Lunch Wrap: ASX comes out swinging, rare earth stocks catch fire on price floor plan

The ASX came out swinging on Tuesday. Picture via Getty Images

- ASX fires up as Wall Street sniffs rate cuts

- Rare earth stocks climb after Canberra hints floor price plan

- Telix tanks as ballooning costs spook investors

The ASX 200 came out swinging on Tuesday, with the benchmark index jumping 1% by lunchtime in the east.

Behind the rally was Wall Street, where jittery traders turned into bargain hunters as all three major indexes jumped over 1%.

Back home, the good vibes got an extra kick from rising consumer confidence this morning.

The ANZ-Roy Morgan index jumped to 90.6, its highest reading since the RBA started its rate-hiking crusade back in May 2022.

That mood music flowed nicely into the market itself.

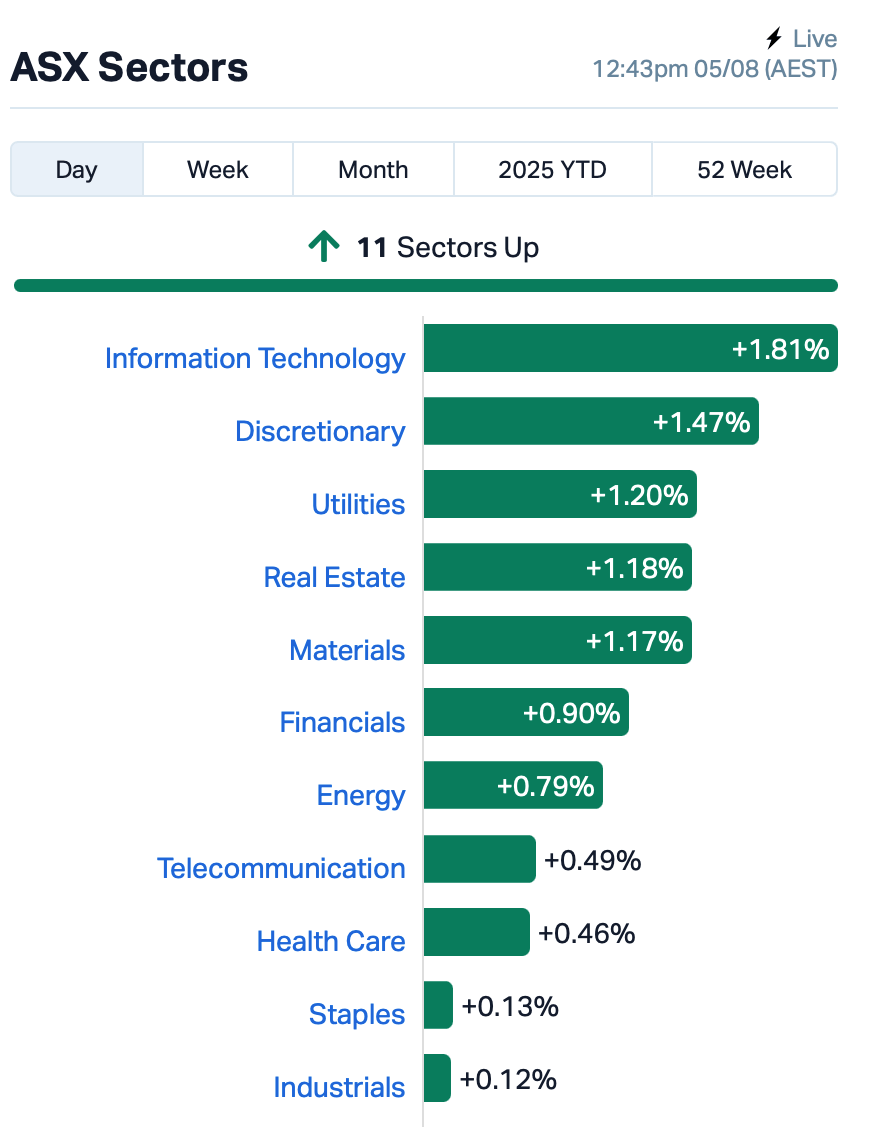

All 11 sectors on the ASX were in the green by mid-morning, with tech, miners and consumer discretionary stocks leading the pack.

Meanwhile, rare earth stocks such as Iluka Resources (ASX:ILU) and Lynas (ASX:LYC) rallied after reports the Aussie government might pull a Trump-style move and set a floor price for rare earths.

The Trump administration has already announced it was pushing a price floor to boost US rare earths production and cut reliance on China.

The idea of a government stepping in to backstop the price of critical minerals is enough to get investors clicking “buy”.

Among large cap news, debt collector Credit Corp Group (ASX:CCP) absolutely stole the spotlight, flying 16% after posting a 16% jump in full-year profit to $94.1 million.

Shipbuilder Austal (ASX:ASB) lifted 6% as it locked in a sovereign defence shipbuilding role with the federal government, and upgraded earnings guidance to not less than $100 million.

The move came hot on the heels of news that Japan has scored a $10 billion deal to build three stealth frigates for the Royal Australian Navy.

