Lodgers and hammer time: Australia’s property auction market in two acts

Via Getty

CoreLogic – the relentless property data cruncher which apparently never sleeps – says the volume of capital city auctions across Australia fell to a three-year low last year, although the rate of successful auctions actually climbed at the same time. So we’re calling 2023 a draw.

Well, I’m calling it a draw.

I believe the CoreLogic boffins are referring to 2023 as a ‘year of two halves.’

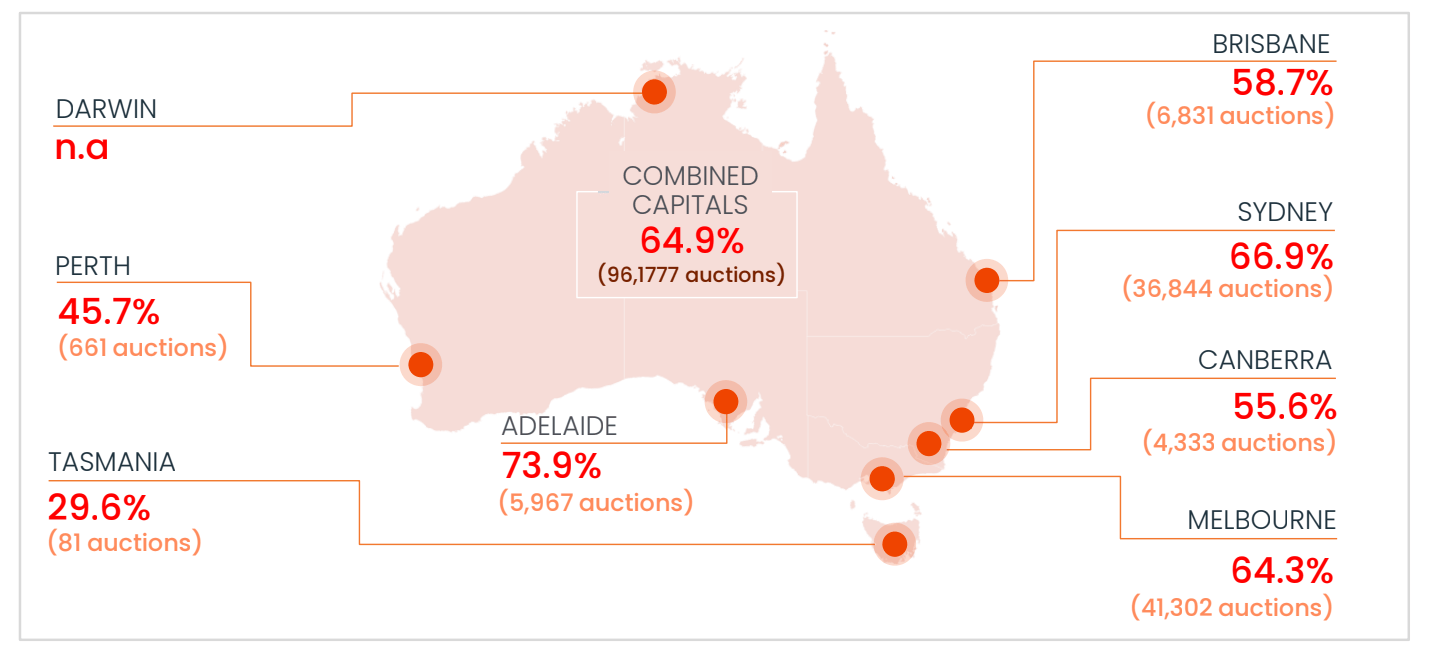

Either way, some 96,177 capital city homes went under the hammer last year, down -8% compared to the 104,511 auctions held in 2022 and a significant 18.2% lower than in 2021 when everyone got sick, locked in and decided to buy stuff online and maybe buy a house.

At 117,535 auctions, 2021 delivered the highest ever annual capital city auction volumes since CoreLogic started the count way back in 2008.

Shoddy consumer sentiment and ballooning interest rates, low levels of advertised supply and rising prices might’ve been the flavours of 2023, but that didn’t overly deter the punters who got out for a crack at a new home. The annual clearance rate – at 64.9% – for capitals was a modest improvement on the previous year.

While up from the 61.2% clearance rate of 2022 – when rising interest rates and falling values made city sellers back away – the 2023 rate was still 80 basis points lower than the weekly average rate recorded over the past decade (65.7%).

