major Chinese mine shut its gates.

Reports said the world’s biggest EV battery maker, CATL, has let a key mining permit lapse.

And when the mine you’re shutting has been a significant source of lithium supply in China – the world’s processing powerhouse – the market hits the panic button.

Traders are now bracing for a short-term squeeze in feedstock, and every lithium stock is riding the sugar high this morning.

Pilbara Minerals (ASX:PLS) and Liontown Resources (ASX:LTR) jumped around 14% and 18% respectively on the news.

In other large cap news, JB HiFi (ASX:JBH) dipped 9% despite a result that beat expectations and came with a shareholder payday.

The bad news was CEO Terry Smart said he will step down after more than two decades, handing the reins to COO Nick Wells.

CAR Group (ASX:CAR) (formerly Carsales) rose 1% on a 10% jump in NPAT to $275 million, a final dividend of 41.5¢, and guidance for double-digit earnings growth next year.

Outgoing CEO Cameron McIntyre leaves after 18 years with the company, having built an international classifieds empire across the globe.

DroneShield (ASX:DRO) added 0.5% after launching SentryCiv, a subscription-based AI counter-drone system for civilian infrastructure like airports and utilities.

Still in large caps, Eagers Automotive (ASX:APE) announced a non-binding MoU with Mitsubishi Corporation to explore growth in dealerships, finance, fleet, and crucially, “new energy” vehicles. Shares were down 1%.

Finally, Capstone Copper Corp (ASX:CSC) confirmed a US$176 million expansion of its Mantoverde project in Chile, set to lift copper output by 20,000 tonnes a year once fully ramped in 2027. CSC’s chares rallied 5%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ETM | Energy Transition | 0.115 | 109% | 42,924,519 | $85,327,477 |

| BP8 | Bph Global Ltd | 0.002 | 100% | 498,187 | $1,050,985 |

| DAL | Dalaroometalsltd | 0.038 | 52% | 1,896,683 | $6,491,298 |

| LNU | Linius Tech Limited | 0.002 | 50% | 19,013,171 | $6,501,216 |

| PAB | Patrys Limited | 0.002 | 50% | 881,202 | $2,365,810 |

| PLC | Premier1 Lithium Ltd | 0.008 | 33% | 4,731,318 | $2,208,363 |

| BCC | Beam Communications | 0.155 | 29% | 120,000 | $10,370,631 |

| BCN | Beacon Minerals | 1.670 | 29% | 330,868 | $136,831,237 |

| FNR | Far Northern Res | 0.175 | 25% | 71,142 | $5,637,216 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 3,714,500 | $4,114,130 |

| MRD | Mount Ridley Mines | 0.003 | 25% | 630,084 | $1,556,978 |

| EPM | Eclipse Metals | 0.027 | 23% | 26,489,816 | $65,981,352 |

| ADO | Anteotech Ltd | 0.028 | 22% | 11,187,346 | $62,221,907 |

| GBZ | GBM Rsources Ltd | 0.034 | 21% | 4,228,579 | $39,644,111 |

| ZEO | Zeotech Limited | 0.071 | 20% | 11,152,663 | $110,933,456 |

| ADY | Admiralty Resources. | 0.006 | 20% | 295,279 | $13,147,397 |

| SER | Strategic Energy | 0.006 | 20% | 166,666 | $4,183,458 |

| SPQ | Superior Resources | 0.006 | 20% | 4,794,499 | $11,854,914 |

| TFL | Tasfoods Ltd | 0.006 | 20% | 684,735 | $2,185,478 |

| LTR | Liontown Resources | 1.008 | 19% | 38,298,742 | $2,052,847,208 |

| MPK | Many Peaks Minerals | 0.860 | 19% | 763,708 | $88,748,959 |

| FL1 | First Lithium Ltd | 0.125 | 19% | 117,331 | $8,363,628 |

BPH Global (ASX:BP8) says its R&D partner TPIH will run extra assays on naturally growing seaweed Sesuvium portulacastrum, to check its knack for hoarding gold, silver and rare earths. It’s a freebie for the company, building on earlier work that showed the species can pack high-value metals into its biomass. The fresh tests will help confirm whether wild-grown seaweed matches or beats the metal content seen in cultivated samples, bolstering its case as a future source of “bio-ore.

Linius Technologies (ASX:LNU) has secured its first sale of Captivate to long-time partner Honest Technology Partners in a deal worth over $250k. The two-year contract will see Captivate used to give ice hockey fans personalised, TikTok-style highlight reels from entire video archives, helping rights-holders boost engagement and monetise directly. The agreement runs through to July 2027, with scope to grow if more games are added.