Meanwhile, Telix Pharmaceuticals (ASX:TLX) took a savage 20% beating after revealing that operating expenses had ballooned in the first half of FY25.

The company, which recently switched to reporting in US dollars, flagged that OPEX (excluding R&D) will hit about 36% of revenue … which spooked the market.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for August 5 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| TKL | Traka Resources | 0.002 | 100% | 63,225,692 | $2,125,790 |

| SRJ | SRJ Technologies | 0.006 | 50% | 4,202,913 | $2,778,987 |

| HMD | Heramed Limited | 0.017 | 42% | 16,673,347 | $10,507,233 |

| THB | Thunderbird Resource | 0.014 | 40% | 7,657,666 | $3,897,414 |

| AUK | Aumake Limited | 0.004 | 33% | 145,012 | $9,070,076 |

| EOS | Electro Optic Sys. | 3.930 | 33% | 7,207,276 | $569,208,692 |

| M4M | Macro Metals Limited | 0.008 | 25% | 17,774,500 | $23,864,505 |

| TRP | Tissue Repair | 0.350 | 25% | 137,781 | $16,930,156 |

| SIS | Simble Solutions | 0.005 | 25% | 1,000,000 | $4,329,321 |

| FAL | Falconmetalsltd | 0.598 | 22% | 2,367,091 | $87,003,080 |

| MEG | Megado Minerals Ltd | 0.039 | 22% | 243,144 | $20,661,864 |

| ALR | Altairminerals | 0.006 | 20% | 41,540,415 | $21,483,721 |

| CUL | Cullen Resources | 0.006 | 20% | 250,328 | $3,467,009 |

| FRX | Flexiroam Limited | 0.006 | 20% | 81,250 | $7,586,993 |

| CCP | Credit Corp Group | 18.290 | 20% | 786,540 | $1,038,700,223 |

| ZNC | Zenith Minerals Ltd | 0.037 | 19% | 670,906 | $16,413,120 |

| WTM | Waratah Minerals Ltd | 0.470 | 19% | 2,587,983 | $92,237,345 |

| TEM | Tempest Minerals | 0.007 | 17% | 49,206 | $6,610,770 |

| TZL | TZ Limited | 0.055 | 15% | 59,326 | $13,469,477 |

| RKN | Reckon Limited | 0.595 | 14% | 531,134 | $58,913,313 |

| AZL | Arizona Lithium Ltd | 0.008 | 14% | 2,118,093 | $37,662,201 |

| CTO | Citigold Corp Ltd | 0.004 | 14% | 100,000 | $10,500,000 |

| RGL | Riversgold | 0.004 | 14% | 150,440 | $5,892,994 |

Software firm SRJ Technologies Group (ASX:SRJ) has locked in $1.38 million from institutional investors at $0.004 a pop, with strong backing from existing shareholders. The retail component set to raise a further $1.15 million when it opens on 8 August. Funds will help SRJ kick off a 50:50 joint venture in the Middle East worth over US$6 million.

Electro Optic Systems (ASX:EOS) has landed a EUR 71.4 million (around $125 million) export order from a European NATO member for its new 100kW high-power laser weapon system, designed to take down drone swarms. It’s the world’s first export order for a laser of this class, with delivery set for 2025-2028.

Macro Metals (ASX:M4M) has locked in $2 million from new and existing professional investors at 0.7 cents a share. Non-exec chair Tolga Kumova is chipping in $311k of that, pending shareholder approval in November. The funds will go towards exploration at the Turner iron ore project, technical services at the Extension iron project, and ramping up its mining services arm.

Falcon Metals (ASX:FAL) has hit visible gold in multiple stacked veins at its Blue Moon prospect, just north of the 22Moz Bendigo Goldfield. The third wedge hole is drilling right down the fold hinge, and has struck quartz veining, sulphides, and what looks like a 7.6m saddle reef. Assays are pending.

And, Boss Energy (ASX:BOE) is still licking its wounds after last week’s brutal 44% crash, triggered by a cost and production downgrade at its Honeymoon uranium project. In a formal reply to the ASX today, Boss defended its disclosure timing, saying it only finalised the new guidance on July 27, one day before releasing it. Shares rose 5%.

IN CASE YOU MISSED IT

A positive case report has highlighted the therapeutic potential of Argent BioPharma’s (ASX:RGT) cannabinoid therapy CannEpil in treatment-resistant epilepsy.

Everest Metals Corporation (ASX:EMC) has the green light to commence mining at its Mt Dimer Taipan gold and silver project this year.

Albion Resources (ASX:ALB) has reason to cheer after the next batch of assays from drilling at the Collavilla prospect within its Yandal West project in WA returned more near-surface, high-grade gold results.

As Australia’s digital economy rapidly expands, new research reveals critical digital skill gaps that could unlock $25 billion in productivity gains by 2035.

West Coast Silver (ASX:WCE) has identified 12 high priority targets that could significantly increase silver resources at Elizabeth Hill.

Hot Chili (ASX:HCH) has announced a $14 million dollar, 2 for 13 non-renounceable rights issue, with funds to go to advancing the Costa Fuego copper-gold project and the Huasco Water project.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.