LIC my ASX: WAM bam it’s FY23 dividend jam as Wilson’s Aussie Microcap fund outperforms

Via Getty

All members of the Wee Cap Club probably already know most of this, but it’s newish to me and I haven’t stopped before to go take a more granular look, so this is me getting all up in the grainy, gritty and farinaceous bits of Wilson’s (WAM) Microcap Fund.

So here we go:

WAM Microcap (ASX:WMI) is a listed investment company (LIC) which wields a portfolio of ASX micro cap stocks (bearing a market cap of less than $300m).

The full selection of stocks within the fund and their weighting is below, and for the small cap amateur and connoisseur alike, it makes for fascinating reading.

Wilson’s punchy little-cap LIC dropped its numbers for FY23 on Friday last, with the investment portfolio delivering a cracker of a performance, considering the overall state of the wicket in FY23 and the uncertain, turbulent times.

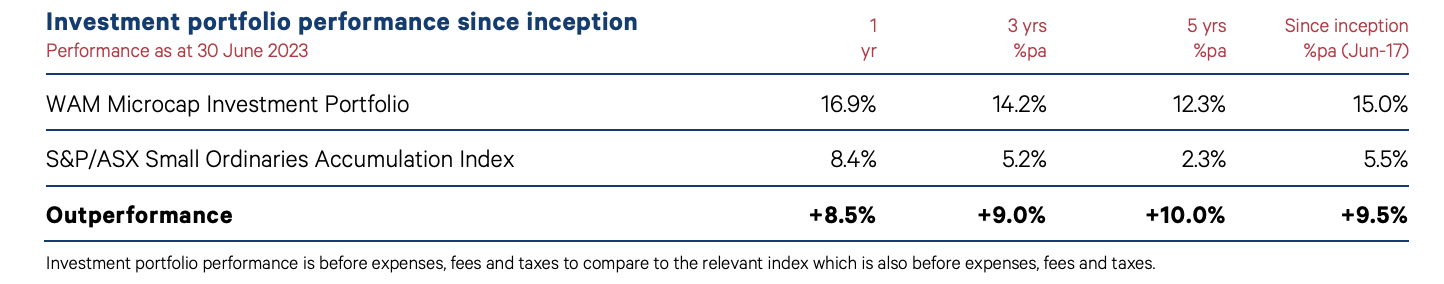

The WMI portfolio grew by a handsome 16.9% outperforming the ASX Small Ordinaries Accumulation Index (XSO) by 8.5% for the year to June 30. That’s the key measurement in LIC land, and the number describes the investment portfolio performance before expenses, fees and taxes when compared to the relevant index – in this case the XSO also before expenses, fees and taxes et al.

Since the Fund’s inception in June 2017, the investment portfolio has increased 15.0% per annum, outperforming the XSO by 9.5% per annum.

The WMI investment mandate allows holding company MAM to invest in international stocks, however, MAM has said it will likely only invest in domestic listed stocks, primarily ASX-listed micro caps.

And while the portfolio’s got a pretty decent long bias with minimal short exposure, the fund’s been green-lit to short stocks, if the Wilson’s crew believe the game’s afoot.

“WAM Microcap also provides exposure to relative value arbitrage and market mis-pricing opportunities,” the Wilson blurb says. “(Our) investment objectives are to deliver a stream of fully franked dividends, provide capital growth over the medium-to-long term and preserve capital.”

WMI’s usually got a spread of between 20 and 70 stocks with a weighting of 1%-5%, focusing historically on the more industrial corners of the ASX, with an effort to keep exposure to the Materials Sector to a minimum and usually goes for ‘high conviction’ positions in stocks which are deemed potential-rich.

WMI’s diversified investment portfolio by sector as at 30 June

“(WMI) provides investors access to a portfolio of undervalued micro-cap growth companies with a market capitalisation of less than $300 million at the time of acquisition,” according to Wilsons.

Here’s the top 20 holdings, as at June 30, and you’d have to admit that’s a fascinating family of companies which probably bear closer inspection:

WAM Microcap reported an operating profit before tax of $35.4 million (FY2022: operating loss before tax of $53.9 million) and an operating profit after tax of $26.3 million.

That’s a fair improvement on the FY2022, where WMI delivered an operating loss after tax of $36.1 million.

This year, to celebrate, the WAM Microcap board of directors declared a full year fully franked dividend of 10.5 cents per share, with the final fully franked dividend being 5.25 cents per share, which is an increase of 5% on the FY22 final fully franked payout.

WMI’s lead portfolio manager Oscar Oberg said during a period where many micro-cap companies underperformed the broader market, WAM Microcap’s investment portfolio outperformed.

“As we enter the 2024 financial year, the WAM Microcap investment team see opportunities in sectors where earnings estimates and share prices have already factored in the challenging macroeconomic conditions,” he added.

As at 31 July 2023, the company had 52.9 cents per share available in its profits reserve, before the payment of the final fully franked dividend of 5.25 cents per share, payable on 16 October 2023.

Since inception in June 2017, WAM Microcap has paid 49.0 cents per share in fully franked dividends to shareholders. The company’s ability to generate franking credits is ‘dependent upon the payment of tax on profits and the quantum of fully franked dividends received from investee companies.’

LICs so far: Comparing the ASX Mid – Small Cap Funds

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.