Lunch Wrap: ASX back on front foot as Qube surges on Macquarie takeover bid

The ASX came out swinging as Wall Street hinted at a rate cut, while Qube belted one over the ropes on Macquarie’s takeover bid. Pic: Getty Images

- Qube bid lights up the board

- Wall Street whispers rate cut

- DroneShield under the microscope

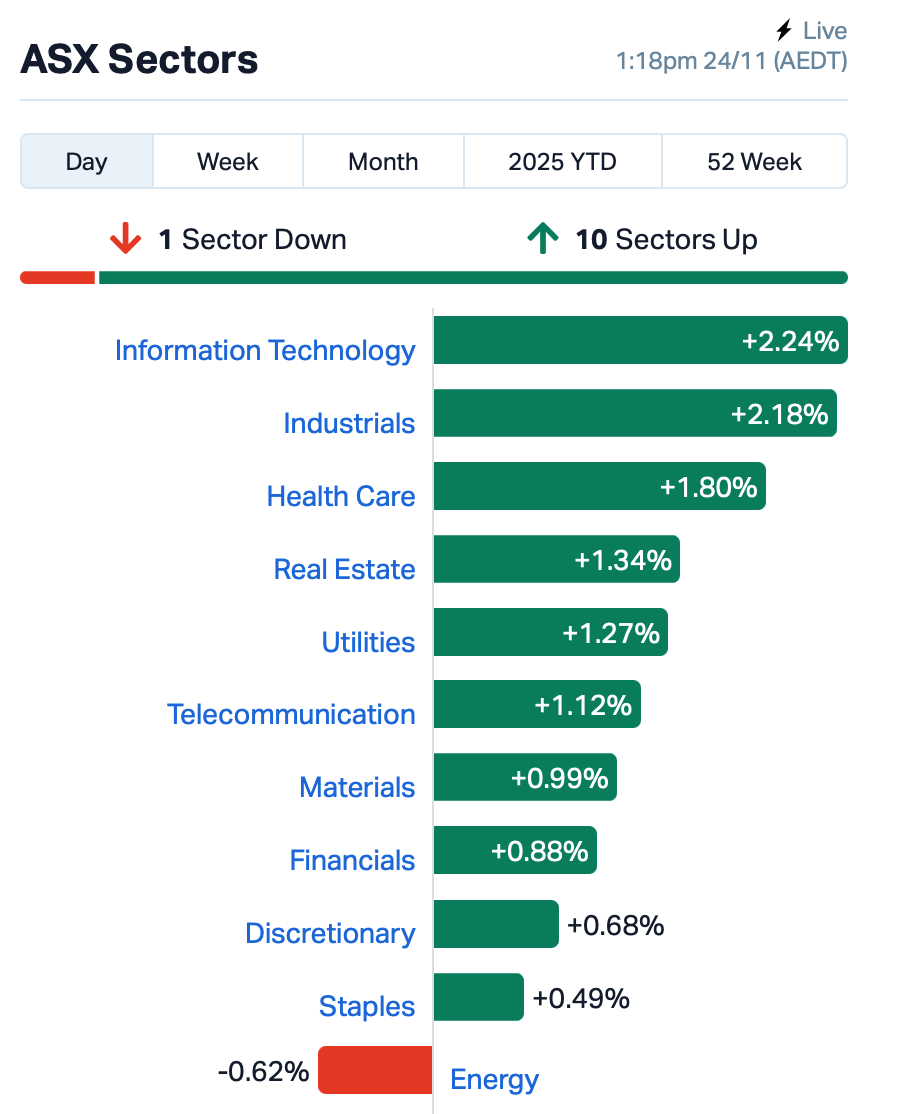

It was a lively start on the ASX in the eastern states on Friday, with the market up a bit over 1% as we headed towards a lunch break in the east.

The mood was positive as investors digested a fresh wave of global signals and a chunky dose of local corporate drama.

Over on Wall Street last Friday, US stocks managed to rally strongly. The S&P 500 rose nearly 1%, while the Nasdaq climbed roughly 0.9% after a seesaw session.

The catalyst was a few carefully chosen words from New York Fed boss John Williams, who hinted there was room for a rate cut in the “near term”.

His comments flicked rate-cut odds for December to around 75%, up sharply from roughly 40% the day before.

Back home, the ASX was keen to join the rebound party.

