Lunch Wrap: ASX claws back from shaky open, Kaili surges 300pc on drilling approval

ASX claws back up. Picture via Getty Images

- ASX shrugs off a wobbly open

- NAB rallies on margins; BlueScope bleeds

- Kaili surges 3x after securing approval to start rare earth drilling

The ASX kicked off Monday with a stumble, down 0.6% at the open.

But by lunchtime in the east coast, it had dusted itself off and crawled back, now down only 0.05%.

Wall Street’s Friday performance didn’t exactly set the mood, with the S&P and Nasdaq trimming a little fat off their peaks.

But back home, a few decent earnings updates this morning steadied the hands hovering over the sell button.

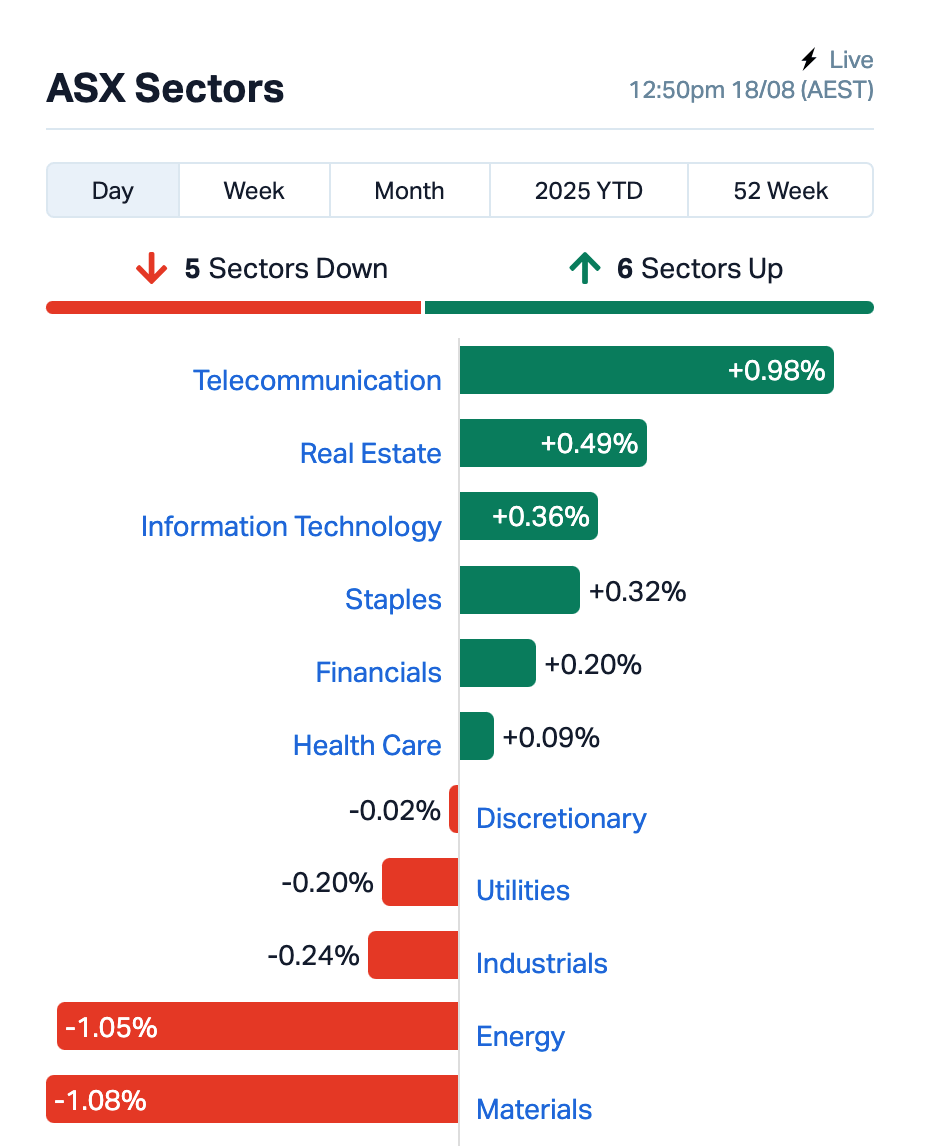

The sectors doing the heavy lifting were the dull-but-dependable types: telcos and real estate.

