Lost property: Australia don’t mind the gender gap in home ownership

Pic: d3sign / Moment via Getty Images

Australian and New Zealand women continue to fall behind in the property ownership race, exacerbating the wealth divide by ceding men the lion’s share of the recent real estate boom.

The Australian Bureau of Stats says the gender pay gap is actually on the rise from 13.4% in November 2020, to 13.8% in November last year.

And that’s just the salary. It sure ain’t as safe as houses. So what then divides the sexes in 2022, when it comes to ‘the most important purchase of your life’?

On this March 8, International Women’s Day, Eliza Owen from CoreLogic tells Stockhead how low global interest rates, coupled with a supply and demand imbalance, have supercharged home values, making more urgent the need to understand trends around women and home ownership.

And when the total value of our residential market went – in the 12 months to January – from a wee $7 trillion to $9.7 trillion (dwelling values jumping by 22.4%, or $130,000 at the median value level) it is easy to see the kind of dollars driving this divide.

Men get houses, women have flats

In January this year, some 26.6% of Aussie residential property was female owned, compared to near 30% male ownership.

CoreLogic says men own 28.5% of all the houses analysed versus women’s share at 24.0%, while women have more units – at 35.2% versus men’s 34.7% share.

That’s no good at all, says Owen, who is also the author of the 2022 Women & Property Report.

“Detached houses generally accumulate more value over time than units… 10 year annualised growth rates in Australian house values was 6.2% per annum, compared with 4.1% per annum for units,” says Owen.

“What this means is that house owners accrue a lot more value over time compared to unit owners. The nominal gains in the median Australian house value over the past decade totalled around $340,000, compared with $197,000 for the median unit gain.”

The report found male ownership is generally higher in markets dominated by detached house stock, such as in resource-based markets like Perth.

Now this also craps on wealth growth, because resource-based markets have seen more aggressive fluctuations in value, and generally less value than cities like Sydney and Melbourne.

However, even in markets with more gender parity, such as Greater Melbourne, men still owned a higher portion of houses (29.9%) than women (25.7%).

Investing in the gender wealth gap

“Around 70% of the discrepancy between male and female residential property ownership in Australia is accounted for by ownership of investment properties,” Owen says.

Men get 36.4% of all investment properties, CoreLogic says. Women, 29.1%.

That’s well over 105,500 more investment properties in the hands of men than women in Australia.

“The portion of investment properties owned by men was also higher than the rate of joint male and female ownership of investment properties (34.5%).”

Owen told Stockhead, while it’s difficult to finger a cause in this discrepancy, it’s significant men enjoy a higher representation in property as an investment.

“We don’t know whether this is a reflection of multiple property ownership being more common among men, or if it’s a response to affordability constraints (such a rent-vesting strategy), but this seems to drive most of the gap in residential property ownership.”