Tech led, and the industrial sector followed, propped by Qube Logistics (ASX:QUB), which absolutely stole the spotlight after Macquarie Asset Management lobbed a $5.20-a-share cash bid on the logistics group, valuing it at around $11.6 billion.

The offer, which implies a 14.4x FY25 EBITDA multiple and a hefty premium to last week’s close, sent Qube shares surging close to 19% in morning trade.

In other large cap news, BHP (ASX:BHP) confirmed it has walked away, again, from takeover ambitions on Anglo American, effectively shelving any hopes of a mega mining tie-up for now. BHP’s shares were trading flattish.

DroneShield (ASX:DRO), meanwhile, found itself in the governance hot seat again.

The counter-drone specialist slid after announcing an interim boss for its US business, and confirming an independent inquiry into recent share sales by the CEO, chairman and another director.

Chairman Peter James emphasised that this reflects a commitment to transparency and continuous improvement, while CEO Oleg Vornik moved to reassure investors that the underlying business remains strong.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| C29 | C29 Metals | 0.030 | 58% | 694,122 | $3,309,576 |

| BMO | Bastion Minerals | 0.002 | 50% | 9,487,500 | $2,566,450 |

| CHM | Chimeric Therapeutic | 0.004 | 40% | 13,128,111 | $9,105,341 |

| MVF | Monash IVF Group Ltd | 0.845 | 39% | 19,851,812 | $237,677,252 |

| ALV | Alvomin | 0.059 | 26% | 5,463,165 | $9,177,446 |

| OEL | Otto Energy Limited | 0.005 | 25% | 104,000 | $19,180,039 |

| FRX | Flexiroam Limited | 0.016 | 23% | 932,193 | $19,726,182 |

| GTK | Gentrack Group Ltd | 8.085 | 22% | 415,800 | $712,074,631 |

| PSL | Paterson Resources | 0.034 | 21% | 244,783 | $14,732,283 |

| MRD | Mount Ridley Mines | 0.040 | 21% | 43,042,191 | $41,230,076 |

| SMM | Somerset Minerals | 0.015 | 21% | 12,850,073 | $11,503,862 |

| LAT | Latitude 66 Limited | 0.060 | 20% | 800,112 | $7,170,035 |

| LNU | Linius Tech Limited | 0.003 | 20% | 5,197,350 | $20,074,651 |

| VAR | Variscan Mines Ltd | 0.006 | 20% | 9,842,667 | $6,235,795 |

| CBL | Control Bionics | 0.074 | 19% | 479,797 | $21,918,125 |

| QUB | Qube Holdings Ltd | 4.825 | 19% | 6,665,533 | $7,202,320,889 |

| FUL | Fulcrum Lithium | 0.090 | 18% | 94,018 | $5,738,000 |

| DTZ | Dotz Nano Ltd | 0.053 | 18% | 232,713 | $29,287,673 |

| BLG | Bluglass Limited | 0.014 | 17% | 2,777,579 | $31,375,388 |

| M7T | Mach7 Tech Limited | 0.425 | 16% | 1,466,820 | $85,763,337 |

| FRB | Firebird Metals | 0.150 | 15% | 263,534 | $21,280,315 |

| TWD | Tamawood Limited | 3.080 | 14% | 22,500 | $104,132,975 |

| ILA | Island Pharma | 0.595 | 14% | 1,772,431 | $132,404,182 |

| CUL | Cullen Resources | 0.008 | 14% | 55,024 | $4,853,813 |

Chimeric Therapeutics (ASX:CHM) has pocketed a $4.5 million R&D tax incentive refund from the Australian government, recognising its 2025 financial year research work and giving it more firepower to push its cell therapy programs forward.

Chimeric’s pipeline includes the first-in-class CDH17 CAR T now in Phase 1/2 trials for gastrointestinal and neuroendocrine tumours, the clinically validated CORE-NK platform with new combination trials underway, and the CLTX CAR T program targeting glioblastoma, which has already shown promising early results.

Monash IVF Group (ASX:MVF) has knocked back an unsolicited, non-binding $0.80-per-share takeover approach from the Genesis/Soul Patts consortium, saying the offer is opportunistic and materially undervalues the business.

It noted the bid implies a 7.7x FY25 EBITDA multiple, well below comparable IVF deals. After reviewing it with advisers, Monash IVF’s board unanimously decided the proposal isn’t in shareholders’ best interests.