Meanwhile, oil prices slid under US$66 a barrel ahead of Trump’s latest meeting with Ukraine’s leader Volodymyr Zelenskiy, and local energy names promptly fell into line.

Santos (ASX:STO) and Woodside Energy Group (ASX:WDS) drifted lower.

Coal names such as Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC) shaved off around 2%.

Large cap earnings announcements

The local earnings season continues in earnest.

National Australia Bank’s (ASX:NAB) June quarter cash earnings slipped 1% to $1.77 billion, hit by higher bad debt charges.

The bank also flagged a $130 million bill this year to fix staff underpayment issues – an ugly look, but hardly a balance-sheet breaker.

But NAB shares rose 2% on stronger revenue and a fatter margin, proving again that as long as it delivers, the market is happy to look past the skeletons.

Bluescope Steel (ASX:BSL) gave investors a reality check.

Full-year profits collapsed from $806 million to just $83.8 million, thanks to tariff uncertainty and a nasty $439 million US writedown.

Ampol (ASX:ALD) didn’t fare much better. Profits at its Brisbane refinery were basically wiped out, sending earnings down 23% and the interim dividend cut to 40 cents.

Management called it “resilient.” Investors might call it something less flattering.

A2 Milk (ASX:A2M) rose after full-year profit jumped 21% to NZ$202.9m on 13.5% revenue growth to NZ$1.9b.

Still milking that growth story, and the market’s happy to lap it up.

And finally, DigiCo Infrastructure REIT (ASX:DGT) was the day’s shocker, plunging 10% despite results that weren’t far off expectations.

The group booked full-year EBITDA of $99 million, only a touch below forecasts, and paid out 10.9 cents per security.

On paper, steady. But the market wanted more sizzle.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 0.140 | 289% | 487,209 | $5,306,413 |

| MTB | Mount Burgess Mining | 0.011 | 75% | 28,769,150 | $2,553,830 |

| GGE | Grand Gulf Energy | 0.003 | 50% | 500,000 | $5,640,850 |

| AHX | Apiam Animal Health | 0.755 | 41% | 1,299,409 | $98,409,250 |

| GTE | Great Western Exp. | 0.019 | 36% | 7,322,951 | $7,948,611 |

| CHM | Chimeric Therapeutic | 0.004 | 33% | 136,568 | $9,763,676 |

| ECT | Env Clean Tech Ltd. | 0.004 | 33% | 2,445 | $12,046,306 |

| MMR | Mec Resources | 0.009 | 29% | 28,001,828 | $12,948,361 |

| SRL | Sunrise | 1.690 | 28% | 1,156,988 | $155,356,259 |

| ADN | Andromeda Metals Ltd | 0.014 | 27% | 23,959,515 | $41,983,440 |

| BCN | Beacon Minerals | 2.160 | 26% | 395,419 | $180,680,630 |

| IFG | Infocusgroup Hldltd | 0.024 | 26% | 5,298,144 | $5,546,844 |

| AOK | Australian Oil. | 0.003 | 25% | 700,825 | $2,075,566 |

| ERA | Energy Resources | 0.003 | 25% | 1,321,373 | $810,792,482 |

| ID8 | Identitii Limited | 0.010 | 25% | 32,402,043 | $6,224,108 |

| LMG | Latrobe Magnesium | 0.021 | 24% | 10,282,670 | $44,786,485 |

| RWL | Rubicon Water | 0.210 | 24% | 33,381 | $40,918,167 |

| IS3 | I Synergy Group Ltd | 0.011 | 22% | 893,410 | $15,356,699 |

| SP3 | Specturltd | 0.024 | 20% | 1,617,558 | $6,338,002 |

| PNT | Panthermetalsltd | 0.010 | 19% | 29,275 | $2,407,236 |

| TMG | Trigg Minerals Ltd | 0.110 | 17% | 26,290,483 | $106,809,056 |

Shares in Kaili Resources (ASX:KLR) shot up 300% after the explorer got the green light from South Australia’s mining regulator to kick off drilling at its rare earths projects across Lameroo, Karte and Coodalya in the Limestone Coast.

The program will use shallow aircore drilling along road verges to test for rare earth mineralisation, with work set to start once a driller, geologist and traffic team are locked in.