There’s been little relief for homebuyers as the scorching pace of the country’s property upswing managed to accelerate even further in the first month of 2024.

The average price for a place to live around the country is now 12.8% more than it was a year ago, according to the January edition of CoreLogic’s monthly measurement.

Prices rose a further 0.4% in January, which is up from the 0.3% increases seen over November and December, as per the latest national Home Value Index.

CoreLogic 2023 Auction Market Review highlights

![]() Melbourne was the busiest auction market in 2023, with 41,302 homes auctioned, down -7.4% on the previous year.

Melbourne was the busiest auction market in 2023, with 41,302 homes auctioned, down -7.4% on the previous year.

![]() Melbourne’s annual clearance rate came in at 64.3%, up from the annual result recorded the previous year (61.8%), but below the average weekly rate seen over the past decade (66.8%).

Melbourne’s annual clearance rate came in at 64.3%, up from the annual result recorded the previous year (61.8%), but below the average weekly rate seen over the past decade (66.8%).

![]() Sydney recorded both the smallest decline in annual auction activity and the largest improvement in annual clearance rates

Sydney recorded both the smallest decline in annual auction activity and the largest improvement in annual clearance rates

![]() There were 36,844 homes auctioned, resulting in an annual clearance rate of 66.9%

There were 36,844 homes auctioned, resulting in an annual clearance rate of 66.9%

![]() Brisbane was the busiest small capital market, with 6,831 homes taken under the hammer in 2023

Brisbane was the busiest small capital market, with 6,831 homes taken under the hammer in 2023

![]() Followed by Adelaide and Canberra with 5,967 and 4,333 homes auctioned, respectively

Followed by Adelaide and Canberra with 5,967 and 4,333 homes auctioned, respectively

![]() Adelaide had the top clearance rate for the second consecutive year, with 73.9% of auctions successful

Adelaide had the top clearance rate for the second consecutive year, with 73.9% of auctions successful

![]() Brisbane came in second among the smaller capitals with a clearance rate of 58.7%, followed by Canberra (55.6%)

Brisbane came in second among the smaller capitals with a clearance rate of 58.7%, followed by Canberra (55.6%)

![]() Perth saw 661 homes auctioned in 2023, with 45.7% returning a successful result

Perth saw 661 homes auctioned in 2023, with 45.7% returning a successful result

![]() Tasmania saw 24 of the 81 homes taken under the hammer successfully sold at auction

Tasmania saw 24 of the 81 homes taken under the hammer successfully sold at auction