Beacon Minerals (ASX:BCN) has wrapped up its biggest-ever RC drill program at the Lady Ida Iguana deposit, punching 298 holes for 16,506 metres to firm up confidence ahead of first production early next year. The first 2,970 assays are back, showing standout hits like 6 metres at 46.8 g/t gold and 5 metres at 39.3 g/t, with some intercepts over 100 g/t. The remaining 13,500 results are due in the next two months, and the high-grade Northwest corridor has Beacon eyeing deeper follow-up drilling.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SNT | Syntara Limited | 0.031 | -46% | 45,724,768 | $92,775,383 |

| AOK | Australian Oil. | 0.002 | -33% | 1,171,757 | $3,113,349 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 655 | $9,671,169 |

| BUX | Buxton Resources Ltd | 0.029 | -31% | 8,771,685 | $14,431,448 |

| AQX | Alice Queen Ltd | 0.003 | -25% | 2,500 | $5,538,785 |

| GTR | Gti Energy Ltd | 0.003 | -25% | 1,895,616 | $14,890,619 |

| JAY | Jayride Group | 0.003 | -25% | 983,469 | $5,711,556 |

| EQS | Equitystorygroupltd | 0.020 | -20% | 126,964 | $4,170,510 |

| AYM | Australia United Min | 0.002 | -20% | 500 | $4,606,444 |

| MSI | Multistack Internat. | 0.004 | -20% | 89,033 | $681,520 |

| PGY | Pilot Energy Ltd | 0.009 | -18% | 8,523,886 | $23,745,260 |

| HTG | Harvest Tech Grp Ltd | 0.015 | -17% | 485,790 | $16,362,330 |

| CRR | Critical Resources | 0.005 | -17% | 23,405 | $16,620,513 |

| SHP | South Harz Potash | 0.003 | -17% | 200,000 | $4,415,170 |

| TKL | Traka Resources | 0.003 | -17% | 15,024,534 | $7,266,417 |

| TMX | Terrain Minerals | 0.003 | -17% | 1,154,239 | $7,595,443 |

| VAR | Variscan Mines Ltd | 0.005 | -17% | 7,622,922 | $4,697,146 |

| NVQ | Noviqtech Limited | 0.036 | -14% | 1,881,216 | $10,564,535 |

| TON | Triton Min Ltd | 0.006 | -14% | 300,000 | $10,978,721 |

| TSL | Titanium Sands Ltd | 0.006 | -14% | 43,500 | $16,413,230 |

| PER | Percheron | 0.010 | -14% | 3,247,727 | $11,961,814 |

| GT3 | G360 Technologies | 0.028 | -13% | 761,201 | $32,304,493 |

Last Orders

AnteoTech (ASX:ADO) has taken in $2.59m in cash from the ATO from a research and development tax incentive for the activities across both its advanced battery tech and life science divisions.

An acceleration for the incentive was a key outcome highlighted in a recent strategic review and refreshed strategy which has prioritised a commercial rollout of AnteoTech’s advanced technologies across key global markets.

Sovereign Metals (ASX:SVM) has finalised its mining method and fleet design and capped off another key input for the ongoing definitive feasibility work at its Kasiya rutile-graphite project in Malawi.

The fleet has been specifically engineered for large-scale dry mining operations, and Sovereign CEO Frank Eagar said its successful validation has enabled it to design a fleet that delivers on a commitment to industry-leading low operating costs while maintaining exceptional flexibility and reliability.

DY6 Metals (ASX:DY6) has validated the high-quality nature of oversized natural rutile nuggets recently found at its Central rutile project in Cameroon with XRF results coming in at an average of 95.64% titanium dioxide.

CEO Cliff Fitzhenry said both the high levels of titanium and low impurities suggest a premium quality, and that the array of lab results provide an excellent foundation for real-time geochemical analysis and delivering low cost, rapid assay turnaround times for future exploration.

West Wits Mining (ASX:WWI) has completed the buy-back of a 10% minority interest and raised the interest in its 5Moz Witwatersrand Basin project in South Africa from 66.6% to 74%.

West Wits considers the deal as a value accretive one, particularly considering a recent DFS which outlined the project as quite the golden prize with a post-tax net present value of US$500m.

Horseshoe Metals (ASX:HOR) has appointed copper mining expert Steve Sickerdick as GM of oxide copper operations to facilitate a direct shipping ore start-up at the historic Horseshoe Lights mine just 60km westward of the legendary DeGrussa copper and gold mine.

Horseshoe believes the project still remains both underexplored and underdeveloped, and director and CFO Kate Stoney said the company was delighted to welcome such an experienced operator as it enters an exciting phase in its evolution as an emerging copper developer.

RareX (ASX:REE) has commissioned a consultancy firm to conduct early-stage community engagement for its Mrima Hill critical minerals project in Kenya.

Managing director James Durrant said the company was confident its consortium with Iluka offers the strongest delivery model for the project, but it had to first earn the trust of local communities, and that leading East African firm AWEMAC’s deep local experience would ensure a mutually confidence-building process.

In Case You Missed It

Power Minerals (ASX:PNN) has completed its due diligence over Santa Anna and is now all set to acquire the Brazilian niobium-rare earths project and enhance its position as a South American-focused explorer and developer of clean energy metals.

Greenvale Energy (ASX:GRV) has swollen the footprint of its Douglas River uranium project by 70% and further backed its belief in the prospectivity of the Northern Territory’s Pine Creek region as it prepares to start of exploration.

Nordic Resources (ASX:NNL) has appointed Henrik Grind as its country manager to oversee the company’s exploration across its Finnish portfolio.

Belararox (ASX:BRX) is gearing up to drill in Botswana later this month on its hunt for the next big discovery in the Kalahari Copper Belt.

At Stockhead, we tell it like it is. While AnteoTech, Sovereign Metals, DY6 Metals, West Wits Mining, Horseshoe Metals and RareX are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.