Kaili has already pulled up encouraging assays at Lameroo, with rare earth grades including up to 356ppm TREO, and is now expanding across all three tenements. The projects sit in the Murray Basin, a region where neighbours like Australian Rare Earths (ASX:AR3) have already defined big resources and government backing.

Mount Burgess Mining (ASX:MTB) has struck binding deals to pick up two high-grade gold projects in WA, with standout drill hits including 6m at 64g/t gold.

The acquisitions bring Metal Hawk and Falcon Metals in as major shareholders, with Metal Hawk also taking a board seat.

Drilling approvals are underway, with work expected to kick off in Q4 2025, backed by an oversubscribed $900k placement at a premium to market.

Beacon Minerals (ASX:BCN) has delivered a spectacular hit from its Iguana deposit in WA, with 10 metres at 69.9 g/t gold, including an extraordinary 1 metre at 593 g/t.

The results come from the second batch of assays in its Stage 2 grade control drilling, which has already pulled up multiple high-grade zones. In total, 116 holes have returned standout numbers, boosting confidence as the company gears up for first production early next year.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

Kogan (ASX:KGN) slid after taking a goodwill write-down on its New Zealand offshoot Mighty Ape. The unit’s been under pressure from weak consumer confidence across the pond, and a messy recovery from tech glitches following last year’s website upgrade. Management called the write-down a “prudent measure” that doesn’t hit cash or ebitda.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HFR | Highfield Res Ltd | 0.130 | -47% | 1,882,384 | $116,148,876 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 58,975 | $2,811,999 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 50,000 | $7,254,899 |

| UBI | Universal Biosensors | 0.013 | -32% | 3,051,145 | $5,663,281 |

| AQX | Alice Queen Ltd | 0.003 | -25% | 471,068 | $5,538,785 |

| M2R | Miramar | 0.003 | -25% | 7,897,727 | $3,987,293 |

| ALR | Altairminerals | 0.010 | -21% | 10,089,315 | $54,560,930 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 4,571,244 | $11,243,383 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 2,070,000 | $23,424,247 |

| AD8 | Audinate Group Ltd | 4.990 | -18% | 1,689,484 | $511,289,266 |

| FBR | FBR Ltd | 0.005 | -17% | 6,263,813 | $34,136,713 |

| RFT | Rectifier Technolog | 0.005 | -17% | 300,000 | $8,291,904 |

| SLZ | Sultan Resources Ltd | 0.005 | -17% | 200,000 | $1,566,501 |

| NPM | Newpeak Metals | 0.017 | -15% | 116,823 | $6,582,866 |

| ZEU | Zeus Resources Ltd | 0.017 | -15% | 6,356,925 | $14,348,733 |

| PVW | PVW Res Ltd | 0.018 | -14% | 20,020 | $4,177,000 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 706,953 | $22,214,246 |

| PET | Phoslock Env Tec Ltd | 0.012 | -14% | 6,972,907 | $8,741,467 |

IN CASE YOU MISSED IT

Godolphin Resources (ASX:GRL) has highlighted strong potential for near-term development opportunities with a Lewis Ponds gold, silver and base metals resource estimate upgrade.

Brazilian Critical Minerals (ASX:BCM) has placed a critical piece of the puzzle needed to advance its flagship Ema rare earths project to development with an ISR trial returning super high grades.

Victory Metals (ASX:VTM) has landed a $250,000 grant from the Minerals Research Institute of WA for North Stanmore project.

Peregrine Gold (ASX:PGD) has identified a strong Channel Iron Deposit target dubbed Peninsula at its Newman gold project in WA’s Pilbara.

LAST ORDERS

St George Mining (ASX:SGQ) has moved to dual list on the Frankfurt Stock Exchange under the ricker FSE: SOG to expand its exposure and engagement with European investors.

While its ASX listing will remain the primary one, the dual listing aligns with SGQ’s international growth strategy, offering exposure to the second largest exchange in Europe even as the company considers a US listing to boot.

Medallion Metals (ASX:MM8) has tapped Ian Gregory as geology manager, effective immediately. Gregory brings 30 years’ experience in gold, nickel and lithium mineral exploration, having most recently worked as exploration project manager at IGO (ASX:IGO).

At Stockhead, we tell it like it is. While St George Mining and Medallion Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.