Lunch Wrap: ASX climbs, uranium stocks catch fire on Meta’s nuclear move

Uranium stocks are on fire today. Picture via Getty Images

- ASX climbs as uranium glows

- Meta’s nuclear deal lights up local energy stocks

- Aussie GDP stalls, Virgin preps for ASX liftoff

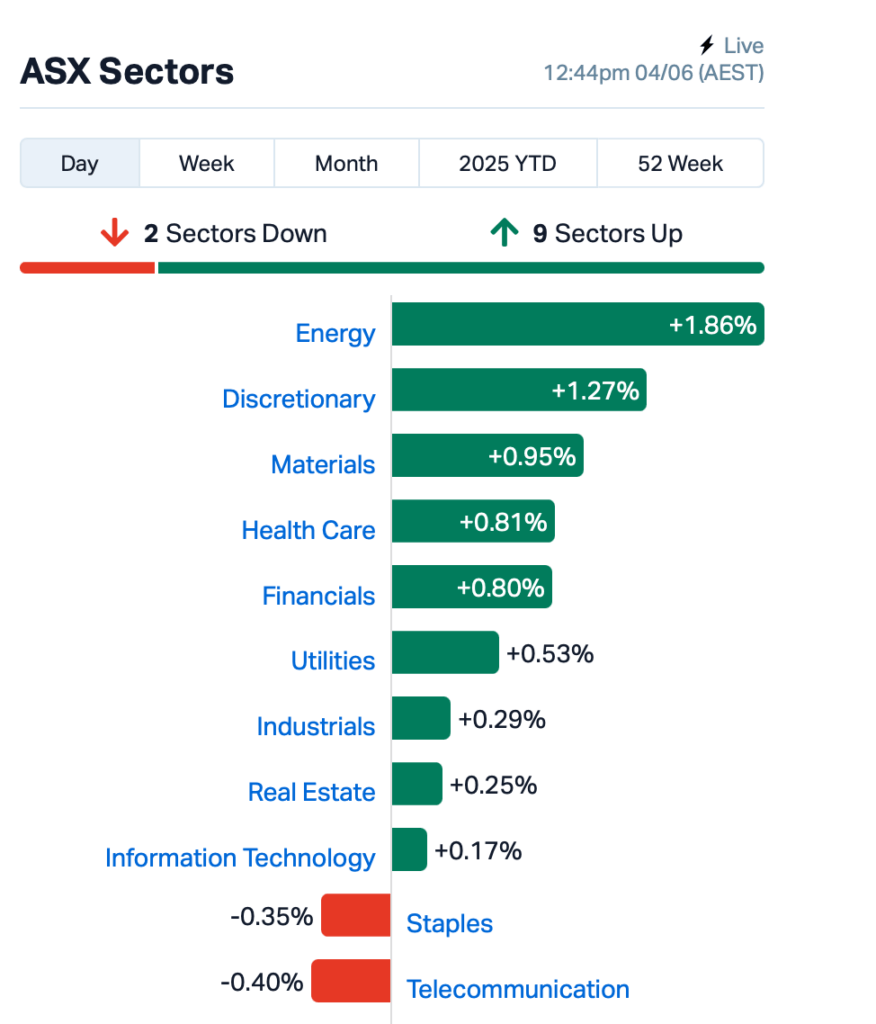

The ASX was up 0.77% by lunchtime AEST on Wednesday, with green lights flashing across the screen and uranium names doing the heavy lifting.

It’s a decent showing, especially given the backdrop of Trump’s latest tariff thunderclaps, and a local GDP print that disappointed.

Overnight, US job openings jumped from 7.2 million to 7.4 million in April, helping the Dow rise 0.5%, the Nasdaq pop 0.8%, and the S&P 500 inch within 3% of its record high.

Nvidia kept rocketing, up another 3%, while Broadcom hit record highs.

Back home, it’s uranium stealing the spotlight this morning, thanks to a surprise power move from Meta.

The tech behemoth behind Facebook and Instagram has inked a 20-year deal to source nuclear power from an Illinois plant to fuel its ravenous AI data centres.

That has lit a fuse under Aussie uranium stocks, pushing the energy sector higher today.

Paladin Energy (ASX:PDN) surged 7.5% to sit near the top of the ASX 200 by late morning. Deep Yellow (ASX:DYL) was up 5% and Boss Energy (ASX:BOE) gained 6%.