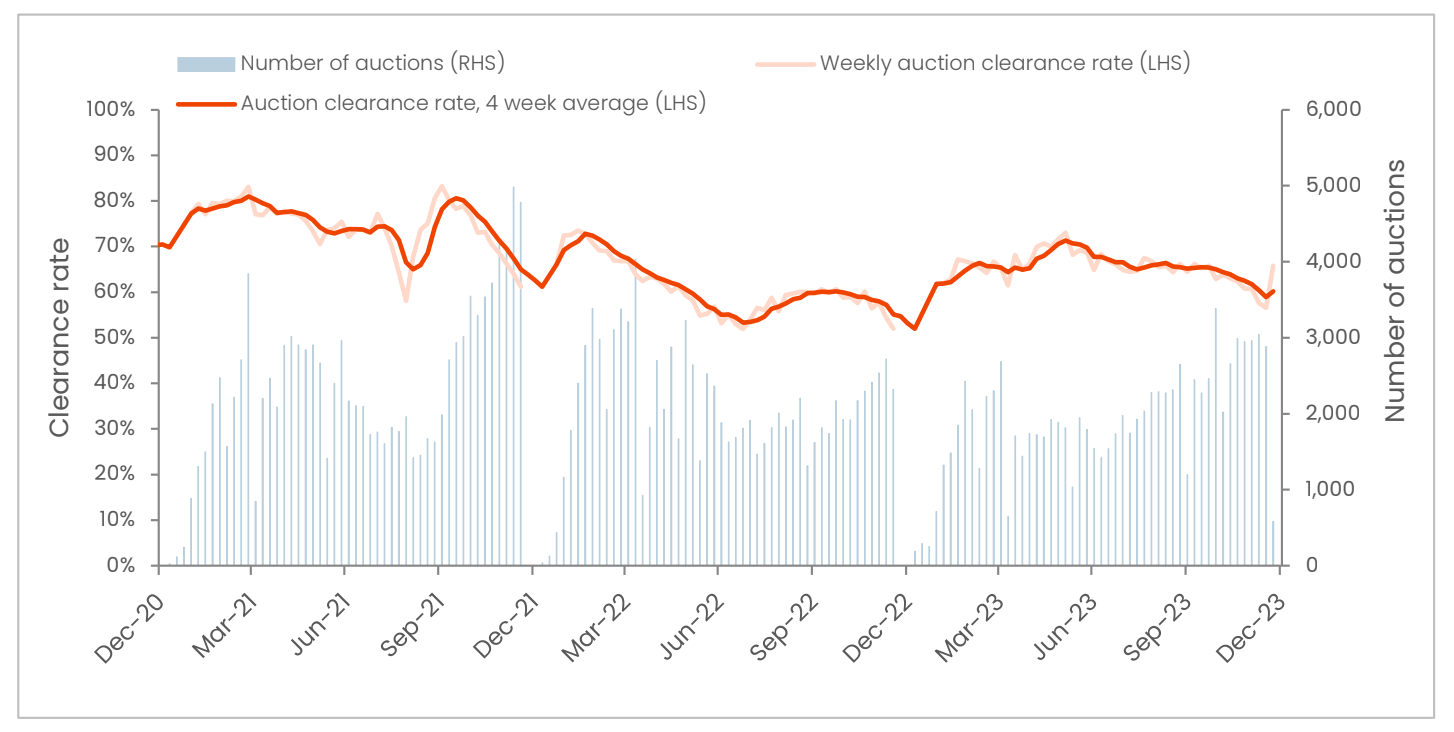

Australian combined capital city

Clearance rate and volume (weekly)

Australian capital city total auction clearance rate and volumes 2023

CoreLogic economist Kaytlin Ezzy says 2024 is looking like a different animal to last year.

“Contrary to the start of auction season this year, the 2023 auction market had a soft start. The first quarter’s capital city auction numbers fell to levels not seen since the September quarter of 2020, when lockdowns and COVID restrictions hampered auction activity, and remained lacklustre through quarter two.

“At the same time, buyer demand started to normalise after values found a floor in January and prospective buyers sought to enter the market before values recovered.”

This badly skewed mismatch between supply and demand meant that capital city clearance rates continue to trend higher through the first half of 2023, before exceeding the 70% mark for the first time since February 2022 in May, and holding above 70% for four consecutive weeks.

“Despite four rate hikes through the first half of the year, Q3 saw an uplift in auction activity, with capital city auction numbers rising 22.1% compared to the previous quarter and 14.9% compared to the September quarter of 2022.”

Kaytlin says it’s likely this unseasonal lift in auction volumes through winter was partly due to “a glut in prospective vendors, who had previously delayed selling, attempting to ‘beat the rush’ by listing before the spring selling season.”

“This upward trend continued into Q4, with auction numbers rising 15.4% quarter on quarter and 19.6% compared to the 2022 spring selling season, which really tested the market.”

Ezzy reckons this rebalancing of supply saw the combined capitals’ clearance rate head lower as the ball went back into the bargain hunters’ court.

“Negotiating power shifted back in favour of buyers,” Kaytlin says. “This saw the success rate fall below the 60% mark over the final two weeks of December.”

After a cracking kick-off to 2024, if last week’s early results are anything to go by, Ezzy says it’s possible the lower than expected inflation reading and the consequent prospect of early rate cuts is already boosting sentiment.

“The next few weeks should provide further guidance on whether this strong result is simply some early year exuberance or a trend that can persist,” she said.

Auctions last week up over 26% on same time in ’23

Certainly the national auction market is off to a strong start, with a surge in both the volume of auctions and clearance rates as the state of inflation and the lower rates outlook whetting both vendor hopes and buyer appetites for an unconditional sale.

