It’s time India’s Warren Buffett-style opportunities make more census to Aussie investors

Holi Festival, India. Via Getty

That latest (2021) Aussie census is a thing of beauty.

Rich in change and vibrant in colour, it’s a certain sign of strength if a nation, that’s also an island, that’s actually a continent somewhere deep in the South Pacific is now home to a bunch of blokes and sheila’s half of whom all have a parent born somewhere else.

And for the first time India has overtaken China and New Zealand to become the third-largest country of birth, behind Australia itself and England, herself.

Australia’s Top 5 countries of birth (excluding, er Australia):

But what do we know of this nation that is more us than ever before?

Is it all cricket, Bollywood blockbusters, Anita Desai and Vikram Seth?

And what of investing in India or even what’s out there in Indian equities in the year of our falling home prices, 2022?

Fortunately here in Australia the twin qualities of ignorance and curiosity are both part of the national id, and at Stockhead, we have them both in vast supply.

Earlier this week, I was lucky enough to catch up with India Avenue Investment Management’s legend, director and founder, Mugunthan Siva.

Mugunthan ran the ship in India as CIO of a boutique asset management business, where he set up a foreign access vehicle to allow global investors to get an eyeful of India’s markets, an earful of Mugunthan’s knowledge and a portfolio full of undiscovered Indian equities.

In an earlier life he was Head of Portfolio Management for ANZ Wealth in Australia and his 20 years experience in portfolio construction, manager selection as well as credit and equity research at companies such as Macquarie Bank and Westpac. All of which come in handy when managing the multi-asset, alternative and global/emerging market share portfolios he runs today.

Here’s what Mugunthan has to say:

Typically, companies which continue to win over time, operate in a growth industry and have qualities of market leadership.

This will lead to strong and sustainable earnings growth as the industry goes through an S-curve (where all participants may grow) before maturing and growing at a more stabilised rate (when only market leaders continue to grow).

Given India’s demographics which includes the world’s largest, youngest population where the average age is 29, a pro-reform, business-oriented Government and a quickly improving infrastructure, there are several businesses which are emerging as compounding growth stories which are long-term buy and hold investments.

One could say these businesses are akin to the kind of purchases Warren Buffett made in the US during its post war industrial revolution. The Apples, Coca-Colas, and the Bank of Americas…

Looking ahead, Indian stocks offer similar appeal given the following characteristics:

- Large, young and consuming population with increasing income (as population growth flattens out and productivity rises)

- A reform driven environment which is increasing financialisation of assets, digitisation of transactions and the formalisation of business

- Increasing excellence in manufacturing and exports driven by incentives and the China + 1 thematic

- A broadening tax base driven by the introduction of the GST in 2017

These kind of opportunities in a country as vast, diverse and aspirational as India are legion at the moment. So here’s just three Indian names you should get to know, and that we watch closely at India Avenue:

Info Edge (India) is India’s premier pure play internet business, which was founded in 1995 and runs an online job portal (Naukri.com), a matrimony website (Jeevansathi.com), real estate classifieds (99Acres.com) as well as a workplace discover platform and an education website.

The company also holds a minority stake in over 20 online companies including two former fabulous unicorns (the food delivery giant Zomato and insurance aggregator Policybazaar).

In 2020 the company set up a venture capital fund (Info Edge Venture Fund) to invest into online start-up companies.

With India’s internet penetration rising rapidly (50%) and smartphone users now above 66% of the population, the platform for increasing digitisation is well in place.

Additionally, India has the lowest cost of data in the world, allowing access at a cheap price to a far greater spread of the population.

Info Edge

As one of the very few profitable pure play internet companies in the country, Info Edge is India’s way-out-ahead online classifieds company. The growing digital player has the potential to establish a market leading position and grab a large slice of the increasing online adoption pie.

It is building a strong platform for organic growth through its online businesses as well as to create and unlock value in potential unicorns. India is already among the top three geographies for unicorns.

Additionally, the management has shown clear capabilities in being able to invest with success and build online brands organically. EBITDA margins are over 30% and the company was exhibiting double digit growth earnings growth leading up to Covid-19 (in FY21).

The recent sell-off in internet related stocks, the rising cost of capital and lower valuations going forward for internet related businesses as well as holding company structures, presents a great long-term opportunity in a company which has several underlying long-term fundamentals in its favour.