If you’re wondering how AI, social media, and nuclear energy ended up in the same sentence, welcome to 2025.

The big tech firms are scrambling for reliable, clean energy to power their server farms, and uranium’s looking more attractive by the day.

Meta joins Microsoft, Amazon, and Alphabet in the nuclear club, signalling that longer-term demand for the yellowcake isn’t speculative any more.

This is where things stood at around lunch time, AEST:

In the large caps space, IDP Education (ASX:IEL) staged a bit of a rebound, up as much as 8% after Tuesday’s near-50% nosedive on immigration policy jitters that rattled its revenue pipeline.

Over in retail, Mark McInnes has added a cool $2 million to his salary as he steps up as executive deputy chair of Lovisa Holdings (ASX:LOV), while John Cheston takes over as global CEO of the $3bn fast fashion jewellery chain. LOV’s shares jumped 8.5%.

And finally, Virgin Australia’s finally prepping for its long-awaited return to the ASX boards, with a $685 million IPO priced at $2.90 a share.

If all goes to plan, the airline will be wheels-up on June 24 with a market cap of $2.3 billion.

Soft GDP

And finally… to the Aussie economy, and it’s not exactly firing on all cylinders.

The ABS said GDP grew just 0.2% in the March quarter, missing forecasts of 0.4% and well down from 0.6% the quarter before.

Annual growth is crawling at 1.3%. It’s not a technical recession, but it sure feels like the engine’s idling.

The RBA has already cut rates twice this year with inflation finally easing, but assistant governor Sarah Hunter didn’t sugarcoat things yesterday.

She said global uncertainty – read: Trump’s tariffs – could weigh heavily on local activity if it drags on.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 4 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| JAY | Jayride Group | 0.002 | 100% | 627,513 | $1,427,889 |

| CDE | Codeifai Limited | 0.011 | 57% | 1,966,163 | $2,282,222 |

| CRN | Coronado Global Res | 0.150 | 43% | 22,611,899 | $176,027,642 |

| ARV | Artemis Resources | 0.007 | 40% | 1,850,608 | $12,642,647 |

| EPM | Eclipse Metals | 0.021 | 37% | 55,456,751 | $42,987,285 |

| ADN | Andromeda Metals Ltd | 0.015 | 36% | 72,521,214 | $41,946,774 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 1,500,000 | $4,880,668 |

| MTB | Mount Burgess Mining | 0.004 | 33% | 2,116,123 | $1,055,108 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 290,025 | $7,254,899 |

| GED | Golden Deeps | 0.024 | 33% | 1,280,670 | $3,188,263 |

| PGD | Peregrine Gold | 0.145 | 26% | 211,856 | $9,757,490 |

| BM8 | Battery Age Minerals | 0.061 | 24% | 2,016,281 | $5,972,699 |

| LCL | LCL Resources Ltd | 0.008 | 23% | 4,749,503 | $7,766,283 |

| MIO | Macarthur Minerals | 0.018 | 20% | 138,888 | $2,994,983 |

| RML | Resolution Minerals | 0.018 | 20% | 2,995,660 | $7,886,803 |

| AJL | AJ Lucas Group | 0.006 | 20% | 140,000 | $6,878,648 |

| ATG | Articore Group Ltd | 0.195 | 18% | 757,686 | $46,981,502 |

| SHN | Sunshine Metals Ltd | 0.013 | 18% | 12,808,152 | $22,964,093 |

| GPR | Geopacific Resources | 0.020 | 18% | 2,004,888 | $54,101,911 |

| REZ | Resourc & En Grp Ltd | 0.020 | 18% | 482,890 | $11,417,865 |

| FAR | FAR Ltd | 0.450 | 17% | 41,752 | $35,579,563 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 1,536,106 | $16,169,312 |

| NAE | New Age Exploration | 0.004 | 17% | 384,602 | $7,978,197 |

Coronado Global Resources (ASX:CRN) has locked in a $150 million loan deal with Oaktree to help ride out low coal prices and keep its liquidity plan on track. CRN will get $75 million upfront, with the rest available over the next year. The three-year facility is backed by receivables and inventory, and comes at a fixed rate below its current high-yield debt. The cash will support day-to-day operations while it finishes expansion projects at Mammoth and Buchanan.