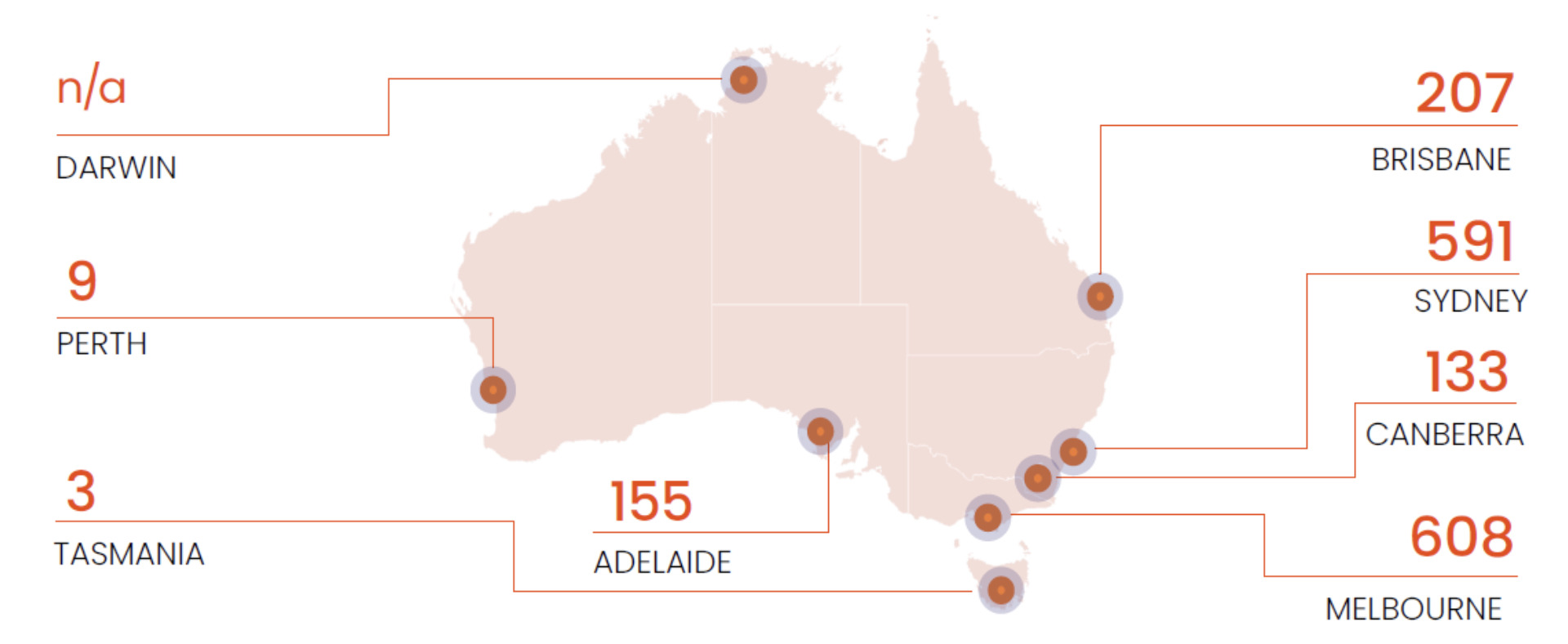

CoreLogic tracked 1,671 auctions last week, the second busiest start to the auction season on record.

There’s 1,706 capital city homes set for auction this week:

The February auction market is starting off with a bang, with 1,706 homes currently scheduled for auction across the combined capitals. Historically, January has been the quietest part of the year, with auction volumes moving through a seasonal lull before ramping up towards February.

Last week’s combined capitals’ preliminary clearance rate jumped relative to the end of last year when fading success at auction saw preliminary clearance rates hold around the mid-60% range before revising below 60% at final numbers. With 1,268 results collected so far, last week’s preliminary clearance rate came in at 73.9%, the highest since the week ending August 20th 2023 (74.0%).

Across the largest auction markets, Melbourne hosted 603 auctions, while Sydney saw 562 homes go under the hammer. Compared to this time last year, both markets saw a sizable lift in auction activity, up 46.0% and 32.5%, respectively.

Melbourne (71.9%), Sydney (76.3%), Adelaide (77.6%) and Canberra (80.0%) all recorded a preliminary clearance rate above 70%, with Brisbane not far off at 68.5%.

Across Sydney’s sub-regions, five cracked the 80% mark, including the Northern Beaches (82.4%), Eastern Suburbs (82.1%), Sutherland (81.3%), Inner West (80.0%) and South West (80.0%). Melbourne’s North East (84.2%) and Mornington Peninsula (82.4%) also posted an early clearance rate above 80%.

Kaytlin says that relative to the same time last year (1,322), last week’s auction activity was up 26.4% and was more than double the number of capital city auctions held over the year so far (803).

“Overall, it looks like auction markets are starting the year on a strong footing. Potentially, the news of low inflation and the possibility of early rate cuts is already boosting sentiment. The next few weeks should provide further guidance on whether this strong result is simply some early-year exuberance or a trend that can persist.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.