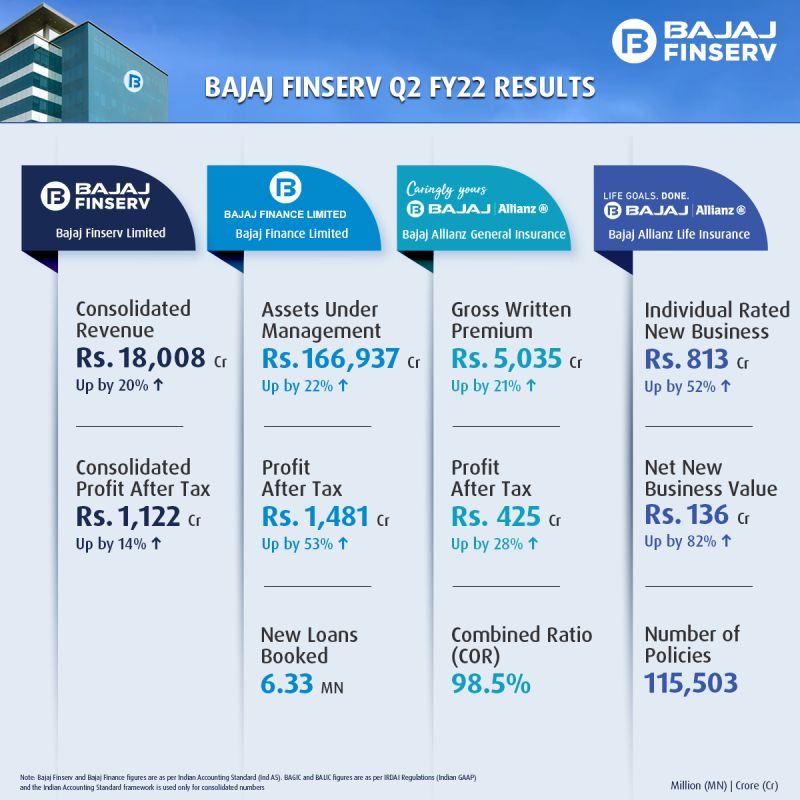

Bajaj Finance

Bajaj Finance is a non-bank financial company with nine product lines which cater to consumer, commercial and small-medium enterprises financing. The company has been around for over 30 years and offers finance to close to 40 million customers. It is present in close to 2000 locations, with a distribution network of over 100,000.

The rising GDP per capital of India will see an ever-increasing need for financing.

India’s gross savings rate is close to 28% which is significant.

Over the last decade India’s banking penetration has risen to close to 80%, driven by the establishment of the Aadhaar Card (national identity card) and a program which focus on opening bank accounts in 2015.

As banking/financing penetration has increased, Bajaj Finance has thrived from focusing on the mass affluent clientele, with a strategy to cross-sell. The strengths of the company include significant distribution and customer analytics, which help it respond to customer needs through innovation and customer service. Even through the COVID-19 impacted period the company’s EPS growth was 22% p.a. (2018-2022).

As banks and NBFCs have struggled with corporate borrowing and impact of slowing growth pre-pandemic and then the impact of the pandemic, Bajaj Finance has gone from strength to strength due to strong management and an established moat.

Avenue Supermarts

Avenue Supermarts operates a chain of hypermarkets which states its mission to research, identify and make available new products and categories which suit the needs of the Indian family. From its first store, established in 2002, the company now has 284 stores across 11 states and one territory in India.

At this stage most of the store growth has been in clusters in predominantly urbanised locations (where the company becomes the expert in retailing knowledge in the area) which is like the traits of Walmart in the US.

Formalisation is occurring at every level in India.

Traditionally the activity of retailing has been highly disaggregated, with a focus on corner stores and neighbourhood retailing/markets. This is largely due to the legacy of purchases being made with a focus on local proximity and fulfilling daily requirements.

However, as the household structure changes and convenience of bulk purchases is sought, a shift is occurring. Today the opportunity is immense as unorganised retailing is still approximately 75% of the total retail sector.

The company has grown profits by 20% p.a. over the last four years and is set to participate further in formalisation from a very low base.

Whilst the threat of e-commerce and competition remains significant, it is likely that the retail market will grow significant over the next 10 years.

What now?

So, the three companies above cannot be purchased by an Australian investor without a foreign portfolio investors licence.

Whilst these licences are possible, it is a cumbersome, painful and sapping exercise for investors seeking exposure to India’s growth story.

However there are several unlisted funds which are based in Australia, which offer exposure to the companies named above. Investing in an Indian fund can be considered a “growth stock” in one’s portfolios given the compounding nature of earnings growth which can be achieved given the macro and micro fundamentals at play in the country.

India Avenue always focuses on education and knowledge as a driver of investment behaviour and have taken a long-term approach towards Australian and New Zealand investors contemplating an allocation to India’s growth as part of their portfolios. Knowledge and insight are what you want as an Aussie or New Zealand-based investors keen to explore and benefit from India’s structural growth story as an allocation in investment portfolios.

At Stockhead we tell it like it is. While we’re big admirers of Bajaj Finance, Info Edge and India Avenue, they did not sponsor this article.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.