Andromeda Metals (ASX:ADN) has also secured credit approval from Merricks Capital for a $75 million debt facility to help fund the development of its Great White Project. The loan runs for 78 months, with repayments kicking off a year after the project is built, and wraps up with a 50% bullet at the end. It’s not a done deal yet, and first drawdown depends on Andromeda locking in the rest of the funding needed to give Stage 1A+ the green light

Tyro Payments (ASX:TYR) has just teamed up with GapOnly to shake up how Aussies pay for pet care. From early 2026, it will power real-time insurance claims and payments at the vet, meaning pet owners can sort bills and insurance in one go. It won the gig after a competitive tender.

Pointsbet (ASX:PBH) has got a sweeter deal on the table. Japan’s MIXI has bumped up its takeover offer to $1.20 a share, up from $1.06, which gives the bid a 44.6% premium to where PointsBet last traded before the first offer. That values the company at around $402 million. If shareholders don’t back it, MIXI said it was ready to launch a takeover bid at the same price, aiming to grab just over half the company.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for June 4 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CR9 | Corellares | 0.002 | -33% | 100,000 | $3,016,820 |

| EDE | Eden Inv Ltd | 0.002 | -33% | 7,181,943 | $12,329,643 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 1,390,677 | $6,828,269 |

| BRX | Belararoxlimited | 0.059 | -30% | 1,949,252 | $13,253,417 |

| PRM | Prominence Energy | 0.003 | -25% | 4,125 | $1,556,706 |

| QXR | Qx Resources Limited | 0.003 | -25% | 880,918 | $5,241,315 |

| BEL | Bentley Capital Ltd | 0.009 | -25% | 53,972 | $913,535 |

| TAS | Tasman Resources Ltd | 0.019 | -24% | 278,672 | $4,603,565 |

| ERA | Energy Resources | 0.002 | -20% | 800,005 | $1,013,490,602 |

| MGU | Magnum Mining & Exp | 0.004 | -20% | 5,673,700 | $5,608,254 |

| TEM | Tempest Minerals | 0.004 | -20% | 703,564 | $3,672,649 |

| TMX | Terrain Minerals | 0.002 | -20% | 1,712,757 | $5,621,392 |

| 1AD | Adalta Limited | 0.003 | -17% | 166,003 | $1,929,668 |

| AZL | Arizona Lithium Ltd | 0.005 | -17% | 1,691,614 | $31,621,887 |

| GGE | Grand Gulf Energy | 0.003 | -17% | 3,691,128 | $8,461,275 |

| NUC | Nuchev Limited | 0.160 | -16% | 57,936 | $27,804,468 |

| EQX | Equatorial Res Ltd | 0.120 | -14% | 100,000 | $18,402,349 |

| FGH | Foresta Group | 0.006 | -14% | 31,182 | $18,570,345 |

| TMS | Tennant Minerals Ltd | 0.006 | -14% | 2,609,911 | $6,691,233 |

| VAR | Variscan Mines Ltd | 0.006 | -14% | 556,072 | $5,480,004 |

| IIQ | Inoviq Ltd | 0.445 | -14% | 991,715 | $57,490,893 |

| BYH | Bryah Resources Ltd | 0.013 | -13% | 11,769,405 | $13,049,303 |

| 5EA | 5Eadvanced | 0.530 | -13% | 39,215 | $9,136,299 |

IN CASE YOU MISSED IT

Blue Star Helium (ASX:BNL) has completed the sixth and final well in its development drilling program at the Galactica helium project in Las Animas county, Colorado.

Language tech company Straker (ASX:STG) has launched a new integration with AI automation platform n8n.

Core Energy Minerals (ASX:CR3) has received regulatory approval for its maiden aircore drilling campaign at the Cummins uranium project in South Australia.

LAST ORDERS

Red Metal (ASX:RDM) has secured two collaborative drilling grants from the Queensland government totalling $400k, for drill testing on the Gulf and Three Ways projects in Northwest Queensland.

The company reckons the area is prospective for oversized copper mineral systems, sitting within the northern extensions of the Mount Isa formation.

Solar technology company ClearVue (ASX:CPV) subsidiary OptiCrop has secured its first commercial project, a greenhouse installation for ground-source heat exchange technology which will net $80k.

It’s a big milestone for the company’s ambitions to expand into the agricultural technology and sustainable greenhouse sector, following CPV’s acquisition of the ROOTS Sustainable Agricultural Technologies’ IP and assets late last year.

At Stockhead, we tell it like it is. While Red Metal and ClearVue are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.