Somerset Minerals (ASX:SMM) has confirmed thick, high-grade copper at Jura North within its Coppermine project, with every hole drilled hitting mineralisation and the system now defined over around 250 metres of strike, with geophysics pointing to continuity at least 600 metres below surface.

It has delivered multiple wide and high-grade intercepts, including standout hits like 42.7m at 2.69% copper and 59.4m at 1.5% copper, while advancing planning and permitting for a larger 2026 drill program.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AEU | Atomic Eagle | 0.230 | -34% | 2,540,267 | $133,369,185 |

| AOA | Ausmon Resorces | 0.002 | -33% | 300,000 | $3,943,840 |

| M2R | Miramar | 0.002 | -33% | 2,462,499 | $3,584,770 |

| CCO | The Calmer Co Int | 0.003 | -25% | 35,785 | $12,233,413 |

| QXR | Qx Resources Limited | 0.003 | -25% | 201,000 | $7,370,653 |

| VHM | Vhmlimited | 0.365 | -22% | 993,783 | $121,810,569 |

| AVLDA | Aust Vanadium Ltd | 0.200 | -20% | 468,377 | $86,346,581 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 125,000 | $7,920,957 |

| AUR | Auris Minerals Ltd | 0.017 | -19% | 763,108 | $11,510,517 |

| MYX | Mayne Pharma Ltd | 3.640 | -18% | 2,094,904 | $361,543,930 |

| CXU | Cauldron Energy Ltd | 0.018 | -18% | 6,422,302 | $39,366,935 |

| GTE | Great Western Exp. | 0.015 | -17% | 1,170,469 | $10,219,643 |

| SCP | Scalare Partners | 0.100 | -17% | 123,280 | $10,104,705 |

| ERA | Energy Resources | 0.003 | -17% | 195,522 | $1,216,188,722 |

| RAS | Ragusa Minerals Ltd | 0.032 | -16% | 460,364 | $6,771,554 |

| AS2 | Askarimetalslimited | 0.012 | -14% | 44,390 | $6,561,842 |

| CRB | Carbine Resources | 0.006 | -14% | 25,000 | $8,343,060 |

| YRL | Yandal Resources | 0.260 | -13% | 552,751 | $113,852,680 |

| FBR | FBR Ltd | 0.004 | -13% | 6,883,985 | $26,747,890 |

| LCY | Legacy Iron Ore | 0.007 | -13% | 328 | $78,096,341 |

| PIL | Peppermint Inv Ltd | 0.004 | -13% | 275,000 | $10,036,083 |

| W2V | Way2Vatltd | 0.007 | -13% | 2,332,246 | $17,039,570 |

| CMG | Criticalmineralgrp | 0.105 | -13% | 138,198 | $12,465,324 |

Baby Bunting (ASX:BBN) shares slipped after confirming CEO Mark Teperson has been diagnosed with myelofibrosis, a rare form of bone marrow cancer.

The company stressed his DIPSS-0 low-risk prognosis and made it clear his treatment would not affect his ability to lead the business, with the board publicly backing him.

Teperson himself reinforced that message, saying his commitment to the company remains unwavering.

IN CASE YOU MISSED IT

Chariot Corporation (ASX:CC9) has inked a formal deal enabling it to advance small-scale lithium mining across four key Nigerian projects.

Trajan Group’s (ASX:TRJ) components and consumables division underpins two-thirds of its revenue and has driven Trajan’s global expansion.

LAST ORDERS

Metallium (ASX:MTM) is moving to establish an American Depositary Receipt (ADR) program in the US and intends to seek quotation of its ADRs on the Nasdaq market.

The sponsored ADR program will first be launched on the OTC market, providing direct access for North American investors to trade Metallium securities in US dollars during US market hours.

MTM is targeting its Nasdaq listing for Q3 2026, while maintaining its primary ASX listing.

ClearVue Technologies (ASX:CPV) has secured $881,000 in an Australian government R&D tax rebate, consequently repaying its loan of $409,000 to Radium Capital. CPV walked away with $444k in net proceeds after the repayment.

Energy Transition Minerals (ASX:ETM) has tapped experienced mining and corporate finance executive Stuart Ausmeier as chief financial officer.

A qualified Chartered Accountant and Chartered Financial Analyst with over 23 years’ experience, Ausmeier most recently served as CFO of ASX-listed iron ore producer Fenix Resources (ASX:FEX), which underwent a phase of rapid growth during his tenure.

At Stockhead, we tell it like it is. While Metallium, ClearVue Technologies and Energy Transition Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.