Parity is not impossible

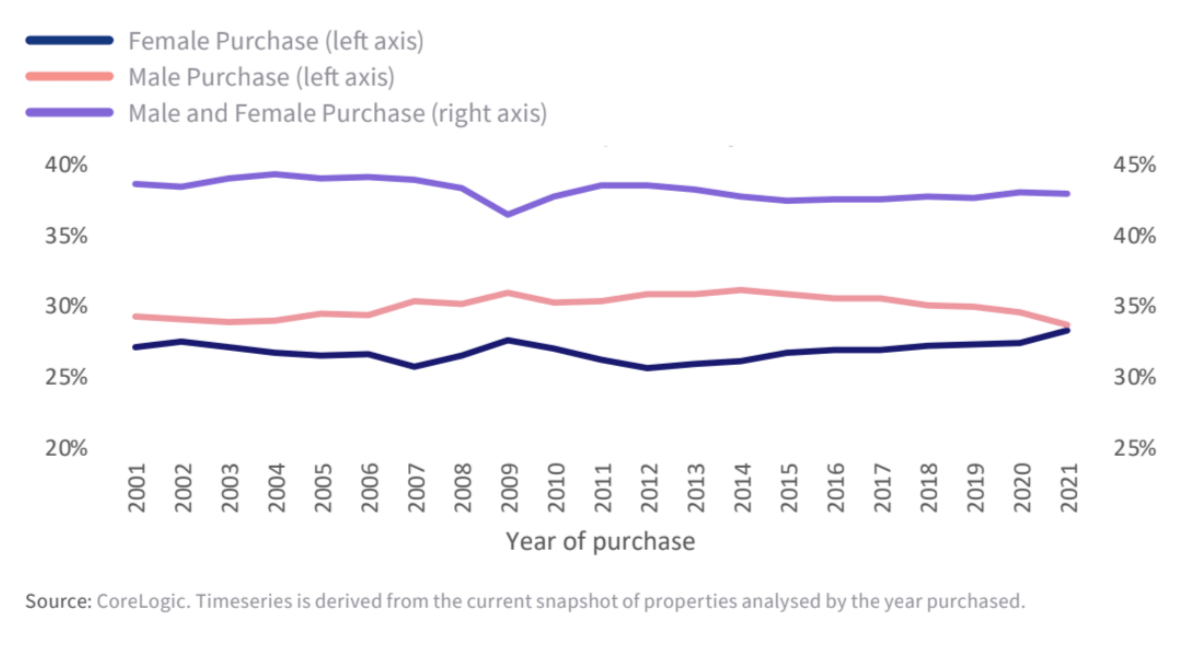

Times are slowly changing for the better, Eliza reckons, as Aussie women tighten the property gender gap, with a time series of purchase date by gender (below) showing the share of female purchase of property is slowly on the up and parity is not impossible.

“Australia shows a really interesting trend where there’s a marginal shift, year by year, of women purchasing a slightly higher portion of properties, and men purchasing a slightly lower portion. Joint purchases have remained steady over time, but did see a dip in 2009 that may have been associated with a surge in first home buyer activity.

“This positive trend may start to reflect greater gender parity in home ownership over time.”

But until then, chew on this:

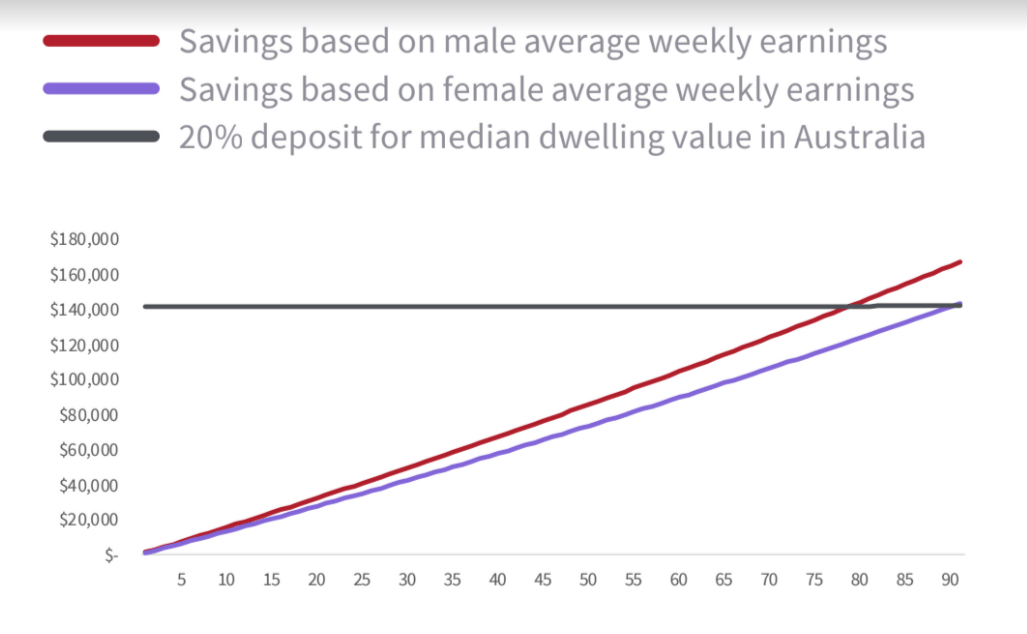

The current discrepancy in incomes between men and women would see men save a 20% deposit on the current median dwelling value after 79 months, compared to 91 months for women.

And a year, as we all know, is a long time in property.

And a little about the report’s author:

Most importantly, Eliza Owen used to be the go-to economist at FBi Radio. Now she’s the head of research Australia at CoreLogic. She been an economist at Residex, a research analyst at Domain Group and previously the commercial real estate and construction analyst at CoreLogic.

In September last year, Eliza was the Winner of Young Achiever of the Year – RICS Awards 2021 – in recognition of being a role model for her peers, for her ‘industry leading achievements,’ and just generally getting things done when people need them most.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.